Vizsla Discovers a New Vein With 557 Gram Per Tonne Silver Equivalent Across 3.4 Metres at Panuco Project in Mexico

Vizsla Resources Corp. is pleased to announce the Company’s aggressive exploration program has defined a new discovery, the Paloma Vein, in Sinaloa.

Vizsla Resources Corp. (TSXV:VZLA) (“Vizsla” or the “Company”) is pleased to announce the Company’s aggressive exploration program has defined a new discovery, the Paloma Vein, at the Panuco precious metals district in Sinaloa, Mexico. Mapping and sampling have revealed outcropping mineralization over the 500 metre long vein.

Sampling Highlights

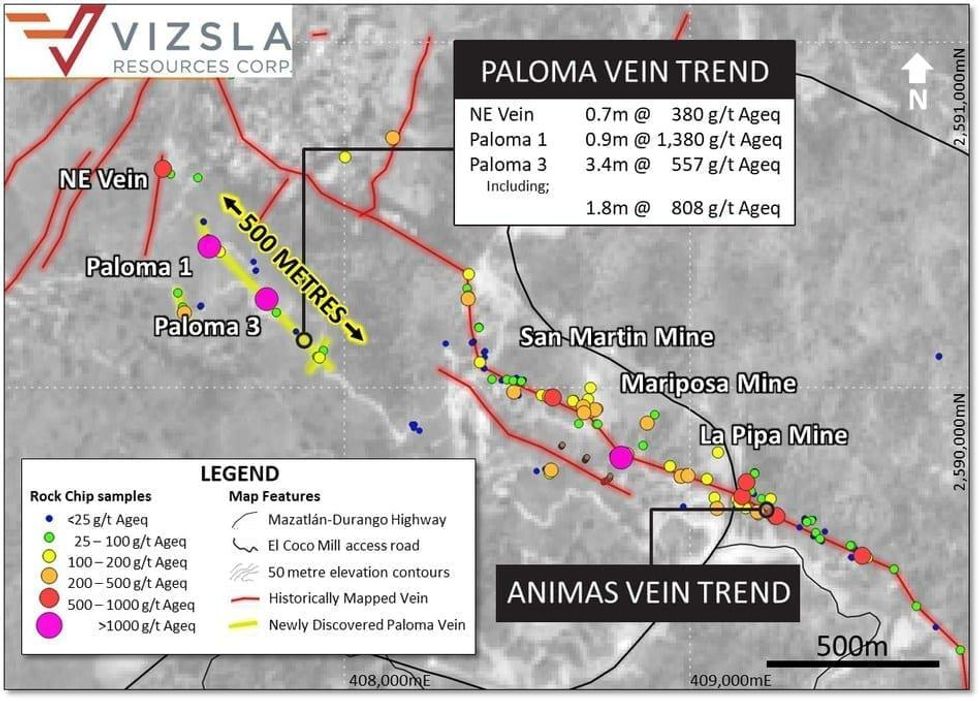

Figure 1: Plan map showing locations of Paloma Vein samples and surface sample results

- 557 g/t silver equivalent (311.7 g/t silver and 3.07 g/t gold) over 3.4 metres including;

- 948 g/t silver equivalent (514.5 g/t silver and 5.43 g/t gold) over 1.8 metres

- 557 g/t silver equivalent (311.7 g/t silver and 3.07 g/t gold) over 3.4 metres including;

Note: All numbers are rounded. Silver equivalent (Ageq) is calculated by multiplying the gold grade by 80 and adding it to the silver grade. This calculation estimates 100% recovery of both metals. Widths are estimated to represent true widths

“Discovering an entirely new vein that has never previously been mapped, sampled or historically mined indicates the exploration potential that exists within the Panuco district,” Vice President of Exploration, Charles Funk commented. “The vein was first recognised in November as the mapping program extended north and infill sampling in late December revealed mineralization over 500 metres of strike. The Company is planning to drill the newly found Paloma vein in late January/early February as one of the now twenty targets that will be drilled during an aggressive exploration program throughout 2020.”

The Paloma vein was found along the Old Panuco Road during detailed mapping of the northern Animas vein corridor. A road cut was sampled that contained crystalline quartz with disseminated argentite and pyrite hosted within a strongly weathered, demagnetised diorite unit. The vein has been tracked along strike with further outcrops in additional road cuts and creeks defining a 500 metre long vein that varies from 0.5-1.9 metres wide with mineralized widths up to 3.4 metres with associated stockwork adjacent to the vein. The vein has a subvertical dip and is postulated to be a hangingwall structure that will intersect the southwesterly dipping Animas vein at depth. Testing beneath outcropping mineralization, the deeper vein intersection and the intersections of the Paloma vein with northeast trending veins represent excellent targets for drilling.

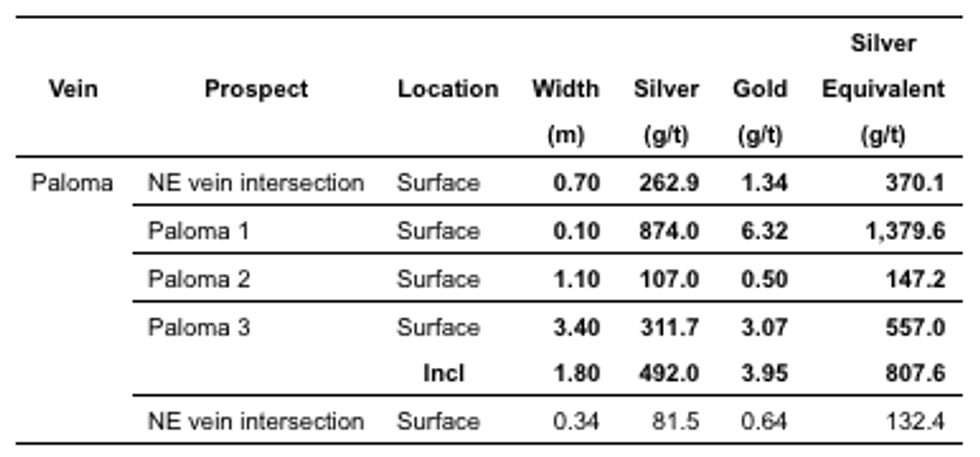

Sampling results along the Paloma Vein

Table 1:

Channel sample results from the Paloma veins at Panuco. Silver equivalent (Ageq) is calculated by multiplying the gold grade by 80 and adding it to the silver grade. This calculation estimates 100% recovery of both metals. Widths are estimated to represent true widths.

About the Panuco project

Vizsla has an option to acquire 100% of the newly-consolidated 9,386.5 Ha Panuco district in southern Sinaloa, Mexico, in the Municipio of Concordia. The option allows for the acquisition of a mill, mines, tailings facilities, roads, power and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

Qualified Person

The scientific and technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf of the Company by Michelle Robinson, MASc. P.Eng. a Qualified Person as defined by NI 43-101 (the “Qualified Person”). Rock samples discussed in this News Release were cut across oriented structures using a hammer and chisel onto a drop-bag. On the drop-bag, samples were crushed to about minus 1 inch between a pair of rock hammers, then rolled and quartered. Two to four kg of roughly homogenized material was collected in a double-plastic bag with the sample tag between bags with the number facing outwards. The bags were then sealed with zip ties. Information including the strike and dip of any structure (right-hand rule), width in decimeters, host rock type and alteration minerals/assemblages were recorded. If significant quartz textures and/or sulfides were present, these were noted. Maximum sample width was 1.5 meters. The samples were packed into rice bags and control samples including field duplicates, pulp duplicates, standard reference pulps and blanks were inserted into the sample stream. The samples were stored in a secure building in Concordia until enough samples were collected to form a batch. When a batch was prepared and tagged for shipping, these were sent via a commercial courier to the ALS sample preparation laboratory in Zacatecas. It is the opinion of the Qualified Person that the sampling methods, preparation and security are adequate.

ALS has a quality management system that meets all requirements of International Standards ISO/IEC 17025:2017 and ISO 9001:2015. At ALS, samples were dried, weighed and logged in, then crushed to 70% passing -2 mm. The sample was then split, and 250 grams were crushed until more than 85% was smaller than 75 microns. Prepared pulps were sent to the laboratory in North Vancouver, Canada for analysis. A 30 gram charge of the pulp was analyzed for gold using a fire assay with an AAS finish (Au-AA23). Detection limits for this method are between 0.005 ppm and 10 ppm. Samples with more than 10 ppm gold were re-assayed using a gravimetric finish (Au-GRA21). Other elements and silver were analyzed using a 0.25 gram charge of pulp digested in 4 acids (ME-ICP61). This method measures silver values between 0.5 and 100 ppm, and base metals between 2 and 10000 ppm. Samples with more than 100 ppm silver, or more than 10000 ppm Cu, Pb or Zn were reanalyzed using four acid overlimit methods (OG62). This method has an upper limit of 1500 ppm for silver. Samples with more than 1500 ppm Ag are re-analyzed using a fire assay of 30 grams of pulp with a gravimetric finish (Ag-GRA21). It is the Qualified Person’s opinion that the analytical procedures used are adequate.

The Qualified Person has checked the blank analyses and certified that no contamination between samples has occurred. Most gold and silver analyses from the standard pulps are within one standard deviation of the mean value, and all are within two standard deviations of the mean value. It is the Qualified Person’s opinion that the accuracy of the laboratory analyses is adequate. Analyses of field and pulp duplicates are mostly within 10%, but some show a larger variation due to the “nugget effect”, a phenomenon where a very small particle of precious metal-rich material can create a large variance in the assay result.

The Company has granted a total of 105,000 stock options to employees under the Company’s stock option plan with an exercise price of $0.72 per share, exercisable for a period of five years from the date of the grant and are subject to the policies of the TSX Venture Exchange.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information. These forward-looking statements or information relate to, among other things: the development of Panuco, including potential drill targets; future mineral exploration, development and production including the identification of drill targets and commencement of drilling; and completion of a maiden drilling program.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Vizsla, future growth potential for Vizsla and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold and other metals; costs of exploration and development; the estimated costs of development of exploration projects; Vizsla’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Vizsla has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: satisfaction or waiver of all applicable conditions to closing of the Acquisition including, without limitation, receipt of all necessary approvals or consents and lack of material changes with respect to Vizsla and Canam and their respective businesses, all as more particularly set forth in the Acquisition agreement; the synergies expected from the Acquisition not being realized; business integration risks; fluctuations in general macro‐economic conditions; fluctuations in securities markets and the market price of Vizsla’s common shares; and the factors identified under the caption “Risk Factors” in Vizsla’s management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Vizsla has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Vizsla does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.