Tech Weekly: Chip Stocks Pop to Close Volatile Trading Week

Feb 6, 2026 01:30PM PST

Explore this week’s top tech news and market movers, plus key catalysts to watch next week.

Explore this week’s top tech news and market movers, plus key catalysts to watch next week.

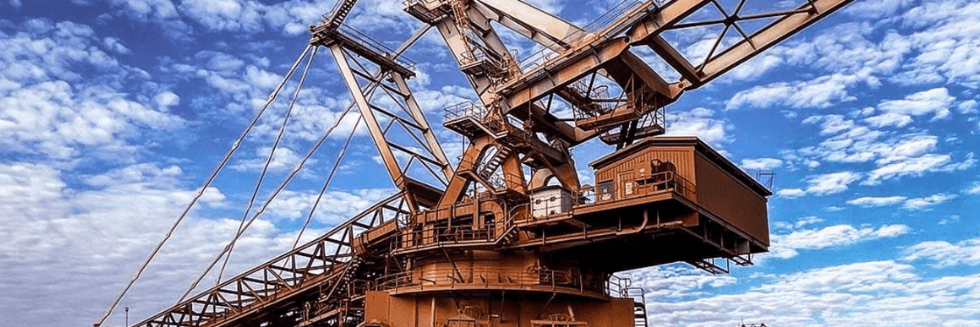

Enabling industrial digital transformations through advanced asset visualisation solutions