February 05, 2023

Balkan Mining and Minerals Ltd (ASX: BMM; “Balkan Mining” or “the Company”) is pleased to advise that initial desktop studies of Balkan Mining’s 100% owned Corvette North and Corvette Northwest which cover ~22km2 in the prolific James Bay lithium region in Quebec, Canada, have been completed.

HIGHLIGHTS

- Initial desktop studies of Balkan Mining’s recently staked Corvette North and Corvette Northwest Projects which cover ~22km2 in the prolific James Bay lithium region in Quebec, Canada, have been completed.

- Corvette North and Corvette Northwest are situated approximately 10km to 15km from Patriot Battery Metals Inc (ASX.PMT) Corvette project which has recently announced exciting lithium results, including 156.9m at 2.12% Li2O1 and 159.7m at 1.65% Li2O2.

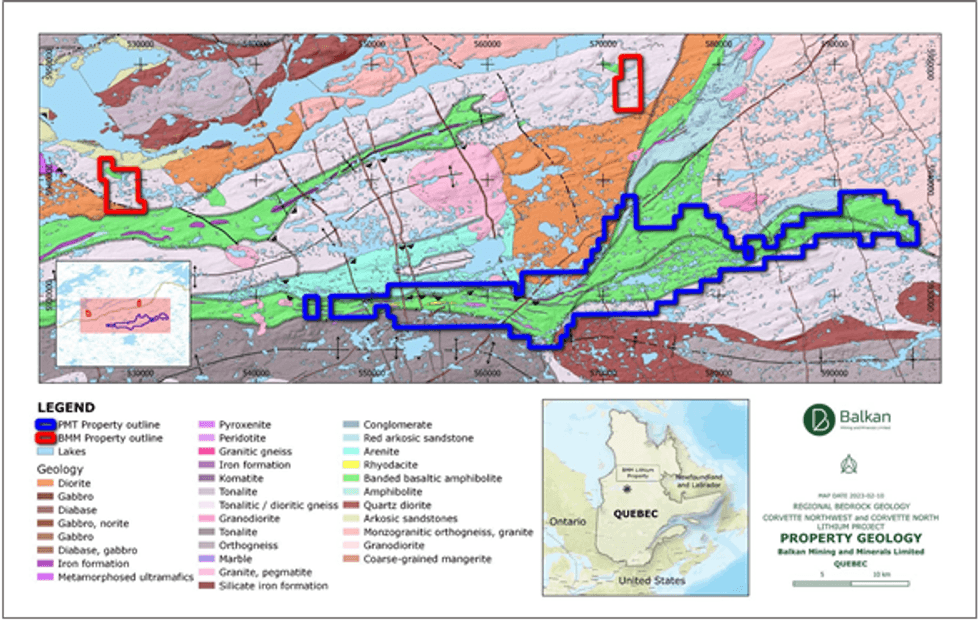

- Amphibolites (denoted in light green in Figure 1) are known to host spodumene-bearing pegmatites, and Balkan Mining notes that both projects host these formations.

- Managing Director Ross Cotton and Director elect Karl Simich will be on the ground late February with Balkan Mining’s geological team to finalise plans for the upcoming work programs.

Corvette North and Corvette Northwest are situated approximately 10km from Patriot Battery Metals Inc (ASX.PMT) Corvette project which has recently announced exciting lithium results, including 156.9m at 2.12% Li2O1 and 159.7m at 1.65% Li2O2.

Amphibolites (denoted in light green in Figure 1) are known to host spodumene-bearing pegmatites, and Balkan Mining notes that both projects host these formations.

Further, the Company has assessed local infrastructure (please refer to Figure 2) and notes that both Corvette North and Corvette Northwest are close to power, roads and numerous airports.

Director elect Karl Simich (to be voted upon by shareholders February 13, 2023) and Managing Director Ross Cotton, will be on the ground late February with Balkan Mining’s geological team to finalise plans for the upcoming work programs.

Mr Simich has 36 years’ experience with publicly listed mining and exploration companies on the ASX, TSX and LSE, most recently as the founder, Managing Director and CEO of Sandfire Resources (ASX: SFR) between 2006 and September 2022.

During this time, he guided Sandfire through the discovery, financing, development and successful 10-year operation of the highly profitable DeGrussa Copper Operations in Western Australia. He oversaw the implementation of Sandfire’s international expansion strategy to become a globally significant copper miner, including the US$1.865 billion acquisition of the MATSA copper operations in Spain. At the end of his tenure, Sandfire had mining operations and development projects spanning three continents.

The projects are located in northern Quebec within the central parts of the La Grande Greenstone Belt, in the James Bay Region, Quebec. The property is situated due north and northwest of the Corvette Lithium Projects of Patriot Battery Metals (ASX.PMT). The rock types of the La Grande Greenstone Belt are dominated by amphibolite facies, mafic to ultramafic metavolcanics and intermediate to mafic paragneiss units. This stratigraphy is analogous to PMET Corvette property where pegmatite intrusions are hosted within basalt derived amphibolite rocks.

Click here for the full ASX Release

This article includes content from Balkan Mining and Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BMM:AU

The Conversation (0)

05 September 2021

Bayan Mining and Minerals

Mining Critical Minerals from the Balkan Region

Mining Critical Minerals from the Balkan Region Keep Reading...

19 January 2025

Further Exploration Targets Identified at Bayan Springs

Bayan Mining and Minerals (BMM:AU) has announced Further Exploration Targets Identified at Bayan SpringsDownload the PDF here. Keep Reading...

31 October 2024

Quarterly Activities/Appendix 5B Cash Flow Report

Balkan Mining and Minerals (BMM:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00