February 26, 2024

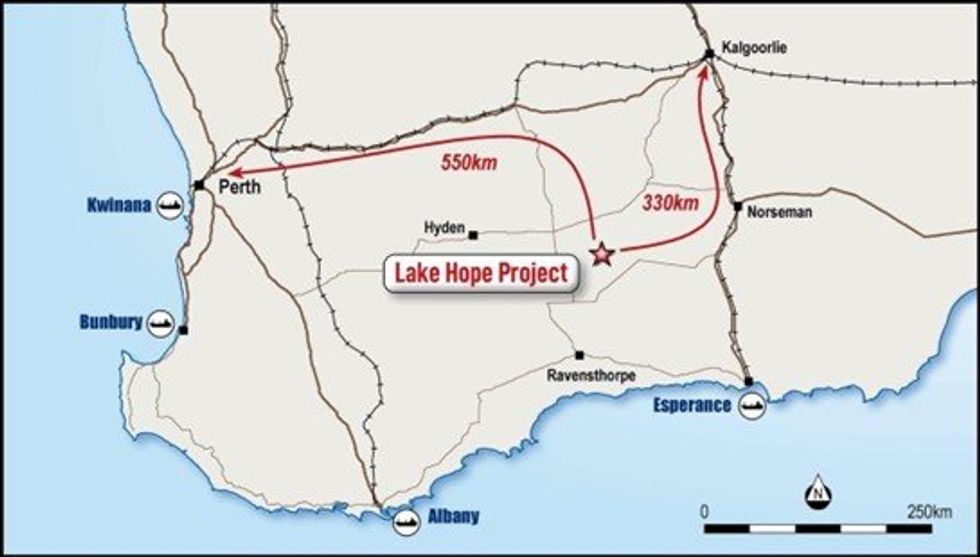

A new proprietary metallurgical process has been identified for producing high-value High Purity Alumina (HPA) from the lake clays at Impact Minerals Limited’s (ASX:IPT) Lake Hope project, located 500 km east of Perth in Western Australia (Figure 1). Impact can earn an 80% interest in Playa One Pty Limited, which owns the Lake Hope project, by completing a Pre-Feasibility Study (PFS) on the project which is in progress (ASX Release March 21st 2023 and November 9th 2023).

- 99.99% (4N) Al2O3 produced from a new low-temperature leach (LTL) and acid digestion process called the “LTL Process”:

- The LTL Process is a simpler process that may lower the Capital and Operating Costs to produce HPA compared to the Sulphate Process, which has been the focus of test work to date.

- The Sulphate Process underpinned the recent Scoping Study, which indicated an operating cost of

- The LTL Process will now be included in the ongoing Pre-Feasibility Study in parallel with the Sulphate Process at marginal extra cost to determine the best processing route to HPA.

- The PFS is due to be completed on schedule in late 2024.

Impact Minerals’ Managing Director, Dr Mike Jones, said, “Today we reveal a further exciting breakthrough for producing HPA from the unique mix of minerals that are present at Lake Hope, minerals which have allowed our new LTL Process to produce the benchmark 99.99% pure HPA very quickly after starting the test work.

The LTL Process is simpler than the Sulphate Process that underpinned our recent Scoping Study and showed that at less than US$4,000 per tonne, Lake Hope may produce HPA at up to 50% cheaper than our peers.

We think that further work on the LTL Process could result in even lower operating and capital costs, and this would only further enhance the already impressive economics of the project, which has an NPV8 of well over A$1 billion.

We have now started further optimization studies for the LTL Process and will push forward with our Pre- Feasibility Study using both process routes for the time being to determine the best strategic choice for processing at the project. Given we can run all these tests in parallel for little extra cost, we are still on course to finish the PFS later this year and continue to look forward towards producing HPA from Lake Hope”.

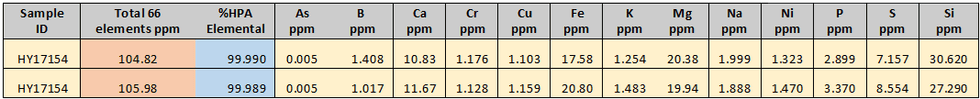

The new process, called the LTL Process, has produced High Purity Alumina (HPA) at 99.99% purity from the raw lake clay in only a few months of laboratory test work (with its attendant delays for holidays and other customer work) (Table 1). This is one of the fastest times to produce HPA from raw materials reported by ASX-listed companies and attests to the relatively straightforward nature of the process. It involves different reagents to those used in the Playa One Sulphate Process, which has also recently successfully produced 4N HPA (ASX Release 19th February 2024).

The LTL Process is a direct low-temperature leach (<90o C) that removes the requirement for sulphuric acid roasting, which was a key part of the Sulphate Process and reduces the number of steps to produce HPA from five stages to four (Figure 2). Accordingly, the new process could offer further reductions in operating costs and capital costs to produce HPA compared to the Playa One Sulphate Process.

The recently released Scoping Study on Lake Hope, which was based on the Sulphate Process, showed that at an operating cost of less than US$4,000 per tonne, Lake Hope could be the lowest-cost producer of HPA globally by a significant margin of up to 50% over Impact’s peers (ASX Release November 9th 2023). Therefore, this margin could be increased should test work on the new process support these initial results and further demonstrate the potential world-class economics of the Lake Hope project.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

3h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

20h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00