May 18, 2023

Alma Gold (CSE:ALMA) focuses on its Karita Gold project in Guinea, West Africa, a region that's among the most prolific and productive gold exploration regions, globally. As the project advances towards development, the company is currently acquiring additional exploration permits in Guinea while maintaining a high ESG rating throughout the exploration and mining cycle.

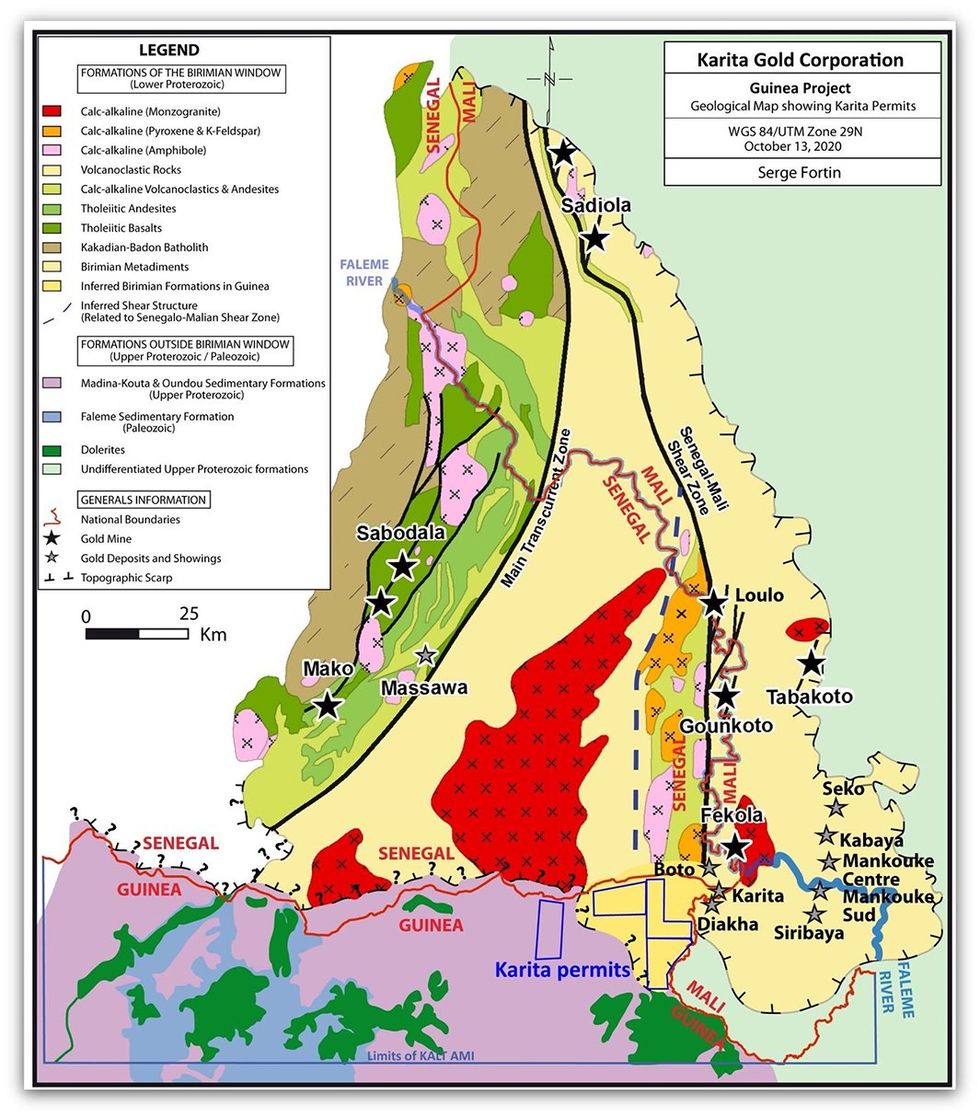

The Karita Gold Project contains a total of four exploration permits located immediately adjacent to IAMGOLD’s newly discovered gold deposit. The Karita Gold Project sits on a Birimian-aged greenstone belt, an extensive mineralization zone that hosts prolific gold deposits. Alma Gold has a comprehensive exploration plan, which is currently moving toward the maiden drilling program stage.

Alma Gold actively engages with local communities, artisanal gold miners, and governments during the permitting process and closely monitors its environmental footprint in each region. Alma Gold CEO Greg Isenor has been widely recognized for his impressive ESG work in previous projects, with more than 20 years of experience working in West Africa, striving to build a strong ESG rating with every project.

Company Highlights

- Alma Gold is an exploration and development gold company focusing on its gold assets in Guinea, including acquiring additional exploration permits.

- The company prioritizes achieving a high ESG rating throughout the exploration and mining cycle by building strong relationships with local communities, artisanal miners, and government officials.

- The Karita Gold Project in West Africa contains four exploration permits adjacent to prolific gold discoveries made by neighboring mining companies including IAMGOLD.

- Alma Gold has developed a comprehensive exploration plan for the Karita Project and is progressing towards commencement of its maiden drilling campaign.

- Alma Gold is actively pursuing additional exploration permits in the region to further increase its land position in East Guinea along the prolific Sanankoro-Kobada-Niaouleni Gold Corridor from Mali.

- Gold reached an 11-year-high spot price in 2022, and demand for the precious metal remains strong amid macroeconomic uncertainty.

- The company’s Clarence Stream North gold project in New Brunswick, Canada recently returned encouraging gold-in-soil assay results indicating the asset's potential.

- Alma Gold’s CEO Greg Isenor has a long track record of working in West Africa and leading projects with a high ESG rating.

- A team of experts with a proven track record of success throughout the mining industry leads the company toward success.

This Alma Gold profile is part of a paid investor education campaign.*

Click here to connect with Alma Gold (CSE:ALMA) to receive an Investor Presentation

ALMA:CNX

The Conversation (0)

25 January 2024

Alma Gold

Promising Gold Exploration Assets in West Africa

Promising Gold Exploration Assets in West Africa Keep Reading...

2h

Centurion Minerals Ltd. Announces Revocation of MCTO

CENTURION MINERALS LTD. (TSXV: CTN) ("Centurion" or the "Company") announces that the British Columbia Securities Commission ("BCSC") has revoked the management cease trade order ("MCTO") previously issued on December 1, 2025 under National Policy 12-203 - Management Cease Trade Orders.The... Keep Reading...

23h

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

23h

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

03 February

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold (TSX:ELD,NYSE:EGO) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that will create a larger, diversified gold and copper producer with two major development projects that are set to enter production in 2026.Following completion under a... Keep Reading...

03 February

Stellar AfricaGold Intersects Multiple Gold-Bearing Zones and Confirms Structural Controls at Tichka Est, Morocco - Drilling Resumed on January 30, 2026

(TheNewswire) Vancouver, BC TheNewswire - February 3rd, 2026 Stellar AfricaGold Inc. ("Stellar" or the "Company") (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold... Keep Reading...

02 February

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00