April 26, 2024

Falco Resources (TSXV:FPC) focuses on developing gold and base metal projects in the Rouyn-Noranda region of Quebec, an established mining camp with a long history of exploration and development. The camp has historically produced 19 million ounces (Moz) of gold and 2.9 billion pounds (Blbs) of copper, and yet it is still under-explored for gold.

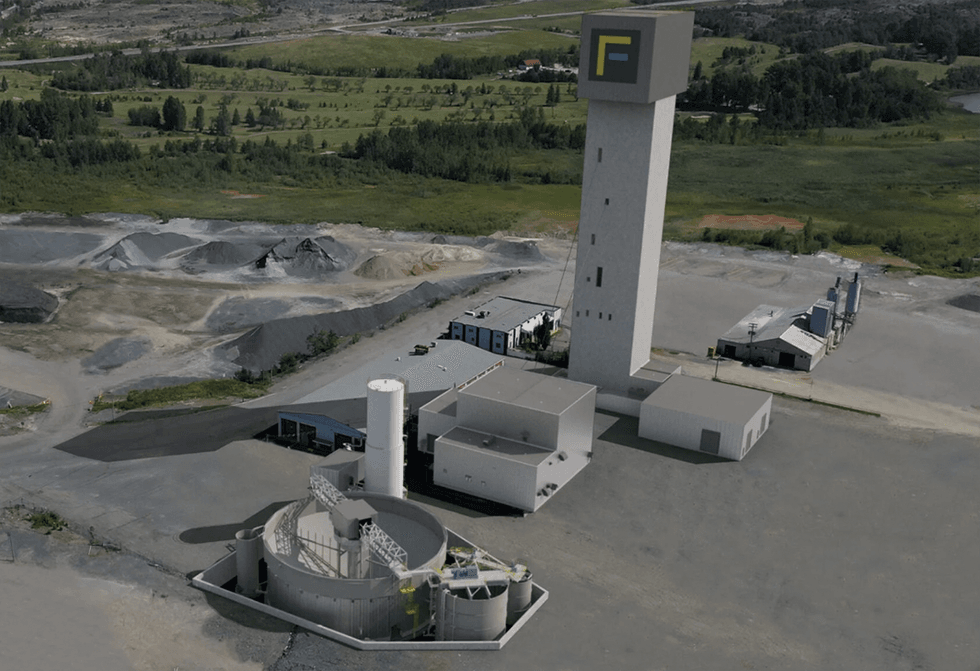

Falcon’s principal property, Horne 5 project, holds 67,000 acres or nearly 67 percent of the total area of the entire mining camp and is located under the former Horne mine which produced 11.6 Moz of gold and 2.5 Blbs of copper. The 2021 feasibility study on the Horne 5 project suggests strong project economics with a total mine life of 15 years, after-tax NPV at 5 percent of US$761 million, and a payback period of 4.8 years, assuming gold prices at $1,600/oz. At the current gold prices of over $2,300/oz, the project economics will be even better.

Falco Resources operating license and indemnity agreement (OLIA) with Glencore Canada will enable Falco to utilize a portion of Glencore's lands. The agreement entails establishing a technical committee comprising two representatives from Glencore and two from Falco, tasked with safeguarding the uninterrupted operations of Glencore’s Horne copper smelter. Additionally, a parallel strategic committee will be formed. Glencore will nominate one representative to join Falco's board of directors.

The successful completion of the OLIA, coupled with life-of-mine copper-zinc concentrate offtake agreements with Glencore, positions Falco to advance its Horne 5 project towards construction. The company is advancing with the permitting and financing processes for the project.

Company Highlights

- Falco Resources is a Canadian explorer of base and precious metals focused on developing its mineral properties in the Rouyn-Noranda region in Quebec, Canada.

- The company holds 67,000 acres of mining claims in the Rouyn-Noranda mining camp, accounting for nearly 67 percent of the entire mining camp.

- Rouyn-Noranda has a long history of mining and exploration. The area has established infrastructure and has been host to 50 former producers, including 20 base metal mines and 30 gold mines.

- Falco’s principal asset is the Horne 5 project which is a gold project with significant base metal by-products. It is located under the former Horne Mine which produced 11.6 Moz of gold and 2.5 billion pounds of copper.

- The Horne 5 is a world-class deposit containing 7.6 Moz gold equivalent in measured and indicated resources and 1.7 Moz gold equivalent in inferred resources.

- The Horne 5 project represents a robust, high-margin, 15-year underground mining project with attractive economics. The 2021 feasibility study indicates after-tax NPV at 5 percent of US$761 million and after-tax IRR of 18.9 percent.

- The operating lease and indemnity agreement (OLIA) with Glencore coupled with EIA admissibility receipt from the government body positions Falco to advance its Horne 5 project towards construction.

This Falco Resources profile is part of a paid investor education campaign.*

Click here to connect with Falco Resources (TSXV:FPC) to receive an Investor Presentation

FPC:CC

The Conversation (0)

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00