- WORLD EDITIONAustraliaNorth AmericaWorld

January 02, 2023

Heavy Rare Earths Limited (“HRE” or “the Company”) is pleased to report assays from another 39 air core holes of the now completed 435-hole exploration and resource expansion drilling program at its 100 per cent-owned Cowalinya rare earth project in the Norseman-Esperance region of Western Australia.

Highlights

- Assays received for additional 39 holes from HRE’s rare earth exploration and resource expansion drilling program of 435 holes at Cowalinya

- Zone of mineralisation over 2 kilometres wide emerging to the west of Cowalinya South deposit

- Other coherent zones of rare earth mineralisation apparent up to 4.2 kilometres from the deposit

- Rare earth grades exceed the Cowalinya resource grade in 27 drill intervals up to 22 metres thick. New intervals include:

- AC200: 6 metres @ 1862 ppm TREO (25.8% magnet REOs) from 20 metres

- including 4 metres @ 2593 ppm TREO from 20 metres

- AC201: 18 metres @ 710 ppm TREO (22.2% magnet REOs) from 22 metres

- including 2 metres @ 3068 ppm TREO from 32 metres

- AC198: 10 metres @ 640 ppm TREO (19.8% magnet REOs) from 35 metres

- including 2 metres @ 1437 ppm TREO from 41 metres

- AC200: 6 metres @ 1862 ppm TREO (25.8% magnet REOs) from 20 metres

- Assays reported to date enable expansion of metallurgical variability program

These latest assays, when combined with those from the first 53 holes (refer to ASX announcement 1 December 2022), demonstrate that coherent zones of saprolite-hosted rare earth mineralisation are apparent up to 4.2 kilometres away from the Cowalinya South deposit. The widest of these mineralised zones, located west of the deposit along drill section A-B on Figure 1, now exceeds 2 kilometres, with mineralisation open to the west of hole AC201 (Figure 2). The 11 consecutive 200 metre-spaced holes that define this zone contain 8 mineralised intercepts where the grade-thickness exceeds the average grade- thickness of the mineralised horizon in the Cowalinya deposit (~9 metres thick @ 624 ppm TREO1). These intercepts are listed in Table 1.

A second zone of mineralisation at least 600 metres wide is present on the same drill section and possibly represents part of an easterly/south-easterly extension to the Cowalinya South resource2. Confirmation of this extension awaits assays from a number of holes north and south of AC178-AC181 and east of AC110-AC112.

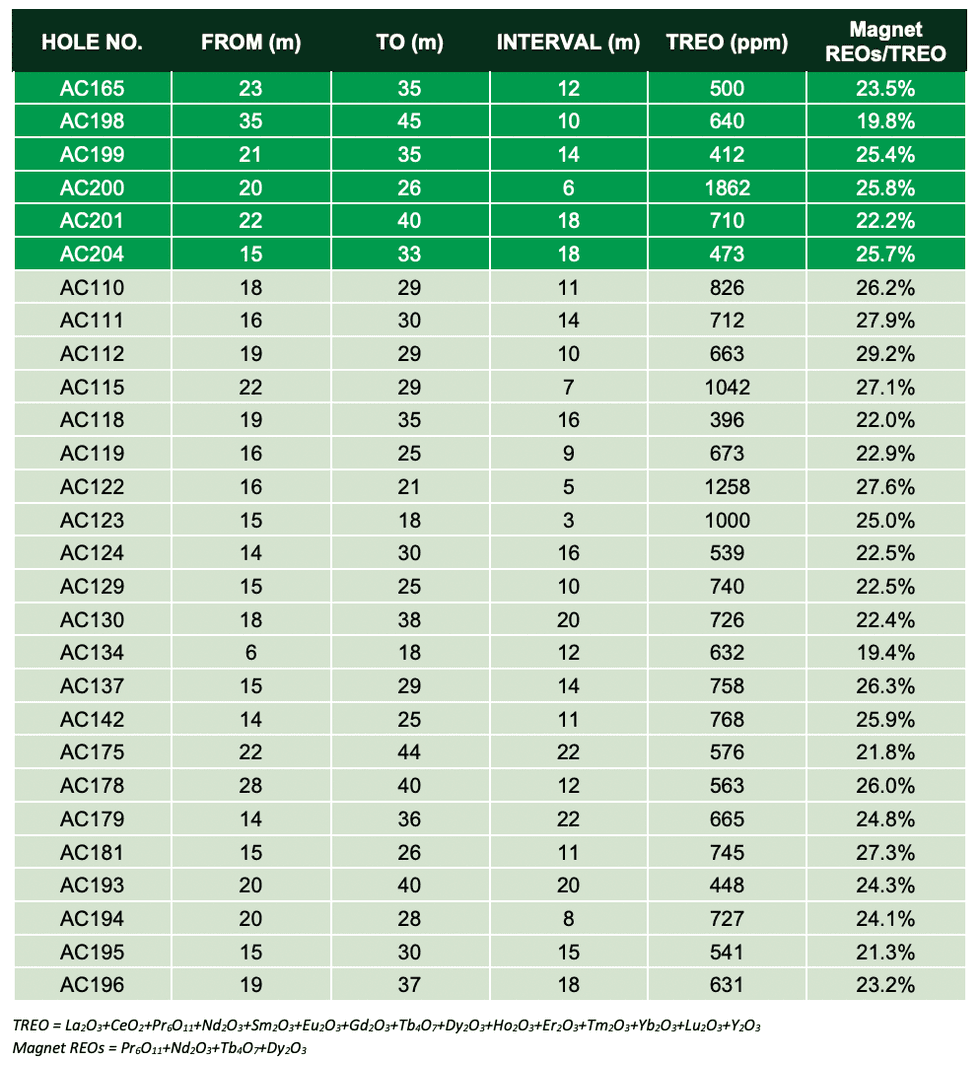

Table 1: Mineralised saprolite intervals from all 2022 drilling

that exceed the average grade-thickness of the mineralised horizon in the Cowalinya deposit.

Newly reported holes are highlighted at the top.

Click here for the full ASX Release

This article includes content from Heavy Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

HRE:AU

The Conversation (0)

06 September 2022

Heavy Rare Earths

Rare Earth Elements in Western Australia and the Northern Territory

Rare Earth Elements in Western Australia and the Northern Territory Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00