August 09, 2023

Dear Lithium Universe Limited Shareholder

I am writing to introduce myself and also share with you my vision for your company, Lithium Universe Limited (ASX code LU7). I am extremely excited to be a part of your new company and the new direction. I believe that we can achieve great things together. In this letter, I would like to present an overview of my vision for Lithium Universe Limited and share some of the ideas I have in mind to achieve our goals. The name of your new company, "Lithium Universe Limited," is a cheeky reminder to the lithium industry that we can do it all again.

Let me begin by providing some background on my experience and why I was chosen to lead your new Company. I am considered a pioneer in the modern lithium industry, and after a ten-year hiatus, I have returned to spearhead this exciting venture. Over twenty years ago, I was one of the first Australian mining executives to recognize the potential of the emerging lithium-ion battery industry. I led Galaxy Resources Limited (Galaxy) and I built the Mt Cattlin Spodumene Project (137,000 tpa of spodumene product) and the downstream Jiangsu Lithium Carbonate Project (with a capacity of 17,000 tpa).

This was the first large-scale vertically integrated, mine-to-battery-grade lithium carbonate, project in the world. During my tenure, I also headed the acquisitions by Galaxy of the James Bay Spodumene Project in Canada and the Sal de Vida Brine Project in Argentina. I left Galaxy in August 2013.

In 2014, the Jiangsu Lithium Carbonate plant was sold to Tianqi Lithium Corp for US$260 million, and in 2018, the north portion of the Sal de Vida project was sold to

POSCO for US$280 million. At the beginning of my time at Galaxy, the company's market capitalization was less than A$10 million, but it has since grown to a valuation of approximately A$2.5 billion at the merger with Orocobre Ltd to form Allkem Limited in August 2021. Most recently, in May 2023, Allkem merged with Livent in a $15.7 billion deal to form a top 3 lithium producer and superpower in Lithium. In addition to my experience leading Galaxy in its formative stages, my involvement with lithium extends back to the early 1990s when I briefly managed the Greenbushes

Lithium Mine and commissioned the first Lithium Carbonate plant for Gwalia Consolidated. I am proud to have contributed to the early development of this industry and to have witnessed its incredible growth in recent years.

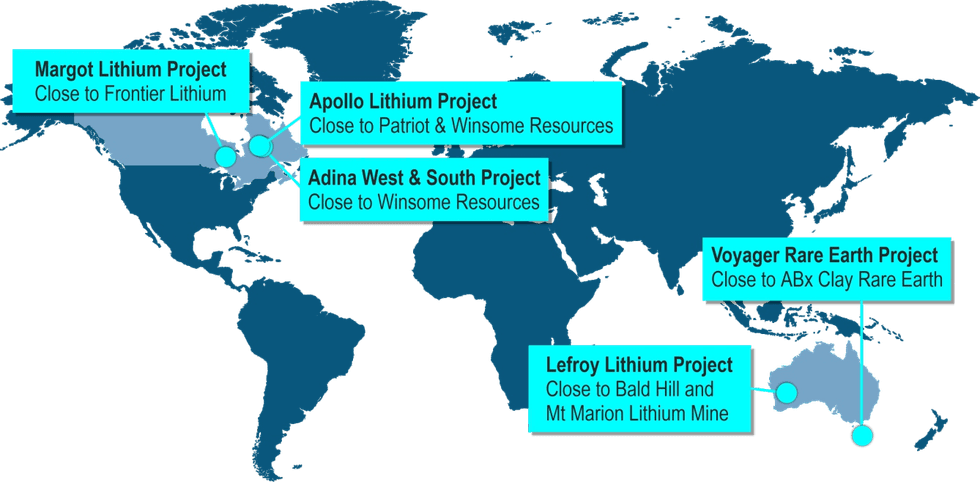

When I accepted the position of Chairman at Lithium Universe Limited, I had a vision that the Company should seek to prioritize the rapid development and construction of successful lithium projects, rather than solely focusing on lithium exploration, this being a natural step in the evolution of a successful explorer. My belief is that while there are many lithium explorers in the world today, only a handful have the expertise and skills required to effectively develop and construct viable projects. Lithium Universe has a rich pedigree of lithium experience and skill, and our goal should be to establish a lithium processing hub in Québec, Canada, as quickly as possible.

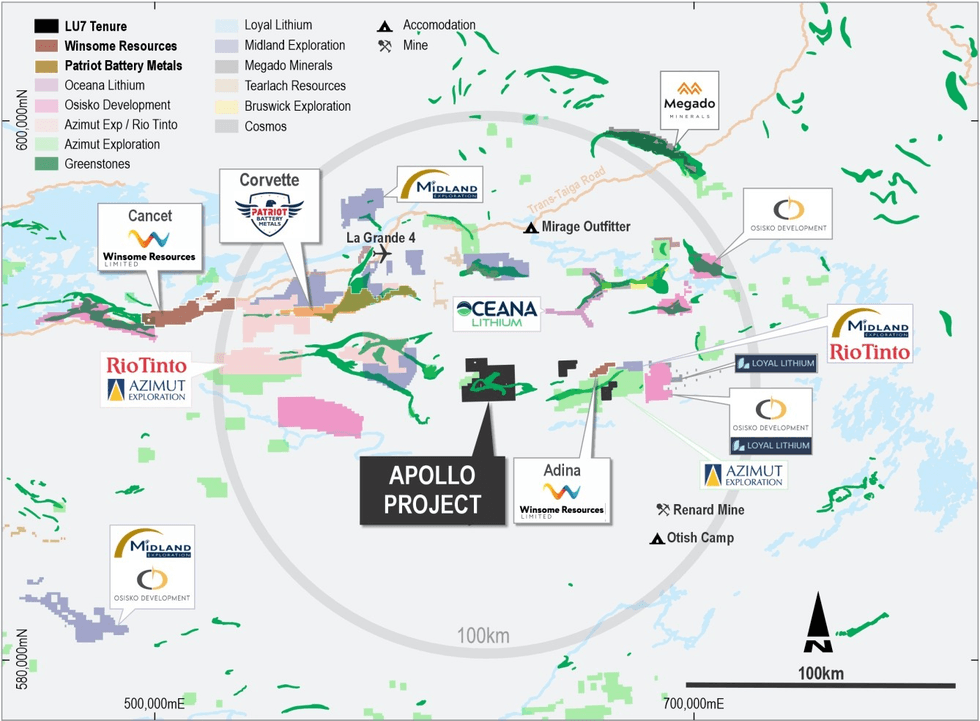

One of the reasons I was drawn back to the lithium industry was the tremendous potential of the Apollo Lithium Project in James Bay, Québec, in which your company holds an 80% ownership stake. I am intimately familiar with the James Bay region, as noted above. The James Bay region is known for its thick, high-grade spodumene mineralization, as evidenced by the positive results of lithium exploration in the area. Notably, the Apollo Lithium Project covers an impressive 240 square kilometres and boasts 17 pegmatite outcrops visible at the surface. One significant advantage of the James Bay region is that spodumene-bearing pegmatites are often quite conspicuous as outcrops, which makes it easier to identify potential lithium deposits. It is an exciting opportunity for us to explore this promising area and discover new deposits that could contribute to our long-term success.

When our partner staked the Apollo tenements in early 2022, the full potential of the project was not realized. However, today we discover that the Apollo Lithium Project is strategically located between two other significant lithium projects, Patriot Battery Metals' (Patriot) Corvette Lithium Project (29km to the northwest) and Winsome Resources' (Winsome) Adina Lithium Project (28km to the east). There have been significant spodumene discoveries by both Patriot Battery Metals and Winsome Resources. As an international benchmark, an intercept of +30m at +1.3% Li2O is considered an excellent result for lithium exploration companies. Patriot reported their best drill result of 156m at 2.12% Li2O at CV5, while Winsome's best drill result was 107m at 1.34% Li2O from 2.3m (AD-22-005). In layman's terms, these are outstanding drill results. This thick and high- grade spodumene mineralisation typically occurs as pegmatite outcrops close to the surface.

These neighbouring companies have seen significant increases in market capitalization, with Patriot now valued at over A$1.4 billion and Winsome at over A$300 million. Lithium Universe's market capitalization prior to re-listing is circa $12 million with an EV of approximately $5 million. The Apollo project is located in the same greenstone belt as these two projects, and similar host geology with similar pegmatite occurrences visible in satellite images. This is why I was attracted back to the lithium industry.

The other advantage of the area is that the spodumene in the neighbouring discoveries is of coarse crystal size, as reported by Patriot and Winsome in their early test work. This feature is not surprising as the Allkem James Bay deposit in the region also contains coarse-grained spodumene. Coarse spodumene requires less fine crushing to extract the lithium from the waste rock and can be processed using simple dense media separation (DMS). This processing method was used at Mt Cattlin and generally, DMS plants result in lower capital and operating costs.

The lithium industry faces a significant hurdle in the form of lengthy project development timelines. From initial resource discovery to the completion of feasibility studies, construction of a lithium concentrator, and eventual product launch, the process can take up to eight (8) years.

Unfortunately, even successful projects often encounter issues during execution, resulting in insufficient supply to meet growing demand. Canada boasts abundant spodumene deposits, making it a prime location for lithium production. However, despite being considered a promising investment opportunity, Canada has seen very little lithium production, in stark contrast to similarly invested countries like Argentina.

Recent developments indicate a shift in the Canadian government's stance concerning the export of critical lithium spodumene concentrate to other countries, particularly China, for downstream processing of battery-grade lithium carbonate and lithium hydroxide. In late 2022, the government ordered Sinomine, a Chinese state-owned company, to divest from Canadian company Power Metals Corp and relinquish its spodumene concentrate off-take contract. The government stated that the decision was made following a comprehensive "multi-step security review" conducted under the Investment Canada Act. This action aligns with the Critical Minerals Strategy and the Investment Canada Act, demonstrating the government's commitment to adding value to the entire supply chain, including downstream processing, rather than solely exporting spodumene concentrate. I believe that this has serious implications for the many lithium junior exploration/mining companies operating in Canada today.

The challenges faced by lithium explorers are twofold. It is not enough to simply unearth lithium deposits; a company must possess the expertise and resources to build and operate fully integrated lithium processing and downstream facilities. This includes an intricate understanding of each stage, from extraction and purification to the final production of battery-grade lithium products.

I acknowledge the admirable intentions of the Canadian government in promoting local downstream processing of spodumene concentrate. However, there are challenges faced in realising this strategy, the main one being the current lack of independent spodumene converters outside of China. Presently, the majority (95%) of spodumene concentrate produced in Australia is sold to China for conversion. China remains the main destination for Australian spodumene concentrate, serving as a vital component in China's lithium-ion battery supply chain. In 2022, more than 2.3 million tonnes of (or 330 Ktpa LCE equivalent) were exported to China for conversion.

While Australia has aspirations to play a part in the conversion process, the two lithium hydroxide plants in Western Australia are still in the commissioning phase. Over the past decade, there have been two vertically integrated lithium projects in Canada—Nemaska Lithium and Canada Lithium—that ultimately failed. Despite significant investments made in Canada comparable to those in Argentina, no noteworthy lithium concentrate production has emerged from Canada.

So the situation is that there are no announced independent spodumene converters in Canada, the United States, or Europe. In addition, the few announced potential lithium refineries in the United States and Europe have secured dedicated spodumene feedstock supply contracts resulting in little capacity to take on additional supply. In essence, there are currently no available spodumene converters outside of China, making it vital for Canadian junior lithium explorers to develop vertically integrated solutions.

These initiatives by the Canadian Federal Government may inadvertently hinder the growth of the local Canadian lithium industry. While there are many junior lithium explorers in Canada, few possess the necessary experience and skills to successfully develop and construct a fully integrated lithium project, spanning from exploration and mining, concentrating, and finally production of battery-grade lithium carbonate or hydroxide. Each stage of the process requires distinct skill sets and mindsets, including exploration mining, crushing and concentrating, and high-grade chemical expertise. It is challenging to find this extensive skillset embedded within a single company, as demonstrated by the difficulties faced by the two previous fully integrated Canadian lithium companies.

I now want to share with you my vision that can promote collaborative growth among lithium junior exploration companies operating in the James Bay area and position Canada as a major supplier of lithium to the global market. In pursuit of this goal, and while we develop our exploration assets, we may also investigate the feasibility of establishing a vertically integrated lithium processing hub (QLPH) in Québec, Canada. My vision is to assess the feasibility of constructing a multi-purpose independent concentrator (QLPH Concentrator) that may supply a battery-grade lithium carbonate refinery (QLPH Lithium Carbonate Refinery) capable of producing 16,000 tons per annum (tpa).

This processing facility (QLPH) should be ideally located along the Trans Taiga Highway in the James Bay district.

As mentioned previously, Lithium Universe already owns 80% of the highly prospective Apollo Lithium Project in the James Bay district. The Company intends to conduct comprehensive drilling activities for resource development, and if successful develop a mine at Apollo. The run of mine (ROM) ore potentially generated from Apollo will form part of the spodumene ROM ore mix feeding the QLPH concentrator. In addition, to feed the QLHP Concentrator, Lithium Universe may consider entering into long-term off-take run of mine contracts with regional lithium junior partners, who could supply spodumene ROM ore.

Now that I am assuming the role of Chairman and have shared a larger prospective vision for our company, my next step is to engage with the board and shareholders in order to gather valuable feedback and gauge interest in exploring this concurrent and complementary strategy further. We have the opportunity to create a new chapter in the history of lithium exploration and project development in Canada. With your support, and our team's expertise and dedication, we are confident that we can make this vision a reality.

Once again, welcome to this exciting lithium journey. Yours sincerely

Click here for the full ASX Release

This article includes content from Lithium Universe Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LU7:AU

The Conversation (0)

03 September 2025

Macquarie Electro Jet Silver Extraction Recovery

Lithium Universe (LU7:AU) has announced Macquarie Electro Jet Silver Extraction RecoveryDownload the PDF here. Keep Reading...

12 August 2025

Acquisition of Silver Extraction Technology

Lithium Universe (LU7:AU) has announced Acquisition of Silver Extraction TechnologyDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Lithium Universe (LU7:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

30 July 2025

Lithium Universe Ltd Quarterly Activities Report

Melbourne, Australia (ABN Newswire) - During the June quarter, Lithium Universe Ltd (ASX:LU7,OTC:LUVSF) (FRA:KU00) (OTCMKTS:LUVSF) announced the acquisition of the global rights to commercially exploit a patented photovoltaic solar panel recycling technology known as "Microwave Joule Heating... Keep Reading...

17 July 2025

Completion of PV Solar Cell Recycling Acquisition

Lithium Universe (LU7:AU) has announced Completion of PV Solar Cell Recycling AcquisitionDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00