January 23, 2024

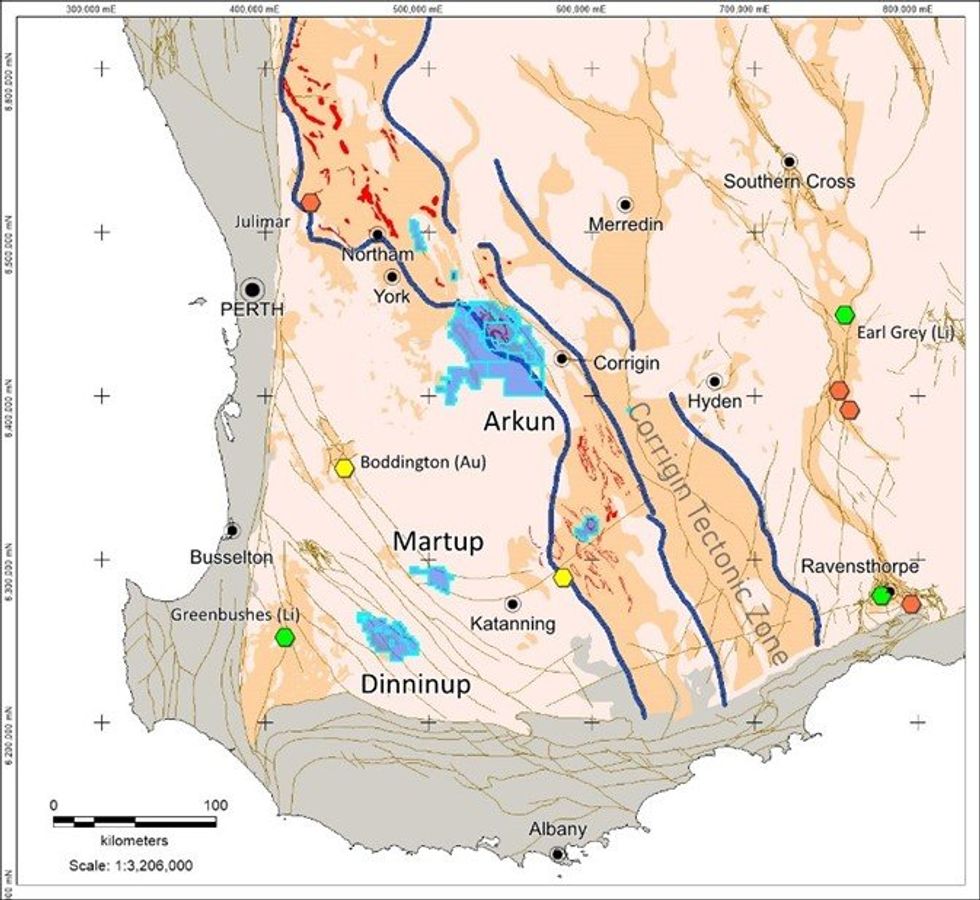

A large and significant target for porphyry copper-gold mineralisation has been identified at Impact Minerals Limited’s (ASX:IPT) 100% owned Arkun Project located 150 km east of Perth in the emerging mineral province of southwest Western Australia (Figure 1).

- A large and significant target for porphyry copper mineralisation has been identified in soil geochemistry data and Mobile Magneto-Telluric (MMT) data at the Caligula Prospect.

- A 5 km by 1 km soil geochemistry anomaly contains the key metal assemblage of copper- silver-cobalt+/-tellurium-bismuth-molybdenum, all indicators of porphyry copper mineralisation such as is found at Boddington and Calingiri in the same region of Western Australia. Gold assays are expected in February.

- The geochemistry anomaly coincides with numerous conductors identified in the MMT data that may represent disseminated or massive sulphides.

- Infill and extensional soil geochemistry surveys, together with a detailed interpretation of the MMT data, are underway to define the extent of Caligula and identify specific drill targets more fully.

- A follow-up aircore drill programme is to be undertaken as soon as practicable, which will also include the recently discovered Hyperion and Swordfish REE prospects.

The newly named Caligula prospect, initially identified in roadside and subsequent follow-up soil geochemistry surveys (Anomaly D: ASX Release 9th August 2023), has been significantly enhanced by the presence of several significant conductors within the geochemistry anomaly that may represent disseminated or massive sulphides.

The conductors were identified in recently acquired helicopter-borne Mobile Magneto-Telluric (MMT) data from one of the first surveys of this cutting-edge technology to be flown in Australia.

Caligula adds to Impact’s previously reported large Rare Earth Element soil geochemistry anomalies identified at Hyperion, located 15 km to the west, and Horseshoe, located 20 km to the east, and emphasises the significant exploration potential for a range of battery and strategic metals at the Arkun project (Figure 4 and ASX Releases 4th January 2024 and 1st June 2023).

Impact Minerals’ Managing Director, Dr Mike Jones, said, “The discovery of the Caligula Prospect is yet another significant and exciting breakthrough in our exploration at Arkun following the recent discovery of the Hyperion and Swordfish Rare Earth Element Prospects. It is one of the first of the many geochemical and geophysical targets we have at the project where we have actually been able to define the size and scale of the anomalies more fully and, given we have at least a dozen more similar areas to follow up, I am confident of more significant anomalies to come at Arkun. We are working towards a maiden drill programme as quickly as possible, and we will aim to cover as many targets as possible, including Hyperion and Swordfish. We are very encouraged by our results so far.”

Soil Geochemistry Results

The soil geochemistry results have defined an area of anomalous copper-in-soils that extends over about 5,000 metres north-south and up to at least 2,000 metres east-west. It is open to the east and the southwest (Figure 2 and Figure 4). The copper is associated with anomalous silver and cobalt and, in the southern part of the anomaly, also has a strong association with bismuth, tellurium and lesser molybdenum (Figure 2). Maximum and minimum values for the metals are given in Table 1.

This metal assemblage is characteristic of metals associated with porphyry copper deposits and this is encouraging for future exploration.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

7h

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

18h

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00