December 12, 2024

Loyal Lithium Limited (ASX:LLI) (Loyal Lithium, LLI, or the Company) is pleased to announce the execution of a definitive agreement for the consolidation of the Hidden Lake Lithium Project, with Patriot Battery Metals (ASX:PMT) becoming a substantial LLI shareholder. Mr. Blair Way, Non- Executive Director and former President & CEO of Patriot Battery Metals, will join the Loyal Lithium Board of Directors, bringing valuable regional and industry expertise to guide the company's growth initiatives. The consolidation of the Hidden Lake Lithium Project provides Loyal Lithium with greater flexibility and optionality to deploy innovative exploration and development solutions.

Highlights

- Loyal Lithium is pleased to announce the execution of a definitive agreement for the consolidation of the Hidden Lake Lithium Project, with Patriot Battery Metals (ASX:PMT) becoming a substantial Loyal Lithium shareholder.

- Mr. Blair Way, Non-Executive Director and former President & CEO of Patriot Battery Metals, will join the Loyal Lithium Board of Directors, bringing valuable regional and industry expertise to guide the company's growth initiatives.

- The consolidation of the Hidden Lake Lithium Project provides Loyal Lithium with greater

- flexibility and optionality to deploy innovative exploration and development solutions.

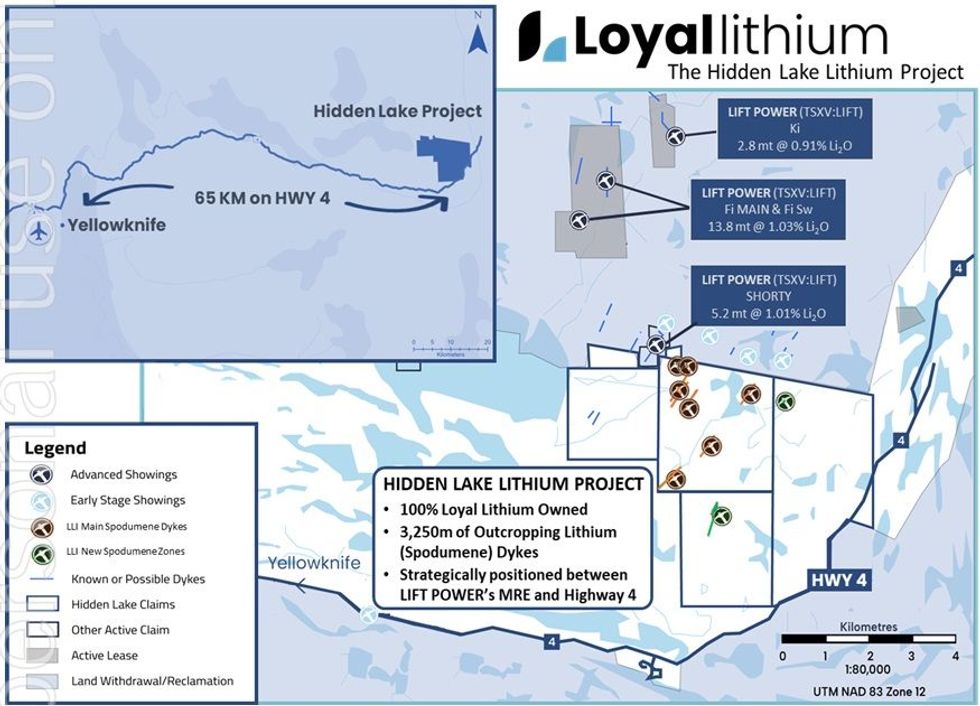

- Loyal Lithium's 100% owned Hidden Lake Lithium Project is strategically located 65 km from the mining city of Yellowknife, NWT. It is positioned between LIFT Power (TSXV:LIFT), which has a regional MRE1 of 50.4 Mt @ 1.0% Li2O, and the all-weather Highway 4.

- Mr. Way is an experienced international executive with over 30 years of management experience within the resources and construction industry throughout Australasia, Canada, the United States, and Europe.

- With $6.0 million in funding2, Loyal Lithium is well positioned to advance its promising Canadian lithium assets for the maturing North American lithium market.

Loyal Lithium's 100% owned Hidden Lake Lithium Project is strategically located 65 km from the mining city of Yellowknife, NWT. It is positioned between LIFT Power (TSXV:LIFT), which has a regional MRE1 of 50.4 Mt @ 1.0% Li20, and the all-weather Highway 4.

Mr. Way is an experienced international executive with over 30 years of management experience in the resources and construction industry across Australasia, Canada, the United States, and Lurope. As President & CEO of Patriot Battery Metals, Mr. Way was integral in growing the company through the successful exploration and consolidation of the largest lithium deposit in North America, the Shaakichiuwaanaan Project (formerly Corvette). With $6.0 million in funding, Loyal Lithium is well positioned to advance its promising Canadian lithium assets for the maturing North American lithium market.

Commenting on the consolidation agreement and appointment of Mr. Blair Way, Loyal Lithium Managing Director, Mr Adam Ritchie, said:

"We are thrilled to welcome Blair to the Loyal Lithium Board. His extensive regional and industry expertise will be invaluable as we drive the company's growth initiatives. Blair's proven track record with Patriot Battery Metals speaks for itself and demonstrates his unique ability to advance projects and create shareholder value."

"The consolidation of the Hidden Lake Lithium Project enables us to actively explore emerging opportunities for innovative solutions in Canadian critical mineral mines. The Hidden Lake Lithium Project, located along a highway, features unique geology and mineralogy that could deliver meaningful economic and social benefits to the region."

"I look forward to working closely with Blair to execute our 2025 strategic plan and advance both our Hidden Lake project and the Trieste Lithium Project in Quebec."

Commenting on his appointment, Loyal Lithium Non Executive Director, Mr Blair Way, said:

"It has been a pleasure working with Adam and the Loyal Lithium team over the last 18 months. The team has done a great job in advancing their Canadian hard rock lithium assets, achieving significant milestones to date.

The long-term source of North America's lithium is becoming increasingly clear with several Quebec-based world-class hard rock assets now defined. The Trieste Greenstone Belt demonstrates significant potential, showing early-stage characteristics similar to those seen by Patriot Battery Metals at Shaakichiuwaanaan.

The collaboration potential of the Trieste Greenstone Belt is the key to unlocking value for all, contributing to the sustainable development of the lithium industry. I look forward to working with the Loyal Lithium team to realise this potential and further advancing Loyal's assets.

THE HIDDEN LAKE LITHIUM PROJECT CONSOLIDATION AGREEMENT

The Hidden Lake Lithium Project was initially structured as a 60% Loyal Lithium and 40% Patriot Battery Metals joint venture. The parties involved have now agreed to divest Patriot Battery Metals' minority 40% holding in exchange for shares in Loyal Lithium.

Click here for the full ASX Release

This article includes content from Loyal Lithium Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00