Rare Earth Elements: Heavy vs. Light

Both light and heavy rare earth metals are versatile and play a vital role in manufacturing electronics. Learn more about them here.

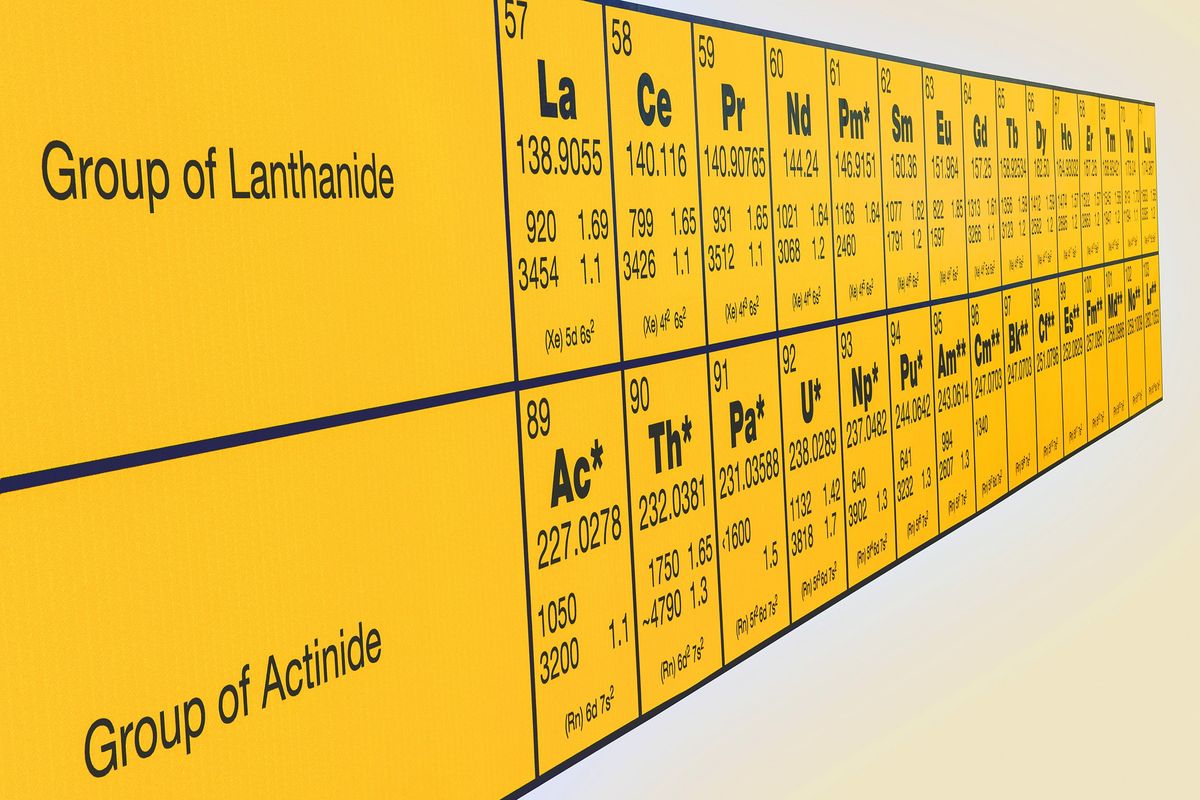

The 17 elements that make up the group of rare earth minerals are diverse in their applications and market dynamics. They are often broken up into two categories according to their atomic weight: light and heavy. Only scandium falls outside this categorization system.

Overall, the different rare earth elements play a huge role in the development of various technologies. They are often used in electronics like laptops and smartphones, as well as spacecraft and missile weaponry. Growing demand for batteries and green technology is adding to their importance and versatility as well.

What are light rare earth elements?

All but two rare earth elements — scandium and yttrium — are part of a chemical group called lanthanides, and light rare earths are the lanthanides with the lowest atomic numbers. The light rare earths are cerium, lanthanum, praseodymium, neodymium, promethium, europium, gadolinium and samarium.

Of the light rare earth metals, neodymium is considered one of the most critical. It is used in everything from mobile phones and electric cars to medical equipment. Neodymium is also the main light rare earth used in the creation of permanent magnets, which are heavily used in data storage systems and wind turbines.

Praseodymium is another significant light rare earth metal. It is used in alloys with magnesium to form aircraft engines, and it also finds use in the film industry for studio lighting and other projects. Like many rare earth metals, praseodymium plays a role in creating permanent magnets.

What are heavy rare earth elements?

Heavy rare earth metals are defined by their higher atomic weights relative to light rare earths. They are less common, and some elements within the group are facing shortages as demand outpaces supply. That typically makes them more valuable than light rare earths, although they also have smaller markets. The full list of heavy rare earth elements is dysprosium, yttrium, terbium, holmium, erbium, thulium, ytterbium, yttrium and lutetium.

Dysprosium, yttrium and terbium are considered critical in the heavy rare earth metals group as they face low supply and increasing importance in the development of clean energy technologies. Like the light rare earths, heavy rare earths also play a key role in other technology, including hybrid cars, fiber optics and medical devices.

Dysprosium is used in tandem with neodymium in magnets that are vital to modern tech and renewable energy. In addition, dysprosium oxide is used in nuclear reactors to help cool fuel rods to keep reactions under control.

Terbium is used in TV screens and solid-state hard drives for data storage. Solid-state drives are heavily favored over conventional hard drives as they are faster and more reliable than conventional hard drives, and these drives are now the default storage format for many laptops and personal electronics. For its part, yttrium has a variety of applications. It is used in TV screens, as an alloying agent and in the polymerization of ethylene.

What else should investors know about heavy and light rare earths?

China's influence remains strong...

The light and heavy rare earths markets are both dominated by China. In 2023, China produced the most rare earth metals globally at 240,000 metric tons (MT). This level of control by Chinese suppliers has made it extremely difficult for other producers to viably mine and sell rare earths. High production, low labor costs and relaxed environmental regulations have all allowed China to control the pricing and market viability of rare earth metals.

That said, Chinese producers must adhere to a quota system for rare earths production, which is a response to China’s longstanding problems with illegal rare earths mining. This system actually led China to become the world’s top importer of rare earths in 2018. In 2023, China issued three rounds of rare earth output quotas for a record total of 255,000 MT — an increase of 21.4 percent over the previous year, according to Reuters. For 2024, analysts expect a slower rate of increase for China’s rare earth quotas of between 10 and 15 percent. The Chinese government issued its first quotas for 2024 in February, set at 135,000 MT for rare earths mining and 127,000 MT for smelting.

The second largest rare earths producer was the US with only 43,000 MT. Rare earths supply in the US currently comes only from the Mountain Pass mine in California. Owned by MP Materials (NYSE:MP), the mine is the largest producer of rare earths in the western hemisphere, with a focus on high-purity separated neodymium and praseodymium oxide; a heavy rare earths concentrate; and lanthanum and cerium oxides and carbonates.

... but investment opportunities exist

Investing in rare earth metals is a challenge due to China’s dominance. That said, global demand for rare earths is expected to rise as the clean energy, electric vehicle and consumer electronics industries gain importance.

Even as regulations and demand create a more favorable environment for rare earths, investors should be specific about their research into the metals — treating the rare earths category as a single group or even as lights and heavies does not provide enough context about an element’s investment potential.

Click here to learn more about the investment landscape for rare earth metals, including information on where to find prices and which companies are operating in the space.

This is an updated version of an article originally published by the Investing News Network in 2011.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.