2023 Operational and Project Highlights:

- The Company raised over $17 million for exploration, with cash and cash equivalents of $5,540,312 at the year end

- Completed aggressive exploration programs with 21,126 meters in 47 holes drilled in 2023.

- Adding results of 39,270 meters in 145 holes of new diamond drilling to the project database for the updated Mineral Resources estimation reported in Q1 2024, which includes:

- A 172% increase of Indicated Mineral Resources to 66.1 million tonnes (Mt) containing 1,093 million pounds (Mlb) copper at 0.75%, 678Mlb nickel at 0.47%, 79Mlb cobalt at 0.05%, 2.34 million ounces (Moz) palladium at 1.10 g/t and 0.42Moz platinum at 0.19 g/t.

- 80% of the Indicated Mineral Resources is Open Pit with 52.7Mt at 0.65% Cu, 0.43% Ni, 0.05% Co, 0.97g/t Pd and 0.17% Pt.

- Inferred Mineral Resources of 25.9Mt containing 558Mlb copper at 0.98%, 333Mlb nickel at 0.58%, 40Mlb cobalt at 0.07%, 1.12Moz palladium at 1.43 g/t and 0.21Moz platinum at 0.25 g/t.

Canadian North Resources Inc. ("the Company", TSXV: CNRI; OTCQX: CNRSF; FSE: EO0 (E-O-zero)) is pleased to announce the operational and financial results for the year ended December 31, 2023.

"We have achieved an important milestone for the Ferguson Lake base metal (nickel, copper, cobalt) and PGM (palladium and platinum) Project ("the Ferguson Lake Project")," said Dr. Kaihui Yang, the President & CEO. "The Company raised over $17 million, accomplished aggressive exploration programs; added 39,270-meter drilling results to the database, and retained SRK Consulting and Ronacher McKenzie Geoscience to update the Mineral Resources estimation and 43-101 compliant Technical Report. We have received the statement of the updated Mineral Resources (Figure 1) that demonstrates the Ferguson Lake project is one of the highest-grade and largest undeveloped critical mineral projects in North America (Refer to the press release "Canadian North Resources Reports Substantial Increase of Copper, Nickel, Cobalt, Palladium and Platinum NI 43-101 Compliant Mineral Resources for its 100% owned Ferguson Lake Project in Canada" dated March 19, 2024, available on the Company's website and Sedar+. The technical report on the resource estimates, which is being prepared in accordance with National Instrument 43-101 ("NI 43-101"), will be available on SEDAR+ (www.sedarplus.ca) under the Company's issuer profile within 45 days.) The effective date of the current Mineral Resource Statement is March 19, 2024.)".

"This year we will continue to expand the mineral resources at the Ferguson Lake project," Dr. Yang added. "We will conduct follow-up metallurgical testing, commence economic evaluation and infrastructure and environmental studies for a low-carbon footprint mine development plan at the Ferguson Lake Project."

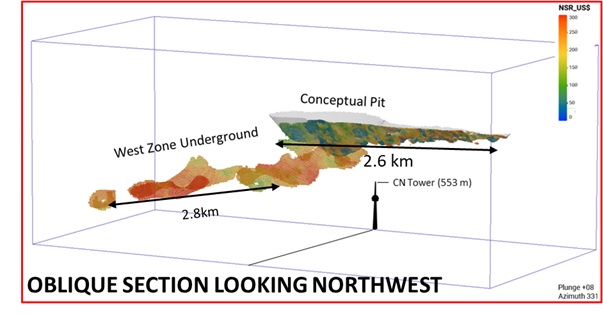

Figure 1, the 3D model of the mineral resources for the West and Central Zones of the Ferguson Lake Project

• The Company also engaged in the following activities in 2023:

- On January 7, 2023, the Company reported 5 new mineralized areas identified from the surface sampling programs over the 156.9 km 2 prospecting area surrounding the 96.9 km 2 mining leases of the Ferguson Lake Project. High-grade nickel-copper-PGM (up to 5.0% Cu, 0.99% Ni, 2.70g/t Pd, 0.62g/t Pt, 1.14g/t Au) was found in the samples (1.5-3.0 kg each) from the outcrops. The Company also reported high-grade gold (up to 52.3g/t) found at the Mac Island and South Mac Island prospects in the Kaminak Lake area (29.2 km 2 ), and copper & gold mineralization samples (1.0-3.0 kg each) found on outcrops throughout the staked area.

- On February 21, 2023, the Company reported the geochemical assay results for the remaining 40 holes (of total 68 holes drilled) consisting of 10,550 meters (of the total 18,144 meters) from the diamond drilling program completed by the Company at its 100% owned Ferguson Lake property. The results extended the mineralized zones for 1,500 meters outside the block model for the updated mineral resources estimates (Refer to "Independent Technical Report, Updated Mineral Resource Estimate, Ferguson Lake Project, Nunavut, Canada. Prepared by Ronacher McKenzie Geoscience Inc. and Francis Minerals Ltd." filed by the Company to Sedar.com on July 13, 2022).

- On March 6, 2023, the Company reported the identification of extensive granitic pegmatites potentially hosting lithium-bearing minerals over the 253.8 km 2 area of the 100% owned Ni-Cu-Co-Pd-Pt Ferguson Lake property. The potential for lithium minerals has never been explored at the Ferguson Lake area. The Company will undertake its first lithium-specific exploration programs during 2023.

- In mid-March, the Company opened the field camp at Ferguson Lake, shipped in fuel and drill materials and prepared for the winter/spring drilling program at Ferguson Lake.

- The Company signed the agreement with the Government of Nunavut on March 22, 2023. The government approved to provide $250,000 to the company to support the exploration expenditures, On March 31, 2023, $125,000 of the total amount has been received by the company.

- On April 3, 2023, the Company announced the commencement of a new 20,000-meter diamond drilling program to continue focusing on the drill testing of high-grade base metal and PGM targets along the 15-km-long main mineralized horizon, to expand and up-grade the mineral resources, and to test the new identified base metal and PGM targets throughout the Property.

- In early May, 2023, the Company granted its directors, officers and consultants, options to purchase a total of 2,750,000 Common Shares of the Company, at an exercise price of $2.45 per share.

- On May 8, 2023, the Company engaged an investor relations firm, Paradox Public Relations Inc., to enhance our investor relations efforts and increase our visibility in the investment community. It was anticipated that their expertise and connections would help the Company to improve its market performance and achieve a fair market value for our shareholders.

- On May 10, 2023, the Company began to trade at OTCQX Market, which provides us with a platform to enhance its our visibility and liquidity among U.S. investors. This marks an important step forward for the Company as it continues to expand our reach and engage with investors in North America.

- On May 16, 2023, the Company was awarded a $250,000 grant from the Government of Nunavut's Discover, Invest, Grow ("DIG") program.

- On May 29, 2023, the Company announced it completed its spring diamond drilling program on ice consisting of 6,151 meters in 21 holes for its 100% owned Ferguson Lake base metal (nickel, copper, cobalt) and platinum group metal ("PGM", mainly palladium and platinum) project in Nunavut, Canada.

- On June 15, 2023, the Company announced that the Company re-started diamond drilling at its 100% owned Ferguson Lake Project ("Ferguson Lake Project") in Nunavut, Canada after a three week pause for regional caribou migration and after completing the first 6,151 metres of drilling on Ferguson Lake during the spring.

- On June 26, 2023, the Company announced that the Company was granted Depository Trust Company (DTC) eligibility, a significant milestone that will enhance the accessibility and efficiency of the Company's shares for investors in the United States.

- On July 18, 2023, the Company reported the assay results for the 6,151 metres in 21 holes of diamond drilling completed during the spring at its 100% owned Ferguson Lake Project ("Ferguson Lake Project") in Nunavut, Canada. The Ferguson Lake project contains base metals (nickel, copper, cobalt) and platinum-group metals ("PGM", mainly palladium and platinum), as well as potentially lithium minerals, along a 15-km-long main mineralized horizon and numerous additional prospective areas.

- On July 26, 2023, the Company announced the closing of non-brokered private placement of common shares ("Flow-Through Shares") on a flow-through basis pursuant to the Income Tax Act (Canada), of which 1,031,425 Flow-Through Shares were issued at a price of $2.70 per share for gross proceeds of $2,784,847.50 (the "Flow-Through Offering").

- On July 31, 2023, the Company further to its news release issued July 27, 2023, the closing of the first tranche of its non-brokered private placement of 1,082,621 common shares ("Charity Flow-Through Shares") on a flow-through basis pursuant to the Income Tax Act (Canada) at a price of $2.877 per share for gross proceeds of $3,114,700.62 (the "Charity Flow-Through Offering").

- In mid August, 2023, the Company granted to officers, employees and consultants' options to purchase a total of 460,000 Common Shares of the Company, at an exercise price of $2.35 per share.

- On August 17, 2023, the Company announced that it had received an additional grant of $125,000 from the Government of Nunavut's Discover, Invest, Grow ("DIG") program. This grant comes on the heels of the $250,000 received in May and June 2023, reaffirming the Company's commitment to advancing mineral exploration in the emerging mining region of Nunavut.

- On September 13, 2023, the Company completed the issuance of Flow-Through Shares of 2,864,046 shares for proceeds of $8,057,298 at the weighted average price of $2.81 per share. The cost of the issuance of $483,438 was offset by the proceeds of Flow-through Shares. A Flow-Through Share premium was recognized as a liability on the statement of financial position for $624,747.

- On September 15, 2023, the Company announced that it has commenced a market awareness program, aimed at enhancing its market visibility and engagement.

- On September 18, 2023, the Company announced it has completed 21,126.50-meter drilling at its 100% owned Ferguson Lake base metal (nickel, copper, cobalt) and platinum group metal (mainly palladium and platinum) project in Nunavut, Canada

- On September 26, 2023, the Company reported the return of initial partial assay results from 21 holes drilled during the summer, which is a portion of the 21,126 metre 2023 diamond drilling program completed at the Ferguson Lake Project. The results indicate high-grade Nickel, Copper, Cobalt, Palladium and Platinum (e.g. 10 metres grading 0.48% Ni, 1.48% Cu, 0.06% Co, 1.28g/t Pd and 0.06g/t Pt in hole FL23-481B), and significant (>3 metres) massive sulphides and wide (up to 110 metres) disseminated sulphide mineralized zones intersected. The results confirm a further expansion of 1,200 metres near-surface mineralized zones in East and West Zones and up to 250 metres down-dip deep mineralized zone of West Zone.

- On October 3, 2023, the Company announced its participation in the prestigious Mines and Money event, held in conjunction with the International Mining and Resources Conference (IMARC) in Sydney, Australia, October 31 to November 2, 2023.

- On October 11, 2023, the Company announced the launch of its newly redesigned website aimed at providing an enhanced online experience for its stakeholders, investors and broader public.

- On October 17, 2023, the Company announced it had commissioned a new Mineral Resource estimation in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") for its Ferguson Lake nickel, copper, cobalt, palladium and platinum project. The Company will add results of 39,270 meters in 145 holes of new diamond drilling to the project database for the completion of an updated Mineral Resources estimation. New Mineral Resource model will include both mineralization types and significant extensions of mineralized zones defined by the Company drilling to September 2023. SRK Consulting (Canada) Inc. and Ronacher McKenzie Geosciences Inc. have been engaged for an independent technical review of the project, an update of the 2022 resource estimate and preparation of the new NI 43-101 Mineral Resource Report.

- On November 28, 2023 the Company reported the return of assay results from 26 remaining holes drilled during the summer, which is the final portion of the 21,126-metre 2023 diamond drilling program at the Ferguson Lake Project. The results indicate three copper-nickel sulphide zones further extended along strike for: 200 m west of West Zone; 450 m of M-Zone, and 300 by 200 m of Anomaly-51 Zone, and confirmed two new sulphide zones: northeast extension of Anomaly-51 Zone and south of Central Zone, with significant (>3 – 15 metres) massive to semi-massive sulphides and widened (up to 112.5 metres) disseminated sulphide mineralized zones intersected including 15.0 metres grading 0.36%Ni, 0.48% Cu, 0.05% Co, 0.70g/t Pd, 0.08g/t Pt and 0.06g/t Rh in FL23-527 hole and 112.5 metres grading 0.16% Ni, 0.23% Cu, 0.02% Co, 0.35g/t Pd, 0.06g/t Pt and 0.02g/t Rh in FL23-527B hole.

- During the year, the Company received $9,186,597 from the exercises of the warrants, and $67,680 from the exercises of options.

- For the year ended December 31, 2023, the Company reported a net loss of $6,400,496 or $0.06 per share.

Subsequent to Year End, the Company has conducted the following work:

- January 2, 2024, the Company reported the results from the processing of Borehole Time-Domain Electromagnetic (BHTEM) surveys from deep West Zone drillholes FL22-481A and FL23-481B completed at its 100% owned Ferguson Lake Project. The results demonstrate the continuance of the West Zone greater than 200 metres beyond the historically defined down-dip drilled extent of the zone and show its open potential for continued expansion both laterally and further down-dip at depths of 650 to >800 metres. The Company also announced that Dr. Trevor Boyd was retired from the VP Exploration and would continue to be a Technical Advisor and QP for the Company.

- January 18, 2024, the Company announced that its IR team would attend the Vancouver Resource Investment Conference (the VRIC) in Vancouver on January 21-22, 2024. During and after the VRIC, the IR team would do the roadshows to the investors in Vancouver.

- February 27, 2024, the Company announced that its participation in the Prospectors and Developers Association of Canada (PDAC) in Toronto on March 3-6, 2024. Dr. Kaihui Yang, the President of CEO was invited to present an overview of the Company and its Ferguson Lake project at the Corporate Presentation Forum for Investors ("CPFI"). During and after the PDAC, the IR team would do the roadshows to the investors in Toronto.

- March 19, 2024, the Company announced an updated Mineral Resource estimate for its 100% owned Ferguson Lake project. The updated Mineral Resources includes (1) a 172% increase of Indicated Mineral Resources to 66.1 million tonnes (Mt) containing 1,093 million pounds (Mlb) copper at 0.75%, 678Mlb nickel at 0.47%, 79Mlb cobalt at 0.05%, 2.34 million ounces (Moz) palladium at 1.10 g/t and 0.42Moz platinum at 0.19 g/t, of which 80% is the Open pit Indicated Mineral Resources with 52.7Mt at 0.65% Cu, 0.43% Ni, 0.05% Co, 0.97g/t Pd and 0.17% Pt; (2) an Inferred Mineral Resources of 25.9Mt containing 558Mlb copper at 0.98%, 333Mlb nickel at 0.58%, 40Mlb cobalt at 0.07%, 1.12Moz palladium at 1.43 g/t and 0.21Moz platinum at 0.25 g/t. The updated Mineral Resource Model shows the Successful major upgrade of Mineral Resource tonnages from Inferred to Indicated category combined with continued expansion of overall Mineral Resource size along strike and down / up dip, and the potential for continued Mineral Resource expansion along strike and at depth over the 15 km long main mineralized horizon and within the open satellite mineralized zones.

- March 21, 2024, the Company announced the amendment on the exercise price of options to purchase a total of 1,600,000 Common Shares from $2.45 to $1.70 per share, for options previously granted to consultants to the Corporation.

- April 3, 2024, the Company provided an update of the metallurgical test programs. Metallurgical flotation test results indicate the reasonable probability of producing three payable copper, nickel and PGM bearing concentrates from the various types of mineralized materials that comprise its National instrument 43-101 Mineral Resource of the Ferguson Lake Project, suggesting a potential low-capital cost option for the project development. Alternatively, hydrometallurgy is considered as an effective option albeit with higher capital and operating cost. The Company will focus on follow-up investigations using new technologies for metal extraction.

- April 5, 2024, the Company announced that it has filed with the TSX Venture Exchange a Notice of Intention to Make a Normal Course Issuer Bid ("NCIB") which is proposed to commence on April 10, 2024 and terminate on April 9, 2025 or the earlier of the date all shares which are subject to the Normal Course Issuer Bid are purchased. In the opinion of the Board of Directors of the Company, the market price of the Common Shares does not accurately reflect the value of those shares. As a result, the Company intends to repurchase CNRI's Common Shares that may become available for purchase at prices, which make them an appropriate use of funds of the Company. The Company intends to attempt to acquire up to an aggregate of 5,726,380 of its Common Shares over the next 12-month period, representing approximately 5% of the issued and outstanding Common Shares of CNRI.

For the Year End 2023 financial statements and Management's Discussion and Analysis, please see the Company website at www.cnresources.com or on SEDAR.

Qualified Person:

The technical contents of this news release have been reviewed by Dr. Trevor Boyd, P.Geo., a qualified person as defined by Canadian National Instrument 43-101 standards.

About Canadian North Resources Inc.:

Canadian North Resources Inc. is an exploration and development company focusing on the critical metals for the clean-energy, electric vehicles, battery and high-tech industries. The company is advancing its 100% owned Ferguson Lake nickel, copper, cobalt, palladium, and platinum project in the Kivalliq Region of Nunavut, Canada.

Dr. Kaihui Yang, President and CEO

Phone: 905-696-8288 (Canada) 1-888-688-8809 (Toll-Free)

Email: info@cnresources.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release, including statements which may contain words such as "expects", "anticipates", "intends", "plans", "believes", "estimates", or similar expressions, and statements related to matters which are not historical facts, are forward-looking information within the meaning of applicable securities laws. Such forward-looking statements, which reflect management's expectations regarding the Company's future growth, results of operations, performance, business prospects and opportunities, are based on certain factors and assumptions and involve known and unknown risks and uncertainties which may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by such forward-looking statements.

These factors should be considered carefully, and readers should not place undue reliance on the Company's forward-looking statements. The Company believes that the expectations reflected in the forward-looking statements contained in this news release and the documents incorporated by reference herein are reasonable, but no assurance can be given that these expectations will prove to be correct. In addition, although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company undertakes no obligation to release publicly any future revisions to forward-looking statements to reflect events or circumstances after the date of this news or to reflect the occurrence of unanticipated events, except as expressly required by law.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c4248f68-32a0-4fd4-b43d-087b4ac4bab6