April 27, 2023

Basin Energy Limited (ASX:BSN) (‘Basin’, or ‘the Company’) is pleased to provide the quarterly report for the period ending 31 March 2023 (“Quarter”, “Reporting Period”) to accompany the Appendix 5B.

Key Highlights

- Successful completion of Airborne Electromagnetic survey at the Geikie Uranium Project

- Significant conductor demonstrating splays and offsets identified

- Historical Geikie data review provides confidence in the geological setting for the suitability of high-grade uranium mineralisation

- Work completed by Basin to date has identified multiple shallow targets ready for drill testing at Geikie

- Continued engagement and consultation with First Nations and stakeholder groups

- Strong cash balance of $7.3M ensures Basin is fully funded for an aggressive 2023 exploration campaign, including maiden diamond drilling programs

Exploration for the Quarter was focused on progressing the Geikie Uranium Project (‘Geikie’, or the ‘Project’) toward maiden drill testing. Basin has been advancing drill targets deemed prospective for high grade uranium mineralisation, using analogies and models derived from neighboring uranium deposits and discoveries in the Athabasca basin. Additionally, as part of the of the Company’s broader exploration campaign within the Athabasca Basin, a continued focus has been placed on the engagement and consultation with rights holders and broader stakeholders within the exploration project areas.

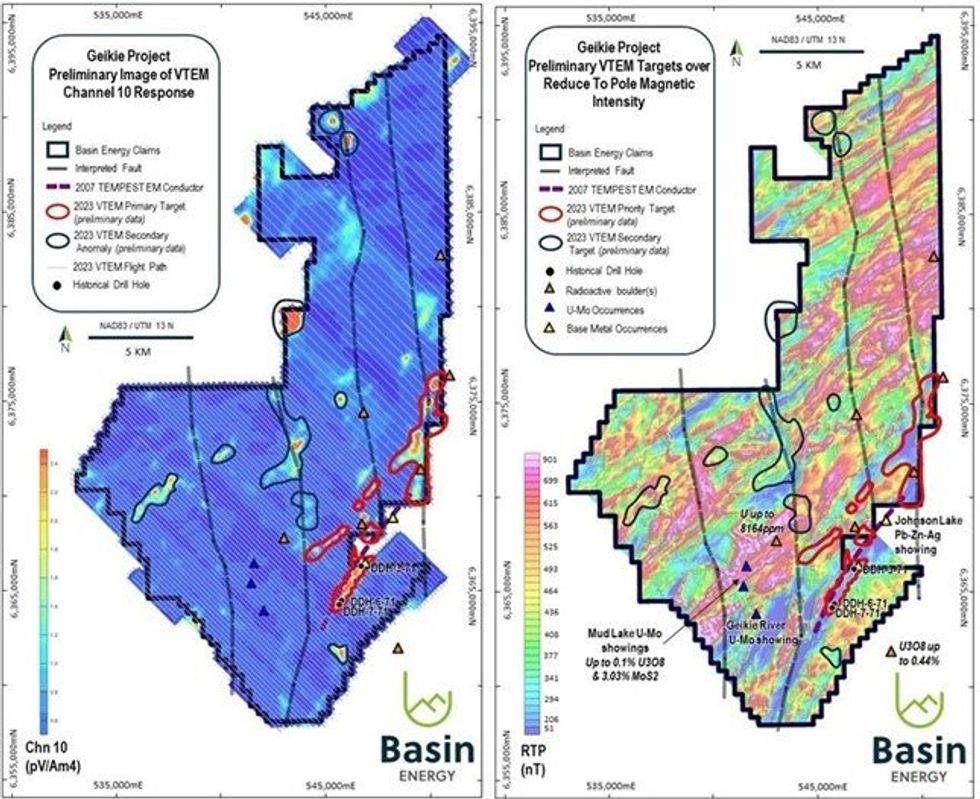

Airborne Electromagnetic Survey at Geikie1,2,3,4

Basin commissioned the airborne electromagnetic (‘AEM’) survey in Q4 2022. A helicopter-borne Versatile Time-Domain Electromagnetic (‘VTEM’) survey method was selected as most appropriate to achieve the survey objectives.

Geotech Ltd were engaged to conduct the survey, which covered the entire project area, at a combination of 400 m line spacing in the northern part of the property and 200 m line spacing in the south. A total of 1,399-line kilometres of data was acquired. Final survey specifications are outlined in ASX release dated 22 March 2023.

Upon receipt of preliminary data, a series of anomalies were categorised into primary and secondary targets, with the next steps for primary targets being the modelling of final AEM data followed by drill testing. The secondary anomalies are potentially significant considering the correlation with regional faults, however further assessment will be conducted as modelling of final data is completed.

A strong coherent northeast trending conductor, classified as a primary target, striking through the southern half of the Project is clearly defined. A series of splays and offsets of this conductor are visible, often in correlation with intersections of regionally significant deep-seated north-south trending faults, part of the Tabbernor Fault System (‘Tabbernor’, or ‘TFS’).

Click here for the full ASX Release

This article includes content from Basin Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSN:AU

Sign up to get your FREE

Basin Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

31 August 2025

Basin Energy

Targeting uranium and rare earth elements (REEs) in Australia, Canada, Sweden and Finland.

Targeting uranium and rare earth elements (REEs) in Australia, Canada, Sweden and Finland. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

17 December 2025

Completes phase one drilling and expands Sybella-Barkly

Basin Energy (BSN:AU) has announced Completes phase one drilling and expands Sybella-BarklyDownload the PDF here. Keep Reading...

30 November 2025

Expands REE and Uranium Footprint at Sybella-Barkly

Basin Energy (BSN:AU) has announced Expands REE and uranium footprint at Sybella-BarklyDownload the PDF here. Keep Reading...

11 November 2025

Drilling Commenced for Sybella-Barkly Uranium and Rare Earth

Basin Energy (BSN:AU) has announced Drilling commenced for Sybella-Barkly uranium and rare earthDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Basin Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00