September 23, 2024

Allup Silica Limited (ASX: APS) (“Allup” or “Company”) is pleased to provide an update on works to progress development of its 100%-owned McLaren Valuable Heavy Mineral Sands (VHMS) Project near Balledonia, WA.

Summary

- IHC Mining Consultants (IHC) has commenced initial stages of McLaren Mineral Sands Pre-Feasibility Study (PFS) engineering design

- Initial design Scope based on 10Mtpa throughput to produce up to 400,000tpa ilmenite product

- Previous metallurgical test work completed by IHC Competent Persons in 2018 demonstrates good ilmenite recoveries from a conventional mineral sands flowsheet

- Allup plans to commence infill drilling program at McLaren in Q4, 2024

- Environmental Resources Management (ERM) appointed to plan infill drilling program and update Mineral Resource Estimate (MRE) once drilling results are received.

- PFS expected to be completed during Q2 2025

Allup is able to leverage extensive previous work to accelerate completion of the PFS for the project which is being completed by IHC Mining Consultants (IHC) (see ASX Announcement dated 26 August 2024).

Allup is also preparing a drilling program for the project in Q4 CY24 to enable an update of the existing Mineral Resource Estimate (MRE) in early 2025, and to investigate potential to increase the known resource.

Previous IHC Metallurgical Testwork Results

In 2018, IHC completed a metallurgical testwork program on a representative sample derived from a 14-tonne bulk sample from the McLaren deposit. The sample assayed approximately 7.2% heavy mineral. Mineralogical analyses of the heavy mineral indicate it to contain 56.3% ilmenites and higher grade titanium minerals such as Leucoxene.

The IHC metallurgical test work program confirmed the material to be amenable to standard mineral sands processing methodologies, utilising typical mineral sands equipment.

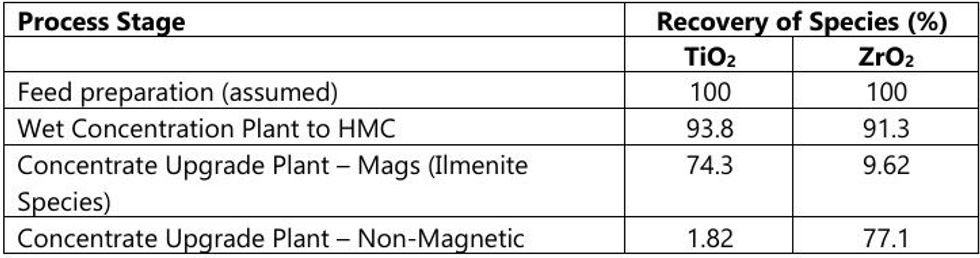

Ilmenite recovery from WCP feed into the CUP Magnetic stream was ~75% of ilmenite, Altered Ilmenite and HiTi minerals. Overall recovery of rutile/anatase from the WCP feed into the non-magnetic concentrate was ~57% Overall recovery of zircon from the WCP feed into the CUP non-magnetic concentrate was ~70%.

Slimes settling was achieved using addition of 3% gypsum, resulting in significant improvement in flocculant dosing rates, down to 150-200g/t.

The test work produced final products of:

- Ilmenite of a suitable grade to be classified as sulphate ilmenite

- Rutile of a typical quality with 95.7% TiO2, 1.49% Fe2O3,

- Zircon of a typical standard zircon quality, noting levels of U + Th at 265ppm were considered very low.

Flowsheet Development

The IHC 2018 test work resulted in the development of a conceptual flowsheet using traditional mineral sands separation techniques. It consisted of three circuits, comprising:

- Feed Preparation - made up of hydrocyclones and a thickener used to settle and separate the slimes. The slimes fraction would be returned to the mining void along with the tails stream. The non-slimes portion would be fed to the WCP.

- Wet Concentration Plant (WCP) - made up of several spiral stages (gravity separation) – the WCP process produced a Heavy Mineral Concentrate (HMC) containing 89.1% heavy mineral, 25.9% TiO2 and 0.37% ZrO2.

- Concentrate Upgrade Plant (CUP) - screening to remove +425 µm material (determined by test work to be barren), then several stages, primarily of magnetic separation.

The HMC produced in the WCP was processed through the CUP to produce a magnetic concentrate suitable for an ilmenite process circuit and a non-magnetic concentrate containing 90-95% Heavy Mineral.

Click here for the full ASX Release

This article includes content from Allup Silica Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

11 November 2025

BHP Invests AU$944 Million in Western Australia Communities

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has released its 2025 Community Development Report for Western Australia, demonstrating a record-breaking investment of AU$944 million. According to the report, a majority of this year’s investment went to local suppliers, with AU$737 million spent. Of this, AU$529... Keep Reading...

02 April 2025

Fortescue's Forrest Hones in on Renewable Energy, Aims to Go Green by 2030

Andrew Forrest, founder and executive chair of major mining company Fortescue (ASX:FMG,OTCQX:FSUMF), has been making headlines following his bold statements on renewable energy.Toward the end of February, the mining tycoon was quoted as saying that Fortescue is quitting fossil fuels. According... Keep Reading...

10 March 2025

Rio Tinto Plans US$1.8 Billion Investment in BS1 Extension, Completes Arcadium Acquisition

Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) made headlines after two announcements on March 6. The mining giant said it will invest US$1.8 billion to develop the Brockman Syncline 1 mine project (BS1), a move that will extend the life of the Brockman region in West Pilbara, Western Australia.BS1 now... Keep Reading...

13 August 2024

Australia's Mining Dilemma: Can ESG Goals and Competitive Production Coexist?

With investors placing increasing value on environmental, social and governance (ESG) issues, mining companies are having to choose between maintaining competitive production and promoting ESG principles. That's the topic explored in an August 8 report from Callum Perry, Solomon Cefai, Alice Li... Keep Reading...

27 February 2020

Rio Tinto to Invest US$1 Billion to Reach Zero Emissions Goal by 2050

Mining giant Rio Tinto (ASX:RIO,LSE:RIO,NYSE:RIO) is set to invest US$1 billion in the next five years to reach its new climate change targets. The company is aiming to reduce emissions intensity by 30 percent and absolute emissions by a further 15 percent from 2018 levels by 2030. “Climate... Keep Reading...

02 January 2020

Iron Outlook 2020: Prices to Stabilize Following Supply Shock

Click here to read the latest iron outlook. Iron ore prices have come off their highest level of 2019, but are still ending on a high note. The year was marked once again by a disaster in the space, with Vale’s (NYSE:VALE) news of a dam collapse in January remaining in the spotlight throughout... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00