February 28, 2023

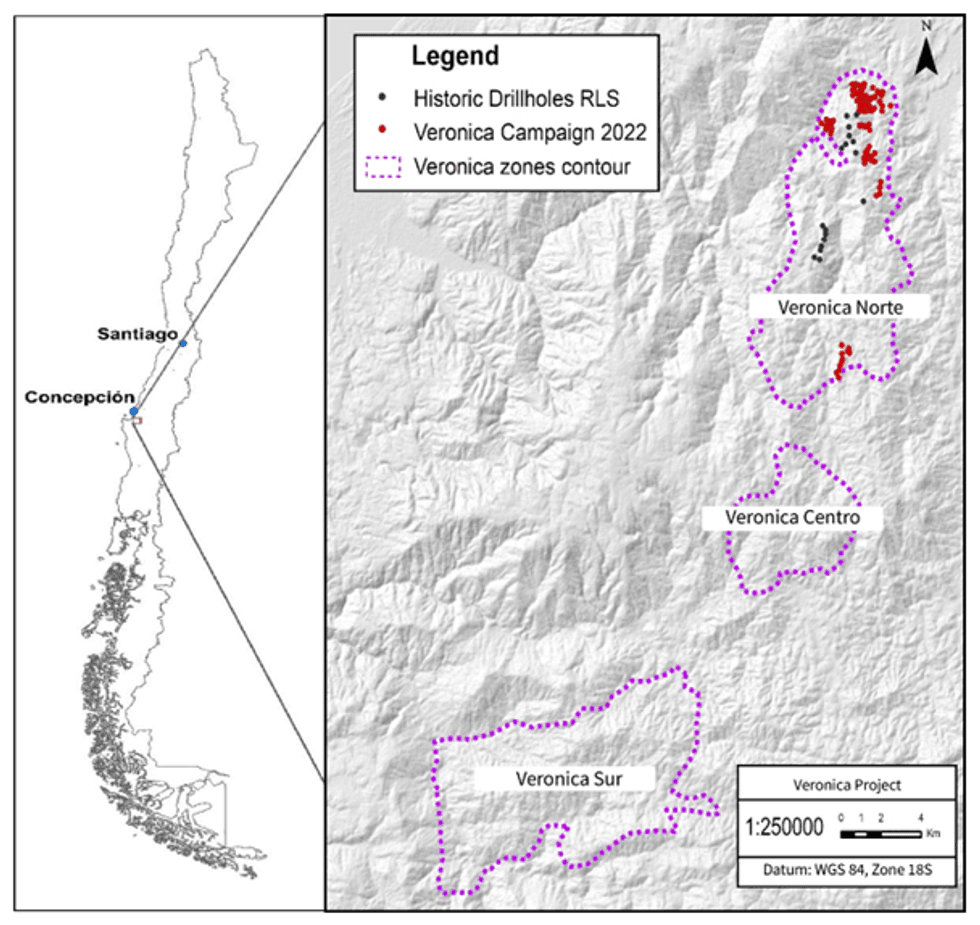

Aclara Resources Inc. ("Aclara" or the "Company") (TSX:ARA) is pleased to announce drilling results completed over Verónica Norte (the "Project") located 45 km from Concepcion, Chile. The Project corresponds to a new target area approximately 45 kms south of the Penco Module Project.

Approximately 2,905 meters (m) from 125 sonic drill holes were completed in the Project in the second half of 2022 as part of an initial drilling campaign covering 982 hectares (Ha) of total target of 5,055 Ha (see Figure 1). The purpose of this initial drilling campaign was to confirm the depth extension of the positive results obtained from surface geological reconnaissance and geochemical sampling and to test the lateral extents of the mineralization.

The drill hole program:

- confirmed rare-earth elements (REE) mineralization recognized through geological work, including geochemical sampling continued at depth.

- recognized that the mineralization occurs mainly in the first 15m below surface, with an economic horizon of approximately 7m.

- confirmed that REE are highly absorbed into ionic clays resulting in a high percentage of REE exchangeable fraction recovery (see table 3).

- confirmed attractive recoverable values of the heavy rare earths (HREE,) Dysprosium and Terbium (DyTb), as well as the light rare earths, Neodymium and Praseodymium (NdPr).

- confirmed that the mineralization remains open on its lateral extents at different topographic levels.

Ramón Barúa, CEO of Aclara, commented:

"Initial exploration results at Veronica North represent the first step towards becoming a multi-modular HREE Company. As we progress, our in-house developed exploration model has proven highly effective in finding REE-enriched ionic clay deposits. We are very encouraged with these results and plan to continue with further drilling campaigns to unlock the full potential of the asset".

A location map is shown in Figure 1, where the full Veronica district is displayed covering approximately 13,122Ha in high priority drilling areas, comprising of Veronica Norte (5,055Ha), Verónica Centro (2,492Ha) and Veronica Sur (5,575Ha). The drilling campaign executed in 2022 is mainly concentrated in the north of Veronica Norte. Drill holes, averaging 25m in depth, intersected mineralization with TREY (total rare earth plus yttrium) economic grades; the interception length and average composite grades (ppm) of these intersections are shown in Table 1.

Patricio Irribarra, Head of Geology at Aclara, commented:

"The drill holes in the Veronica Norte area were designed to (i) confirm the presence of REE mineralization beneath the good results obtained during surface geochemical scan and sampling, (ii) test other targets in the area and finally, (iii) understand the geological factors that control the mineralization.

Verónica Norte displays different characteristics to the Penco Module, such as being a shallower yet potentially larger deposit, with lower grades but with a significantly higher exchangeable REE fraction with interesting levels of both DyTb and NdPr. We are encouraged that Veronica Norte mineralization remains open on its lateral extents at different topographic levels, generating new targeting zones and rewarding our exploration efforts. We have decided to continue with the drilling and sub-surface sampling in the Veronica Norte area, targeting other sectors to keep evaluating the site potential and its extension.

The areas of Veronica district were heavily impacted by the fires during February, which has put a temporary restriction to re-initiate drilling works. During the summer season, we will keep helping the affected communities on site as well as collaborating with forestry companies. We intend to resume greenfield campaigns at the appropriate time once we receive clearance from superficial land owners."

Geological Overview

The Project hosts rare earth elements mineralization absorbed into an ionic clay deposit, which is formed by the weathering of calc-alkaline with peraluminous signal rocks as protolith, containing REE bearing and accessory minerals such as monazite, allanite, and apatite, and as impurities in primary minerals. Due to surface weathering, REE containing minerals are decomposed, and ionized REEs are absorbed on the surface of clay minerals such as halloysite and kaolinite.

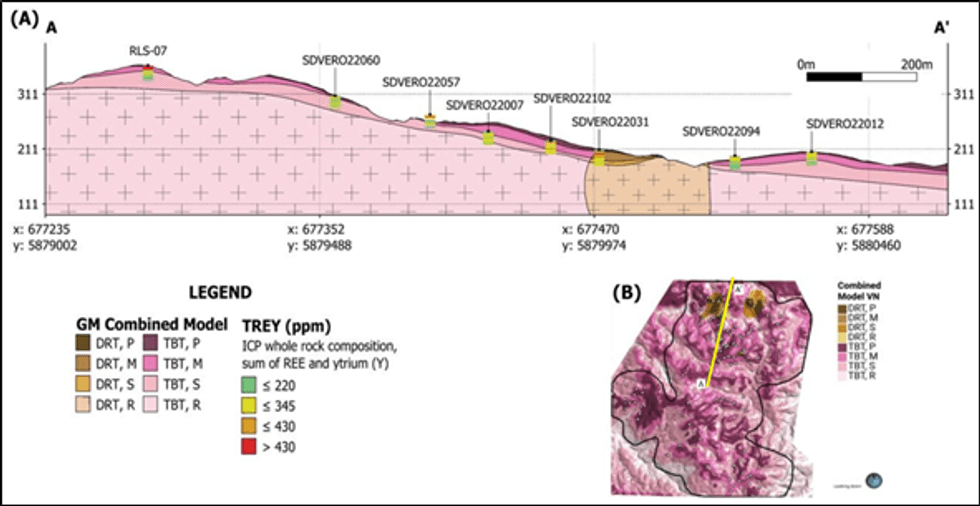

According to the geological mapping and the information obtained from the Veronica Norte 2022 drill hole campaign, the local geology is shown to be homogeneous, defined by two lithological Units (Figure 2B). Predominating in areal extent is biotite granitoid (TBT) and, to a lesser extent, in the northern portion of the area, a diorite (DRT). The chemical results of both Units do not show significant differences in grade values, implying a priori the lack of lithological control of the mineralization. Even though mineralized DRT tends to be richer in TREY, the extent of TBT in the area presents more interest, considering it also reaches potentially economic values of its exchangeable fraction. The regolith profile shown in Figure 2A is characterized not only by its observed geological criteria (texture, alteration grade, mineral composition), but also by its chemical data, which helps limit their extent, narrowing the horizon hosting the mineralization. Topography appears to control the formation and preservation of the mineralized horizon, being present at different topographic altitudes, where the exchangeable fraction of the mineralization is hosted at shallow depths (between the first 10-15 m).

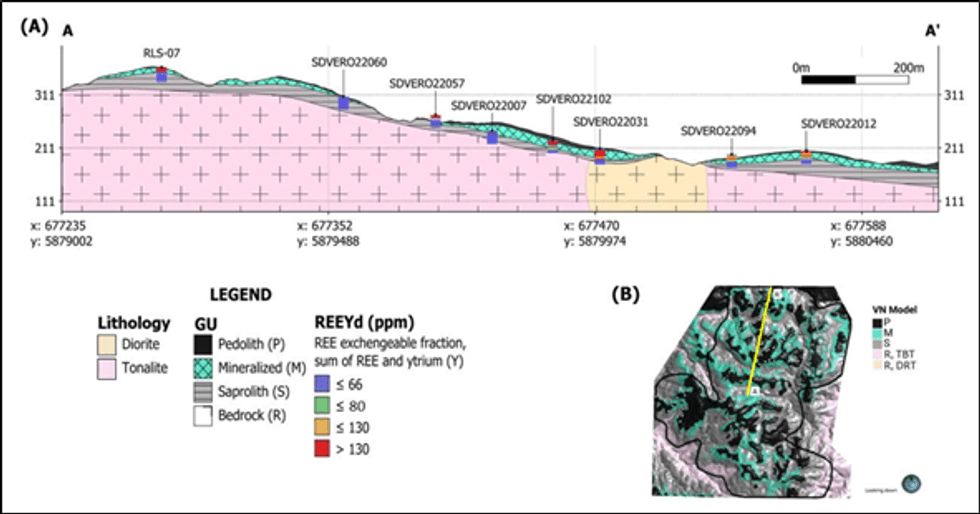

As the mineralization is controlled mainly by the weathering/regolith development instead of the lithology, Figure 3A shows the 3D geological units, which will be used for eventual Mineral Resource estimation. These units are displayed in the cross section presented in Figure 3A and the map view in Figure 3B.

Sampling and Assay Protocols

The 125 sonic drill holes were sampled in intervals of 0.8m to 2m, for a total of 1,827 samples, which had been sent for TREY analysis to ALS, and desorption TREY Analysis to AGS. Sampling and analytical protocols are unchanged from the Penco Technical Report, which was identified to be in line with standard industry practice. The QA/QC program indicates high levels of precision and accuracy for Dy, Tb, Nd, Pr and Lu. Overall, the database for total grades similarly shows high precision and accuracy.

Qualified Person and technical help

The technical information in this news release, including the information related to geology, drilling, and mineralization, has been reviewed and approved by Luis Oviedo, an independent Consulting Geologist with more than 45 years of experience. Mr. Oviedo is a member of the Colegio de Geólogos de Chile and the Comisión Calificadora de Competencias en Recursos y Reservas Mineras (Institute of Mining Engineers of Chile) and is an Independent Qualified Person as defined by National Instrument 43-101 (Standards of Disclosure for Mineral Projects ).

The QP confirms that he visited the project area on January 26, 2023 and was supported by the Head of Geology at Aclara, Patricio Irribarra, and colleague Rene Henriquez, who reviewed and analyzed the relevant project information. Carlos Santos, Database and QA/QC Geologist of the company provided an analysis of the QA/QC work over the Veronica Norte deposit.

For further information, please contact:

Ramon Barua

Chief Executive Officer

investorrelations@aclara-re.com

Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of applicable securities legislation, which reflects the Company's current expectations regarding future events, including statements with regard to mineral continuity, grade, and upside at the Veronica Norte zone, the issuance of an updated Mineral Resource statement, and the contemplated development of greenfield targets and expected reduction in permitting risk. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company's control. Such risks and uncertainties include, but are not limited to, the factors discussed under "Risk Factors" in the Company's annual information form dated as of March 30, 2022 filed on the Company's SEDAR profile. Actual results and timing could differ materially from those projected herein. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained in this news release is provided as of the date of this news release and the Company does not undertake any obligation to update such forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required under applicable securities laws.

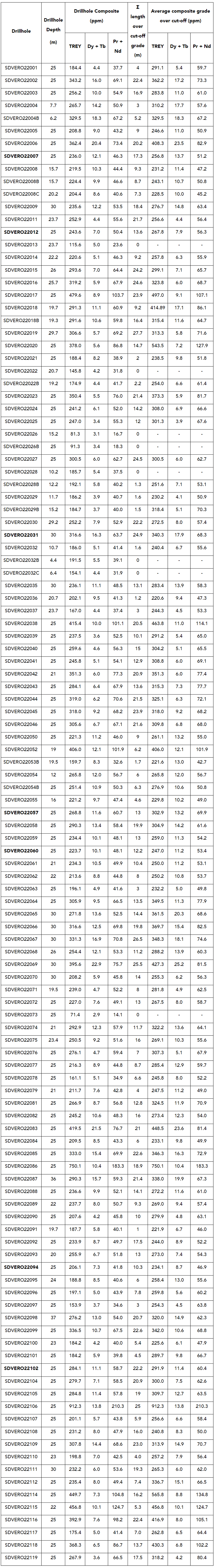

Table 1: Summary of Veronica Norte Drill Hole results

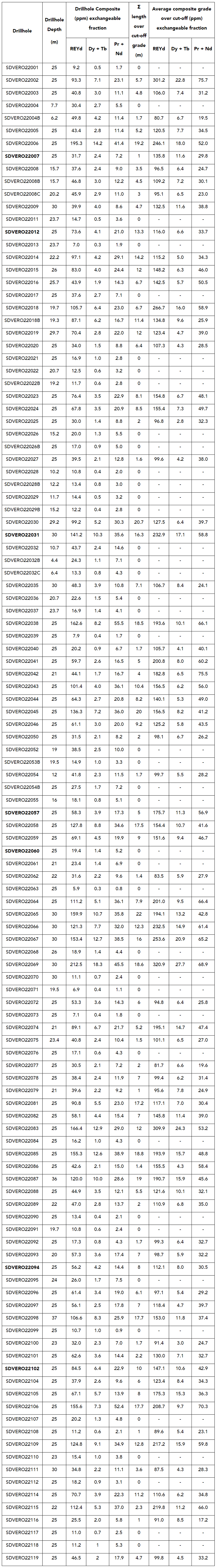

Table 2: Summary of Veronica Norte Drill Hole with exchangeable fraction (desorption) results

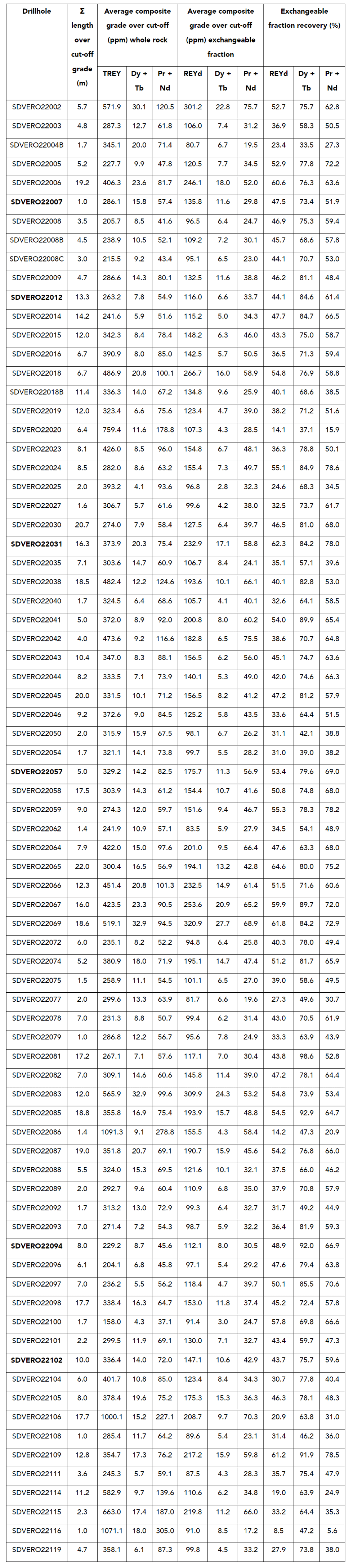

Table 3: Comparison of whole rock and exchangeable fraction results for desorbable mineralized lenght

Notes:

- TREY = Total rare earth plus yttrium

- REYd = Desorption rare earth plus ytrium

- Dy + Tb = Dysprosium plus terbium

- Pr + Nd = Praseodymium plus neodymium

- The boreholes in bold letters are shown in the cross sections

- All holes are vertical and interval thickness approximates true thickness.

Click here to connect with Aclara Resources Inc. (TSX:ARA), to receive an Investor Presentation

ARA:CA

The Conversation (0)

11 September 2023

Aclara Resources

Environmentally Sustainable Rare Earth Element Extraction with a Transformative Proprietary Process

Environmentally Sustainable Rare Earth Element Extraction with a Transformative Proprietary Process Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00