January 10, 2025

Boab Metals (ASX:BML) is a base and precious metals explorer and developer progressing toward a final investment decision (FID) on its Sorby Hills project, a world-class lead-silver deposit. Boab Metals is poised to capitalize on the rising demand for lead and silver, delivering value to shareholders and supporting the global transition to sustainable energy systems.

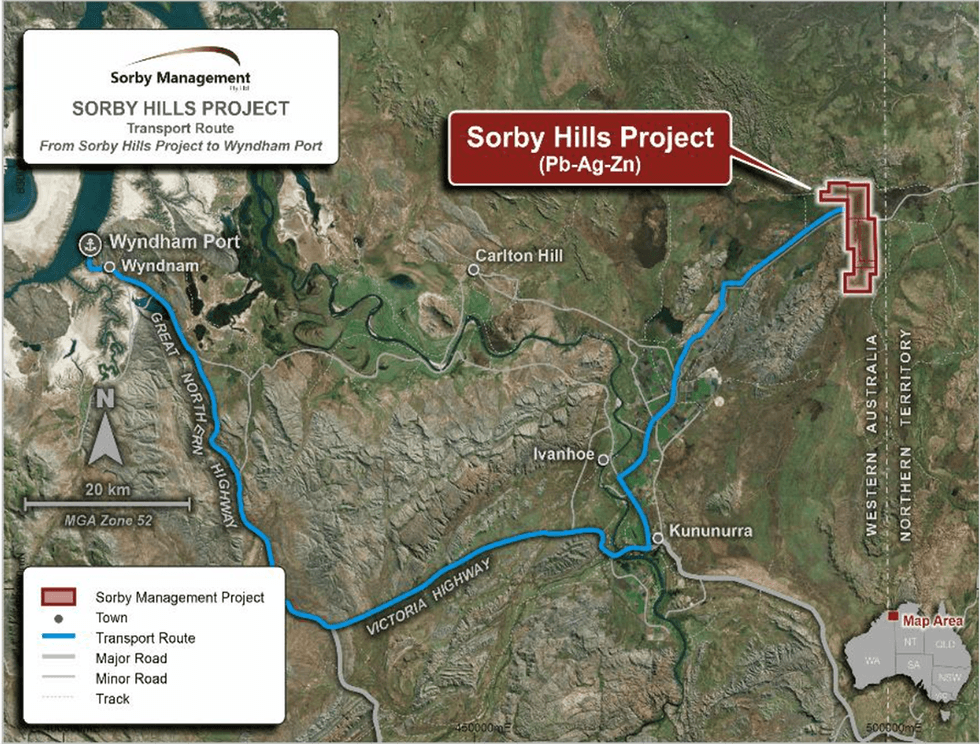

The Sorby Hills project is strategically located 150 km from Wyndham Port providing access to excellent infrastructure, and green power from the Ord River hydroelectric plant. Boab Metals combines technical expertise, sustainable practices, and robust financial planning to advance the Sorby Hills project, which is slated to produce high-grade lead-silver concentrate through conventional open-pit mining.

Boab Metals owns 75 percent of the Sorby Hills Project, with the remaining 25 percent held by Henan Yuguang Gold & Lead Co., China's largest lead smelting and silver producer. The project boasts a substantial, high-quality resource base of 47.3 million ton resource base at 4.3 percent lead equivalent (123 g/t silver equivalent), including 53 million ounces of contained silver, all with significant exploration upside.

Company Highlights

- Boab Metals is an ASX-listed base and precious metals explorer and developer with a flagship project poised for near-term production.

- The Sorby Hills project, Boab’s flagship asset, boasts a high-quality 47.3 Mt resource at 4.3 percent lead equivalent (123 g/t silver equivalent), including 53 Moz contained silver, and is in Western Australia, 50 km northeast of Kununurra.

- Strong economics underpin the project with an NPV (8 percent) of AU$411 million and an IRR of 37 percent, as confirmed by the completed FEED study. Life-of-mine operating cash flow of AU$1.1 billion with an average annual EBITDA of AU$126 million. Competitive C1 cash cost of US$0.36/lb payable lead (after considering silver credits).

- Binding offtake and prepayment agreements with Trafigura.

- Access to green hydroelectric power and existing environmental approvals enhance the project’s sustainability credentials and support reduced operational costs.

- Committed to community engagement, Boab Metals fosters strong relationships with local stakeholders and supports regional development initiatives.

- Expert leadership with a proven track record in exploration and development of mining assets

This Boab Metals profile is part of a paid investor education campaign.*

Click here to connect with Boab Metals (ASX:BML) to receive an Investor Presentation

BML:AU

The Conversation (0)

09 January 2025

Boab Metals Limited

Advancing toward near-term lead and silver production in Western Australia

Advancing toward near-term lead and silver production in Western Australia Keep Reading...

07 September 2025

Extension of Option to Acquire 100% of Sorby Hills

Boab Metals Limited (BML:AU) has announced Extension of Option to Acquire 100% of Sorby HillsDownload the PDF here. Keep Reading...

03 September 2025

EPBC Approval Granted for Sorby Hills

Boab Metals Limited (BML:AU) has announced EPBC Approval Granted for Sorby HillsDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Boab Metals Limited (BML:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 June 2025

Completion of Capital Raising

Boab Metals Limited (BML:AU) has announced Completion of Capital RaisingDownload the PDF here. Keep Reading...

16 June 2025

A$6 Million Placement to Advance the Sorby Hills Project

Boab Metals Limited (BML:AU) has announced A$6 Million Placement to Advance the Sorby Hills ProjectDownload the PDF here. Keep Reading...

09 February

Panelists: Silver in Bull Market, but Expect Price Volatility

Gold often dominates conversations at the annual Vancouver Resource Investment Conference (VRIC), but silver's price surge, which began in 2025 and continued into January, placed the metal firmly in the spotlight. At this year’s silver forecast panel, Commodity Culture host and producer Jesse... Keep Reading...

09 February

Southern Silver Intersects 5.8 metres averaging 781g/t AgEq at Cerro Las Minitas Project in Durango, México

Southern Silver Exploration Corp. (TSXV: SSV,OTC:SSVFF) (the "Company" or "Southern Silver") reports additional assays from drilling which continues to outline extensions of mineralization on the recently acquired Puro Corazon claim and identified further thick intervals of high-grade and... Keep Reading...

06 February

After Major Gold Payout, Bian Ximing Turns Bearish Sights on Silver

A Chinese billionaire trader known for profiting from gold’s multi-year rally has turned sharply bearish on silver, building a short position now worth nearly US$300 million as the metal's price slides. Bian Ximing, who earned billions riding gold’s multi-year rally and later turned aggressively... Keep Reading...

03 February

Silver Supply Tight, Demand Rising — What's Next? First Majestic's Mani Alkhafaji

Mani Alkhafaji, president of First Majestic Silver (TSX:AG,NYSE:AG), discusses silver supply, demand and price dynamics, as well as how the company is positioning for 2026.He also shares his thoughts on when silver stocks may catch up to the silver price: "You've got to give it a couple of... Keep Reading...

03 February

Rio Silver’s Path to Near-Term Cashflow

Rio Silver (TSXV:RYO,OTCPL:RYOOF) President and CEO Chris Verrico outlines the company’s transition into a pure-play silver developer. With the silver price reaching historic highs, Rio Silver is capitalizing on its strategic position in Peru — the world’s second largest silver producer — to... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00