July 15, 2024

Rua Gold Inc. (CSE: RUA) (OTC: NZAUF) (WKN: A4010V) ("RUA GOLD" or the "Company") is pleased to announce it has entered into a definitive share purchase agreement (the "Agreement"), pursuant to which the Company will acquire 100% of the issued and outstanding shares of Reefton Resources Pty Limited ("Reefton"), a 100% owned subsidiary of Siren Gold Ltd. (ASX:SNG) ("Siren") with tenements located adjacent to the Company's suite of properties in New Zealand's prolific Reefton Goldfield (the "Transaction").

Figure 1: Tenement map of the Reefton Goldfield. (CNW Group/Rua Gold Inc.)

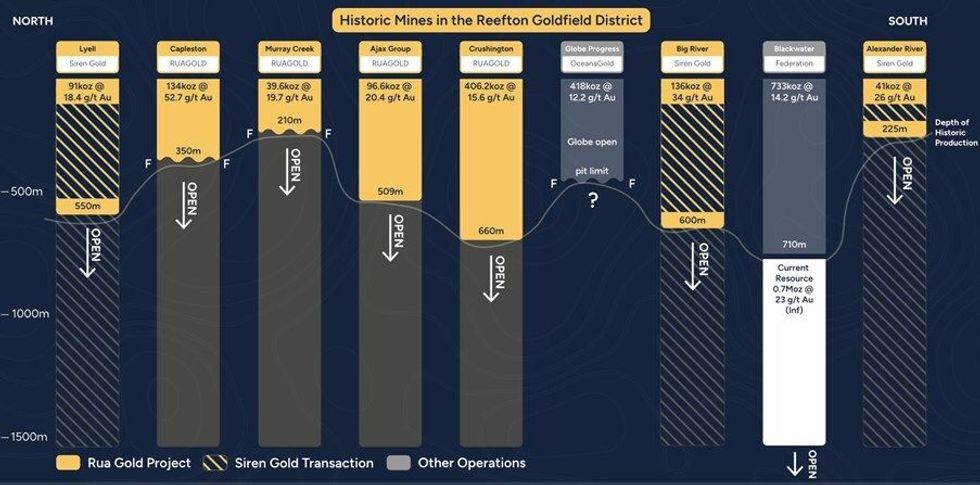

Figure 2: Cross Section of historic underground mines in the Reefton Goldfield. (CNW Group/Rua Gold Inc.)

The Transaction will establish the Company as the dominant landholder in the Reefton Goldfield on New Zealand's South Island, with approximately 120,000 hectares ("ha") of tenements. The district produced over two million ounces at gold grades ranging from 9 to 50g/t. The Reefton Goldfield is seeing a resurgence in interest, led by the construction of Federation Mining's Blackwater mine, which is expected to produce 70koz per annum at US$738/oz AISC1.

Actively Advancing a District-Scale Discovery in a Tier 1 Jurisdiction:

- Represents the next chapter in RUA GOLD's development towards our goal to be a major gold producer in New Zealand.

- Newly consolidated project represents one of the least explored, high-grade gold districts in the world.

- Permits, access, and consents in place for aggressive drilling following a district-wide reassessment of targets and potential on the combined land package.

- The Transaction will increase regional tenement holdings from ~34k ha to ~120k ha and cover all known past production camps outside of Blackwater and the Globe Progress mine.

- Potential for lower overall project capital expenditures through the development of a potential central processing hub.

- The Transaction creates a bigger player in New Zealand, allowing greater opportunity to work alongside a pro-mining Government in helping them draft their Minerals Strategy for New Zealand.

- Backed by team of mining professionals with +200 years of combined experience.

________________________ |

1 Source: Federation-Mining-Deck-July-2023-020823-V2.pdf (federationmining.com.au). |

More information can be found at the Company's website: www.ruagold.com

Following the completion of the Transaction, the Company will be well positioned as the preeminent gold explorer in New Zealand with a pro forma market capitalization of ~C$60 million.

Combining properties and exploration activities in the Reefton Goldfield provides many strategic benefits, including:

- Increased profile with a very supportive local community that has a long history and skilled work force in mining.

- Opportunity to realize significant synergies and cost savings.

- Combined data sets, local work force and historic knowledge, leading to higher quality target generation with a greater scale of opportunities.

- Ability to expand exploration programs and generate more consistent news flow.

- Consolidation of permitting activities with an expedited project development timeline.

Transaction Highlights

- Under the terms of the Agreement, Siren shall receive:

- A$2 million (C$1.8 million) in cash, of which A$1 million has been paid and the remaining A$1 million will be paid at the close of the Transaction; and

- 83,927,383 fully paid shares of RUA GOLD representing A$18 million (C$16.6 million2), to be issued at the close of the Transaction with agreed contractual resale restrictions.

- The total consideration represents:

- an implied value of A$20 million (C$18.5 million); and

- an acquisition price of ~US$25/oz AuEq based on Reefton's 0.5 Moz AuEq Resource3.

- Upon completion of the Transaction, Siren will own ~30% of RUA GOLD, and Siren Chairman, Mr. Brian Rodan, will join the RUA GOLD Board. Mr. Rodan is a Fellow of the Australian Institute of Mining and Metallurgy (FAusIMM) with 48 years' experience. Previously, Mr. Rodan was the owner and managing director of Australian Contract Mining Pty Ltd. (ACM), a contract mining company completing $1.5 billion worth of work over a 20-year period. Mr. Rodan held various roles with Eltin Limited over 15 years as General Manager between 1993 and 1996 and Executive Director from 1996 to 1999), being Australia's largest full service ASX listed contract mining company with annual turnover of +$850 million. Mr. Rodan was a founding Director of Dacian Gold Ltd. 2013 and Desert Metals Ltd. 2020. Mr. Rodan was the founding director and is currently Chairman of Siren, Iceni Gold Limited (ICL) and Augustus Minerals (AUG), all listed on the ASX.

- The Transaction is targeted to close in Q4-2024 (subject to regulatory approvals and satisfaction of all conditions under the Agreement).

_______________________________ |

2 Calculated using RUA GOLD's 30-day VWAP on the CSE as of July 12, 2024 of C$0.1983 at an AUD:CAD exchange rate of 0.9246. |

3 Gold equivalency calculated using metals prices of US$2,200/oz Au and US$20,500/t Sb. |

Simon Henderson, COO of RUA GOLD commented: "This Transaction creates a significant opportunity in an under explored orogenic gold district. The Company has focused on the Reefton Goldfield and in four years combined rapid geochemical sampling, ultra-detailed geophysical surveying and mapping to highlight the potential of exploring old workings at depth as well as several new greenfield prospects. It is very exciting to combine RUA GOLD and Siren data sets, combined knowledge, and have the whole orogenic district to explore. We will be looking at a combination of new discoveries and scalability of historic high-grade gold mines to develop the next major gold producer in the region."

Brian Rodan, Chairman of Siren commented: "Having personally been involved with the Reefton Project for over 6 years, I firmly believe that the Reefton Goldfield has enormous untapped potential to create a substantial long-term, high-grade gold and antimony mining operation. Antimony being a rare critical mineral will also provide the opportunity to create a world class operation that will assist the western countries transition to greener economies through securing a long-term supply of antimony, which is necessary to construct solar panels, wind turbines, electric vehicles, power storage batteries and defense needs. The decisions taken by the Boards of both Siren and Rua to take a major step to consolidate the 40km line of strike of the entire Reefton field is truly visionary and will realize significant long-term benefits to the Reefton district as a whole. The additional flow on effects created from this consolidation will also bring long term generational growth in regional development through increased infrastructure spending and increased employment opportunities that are created by the "mining multiplier affect". The significant improvement in regional infrastructure and employment opportunities that will follow will be transformational for the entire West Coast and New Zealand as a whole."

The Transaction will deliver the following benefits to the Company's shareholders:

- Increased scale and resources by combining projects and exploration teams.

- Increased exposure to the highly prospective and under-explored Reefton Goldfield, as the largest landholder in the district with approximately 120,000 ha of combined tenements.

- The tenements owned by Reefton host a total JORC-compliant inferred mineral resource estimate (at a 1.5 g/t Au cut-off grade) containing 444koz Au @ 3.81g/t Au and 8.7kt Sb @ 1.5% Sb4 with the excellent opportunity to define further mineralization with aggressive exploration across the combined land package.

- Improved investor visibility and positioning amongst peers, with the opportunity to broaden the Company's shareholder base.

- Potential for future operational synergies (i.e., centralized infrastructure and workforce) by realizing economies of scale across the whole land package.

- Continued exposure to the Company's highly prospective asset, Glamorgan on the North Island of New Zealand.

____________________________ |

4 Source: Siren AGM presentation: www.sirengold.com.au/site/pdf/3e3b3e4b-9e32-4842-aac3-809c9506778b/AGM-Presentation.pdf. |

Transaction Details

The Transaction will be effected by way of a share purchase agreement under applicable Canadian laws.

As consideration for the acquisition of Reefton, the Company will:

- pay an aggregate of A$2.0 million (subject to a working capital adjustment) to Siren, of which (i) A$1.0 million was paid by the Company upon entering into the Agreement in the form of a forgivable loan (repayable only in the event the Agreement is terminated prior to consummation of the Transaction), evidenced by a promissory note issued by Siren in favor of the Company and secured by an enforceable security interest in all of Reefton's present and after-acquired personal property; and (ii) A$1.0 million will be payable at the completion of the Transaction (the "Closing Date"); and

- on the Closing Date, issue 83,927,383 common shares in the capital of the Company to Siren at a deemed price of C$0.1983 per RUA GOLD Share (based on the 30-day volume-weighted average price of the common shares on the Canadian Securities Exchange prior to the date of the Agreement), having an aggregate value of A$18.0 million5 (the "Consideration Shares").

Key conditions precedent to the completion of the Transaction include, amongst others:

- the parties obtaining all required corporate, shareholder and regulatory approvals for the Transaction;

- the parties obtaining all required material third party, regulatory and ministerial consents; and

- other conditions customary for a public transaction of this nature.

____________________________ |

5 Calculated using RUA GOLD's 30-day VWAP on the CSE as of July 12, 2024 of C$0.1983 at an AUD:CAD exchange rate of 0.9246. |

The Agreement otherwise includes customary representations, warranties, covenants and conditions contained in agreements for transactions of this nature.

In connection with the closing of the Transaction, the Company will enter into a shareholder rights agreement with Siren pertaining to Siren's interest in the Consideration Shares, which will include, amongst others, the following terms:

- Siren shall have the right to nominate one member to the board of directors of the Company, so long as Siren maintains at least a 10% equity interest in the Company's issued and outstanding common shares.

- The Consideration Shares shall be subject to the following contractual resale restrictions:

- 22.2% will be restricted from trading for a period of six months from the Closing Date;

- 22.2% will be restricted from trading for a period of 12 months from the Closing Date;

- 22.2% will be restricted from trading for a period of 15 months from the Closing Date;

- 22.2% will be restricted from trading for a period of 18 months from the Closing Date; and

- the remaining Consideration Shares will be restricted from trading for a period of 24 months from the Closing Date.

- The contractual resale restrictions above shall be lifted if, at any time after six months following the Closing Date, RUA GOLD's market capitalization is five times greater (or more) than its market capitalization measured as of July 12, 2024 (being the date the Agreement was signed).

- For so long as Siren owns or controls 10% or more of the issued capital of RUA GOLD, Siren shall agree to vote, or cause to be voted, all Consideration Shares in the same manner as the board of directors of RUA GOLD at any general or special meeting of shareholders of the Company.

Conference Call and Presentation

RUA GOLD will host a conference call and presentation on July 15, 2024 at 9:00 a.m. (Toronto time) to discuss the Transaction.

Webcast:

- Participants can access the webcast at the following link: https://event.choruscall.com/mediaframe/webcast.html?webcastid=hdiq90oN

- An archive of the webcast will be available until end of day on October 15, 2024.

Conference Call:

Participants may gain expedited access to the conference call with the following registration link. Upon registering, call in details will be displayed on screen. Using these call details will by-pass the operator and avoid the call queue. Registration will remain open until the end of the live conference call. Participants who prefer to dial-in and speak with a live operator, can access the call by dialing 1-844-763-8274 or +1-647-484-8814. It is recommended that you call 10 minutes before the scheduled start time.

Advisors and Legal Counsel

Cormark Securities Inc. is acting as financial advisor to the Company and its Board of Directors. McMillan LLP is acting as Canadian legal counsel to the Company and Simpson Grierson is acting as New Zealand legal counsel to the Company.

Red Cloud Securities Inc. is acting as financial advisor to Siren and its Board of Directors. Steinepreis Paganin is acting as Australian legal counsel to Siren and Cassels Brock & Blackwell LLP is acting as Canadian legal counsel to Siren.

Intention to list on the TSX Venture Exchange

Aligned to executing on the growth strategy, the Company is also pleased to announce that it has applied to list the common shares of the Company on the TSX Venture Exchange ("TSX-V") under the symbol "RUA". The Company's application remains subject to TSX-V approval. In connection with listing on the TSX-V, it is expected the Company's common shares will be voluntarily delisted from the Canadian Stock Exchange ("CSE").

About RUA GOLD

RUA GOLD (CSE: RUA, OTC: NZAUF, WKN: A4010V) is a new entrant to the mining industry, specializing in gold exploration and discovery in New Zealand. With permits that have a rich history dating back to the gold rush in the late 1800's, RUA GOLD combines traditional prospecting practices with modern technologies to uncover and capitalize on valuable gold deposits.

The Company is committed to responsible and sustainable exploration, which is evident in its professional planning and execution. The Company aims to minimize its environmental impact and to execute on its projects with key stakeholders in mind. RUA GOLD has a highly skilled team of New Zealand professionals who possess extensive knowledge and experience in geology, geochemistry, and geophysical exploration technology.

For further information, please refer to the Company's disclosure record on SEDAR+ at www.sedarplus.ca.

Technical Information

Simon Henderson CP, AUSIMM, a qualified person under National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the technical disclosure contained herein.

Website: www.RUAGOLD.com

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur and specifically include statements regarding: the Company's strategies, expectations, planned operations or future actions; the strategic benefits of the Transaction; the benefits of the Transaction to shareholders; closing of the Transaction and the satisfaction of the conditions thereof, including but not limited to the receipt of all corporate and regulatory approvals and consents; listing the Company's common shares on the TSX-V and the receipt of TSX-V approval therefor; and delisting the common shares from the CSE. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements.

Investors are cautioned that any such forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. A variety of inherent risks, uncertainties and factors, many of which are beyond the Company's control, affect the operations, performance and results of the Company and its business, and could cause actual events or results to differ materially from estimated or anticipated events or results expressed or implied by forward looking statements. Some of these risks, uncertainties and factors include: general business, economic, competitive, political and social uncertainties; risks related to the effects of the Russia-Ukraine war; risks related to climate change; operational risks in exploration, delays or changes in plans with respect to exploration projects or capital expenditures; the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; changes in labour costs and other costs and expenses or equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, including but not limited to environmental hazards, flooding or unfavourable operating conditions and losses, insurrection or war, delays in obtaining governmental approvals or financing, and commodity prices. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements and reference should also be made to the Company's annual information form dated April 19, 2024, filed under its SEDAR+ profile at www.sedarplus.ca for a description of additional risk factors.

Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

RUA:CNX

The Conversation (0)

3h

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

4h

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00