CEF believes that although China currently dominates cleantech leadership, Australia has the ability to take the lead in green iron production, which it says is the country's top emerging export opportunity.

The organisation also sees strong potential for Australia in areas like green hydrogen and green ammonia. However, the country won't be able to unlock these possibilities without electrifying and decarbonising the Pilbara area.

Under its list of recommendations, CEF includes three ways mining giants such as BHP (ASX:BHP,NYSE:BHP,LSE:BHP), Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Fortescue (ASX:FMG,OTCQX:FSUMF) can contribute.

First, there is a need for companies to “(b)ring together their globally leading financial and technological corporate power into a robust and sustained Pilbara-wide industry collaboration on common-user energy infrastructure in the region.”

The report identifies APA (ASX:APA) and BP (LSE:BP,NYSE:BP) as "well positioned" to take the lead on aggregating existing grid transmission and generation into single common-user grid infrastructure.

The second recommendation focuses on investing in accelerated decarbonisation plans at each of the companies’ Pilbara operations. The report says that there is a need for firms to "rapidly deploy their balance sheets’ firepower."

“While BP (via its majority-owned AREH), APA and Fortescue are leading, BHP and Woodside Energy (ASX:WDS,LSE:WDS,OTC Pink:WOPEF) are failing to adequately respond to the material risks of the climate crisis, looming regulatory penalties for carbon-intensive production, and the opportunities to invest at speed and scale into energy transformation,” CEF states in its report. It goes on to add that Rio Tinto is already working on energy supply decarbonisation at its aluminium operations and should extend those efforts to the Pilbara region.

Lastly, CEF asks major resource companies to use their economic influence — namely job creation, royalties and corporate taxes — to push the Western Australian government to adopt more ambitious climate and energy policies. The think tank said that the government is falling behind in these endeavours compared to nearby states.

"This boost in ambition needs to be on a scale commensurate with both the climate challenge and the immense economic opportunities of an accelerated transition in the Pilbara region," CEF notes.

Recommendations for other involved parties, such as energy stakeholders, the federal government and the Western Australian government, are also discussed in the report. CEF's suggestions include, but are not limited to, equity participation, financing and tax incentives, in-depth discussions and legislative efforts.

In the organisation's view, there will be strong consequences for not taking action.

"Failure to act now to decarbonise and electrify the Pilbara puts at risk Australia's biggest single export opportunity — to potentially double our iron ore exports to $250bn pa by producing green iron," according to CEF.

Don’t forget to follow us @INN_Australia for real-time news updates!

Securities Disclosure: I, Gabrielle de la Cruz, hold no direct investment interest in any company mentioned in this article.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/13/c4639.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/13/c4639.html

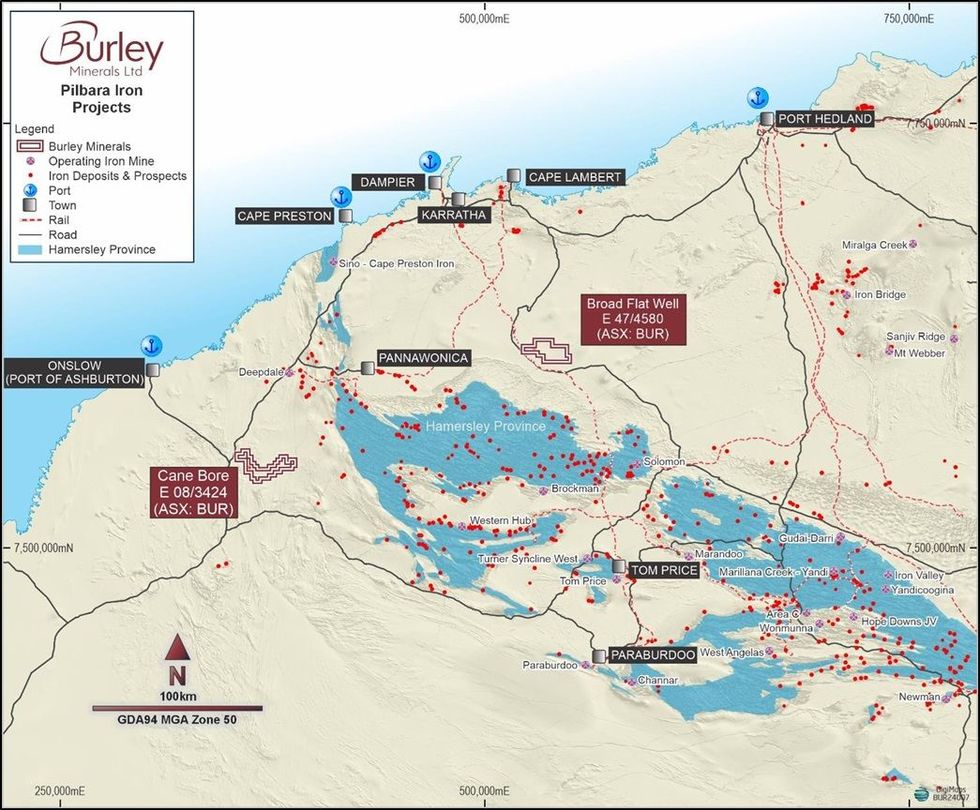

Figure 1: Cane Bore and Broad Flat Well Iron Projects Location Plan, Pilbara, Western Australia.

Figure 1: Cane Bore and Broad Flat Well Iron Projects Location Plan, Pilbara, Western Australia.

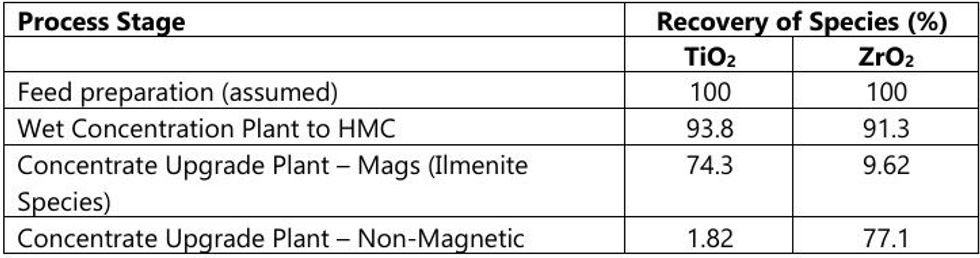

Table 1: Results from IHC testwork completed in 2018

Table 1: Results from IHC testwork completed in 2018