- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

Overview

Rare earth elements (REEs) collectively represent some of the most critical minerals in the world. This group of interrelated minerals has an incredibly broad range of applications — everything from military equipment to consumer electronics. They are also pivotal in the global transition to clean energy and decarbonisation. Neodymium magnets, for instance — composed of neodymium, iron and boron (NdFeB) — are increasingly being used in wind turbines and electric vehicle motors. Dysprosium and Terbium are added to high performance NdFeB magnets to increase the magnet’s resistance to demagnetisation, thereby improving performance through higher operating temperatures.

REEs are also essential to the production of devices such as smartphones, lending context to the news that alongside other critical minerals such as lithium and cobalt, global demand for REEs is expected to increase by as much as 600 percent over the next several decades.

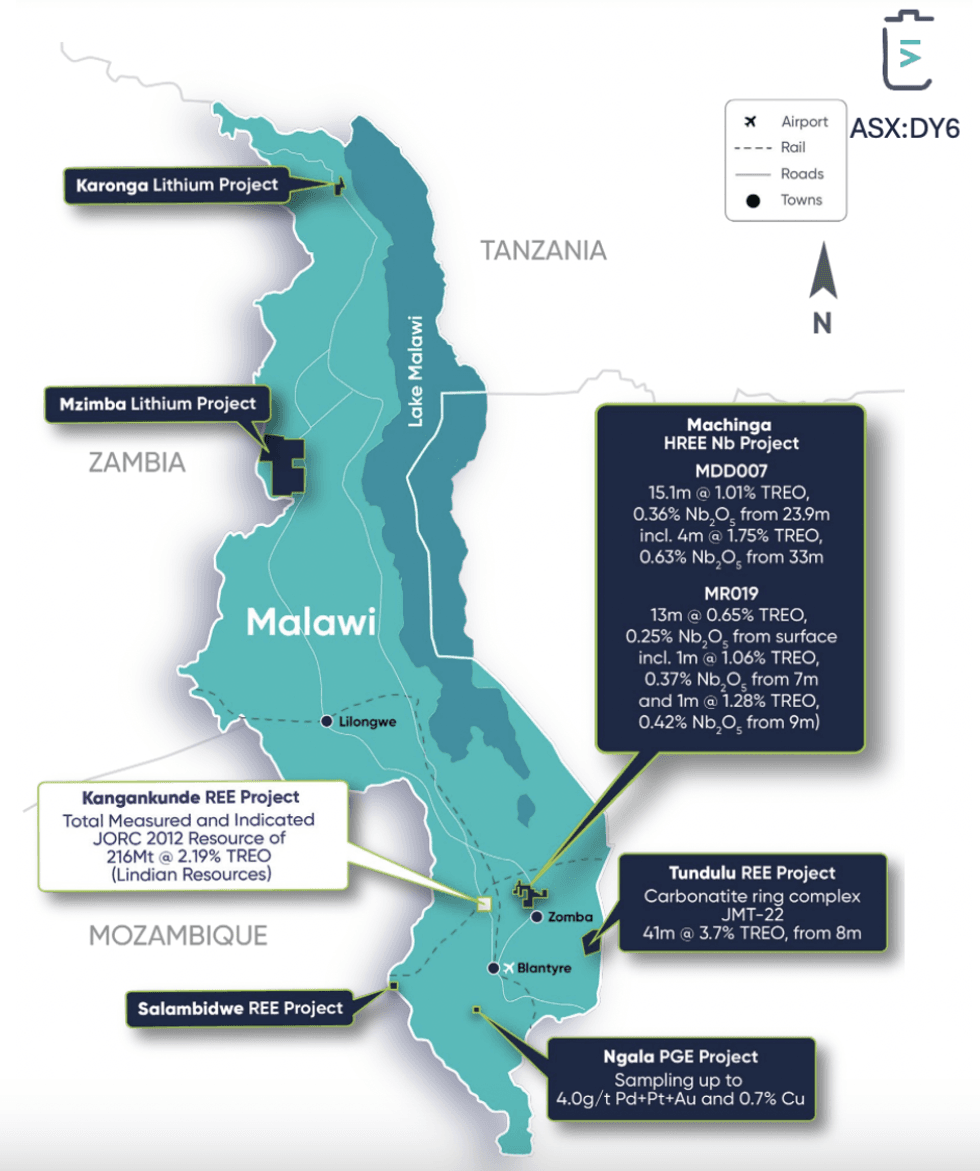

It is clear the world needs to ramp up rare earths production — a challenge DY6 Metals (ASX:DY6) understands. This mineral exploration company holds a 100 percent interest in six highly prospective critical metals projects in Malawi. As one of the most stable jurisdictions in Southern Africa, Malawi is home to considerable mineral wealth — a fact which, alongside its mining-friendly government, has seen the country enjoy significant mining investments over recent years.

Successful completion of maiden 35-hole RC and 8 DDH drilling program for 3,643m RC and 900m of DDH at Machinga HREE and Nb project was completed in September 2023. Assay results of the final diamond Drill hole program returned an average of 29 percent heavy rare earth oxide to total rare earth oxide (HREO:TREO) and 3.6 percent dysprosium (Dy) and terbium (Tb) (DyTb:TREO) at a cutoff grade of >0.25 percent TREO.

DY6 expanded its overall strategic footprint in Malawi to a total of 1,080 square kilometres by staking a carbonatite ring complex in southern Malawi known as Tundulu and several licences considered to be highly prospective for lithium. An exclusive prospecting licence application for 91.5 square kilometres was submitted over Tundulu while an additional four exclusive prospecting licence applications totaling 746.7 square kilometres have also been submitted for the company’s Mzimba (West, Central and South) and Karonga projects.

Company Highlights

- DY6 Metals is an ASX-listed company building a portfolio of critical minerals projects in Malawi that are highly prospective for rare earths, niobium and lithium.

- The company has completed a successful $7-million initial public offering.

- DY6 employs an experienced management team which includes geotechnical experts and mining professionals.

- DY6's projects feature near-surface, high-grade historical drillings and/or workings, and are significantly underexplored with considerable potential to define new mineralised zones.

- Malawi as a mining jurisdiction is incredibly prospective for rare earth elements. In recent years, multiple resource companies have been engaged in comprehensive exploration and development within the region, including:

- Malawi is also known for its excellent operating infrastructure, mining-friendly regulations, and push for renewable energy.

Get access to more exclusive Rare Earth Investing Stock profiles here