October 09, 2024

Artemis Resources Limited (‘Artemis’ or the ‘Company’) (ASX/AIM: ARV) is pleased to announce ground reconnaissance at the Titan prospect in the West Pilbara region of Western Australia continues to deliver high grade gold and silver from assays, highlighting the emergence of a broad mineralised area over the prospect.

Highlights:

- Recent rock chip sampling at Titan delivers further high-grade gold from assays, and newly discovered silver including:

- 553,754 g/t Au & 1,305 g/t Ag (24AR19-075)

- 223,056 g/t Au & 1,195 g/t Ag (24AR19-068)

- 33,389 g/t Au & 233 g/t Ag (24AR19-061)

- 7.5 g/t Au (24AR19-032)

- 5.7 g/t Au (24AR19-047)

- 1.2 g/t Au (24AR19-040)

- 2.0 g/t Au (24AR19-030)

- Emerging broad prospective area covering >63ha and considered to remain open pending further exploration

- Previous reported over-limit and high-grade assays have now been quantified by the laboratory and returned assay results as follows;

- 692,579 g/t Au & 3,000 g/t Ag (24AR11-005)

- 471,937 g/t Au & 1,775 g/t Ag (24AR11-008)

- 45,103 g/t Au & 344 g/t Ag (24AR11-004)

- 7,440 g/t Au & 212 g/t Ag (24AR11-002)

Executive Director George Ventouras commented: “It is pleasing to see further high- grade rock chip assays being recorded at the Titan prospect, together with confirmation of the extent of gold in previous sampling. These results, together with the previously reported gold, silver and copper results, point to the Carlow tenement being a highly prospective region with the potential for a larger scale gold system.

These high-grade gold assays continue the trend found in our original rock chip discoveries at Titan1 by emerging from quartz-iron veining and are therefore not analogous to conglomerate mineralisation. This veining structure will vary throughout Titan but the structure continues to demonstrate its potential. We are looking forward to further gold exploration at Titan and over the greater Carlow tenement.”

Titan Prospect

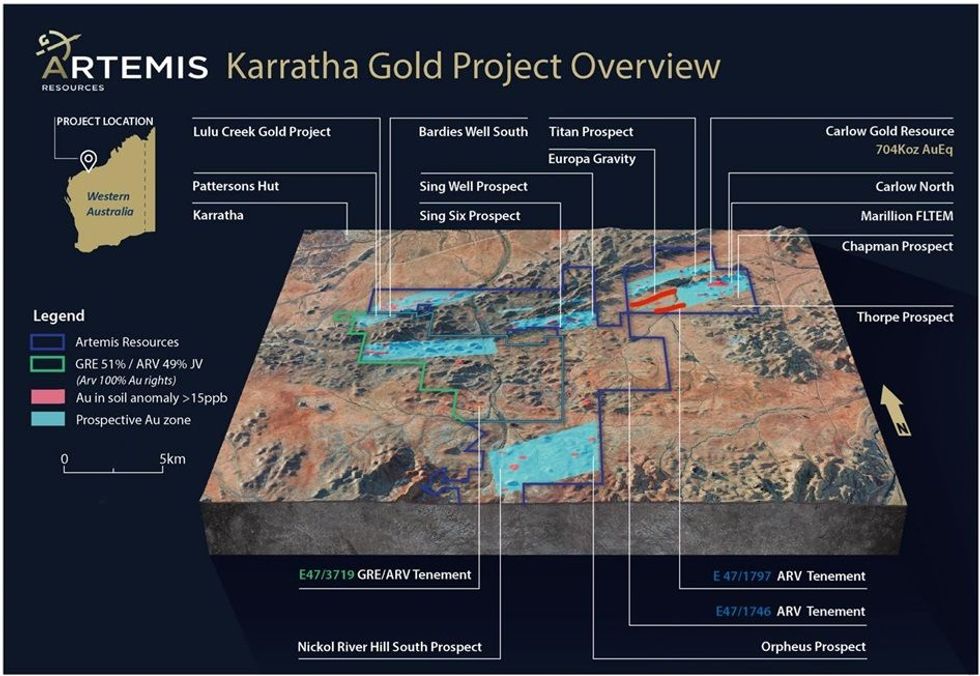

The Titan prospect is located towards the northern part of the Carlow tenement E47/1797, in the West Pilbara region of Western Australia. Titan has had minimal exploration work conducted previously other than broad spaced soil sampling and a constrained moving loop transient electromagnetic survey (MLTEM).

The Company has followed up the preliminary ground reconnaissance undertaken in August 2024 with a second phase of sampling. This second phase has confirmed the previously reported over-limit assay results and also identified further potential mineralised areas through the discovery of additional high grade, previously untested quartz/iron-oxide veins. In total, 97 samples were collected and sent to the laboratory for processing. The majority of samples were collected from in-situ veining with some sub-crop and three float samples.

Click here for the full ASX Release

This article includes content from Artemis Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

12h

The True Value of Olympic Gold: Beyond Metal and Market Prices

As organizers award the medals for the Milan Cortina 2026 Winter Olympics, fans and spectators alike may have pondered a singular question at some point: how much is an Olympic gold medal actually worth?The short answer is far less—and far more—than most people assume.Don’t forget to follow us... Keep Reading...

14h

Tajiri Discovers Potentially Economic Gold Mineralization in Multiple Trenches at Yono Property Including: 12m@ 2.4 g/t; 20m@ 1.4g/t; 8m@ 1.0g/t; 18m@ 0.8g/t & 4m@ 5.5g/t Gold; Bordered by G Mining Ventures Oko West and G2 Goldfields Oko Properties, Guyana

Tajiri Resources Corp. (TSXV: TAJ) ("Tajiri" or the "Company") is pleased to report results from its ongoing Phase II trenching program at the majority owned Yono Project, Guyana, which indicate three significant gold zones potentially hosting economic mineralisation. All results are given in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00