June 18, 2023

Impact Minerals Limited (ASX:IPT) is pleased to announce a significant, substantial and high-grade maiden Mineral Resource Estimate (MRE) for its flagship Lake Hope High Purity Alumina (HPA) Project located about 500 km east of Perth in Western Australia. Impact has the right to earn an 80% interest in Playa One Pty Ltd, owner of the Lake Hope Project, via an incorporated joint venture (Figure 1 and ASX Release 21st March 2023).

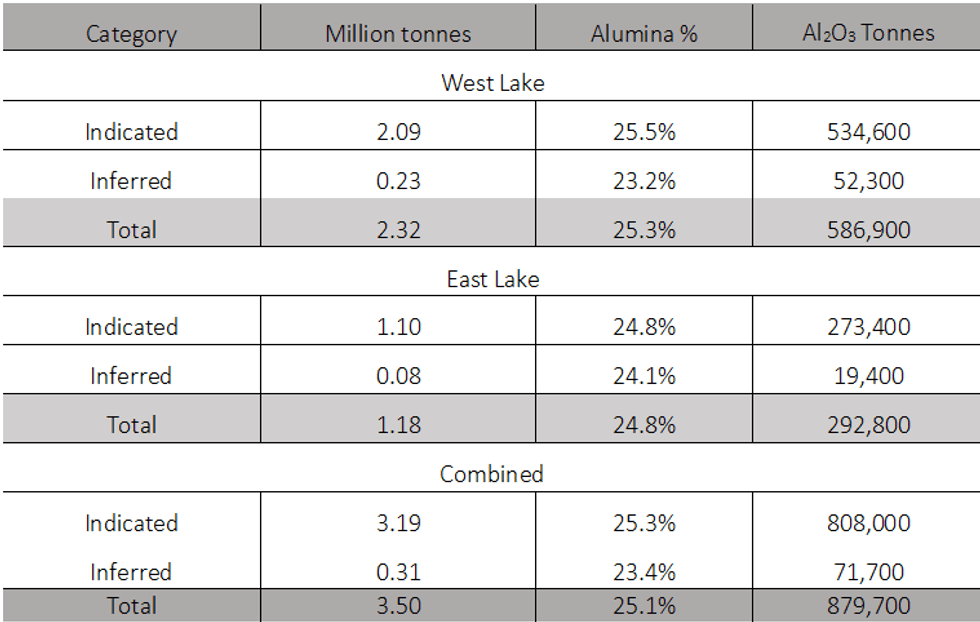

- A maiden mineral resource of 3.5 million tonnes at 25.1% alumina (Al2O3) for a contained 880,000 tonnes of alumina has been defined at the Lake Hope HPA Project in WA.

- 88% of the resource, or about 775,000 tonnes of alumina, is in the higher confidence Indicated Resource category.

- Impact aims to bring Lake Hope into production to deliver high-margin end-products into a rapidly expanding global market with current prices for benchmark 4N HPA (99.99% Al2O3) and related products of about US$20,000 per tonne.

- The unique geological properties of the Lake Hope deposit will allow for a shallow, very low-cost, free-digging operation only one to two metres deep and with offsite metallurgical processing at an established industrial site.

- Previous bench-scale metallurgical test work has produced HPA from representative lake clays via a disruptive sulphuric acid hydrometallurgical process likely to be cost- competitive with other producers and developers in Australia and globally.

- The proposed operation will have a small environmental footprint and low carbon emissions.

- Impact will continue to focus its immediate activities on completing the Scoping Study, lodgement of a Mining Lease Application in Q3 2023 and the continuation of a Pre-Feasibility Study, which includes more comprehensive metallurgical test work and baseline environmental studies.

- An initial heritage survey with the Ngadju First Nations group will commence in late June-early July.

Impact Minerals’ Managing Director, Dr Mike Jones, said, “This large and high-grade alumina resource will underpin our quest to become one of the world’s lowest-cost producers of High Purity Alumina over the next few years. This unique resource could provide multi-decade delivery of a mineral product recently added to Australia’s Critical Mineral list.

The resource allows us to now finish our Scoping Study which will demonstrate the economics of the project and be a catalyst for Impact to lodge a Mining Lease Application in the next Quarter. The Pre- Feasibility Study also continues apace with metallurgical test work, environmental baseline studies in progress, and a heritage survey with the Ngadju First Nations group to be completed in July. We continue our rapid journey to low-cost production in the quickly expanding, high-margin HPA business where current benchmark prices for 99.99% purity alumina or so-called 4N HPA, are currently in the region of US$20,000 per tonne”.

The Mineral Resource, 88% of which is in the higher confidence category of Indicated Resources, lies within a unique deposit of high-grade alumina (aluminium oxide, Al2O3) hosted by extremely fine-grained evaporite and clay minerals in the top two metres of two small dry salt lakes in the Lake Hope playa system (West Lake and East Lake, Figure 2 and ASX Release 21st March 2023).

The Mineral Resource Estimate is shown in Table 1 and is reported in accordance with the requirements of the JORC Code 2012 by resource consultants H and S Consultants Pty Ltd (H&SC) of Brisbane, Queensland. All drill hole information and assay data are provided in Appendices 1 and 2.

The alumina block grade distribution for the two Mineral Resources is shown in Figure 2. The grade increases towards the centre of the lakes, and this offers an opportunity for preferential mining of the higher-grade material in the early stages of any future mine development.

Planned Production of High Purity Alumina

Playa One has developed a novel, relatively low-cost hydro-metallurgical process to convert alumina mineralisation of a type as found on Lake Hope into High Purity Alumina (HPA) with the potential to produce a purity exceeding 99.99%, (so-called 4N HPA), generally taken as the industry standard purity for product comparison. (ASX Release 21st March 2023).

Impact’s review of this novel process indicates that, together with the unique physical and chemical characteristics of the Lake Hope clays, the entire project may offer a breakthrough in the cost of HPA production and be potentially cheaper than other HPA ores such as kaolin or feldspar.

Initial and unoptimised recoveries from the bench scale test work of the process suggest that a significant proportion of the alumina resource at Lake Hope may be converted to HPA. Optimisation of the process is a key focus of the Pre-Feasibility Study currently in progress (ASX Release 6th April 2023).

Impact will also own a proportional share of the processing technology by earning an interest directly in Playa One Pty Limited via an incorporated joint venture. Further details on the joint venture are provided at the end of the report.

Other advantages of the Lake Hope Project which indicate the potential for low-cost production of HPA include (ASX Release 21st March 2023):

- The naturally occurring and homogeneous micron-sized particles in the clay, which can be mined by free-digging and will require no comminution, grinding, classification, or wet-dry screening.

- The clay can be dug up and trucked to an off-site processing facility, likely to be in either Kalgoorlie or Perth where permitting will more straightforward (Figure 1)

- A simple wash and filtration circuit is all that is required for upfront processing.

- A low-temperature sulphuric acid leach can be used which is a generally readily available and is a cheaper acid than others.

- The sulphuric acid leach also eliminates the front-end energy-intensive calcination required in the kaolin hydrochloric acid leach process, thus significantly reducing energy costs, flow sheet complexity and CO2 emissions.

Next Steps

In order to accelerate the development timeline for Lake Hope, a Scoping Study and Pre-Feasibility Study (PFS) on Lake Hope are being run in tandem. The Scoping Study, to be completed in the third Quarter of 2023, will comprise high-level assumptions about the economic potential of the project based on the new resource, mining studies, preliminary metallurgical recoveries and likely offtake prices.

The PFS, which will be completed in mid-2024 will be based on more detailed studies which are in progress (ASX Release 6th April 2023). This work includes metallurgical optimisation test work, baseline flora, fauna and groundwater surveys, and geotechnical, logistics and freight studies.

As part of the PFS, an initial cultural and heritage survey with the Ngadju First Nations group will be completed in early July. This is a key part of the process to allow Impact to lodge its first ever Mining Lease Application over Lake Hope in the next Quarter.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

1h

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

09 March

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

09 March

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

09 March

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

09 March

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00