Overview

The supply and demand of nickel have stirred the attention of the markets with an average price growing up to 80 percent year on year. . The increasing demand for commodities, such as stainless steel and batteries, limited new sources of supply, export bans, and the electric vehicle (EV) revolution are fueling this demand for nickel and its recent price increases.

The global shift towards EV transportation continues to play a major factor in generating demand for nickel. By 2030, it is estimated that there will be a 5-fold increase in the demand for this metal, with the potential to achieve a 600 percent increase by 2040. This surge in demand is an opportune time for Australian mining companies since Australia has the world's largest nickel reserves, and Western Australia is currently the sole producer of nickel.

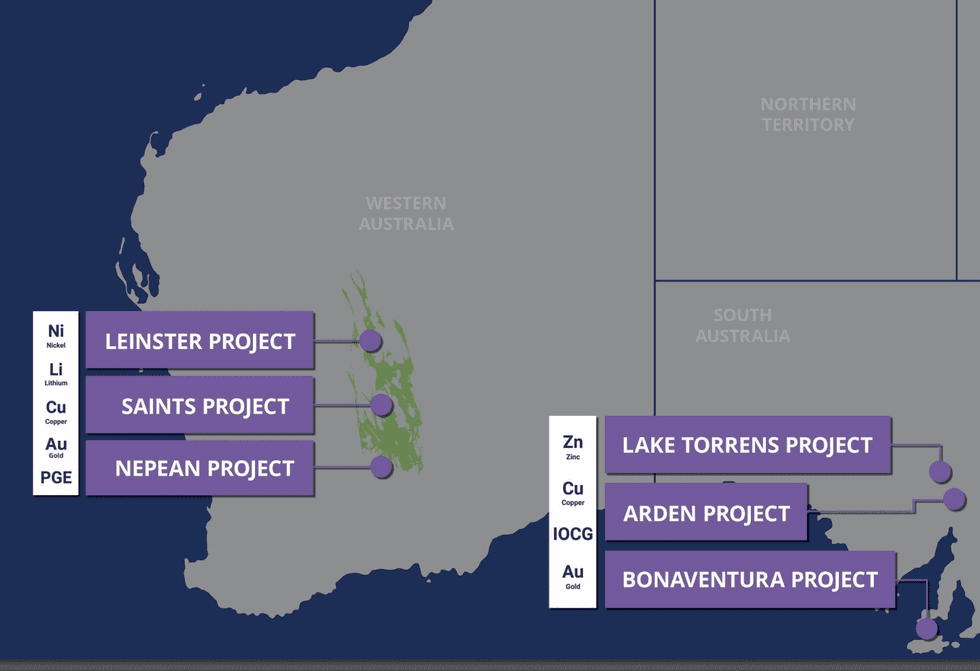

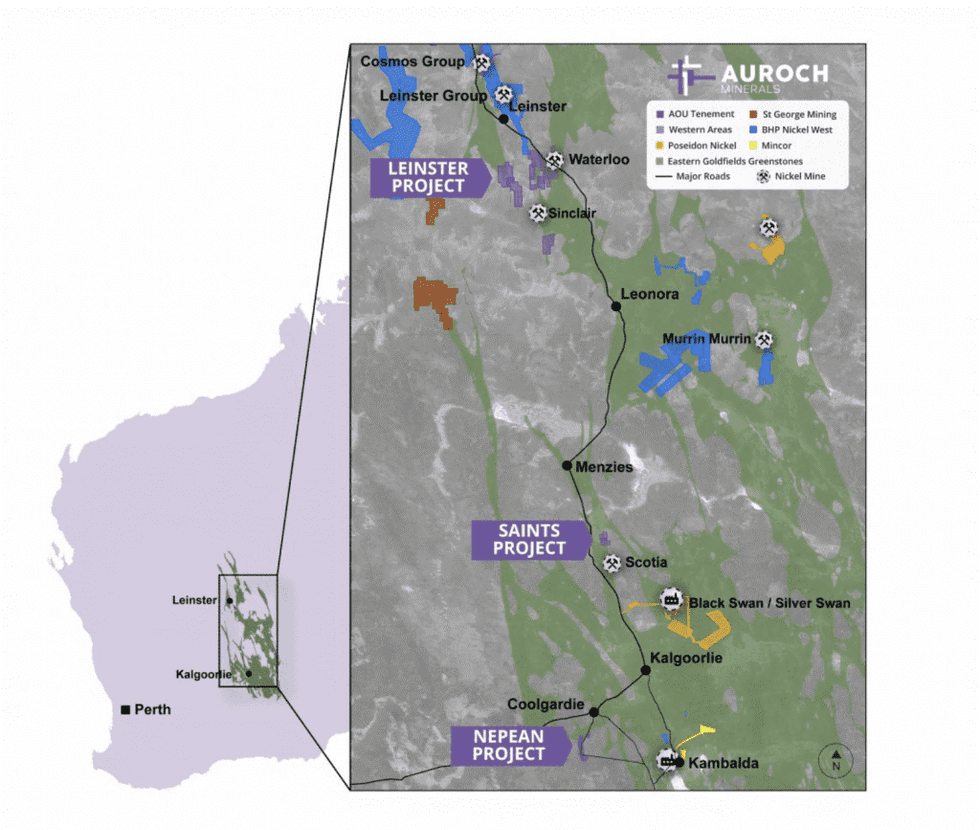

Auroch Minerals (ASX:AOU) is an exploration company located in Western Australia with existing access to high-grade nickel sulfide for development and production. The company is strategically located in the Norseman Wiliuna Greenstone Belt, a tier-one jurisdiction, which contains some of the best nickel sulfide deposits globally.

Auroch's three projects are situated near the Goldfields Highway for easy access to five processing plants within trucking distance. Furthermore, the company has an existing partnership with BHP Nickel West (ASX:BHP) to assist with processing and short- to medium-term production.

"We already have high-grade resources. And we're starting to move into [the] realm of studies and quickly moving into development and production, and feeding those hungry BHP plants that have already come to us for our ore… And now we can produce in the not too distant future," commented Aidan Platel, Managing Director at Auroch Minerals, in an interview with INN.

Auroch's flagship Nepean nickel project was a historic mining area that generated over 32 kilotons of nickel at less than 500 meters deep. There is a massive exploration potential as the company plans to drill past a pegmatite vein to access the Nepean deeps target area. Auroch reported that preliminary metallurgical test work confirmed that nickel sulphide mineralisation responds well to conventional flotation beneficiation with nickel recoveries between 85 percent to 97 percent. In 2022, the project revealed intersections of lithium mineralisation in RC drill-hole samples confirming the presence of lithium mineralisation in the northern area with results including 1m @ 0.88 percent Li2O from 78m within a broader mineralised zone of 4m @ 0.35 percent Li2O from 78m. These are in addition to surface rock-chip samples of up to 2.26 percent Li2O taken from the same area.

The Leinster project spans over 331 square kilometers with a focus on exploring nickel and copper deposits. Leinster is a world-class gold, nickel, and base-metal province and hosts BHP's Leinster Group. This site also contained nickel and copper at shallow depths and thus there is a huge potential to explore deeper and the surrounding areas. Auroch commenced a Two hole diamond drill programme at Leinster to test for potential nickel sulphide mineralisation at the Woodwind and Brass Prospects.

The Saints project is a high-grade, JORC(2012)-compliant resource with 1.05 metric tons at 2 percent nickel and 0.2 percent copper for over 21 kilotons of contained nickel. Auroch began drilling in early 2020 and now is underway scoping studies in partnership with experienced P1 Australasia Pty Ltd. Auroch received the most recent assay results for the Saints project which showed all four drill-holes intersected high-grade massive nickel sulphides. The results will also will be used to upgrade and potentially extend the current Saints Inferred Mineral Resources of 1.02Mt @ 2.0 percent Ni for 21,400t of contained nickel.

Auroch also acquired 80 percent interest in the Nevada Lithium Project composed of four prospect areas comprising ~65 km2 covering the same geology that is known to host other major lithium deposits in the region like American Lithium Corporation’s (TSX.V: LI; US OTC:LIACF; Frankfurt: 5LA1) TLC Lithium Project.

The company’s strategic portfolio includes exploration for key future minerals including Ni, Cu, Zn and Li in stable pro-mining jurisdictions. Auroch’s projects in Southern Australia includes the copper-zinc focused Arden project, copper-gold focused Torrens East Copper Project and the zinc focused Bonaventura project.

Auroch has a strong cash position of AU$9.2 million. The company has no debt and the current market cap is worth AU$43 million with 361 million shares as of February 2022. Approximately one-third of the company is owned by the top 20 shareholders, demonstrating a strong backing by existing stakeholders.

Auroch has a well-experienced team to lead the company to success. Of particular note, Matthew McCarthy is an accomplished geologist with over 20 years of experience in minerals exploration and business development. He was previously the principal geologist at BHP. The team combines geological and financial expertise with over decades of experience to execute Auroch's corporate strategy.

Company Highlights

- Auroch Minerals is an exploration company focused on nickel mining in Western Australia, home to the Norseman Wiliuna Greenstone Belt, which contains some of the best nickel sulfide deposits globally.

- The Nepean nickel project demonstrated historic success at shallow levels and thus there is massive potential for deeper exploration. Scoping studies have commenced for this site and the Saints project.

- The Leinster and Saints projects provide additional opportunities to explore the Norseman Wiliuna Greenstone Belt with both having easy access to processing plants nearby.

- Auroch has a strong financial foundation as the company has no debt and can go into production in the short- to mid-term giving greater leverage to do deeper exploration in the future. With a strong financial foundation along with expert leadership, Auroch is poised to go from a nickel-and-dime company to a major nickel producer.

- Auroch acquired 80 percent interest in the Nevada Lithium Project

Get access to more exclusive Resource Investing Stock profiles here