November 08, 2023

Outstanding Economics show Lake Hope to potentially be the lowest-cost producer of High Purity Alumina (HPA) globally by up to 50%

Impact Minerals Limited (ASX:IPT) is pleased to announce the positive results of a Scoping Study based on realistic production and capital expenditure estimates for the company’s Lake Hope High Purity Alumina (HPA) Project, located 500 km southeast of Perth in the Tier 1 jurisdiction of Western Australia.

SCOPING STUDY HIGHLIGHTS

The Lake Hope project contains a significant alumina (Al2O3) resource, which could become a major global supplier of High Purity Alumina (HPA) because of the unique nature of the deposit that allows very cost-effective mining and processing.

This Scoping Study indicates that, as far as Impact can ascertain from published data, the Lake Hope project could be one of, if not the lowest-cost producer of HPA globally, possibly by a significant margin of up to 50%.

- Potential to become a significant producer of HPA with steady-state production of 10,000 tonnes per annum following a two-year ramp-up.

- Low capital costs compared to peers driven by the unique nature of the clay deposit at Lake Hope.

- Low operating cost and high margins due to the deposit size, zero strip ratio, high- grade mineralisation at surface, no on-site beneficiation required, advantageous kinetics of the metallurgical process and by-product credits.

- Natural ESG benefits include probably considerably reduced CO2 emissions compared to incumbent producers.

- Very favourable market fundamentals with HPA deemed a Critical Mineral in Australia and many other countries.

- Forecast compound annual growth rate of about 20% for the HPA and related products market over the next decade driven by expansion in the battery and LED sectors.

- The study of HPA is based on a conservative commodity price estimate of US$22,000 per tonne compared to recent forecasts of more than US$25,000 per tonne from 2025 onwards.

Impact Minerals’ Managing Director, Dr Mike Jones, said, “This Scoping Study demonstrates the world-class potential of the Lake Hope Project and supports what we first thought was possible when we came across it and the work already done by Roland Gotthard and the Playa One team”.

“If you are playing in the industrial minerals space, at least one of four things has to be true about your mine otherwise you will not make it through the market cycle: the deposit has to be either the biggest, have the highest grade, be the first to market or, preferably, be the lowest cost producer. The unique characteristics of the Lake Hope deposit, both in terms of mining and processing, look like they could possibly deliver HPA at the lowest cost globally by a significant margin”.

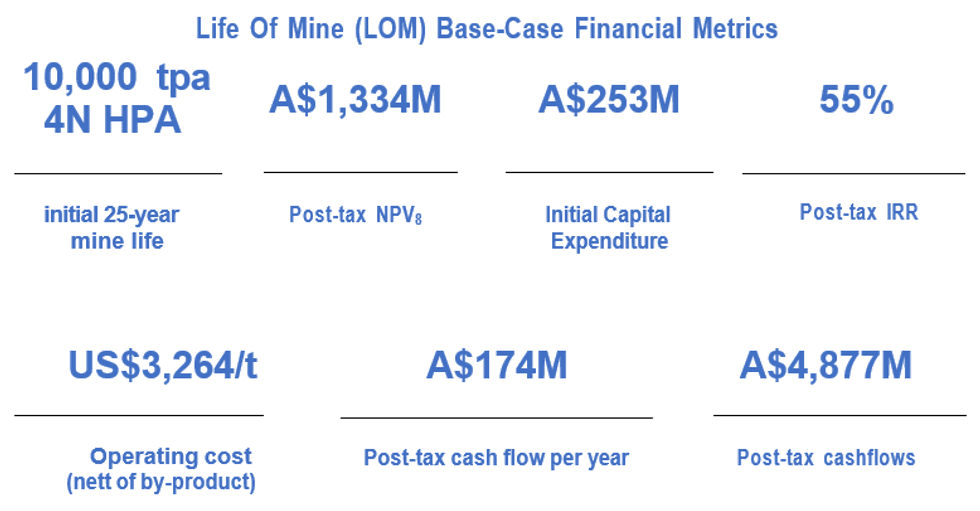

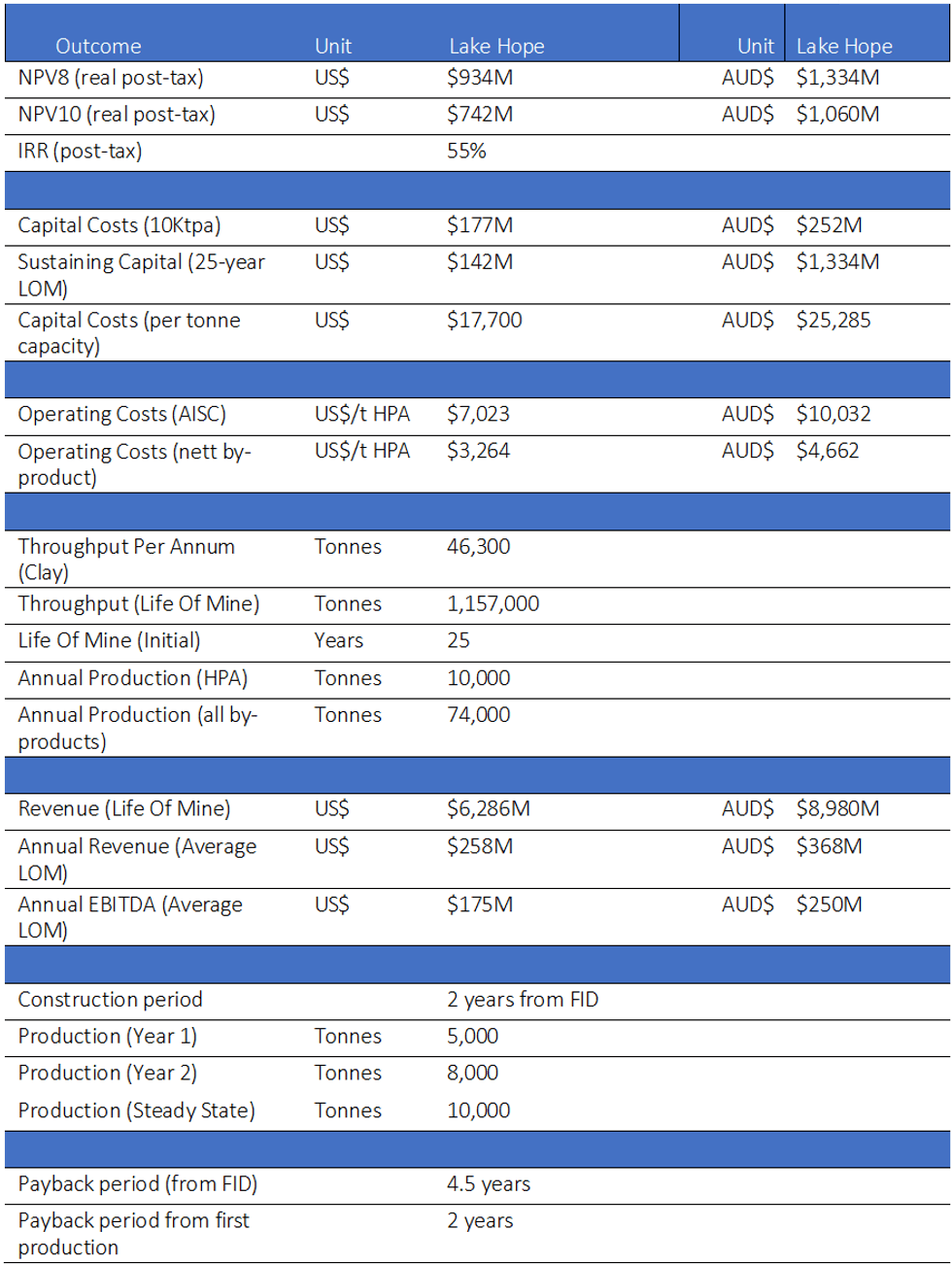

“Even though we are only at the Scoping Study stage, with all its inherent uncertainties, the financial model demonstrates the world-class economics of the project, which has an NPV of more than A$1 billion, very large operating margins and significant after-tax earnings of A$174 million per year. The ability to deliver sub-US$4,000 per tonne HPA is an extraordinary competitive advantage that Impact will continue to leverage in the current Preliminary Feasibility Study, due for completion in 2024.”

KEY SCOPING STUDY OUTCOMES

SUMMARY OF THE SCOPING STUDY

Impact Minerals Limited (ASX:IPT) is pleased to publish the results of a Scoping Study into a series of development options for the Lake Hope High Purity Alumina (HPA) Project located 500 km east of Perth in the Tier 1 jurisdiction of Western Australia. The Study comprises the results of preliminary metallurgical, engineering and logistical studies into the economic viability of the Lake Hope project.

HPA is now listed as a Critical Mineral in Australia, the US and Europe and is an essential mineral required for the ongoing decarbonisation of the world’s energy market.

The Scoping Study is reported in accordance with the JORC 2012 Code and ASX Listing Rules and with a level of accuracy of +/-30% commensurate with this level of study. The Study justifies the project progressing to a Preliminary Feasibility Study, which is well underway (ASX Release October 18th 2023).

The Study is based on work completed by Playa One Pty Ltd before Impact’s involvement in the project and work completed by Impact since acquiring the right to earn an 80% interest in the project earlier in 2023 (ASX Release March 21st 2023). Impact can earn its 80% interest by completing the PFS.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

22h

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00