January 01, 2024

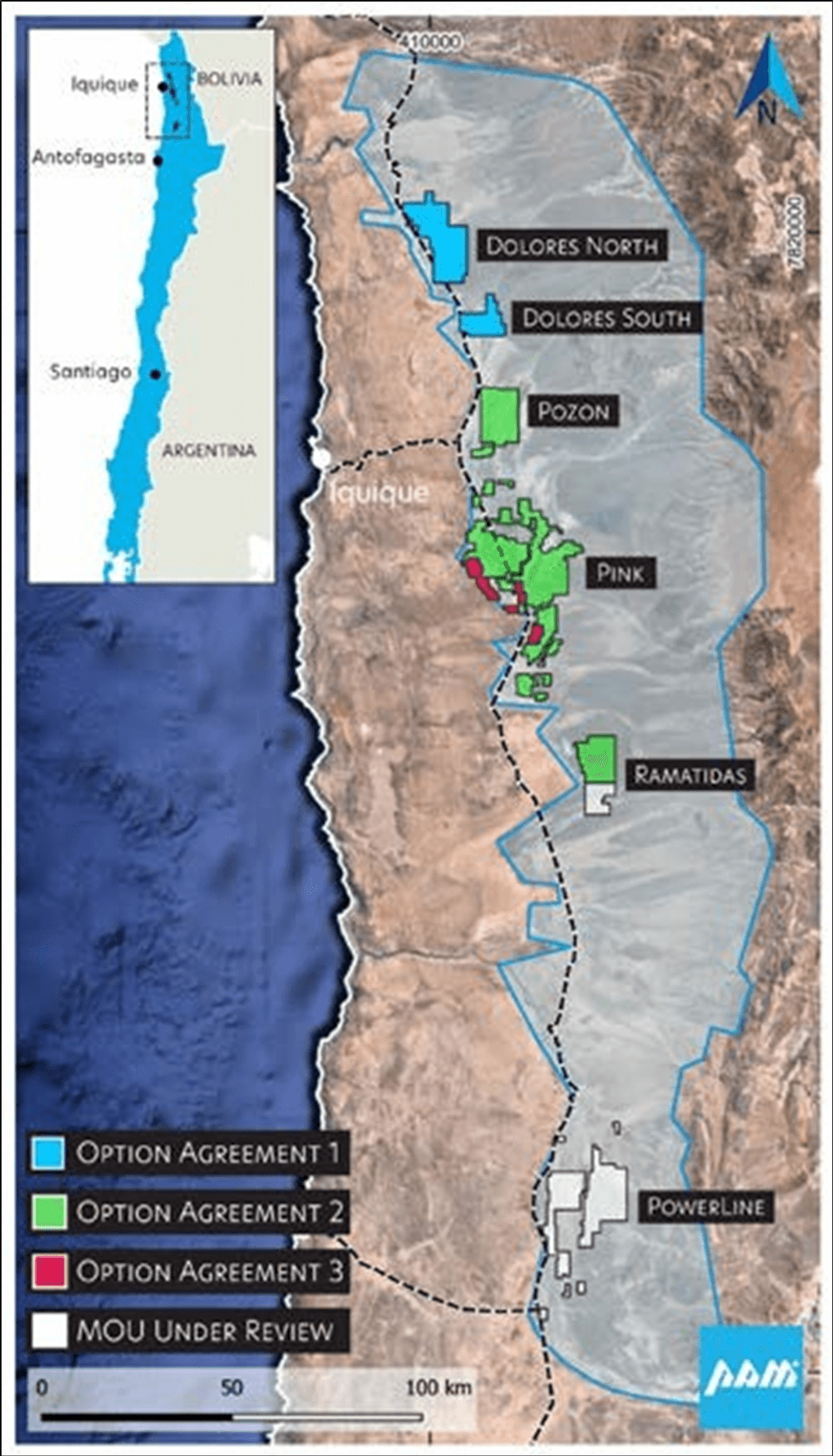

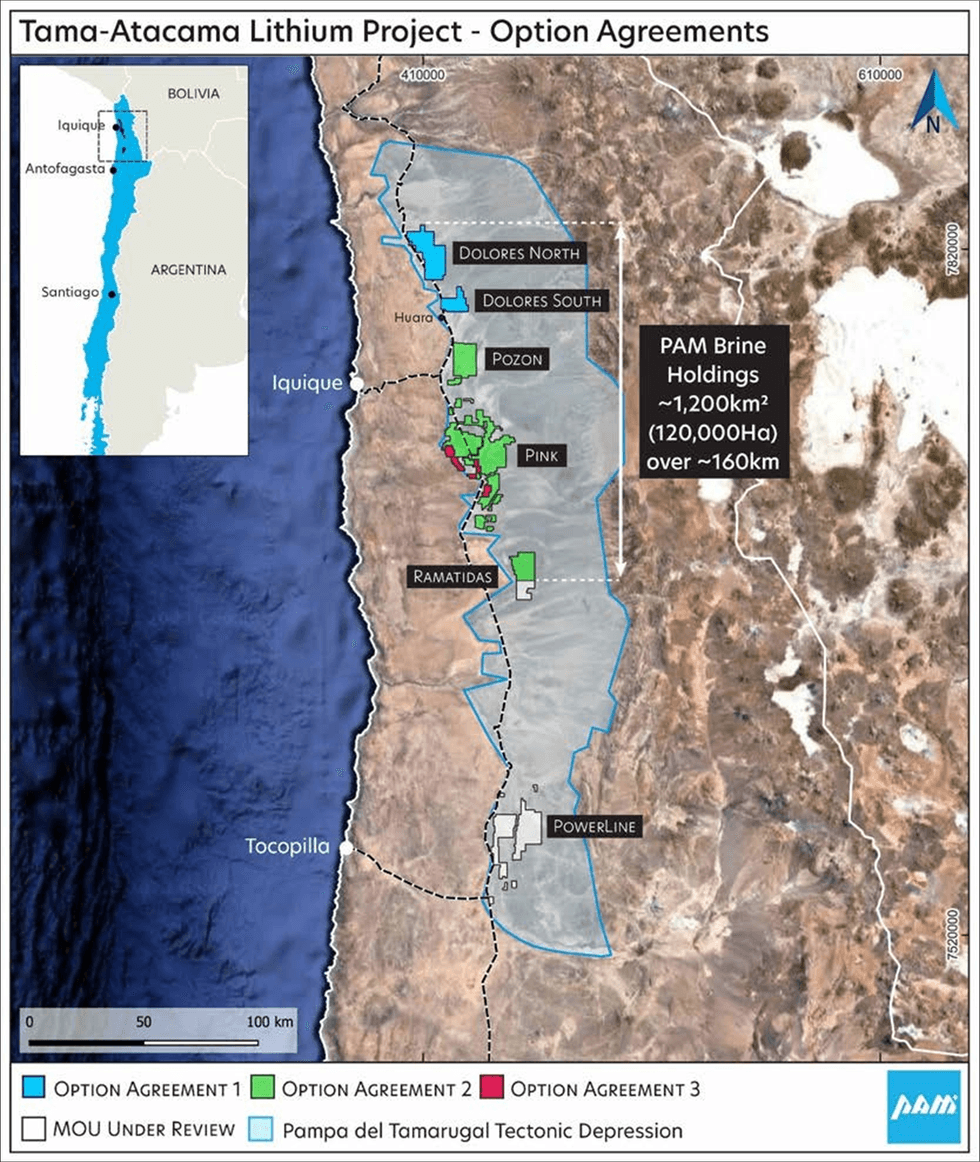

Battery and critical metals explorer and developer Pan Asia Metals Limited (ASX: PAM) (‘PAM’ or ‘the Company’) has entered into three binding Option Agreements to Purchase 100% of the Dolores North, Dolores South, Pozon and Pink project areas which form the Tama Atacama Lithium Brine Project, as well as the northern half of the Ramatidas project area. The total area is approximately ~120,000ha or ~1,200km2, see Figure 2 and Table 1 for further details.

- PAM has converted MOUs into binding Option Agreements to Purchase 100% of the ~1,200km2 Tama Atacama Lithium Brine Project.

- Tama Atacama is one of the largest lithium brine projects in South America, with ~120,000ha (~1,200km2) holdings across three salars.

- Extensive lithium surface anomalies with elevated lithium results up to 2,200ppm Li and averaging 700ppm Li (270ppm Li cutoff) extending over 160km north to south.

- Tama Atacama is a Tier 1 asset in a Tier 1 jurisdiction - in the truest sense of the term ‘Tier 1’ – and PAM is already in discussions with potential strategic partners.

- PAM plans to commence geophysics and drilling in early 2024.

- The Option Agreements have timelines and expenditure commitments which are attractive and achievable when considered in the context of similar lithium brine project transactions in Chile and the United States.

Pan Asia Metals’ Managing Director, Paul Lock, said: “The Tama Atacama Lithium Project has the potential to be one of the largest lithium brine projects in the global peer group. Surface assays for lithium are extremely high and the project has enviable strategic positioning, with all infrastructure requirements satisfied. Waste and water balance solutions are available should straight evaporation or a DLE-evaporation hybrid lithium extraction model be adopted. The project is situated at a comfortable altitude, is close to a large labour pool and will attract specific brine skillsets from elsewhere in South America. Underlying PAM’s advantages are the progressive changes happening in the Chilean lithium sector, the recent MOU between SQM and Codelco quells speculation around nationalisation, which follows several strategic moves in Chilean lithium by multinational mining and chemical companies, including French based Eramet SA’s recent purchase of early stage Li brine assets for ~A$150m, Codelco’s acquisition of Lithium Power Int. and its Maricunga Li brine assets for A$385m, and recent indications from BASF, BYD and Tsingshan that they plan to build lithium conversion plants in Chile.“

Tama Atacama is a Tier 1 lithium brine exploration project located in a Tier 1 mining jurisdiction, in the truest sense of the term ‘Tier 1’. It is one of the largest lithium brine projects in South America, with ~120,000ha (~1,200km2) under granted exploration licenses or exploration license applications - over which PAM has secured priority as regards to the mineral rights. The project spans three salars and within this area are extensive lithium surface anomalies with assays up to 2,200ppm Li and averaging 700ppm Li (56/177 assays, 270ppm cutoff). The Li anomalies are situated in a trend which extends ~160km from north to south, see Figure 3.

Click here for the full ASX Release

This article includes content from Pan Asia Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PAM:AU

The Conversation (0)

09 July 2023

Pan Asia Metals

First-mover Advantage in Critical Metals for Southeast Asia Market

First-mover Advantage in Critical Metals for Southeast Asia Market Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00