Top 5 Canadian Cobalt Stocks (Updated January 2026)

Rare Earths Stocks: 5 Biggest ASX Companies in 2026

Overview

Demand for rare earth elements (REEs) is rapidly increasing. These minerals are necessary to manufacture permanent magnets, auto and fluid cracking catalysts, and are also used in emerging technologies. Much of the world’s REE comes from China, making countries investing in clean energy largely reliant on Chinese supply. However, Australia is quickly ramping up production and was the fourth-largest REE miner in 2021, providing the market with 22,000 tonnes. The country also has the fifth largest reserves globally, with 4 million tonnes.

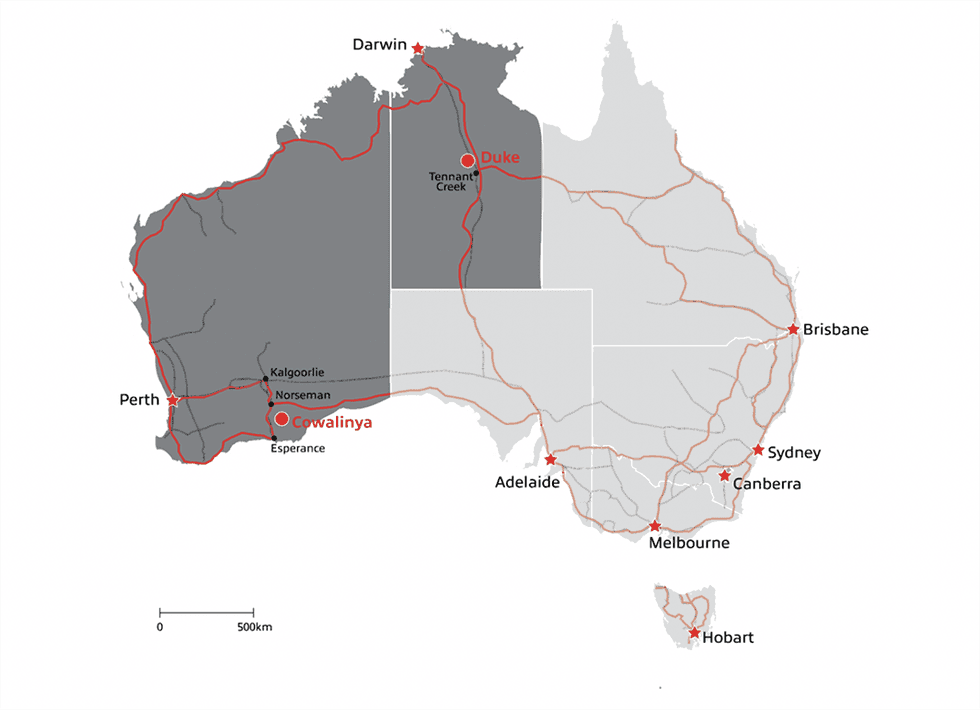

Heavy Rare Earths Limited (ASX:HRE) is committed to supporting the transition to sustainable technologies by providing new sources of these critical minerals. HRE has 100 percent ownership of two REE projects in Australia. The flagship Cowalinya Project is located in the premier mining jurisdiction of Western Australia and has demonstrated potential for a significant rare earth resource with an ideal composition. The company raised AU$6 million in its IPO, indicating foundation investor confidence and funding campaigns to advance its assets.

The Cowalinya Project has a JORC-compliant inferred mineral resource of 28 million tonnes at 625 parts per million (ppm) total rare earth oxides (TREO). The resource has an ideal composition of 25 percent magnet REEs and 23 percent heavy REEs, and importantly also contains low concentrations of radioelements.

The company has also confirmed a substantial new body of rare earth mineralisation at Cowalinya. Assays from 215 holes from HRE’s 441-hole rare earth exploration and resource expansion drilling program in 2022 have revealed multiple high-grade REE intercepts (up to 7222 ppm TREO) and the project’s thickest mineralised intercept to date at 42 meters @ 790 ppm TREO from 12 meters in hole AC226 – within a substantial new Western Zone of rare earth mineralisation.

Heavy Rare Earths’ second project, Duke, is located in the Northern Territory and close to both road and rail. The Company plans to commence exploring the asset for heavy REE-enriched deposits similar to the Browns Range project in Western Australia in the middle of 2023.

A management team with extensive experience in the natural resources sector leads the company, with expertise in rare earth exploration and development, financial management and corporate administration. HRE’s leadership team creates confidence in its ability to bring new REEs to market to support the energy transition.

Company Highlights

- Heavy Rare Earths is an Australian exploration and development mining company focusing on rare earth assets to support the clean energy transition.

- The company has 100 percent mineral rights ownership of two assets in premier mining jurisdictions, Western Australia and the Northern Territory.

- The flagship Cowalinya Project has a JORC-compliant inferred resource of 28 million tonnes at 625 ppm TREO with the highly sought-after composition of 25 percent magnet rare earths and 23 percent heavy rare earths.

- Heavy Rare Earths has confirmed a substantial new body of rare earth mineralisation at Cowalinya in 2023.

- An experienced management team leads Heavy Rare Earths with a range of expertise throughout the mining sector, including project management, corporate administration, and rare earth exploration and development.

Get access to more exclusive Rare Earth Investing Stock profiles here