May 03, 2024

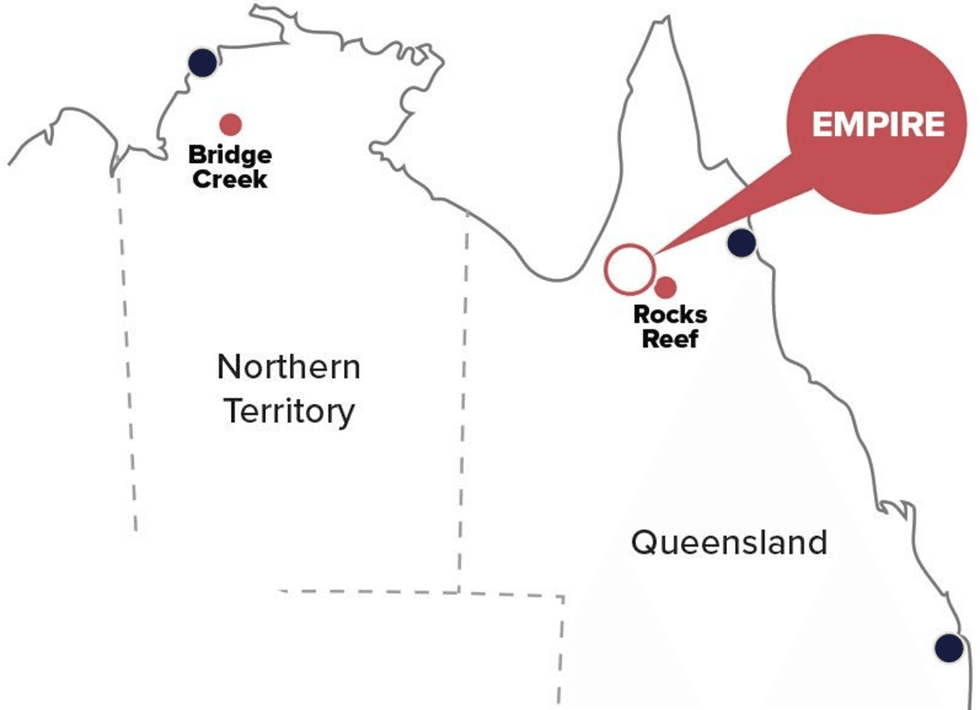

Far Northern Resources (ASX:FNR) focuses on three gold and base metals projects – two based in Northern Queensland (Empire and Rocks Reef) and one in the Northern Territories (Bridge Creek). Far Northern Resources debuted on the ASX on April 12, 2024, and secured AU$6 million in funding.

The company's Empire Project is located 34 kilometres west of Chillagoe in North Queensland covering 252 hectares, on granted mining lease 20380. The claims boast a rich exploration history, marked by substantial drilling conducted across various phases. This culminated in the determination of a 2019 mineral resource estimate of 22,505 oz of gold on the Empire Stockworks gold deposit.

Far Northern is planning a 20,000-meter drilling program over the next two years, which will consist: of 5,000+ meters for Empire; 2,500 to 5,000 meters for Bridge Creek; and 2,500 meters planned at Rocks Reef in the China Wall prospect.

Company Highlights

- Far Northern Resources (FNR) is a newly listed Australia-based gold and base metals exploration company. The company was listed on the ASX on April 12, 2024, following the completion of its IPO in which it raised AU$4 million.

- The company has three projects across Northern Queensland and the Northern Territories – Empire, Bridge Creek and Rocks Reef. Empire and Bridge Creek are significantly advanced, drill-ready with JORC-compliant resources.

- The flagship project Empire has undergone extensive exploration work culminating in a 2019 mineral resource estimate of 22,500 oz gold. The company intends to undertake 5,000 meters of drilling at Empire over the next two years which should lead to further expansion of the resource base.

- At Bridge Creek, FNR is planning a 2,500- to 5,000-meter drilling program, which aims to enhance inferred resources to indicated status, as well as extend the mineralization both along the strike and at depth.

- The Rock Reefs property presents a prospective upside for FNR with historical exploration confirming the presence of a mineralized vein system at the China Wall prospect. FNR is planning a 2,500-meter drill program at the China Wall prospect.

- The presence in relatively attractive mining jurisdictions in Australia positions the company to capitalize on opportunities in Australia's resource sector and deliver superior returns to its shareholders.

This Far Northern Resources profile is part of a paid investor education campaign.*

Click here to connect with Far Northern Resources (ASX:FNR) to receive an Investor Presentation

FNR:AU

The Conversation (0)

23 June 2025

Bridge Creek Phase 1 Assays

Far Northern Resources (FNR:AU) has announced Bridge Creek Phase 1 AssaysDownload the PDF here. Keep Reading...

21 May 2025

Bridge Creek Phase 1 Assay Composites Received

Far Northern Resources (FNR:AU) has announced Bridge Creek Phase 1 Assay Composites ReceivedDownload the PDF here. Keep Reading...

29 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Far Northern Resources (FNR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

08 April 2025

Drilling to Commence on Bridge Creek Mining Lease

Far Northern Resources (FNR:AU) has announced Drilling to Commence on Bridge Creek Mining LeaseDownload the PDF here. Keep Reading...

17 February 2025

Amended Appendix 5B

Far Northern Resources (FNR:AU) has announced Amended Appendix 5BDownload the PDF here. Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00