March 21, 2023

Basin Energy Limited (ASX:BSN) (‘Basin’, or ‘the Company’) is pleased to advise that the airborne electromagnetic (‘AEM’) survey is now complete at the Geikie Uranium Project (‘Geikie’ or the ‘Project’). All preliminary data has been received with high priority targets identified. Data processing analysis has commenced which will be used for final target definition to support the maiden drill program. In addition to the significant, newly identified electromagnetic (‘EM’) conductor in the Southeast of the Project (Refer ASX announcement dated 8th March 2023) and the multiple conductive anomalies associated with regional structures, the survey has also highlighted an additional conductor in the west of the Project.

Key Highlights

- Property-wide Airborne Electromagnetic Survey now completed at Geikie

- Data processing underway for target definition and priority ranking

- Additional EM conductor identified in the west of the property

- Preparation works well underway for maiden drill program

- Fully funded for a significant 2023 exploration program with $7.6m at 31 December 2022

Basin’s Managing Director, Pete Moorhouse, commented:

“The completion of the AEM survey is a significant milestone for our Geikie project and forms a critical step towards de-risking drill targets. This is the first detailed airborne electromagnetic survey over the entirety of the Project and is a significant step forward in delineating a series of high-quality, high-grade, yet shallow uranium targets.

The survey has identified a series of compelling drill ready targets in the structural intersections of the main conductor and the district scale faults observed in the magnetic data. Whilst the final AEM data is required to allow refinement of these targets, the Company can now continue preparations for inaugural drilling at its Geikie project.

We eagerly await the commencement of the next phase of work. The Company is fully funded for exploration on the Project with a high-quality suite of targets in a proven uranium region in the Athabasca Basin puts the Company in a strong position for the year ahead.”

AEM Preliminary Results

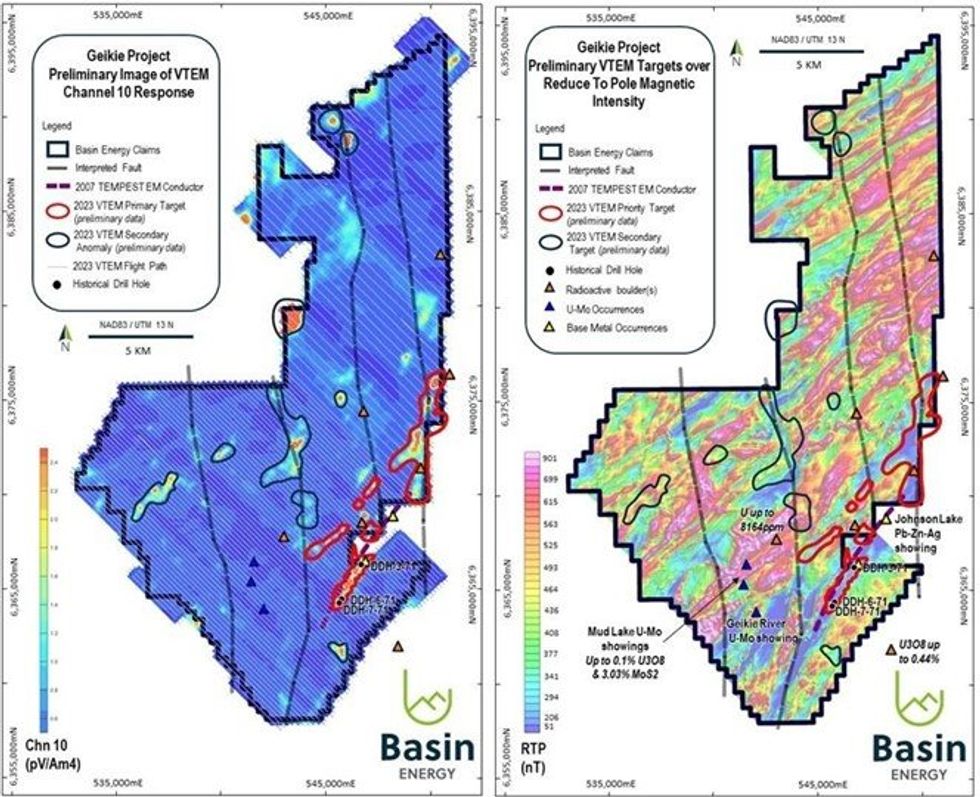

Data acquisition for the AEM survey has now been completed at Geikie. The survey objectives were to map suitable lithological and structural settings conducive to high-grade uranium mineralisation. This includes the identification of graphitic lithologies coincident with fault zones, as seen in deposits of the local region. The data in conjunction with existing knowledge will now be used for drill targeting.

Preliminary results from the initial 65% of the survey were released on the ASX on 8 March 2023, “Geophysical Targets Identified at Geikie” and identified a new, significant EM conductor in the southeast of the Project. On completion of the full survey, an additional conductor in the west of the Project was identified.

Preliminary data has been categorised into primary and secondary targets, with the next steps for primary targets being the modelling of final AEM data followed by drill testing. The secondary anomalies are potentially significant considering the correlation with regional faults, however further assessment will be conducted as modelling of final data is completed.

A strong coherent northeast trending conductor, classified as a primary target, striking through the southern half of the Project is clearly defined. A series of splays and offsets of this conductor are visible, often in correlation with intersections of regionally significant deep-seated north-south trending faults, part of the Tabbernor Fault System (‘Tabbernor’, or ‘TFS’).

Click here for the full ASX Release

This article includes content from Basin Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSN:AU

Sign up to get your FREE

Basin Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

31 August 2025

Basin Energy

Targeting uranium and rare earth elements (REEs) in Australia, Canada, Sweden and Finland.

Targeting uranium and rare earth elements (REEs) in Australia, Canada, Sweden and Finland. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

17 December 2025

Completes phase one drilling and expands Sybella-Barkly

Basin Energy (BSN:AU) has announced Completes phase one drilling and expands Sybella-BarklyDownload the PDF here. Keep Reading...

30 November 2025

Expands REE and Uranium Footprint at Sybella-Barkly

Basin Energy (BSN:AU) has announced Expands REE and uranium footprint at Sybella-BarklyDownload the PDF here. Keep Reading...

11 November 2025

Drilling Commenced for Sybella-Barkly Uranium and Rare Earth

Basin Energy (BSN:AU) has announced Drilling commenced for Sybella-Barkly uranium and rare earthDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Basin Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00