February 18, 2024

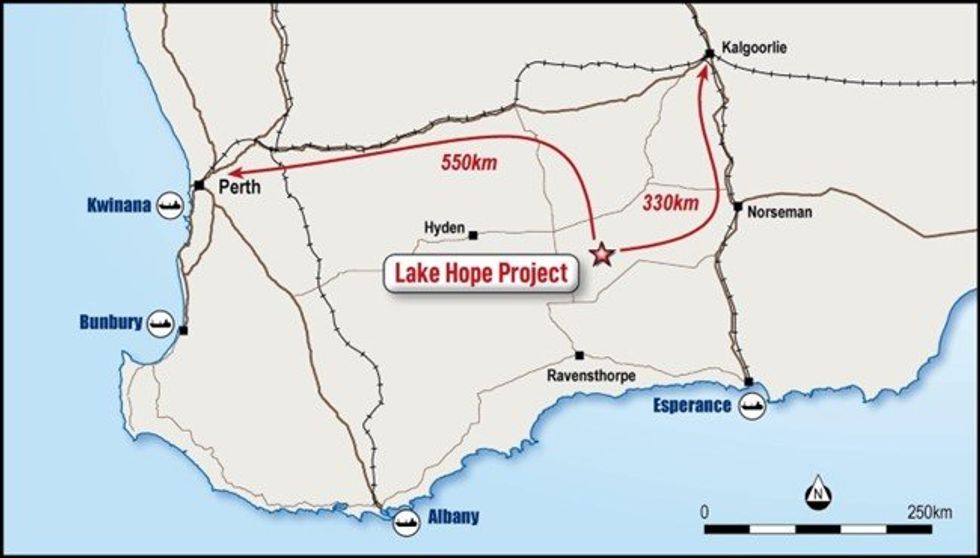

High Purity Alumina (HPA) at greater than 99.99% (4N) purity has been produced from the metallurgical processing of lake clays from Impact Minerals Limited’s (ASX:IPT) Lake Hope Project, located 500 km east of Perth in Western Australia (Figure 1). Impact can earn an 80% interest in Playa One Pty Limited, which owns the Lake Hope project, by completing a Pre-Feasibility Study (PFS) on the project which is in progress (ASX Release March 21st 2023 and November 9th 2023).

- Better than 99.99% (4N+) High Purity Alumina (Al2O3) produced from Lake Hope mud via the proprietary and patented Playa One Sulphate Process.

- The Sulphate Process underpins the recent Scoping Study, which demonstrated an NPV8 of A$1.3 billion for the project and an estimated operating cost to produce 4N HPA up to 50% lower than anyone else globally at less than US$4,000 per tonne.

- Production of larger quantities of HPA can now commence using the now-optimized Sulphate Process to demonstrate consistent quality to potential customers.

- Preliminary discussions with potential customers indicate very strong demand for 4N HPA.

- Other possible process routes to produce HPA from Lake Hope may be possible, with initial results due shortly.

- The Pre-Feasibility is on schedule to be completed in late 2024.

Impact Minerals Limited’s Managing Director, Dr Mike Jones, said, “The production of 4N HPA is a major milestone and exciting result for Impact and its shareholders as we have now shown that we can produce this high-value product, which commands prices of US$20,000 per tonne or more, from the mud in the top two metres of Lake Hope. It underpins the results of the Scoping Study, which showed an NPV8 of A$1.3 billion for the project and, at less than US$4,000 per tonne, possibly the lowest cost of production of HPA globally by a significant margin of up to 50%.

We have also optimized the Playa One Sulphate Process and have already started batch production of HPA to demonstrate consistent quality to our potential customers. We have discovered from our marketing that there is very strong demand for this high-value product, so we will continue progressing the Pre-Feasibility Study as quickly as possible. In addition, we recently uncovered two other possible process routes to produce HPA from these remarkable clays, which may offer yet further reductions in operating cost and capital expenditure if our initial test work is positive, and we are looking forward to getting those results soon,” Dr Jones said.

The 4N HPA was produced via a proprietary and patented metallurgical process called the ‘Sulphate Process’ which is owned by Playa One. The replication and optimization of this process for Lake Hope has been the key focus of Impact’s Pre-Feasibility Study to date, and therefore, these new results are a key milestone in the development of the project (ASX Releases March 21st 2023 and October 18th 2023).

The clays at Lake Hope occur in the top two metres of two small salt lakes on E63/2086 in a deposit containing about 880,000 tonnes of alumina (Al2O3) in various minerals. The deposit comprises Indicated (88%) and Inferred Resources (12%) of 3.5 million tonnes at an average grade of 25.1% alumina (see the Resource Estimate below and ASX Release 19th June 2023).

The lake clays contain a unique combination of naturally extremely fine-grained minerals, which delivers significant cost advantages to the mining and processing of the ore to produce HPA. The clays are free- digging and require no crushing, screening or other on-site preparation, and it is envisaged that the clay will be trucked offsite to a pre-permitted industrial site, most likely either in Kalgoorlie or Perth (Figure 1 and ASX Release March 21st 2023 and November 9th 2023).

The Playa One Sulphate Process is straightforward and comprises five stages based around very modest amounts of sulphuric acid (Figure 2): Stage 1 Wash circuit, Stage 2 Sulphuric acid leach and roast circuit, Stage 3 Intermediate alumina salt production, Stage 4 purification by conventional hydrochloric acid gas sparging and Stage 5 calcining to produce HPA. Results from the optimization of the first three Stages of the Process were reported to the ASX on October 18th 2023.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

5h

Filing of Initial Prospectus

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to announce that it has filed a preliminary non-offering prospectus (the "Prospectus") with the Ontario Securities Commission (the "Commission") and has applied to the Canadian Securities... Keep Reading...

23h

Keith Weiner: Silver Being Remonetized "With a Vengeance" as Gold Rises

Keith Weiner, founder and CEO of Monetary Metals, shares his outlook for gold and silver in 2026, saying that while he expects higher prices there will be volatility. He also outlines his thoughts on the role of precious metals in the monetary system. Don’t forget to follow us @INN_Resource for... Keep Reading...

12 February

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

12 February

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00