September 17, 2023

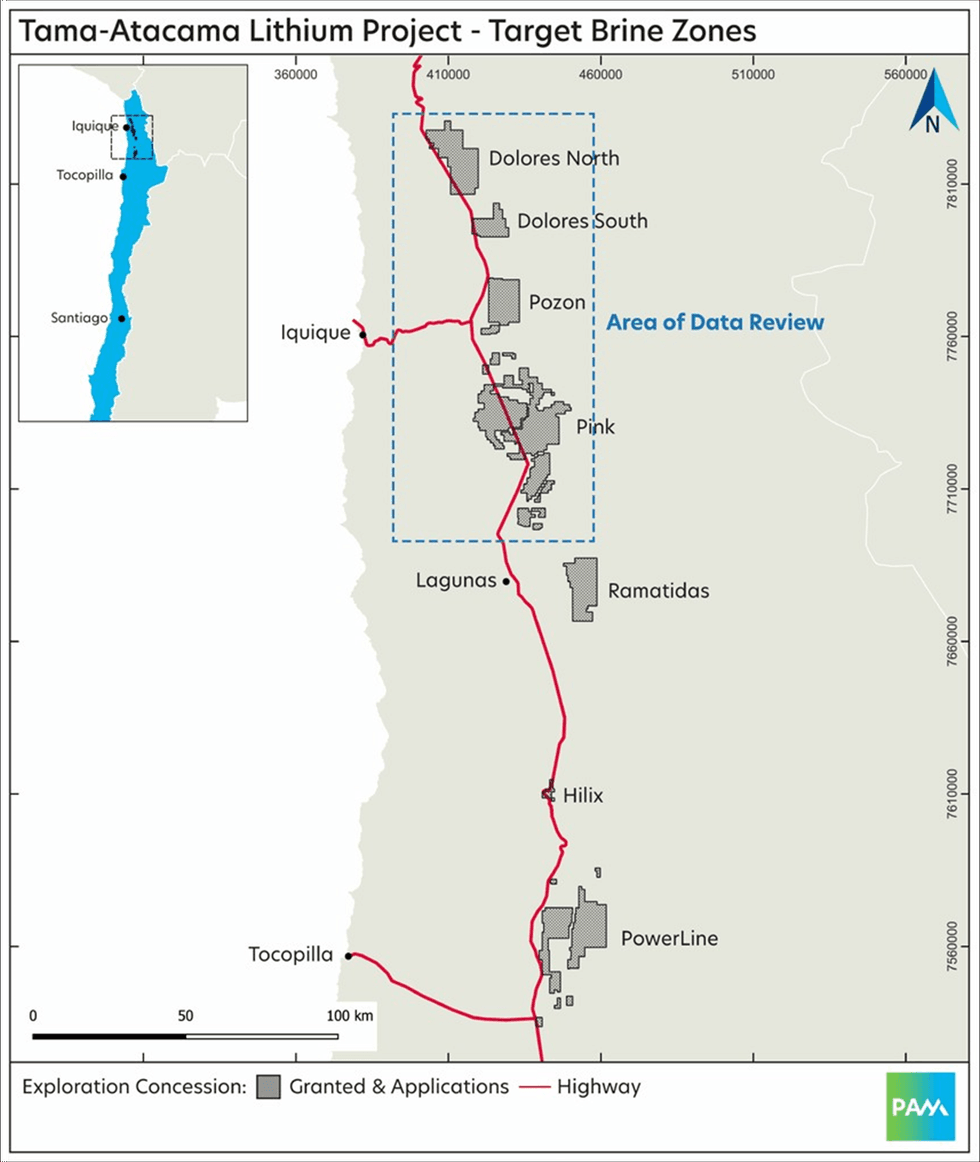

Battery and critical metals explorer and developer Pan Asia Metals Limited (ASX: PAM) (‘PAM’ or ‘the Company’) is pleased to report an exploration update for the Pink, Pozon, Dolores South and Dolores North Lithium Prospects situated in the Tarapaca region of the Atacama Desert in northern Chile, with a primary focus on the Pink Lithium Prospect. The review and this exploration update relates to historic seismic surveying undertaken in the 1960’s and shallow groundwater drilling undertaken in the early 1990s’. The target lithium in brine zone at the Pink Lithium Prospect has been re-defined, with overlapping areas of elevated Li and chlorine (Cl), an indicator of salty water/brine, interpreted at >500km2, while the total target lithium in brine zone at the Pink, Pozon and Dolores South and North Lithium Prospects is interpreted at ~1,000km2.

HIGHLIGHTS

- Data review yields positive results

- Review focuses on Pink, Pozon and Dolores Li in Brine Prospects

- Primary focus on Pink Lithium Prospect, with preliminary drill targets defined

- Seismic results confirm deep basin sediments, approximately 400-600m thick

- Historic groundwater investigations confirm shallow saline aquifers

- Saline groundwater zones correspond with highly elevated Li in surface salt crusts

- Target Li Brine area re-defined with elevated Li and chlorine (Cl) over ~1,000km2

- Results awaited for additional surface geochemical samples

- Geophysical exploration being planned

- Drill planning underway

Pan Asia Metals Managing Director said: “We are making great progress at the Tama Atacama Lithium Project.The historical seismic data at the Pink Lithium Prospect provides great insight. When overlayed with historic water drilling data, which identified an area of ~2,000km2 of elevated chlorine levels - a proxy for brine, and which corresponds with PAM’s surface assays, with ~65% at >100ppm Li, of which about half were >250ppm Li and about one quarter were >650ppm Li and up to 2,200ppm Li, we know we are in a good position. The data review confirms that PAM’s northern Li Brine prospects, being Pink to the south and Pozon, Dolores South and Dolores North to the north, cover an area of ~1,000km or 50% of the Li Brine target area. The Tama Atacama Lithium Project in Chile complements PAM’s initiatives in Southeast Asia, the latter being PAM’s pathway to earlier cash flow and the former PAM’s pathway to future growth, which will set PAM up to secure its position in the global lithium supply chain.”

Project Overview

Location and Access

The Pink Lithium Prospect (Pink) is located in the Tarapacá Region, in northern Chile. The project area is part of the larger Pampa del Tamarugal Basin (PT Basin) where PAM holds approximately 1,600km2 of granted concessions or concession applications. The project area has excellent access to infrastructure with the energy grid and a major highway (Ruta 5) running through it. The nearest large city is Iquique, located about 75km by road to the west, on the coast (see Figure 1). The mining service town of Pozo Almonte is located immediately north of the project area.

Land Ownership and Tenure

The project area hosts a variety of land uses, in the north and east there is private residential land in and around several villages, small acreage land with ‘weekend homesteaders’, some military land, some Reserve land and some other public lands. The western and southern parts of the project area host an extensive zone of salt flats associated with Salar’s Pintados and Bellavista, which are essentially unpopulated.

Previous Mining and Exploration

Certain areas of the Salars in this region host historic borate, potassium and salt extraction, with many areas immediately west of the project area the host to historic nitrate mining. There is little record of any of these past mining activities.

Modern Exploration

More recent exploration, since 2016, has been conducted by Rajo in conjunction with ASX-listed Specialty Metals Limited (ASX:SEI). SEI were awarded 20 exploration concessions covering the southwestern parts of Salar de Pintados and northern parts of Salar Bellavista. From 2016-2018 Rajo/SEI collected 128 samples that now occur within or immediately adjacent to PAM’s granted concessions and concession applications. These samples are mostly from the near surface salt/gypsum crust with lesser samples of adjacent clay rich zones. Samples were taken along traverse lines using roads, tracks associated with powerlines, pipelines and the railway line. The samples were nominally collected at 1km spacings however, this does vary. The Rajo/SEI relationship concluded in 2019 and SEI exited Chile, with Rajo continuing to explore.

Click here for the full ASX Release

This article includes content from Pan Asia Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PAM:AU

The Conversation (0)

09 July 2023

Pan Asia Metals

First-mover Advantage in Critical Metals for Southeast Asia Market

First-mover Advantage in Critical Metals for Southeast Asia Market Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00