May 12, 2023

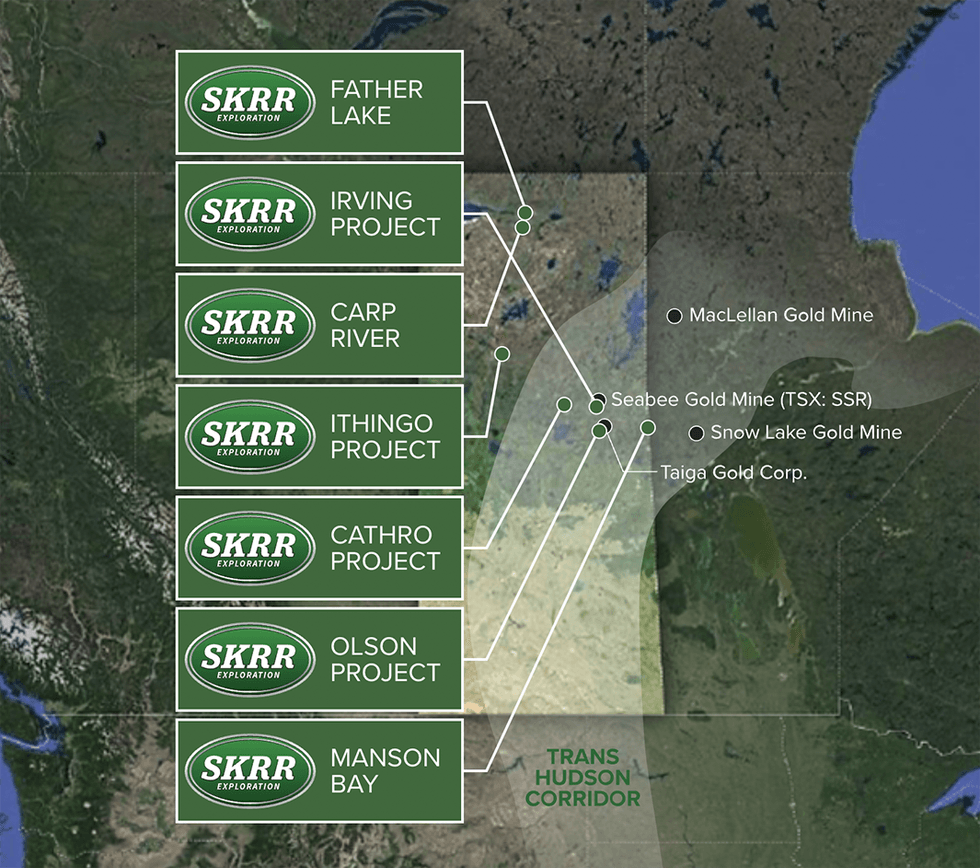

SKRR Exploration (TSXV:SKRR, OTCQB:SKKRF, FSE: BO4Q), OTCQB:SKKRF, FSE: BO4Q) focuses on gold in the underexplored Trans Hudson Corridor in Saskatchewan, with five highly prospective gold assets in the area. In addition to its gold projects, SKRR holds two nickel-zinc properties that are also in Canada.

The company aims to change this gold supply trajectory, through exploration work at its highly prospective assets within the emerging gold-producing region of the Trans Hudson Corridor. The Homestake Gold Mine has been the most significant deposit within the Trans Hudson Corridor producing 43.9 million ounces (Moz) of gold between 1878 and 2002.

The Trans Hudson Corridor demonstrates a similar potential to the famous Abitibi Greenstone Belt yet remains underexplored. The company owns five assets within the corridor and is currently systematically exploring each property. The company’s portfolio contains several unexplored or underexplored assets with blue-sky potential.

Company Highlights

- SKRR Exploration is focused on gold exploration in the Trans Hudson Corridor in Saskatchewan, Canada.

- The Trans Hudson Corridor is a highly prospective gold belt with similar geology to the renowned Abitibi Greenstone Belt.

- The company owns five gold projects within the Trans Hudson Corridor and two nickel-zinc projects in British Columbia and Saskatchewan.

- SKRR's portfolio of gold assets is its primary focus, while its nickel-zinc resources represent additional revenue streams.

- Each of SKRR’s assets is underexplored or unexplored, representing a significant potential for discovering new deposits.

- An expert management team with a range of expertise throughout the natural resource industry leads the company toward fully exploring its assets.

This SKRR Exploration profile is part of a paid investor education campaign.*

SKRR:CA

The Conversation (0)

28 November 2023

SKRR Exploration

Assets with Blue-sky Potential in Underexplored Trans Hudson Corridor

Assets with Blue-sky Potential in Underexplored Trans Hudson Corridor Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00