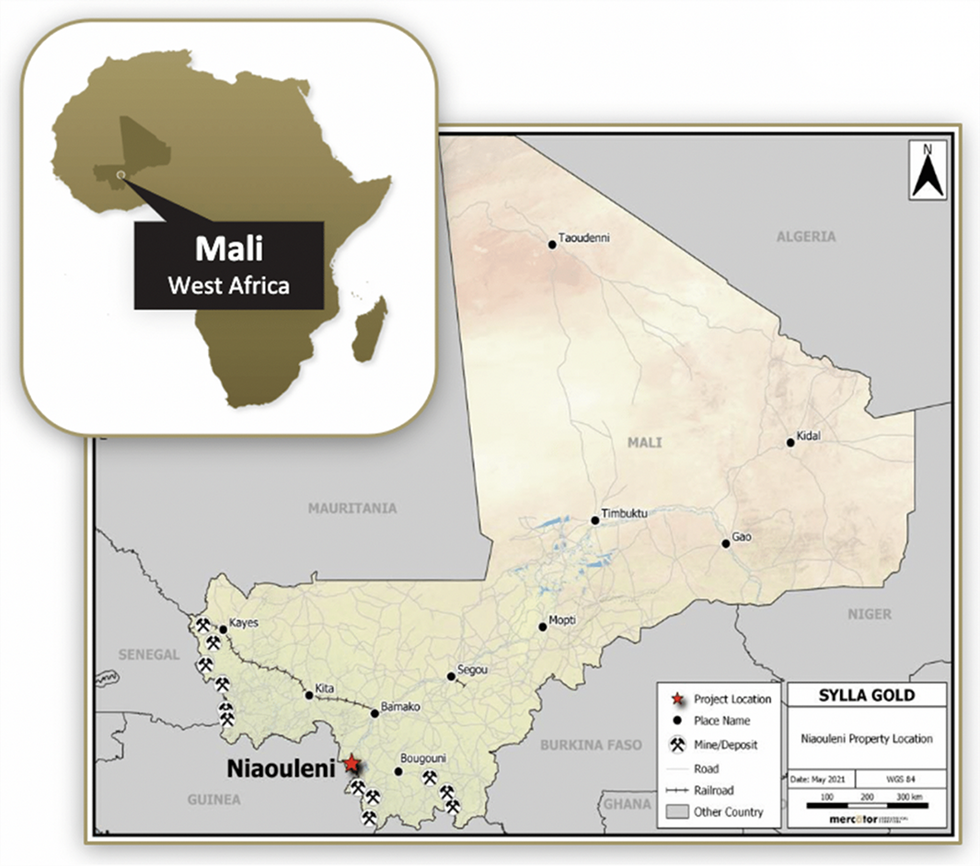

Sylla Gold Corp. (TSXV: SYG) (the "Company") is pleased to announce that, further to its press releases dated May 9, 2022, and October 26, 2022, it has entered into definitive option agreements (the "Option Agreements") with Touba Mining SARL. ("Touba") pursuant to which the Company has been granted options (the "Option") to acquire a 100% interest in gold exploration permits, Niaouleni West, Samaya South and Sananfara (Figure 1) all contiguous licences with the Company's core Niaouleni project. (the "Transaction").

The Samaya South, Niaouleni West and Sananfara exploration permits comprised of 2,500 hectares, 3,200 hectares and 2100 hectares, respectively and represent a 40% expansion of the Company's licence holdings in the area for a total of 17,200 hectares.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6472/157019_6c4e7eba84ec5ad2_001full.jpg

TERMS OF THE OPTION AGREEMENTS

Niaouleni West

- Pay Touba 100,000,000 FCFA (approximately CDN $218,000), of which 20,000,000 FCFA (CDN $40,936) was paid in 2022 and the balance of 80,000,000 FCFA (approximately CDN $177,000) is to be paid over a two (2) year period.

- Incur exploration expenditures of 528,000,000 FCFA (approximately CDN $1,167,000) over a three (3) year period upon issuance of the mineral exploration permit.

Samaya South

- Pay Touba 45,000,000 FCFA (approximately CDN $95,000), of which 30,000,000 FCFA (CDN $62,076) was paid in 2022 and the balance of 15,000,000 FCFA (approximately CDN $33,000) is to be paid by May 14, 2023.

- Incur exploration expenditures of 528,000,000 FCFA (approximately CDN $1,167,000) over a three (3) year period upon issuance of the mineral exploration permit.

Sananfara

- Pay Touba 100,000,000 FCFA (approximately CDN $218,000), of which 20,000,000 FCFA (CDN $41,060) was paid in 2022 and the balance of 80,000,000 FCFA (approximately CDN $177,000) is to be paid over a two (2) year period.

- Incur exploration expenditures of 641,025,000 FCFA (approximately CDN $1,417,000) over a three (3) year period upon issuance of the mineral exploration permit.

Other

- Pursuant to each option agreement, Touba retained a 2% Net Smelter Royalty ("NSR") on all ore mined from each optioned property. The Company has the right to purchase one-half of each NSR (equivalent to a 1% NSR) for US$1,000,000 per option agreement; and,

- During the applicable option period, the Company shall be responsible for maintaining each permit in good standing and performing any and all obligations required by law.

UPDATE ON PRIVATE PLACEMENT OF UNITS

Further to the Company's press release of February 1, 2023, the Company will not proceed with the second tranche of its private placement. Pursuant to the non-brokered private placement the Company issued a total of 3,151,420 units (each, a "Unit") at a price of $0.10 per Unit for aggregate gross proceeds of $315,142 (the "Offering"). The Company issued 150,000 common shares (the "Common Shares") in the capital of the Company at a price of $0.10 per Common Share to Canaccord Genuity Corp. as payment for their services as financial advisor for the Offering.

For further details on the Offering, please refer to the Company's press releases of October 20, 2022, December 8, 2022, January 3, 2023 and February 1, 2023.

The Company is currently negotiating to secure an additional financing transaction.

Niaouleni Project

The Niaouleni Project is 17,200 hectares in size and accessible by paved highway and includes extensive artisanal mining activity within the interpreted extensions of gold bearing structures. Niaouleni is strategically located roughly 3km south of Toubani Resources Kobada deposit within the emerging Niaouleni-Kobada-Sanankoro Corridor. Sylla Gold's maiden drilling program was completed between April and July 2022 and included 57 reverse circulation (RC) drill holes (7,305 m) and 212 air core (AC) drill holes (10,600 m) completed along several drill fences. These drill holes targeted the Niaouleni South, Lebre Plateau and Kankou Moussa prospects along the Kobada Shear, and the Gouingouindougou target located on the Gosso Shear. These targets were all previously defined by termite mound and soil geochemistry results. Assay results from the RC and AC drilling programs were released by the Company in news releases dated August 29, 2022, September 13, 2022, and October 4, 2022. Significant assay highlights from the 2022 drilling program include 5.17 g/t Au over 25 m from drill hole NSRC22-018 and 2.13 g/t Au over 25 m from drill hole NSRC22-027.

For more information, please contact:

Regan Isenor

President and Chief Executive Officer

Tel: (902) 233-4381

Email: risenor@syllagold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain "forward-looking information" within the meaning of applicable securities laws. Forward looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "would", "potential", "proposed" and other similar words, or statements that certain events or conditions "may" or "will" occur. These statements are only predictions. Forward-looking information is based on the opinions and estimates of management at the date the information is provided, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. For a description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company's Management's Discussion and Analysis. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change, unless required by law. The reader is cautioned not to place undue reliance on forward-looking information.

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/157019