July 25, 2024

Landmark acquisition sees PVW secure a major position in ionic clayrare earths in one of the world’s fastest growing REE jurisdictions

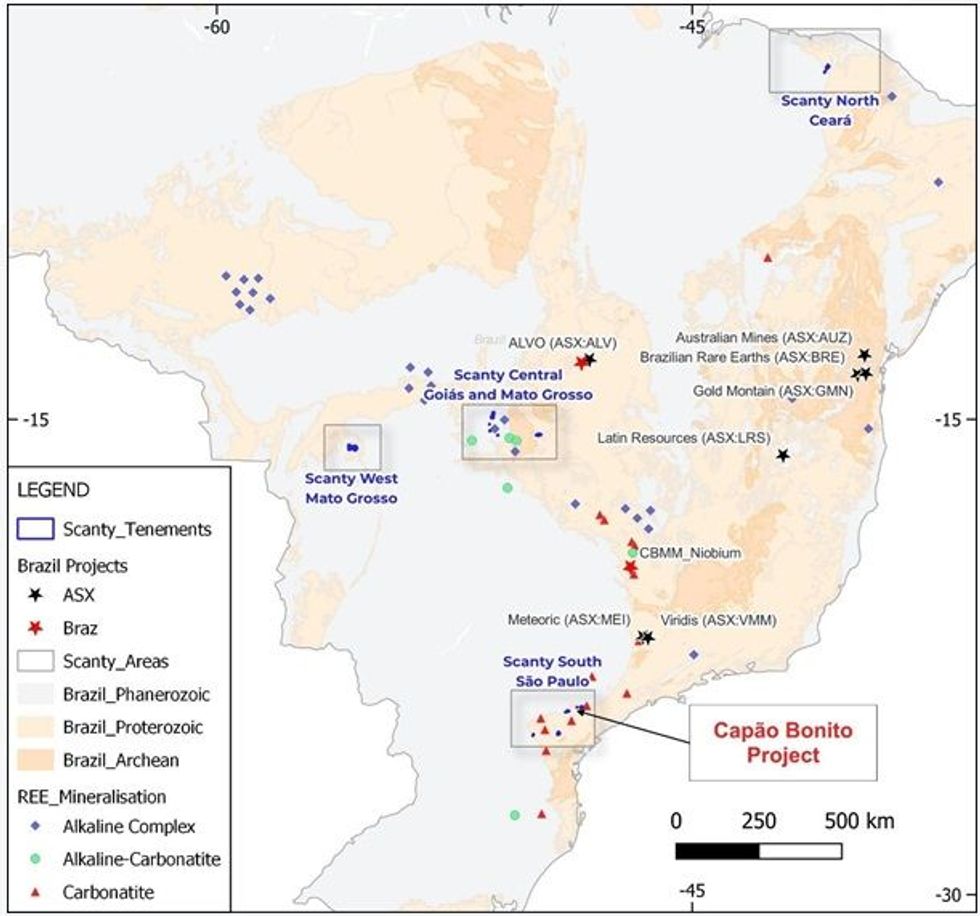

PVW Resources (ASX:PVW) (“PVW”, “the Company”), is pleased to advise that it has secured a significant position in the rapidly emerging Brazilian rare earths industry after signing a binding agreement to acquire Brazil-registered Scanty Mineracao Ltda (“Scanty”), the holder of strategically important and highly prospective portfolio of Rare Earth Element (“REE”) projects across four different areas in Brazil.

Highlights

- PVW Resources (PVW) has entered into a binding agreement to acquire a major portfolio of highly prospective ionic clay Rare Earth Element (REE) projects in Brazil.

- The acquisition of Scanty Mineracao Ltda, the holder of 11 Projects totaling 952km2, provides an exciting pipeline of opportunities to explore for REE in strategically prospective regions of Brazil.

- As a world-renowned mining jurisdiction, Brazil has geological conditions highly prospective for ionic rare earths with many advanced REE projects. Emerging Brazilian producers are setting the pace globally in the race for REE self-sufficiency and the development of major new independent supply sources.

- Commencement of due diligence provides proof of concept with REE anomalism confirmed using a portable X-Ray fluorescence analyser (pXRF) at the Sguario and Capáo Bonito Projects. Early exploration by Scanty will continue to be verified and validated with the view to release historical results once confirmed.

- Exploration will include surface sampling, and auger drilling to validate existing targets and test for further REE mineralisation in saprolite clay, while confirming the extent of the ionic clay hosted mineralisation.

- Luis Azevedo, vendor and experienced Brazilian mining expert to join the board of PVW Resources as a non-executive Director on completion of the transaction.

- Celeste Queiroz, 28-year experienced Brazilian geologist with 23 years with Vale to join the team as Country Manager - Brazil

- PVW Resources to leverage the expertise experience of its team in rare earths exploration, development and operations with the aim of building a substantial new rare earths business.

The portfolio of 11 projects have been identified and selected with the assistance of independent Brazilian geological consultants. As a package they offer the opportunity for significant new ionic clay REE discoveries in underexplored areas.

PVW’s move into Brazil gives the Company exposure to the rapidly growing Brazilian resources industry, in particular the strategically vital rare earths industry.

Non-Executive Chairman, Mr George Bauk said:

“The PVW Board see these projects as an exceptional opportunity to grow our presence in the rapidly evolving critical minerals landscape globally. The acquisition of strategically located rare earth element projects in Brazil allows us to gain a foothold in a highly prospective and stable region which has recently established itself at the forefront of the rare earth industry globally.”

“We are delighted in the appointment of Mr Luis Azevedo as a Non-Executive Director, a major shareholder of Scanty following the completion of the transaction. Mr Azevedo is an experienced Brazilian mining and legal professional who began his career with WMC Resources, a company I also worked for over a decade.”

Click here for the full ASX Release

This article includes content from PVW Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PVW:AU

The Conversation (0)

24 March 2022

PVW Resources

Exploring Western Australia for REE and HREE

Exploring Western Australia for REE and HREE Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00