July 06, 2022

Auroch Minerals Limited (ASX:AOU) (Auroch or the Company) is pleased to provide an update on the work programmes at its 100%-owned Saints Nickel Project (Saints) in Western Australia.

Highlights

- All assay results from the Saints infill drill programme have now been received, confirming high-grade massive and semi-massive nickel-copper sulphides

- Results will be used in an upgrade of the Saints Mineral Resource Estimate (MRE), which is underway and expected to be completed in approximately 4 to 6 weeks

- The update in the Saints MRE is focussed on using the information from the infill drilling to upgrade a large portion of the current Saints Mineral Resources of 1.02Mt @ 2.0% Ni for 21,400t of contained nickel 1 from an Inferred Resource to an Indicated Resource category

- Excellent interim results received from the metallurgical testwork on the Saints nickel sulphide mineralisation, producing nickel concentrate grades of up to 24% Ni

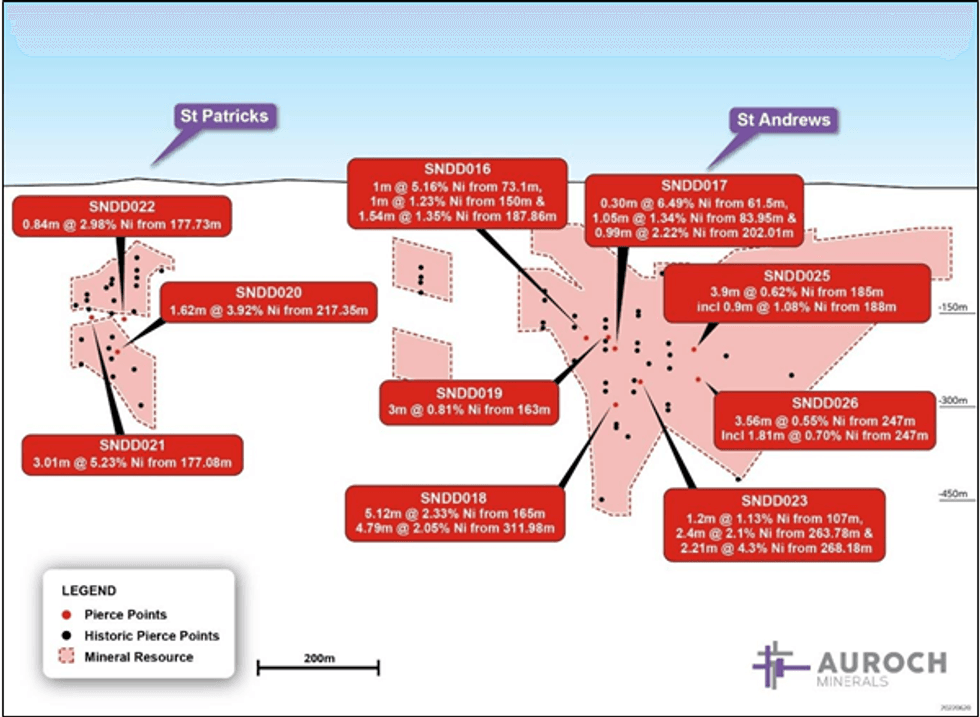

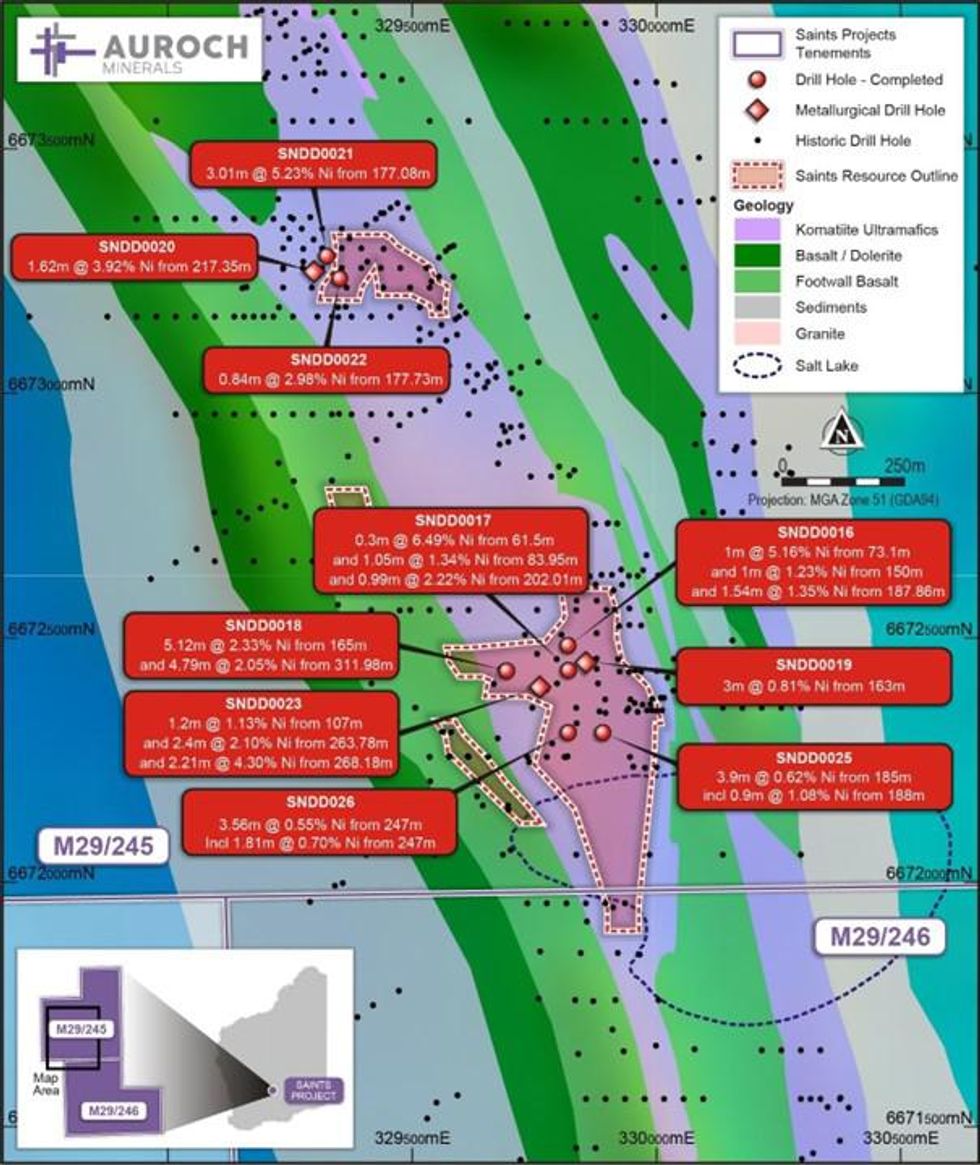

All outstanding assay results have been received from the infill diamond drill programme completed earlier this year. All drill-holes intersected nickeliferous massive or semi-massive sulphides (refer to Figures 1 & 2), with significant intersections including (see Table 1 for full table of results):

- SNDD021: 3.01m @ 5.23% Ni, 0.69% Cu, 0.77g/t PGE from 177.08m;

- SNDD023: 2.40m @ 2.10% Ni, 0.14% Cu, 0.09% Co, 0.36g/t PGE from 263.78m and 2.21m @ 4.30% Ni, 0.37% Cu, 0.13% Co, 0.58g/t PGE from 268.18m;

- SNDD016: 1.00m @ 5.16% Ni, 0.06% Cu, 0.09% Co, 0.56g/t PGE from 73.10m; and

- SNDD020: 1.62m @ 3.92% Ni, 0.42% Cu, 0.11% Co, 0.70g/t PGE from 217.35m. 2

Following the receipt of the final outstanding assays, the Company has initiated an update of the Mineral Resource Estimate (MRE) on the Saints Nickel Project, contracting experienced resource geologist Shaun Searle from Ashmore Advisory Pty Ltd to complete the work.

The update of the Saints MRE is focussed on using the assay results and geological information from the infill drilling to upgrade a large portion of the current Saints Mineral Resource of 1.02Mt @ 2.0% Ni for 21,400t of contained nickel 1 from an Inferred Resource to an Indicated Resource category. The expected upgrade in resource classification is a critical step in the Saints Scoping Study and will result in a higher level of confidence in the financial modelling of the potential underground mining scenario. The MRE upgrade is expected to be completed within the next four to six weeks.

The Company is also pleased to announce that it has received excellent interim results from the ongoing metallurgical testwork on the nickel sulphide mineralisation at Saints. Strategic Metallurgy Pty Ltd has completed a first-pass test of two bulk composite samples from the recent drilling, one from the Saint Patricks mineralisation and the other from Saint Andrews, following the traditional flow sheet of “Kambalda-style” nickel sulphide deposits.

Both metallurgical samples produced very good concentrate grades over 14%, with initial concentrate grades up to 24% Ni and 5% Cu. Importantly, the iron to magnesium ratio is also very good (Fe:MgO >10 and >22, respectively), the cobalt grade and recoveries are good (>0.5% Co) and there is no arsenic (As) in the material.

The testwork will now focus on improving the recoveries, as there were still nickel sulphides observed in the tailings of both initial tests. The final results for the Saints metallurgical testwork are expected in the next four to six weeks and will provide further critical inputs into the Saints Scoping Study.

Auroch Managing Director Aidan Platel commented:

“We are extremely encouraged with the initial results from the metallurgical testwork at Saints. The tests have shown that the sulphide mineralisation at both Saint Patricks and Saint Andrews can produce a very clean, high-grade nickel-copper-cobalt concentrate with excellent Fe:MgO ratios, which would make it a desirable ore source for any nickel sulphide beneficiation facility in the region.

We are also pleased to have commenced work on upgrading the MRE at Saints. These two work streams will provide critical inputs into the Saints Scoping Study and, importantly, will result in a higher level of confidence in our financial modelling of the potential underground mining scenario at Saints. We look forward to the results of this work and to finalising the Scoping Study later this quarter.”

Figure 1 – Long-section (looking east) of the current modelled resource at the Saints Nickel Project showing intersected pierce points and significant intersections from recent diamond drill programme

Figure 1 – Map of the Saints Nickel Project showing results from the recent diamond drill programme against interpreted geology, historic drill-holes and resource outline

This announcement has been authorised by the Board of Directors of the Company.

Click here for the full ASX Release

This article includes content from Auroch Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AOU:AU

The Conversation (0)

23 September 2021

Auroch Minerals

Exploring High-Grade Nickel Sulfides in Western Australia

Exploring High-Grade Nickel Sulfides in Western Australia Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

19 December 2025

Nickel Price 2025 Year-End Review

After peaking above US$20,000 per metric ton (MT) in May 2024, nickel prices have trended steadily down. Behind the numbers is persistent oversupply driven by high output from Indonesia, the world’s largest nickel producer. At the same time, demand from China's manufacturing and construction... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00