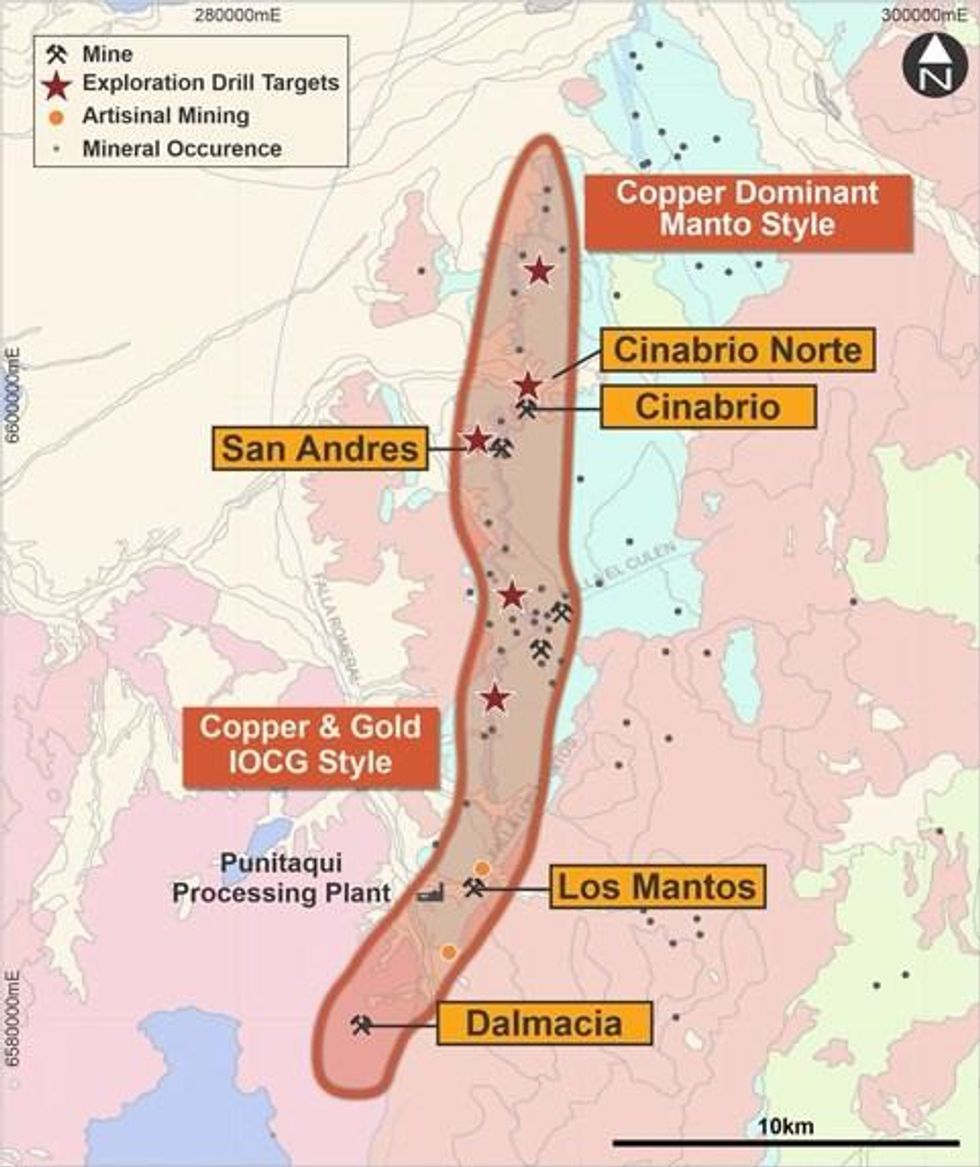

Battery Mineral Resources Corp. (TSXV: BMR) (OTCQB: BTRMF) ("Battery" or "BMR" or the "Company") is pleased to announce encouraging drill core assay results from the 2021 exploration and in-fill drill program at the Punitaqui mine complex ("Punitaqui") in Chile. Punitaqui is slated for resumption of copper concentrate production in mid to late-2022. The Dalmacia Target is second of several historic zones within BMR's Punitaqui project with partially delineated resources and established underground access. Dalmacia is located in the southern portion of the Punitaqui area about 6 kilometers south of the Punitaqui copper processing plant.

Highlights

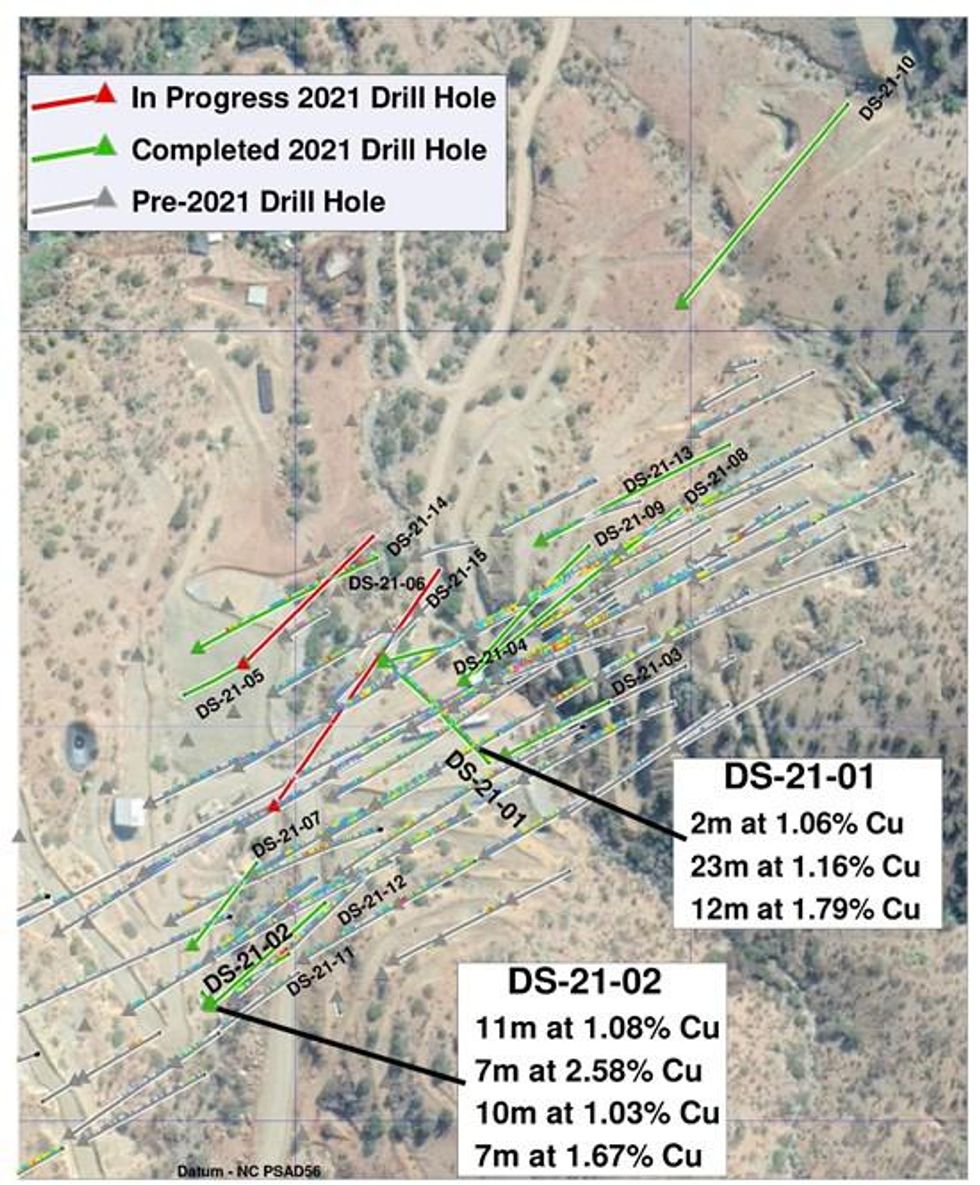

- Complete final assay results from two Dalmacia drillholes (DS-21-01 and DS-21-02 see Table 1) have been returned with encouraging results as follows:

Drillhole DS-21-O1:

- 12 meters ("m") grading 1.79% copper ("Cu") and 2.5g/t silver ("Ag") including 8m at 2.44% Cu, 3.2g/t Ag and 0.04g/t gold ("Au")

- 23m grading 1.16% Cu and 1.7g/t Ag including 13m at 1.56% Cu and 2.1g/t Ag and including 7m at 2.32% Cu, 3.1g/t Ag and 0.04g/t Au

- 2m at 1.06% Cu, 0.7g/t Ag and 0.03g/t Au

- 4m at 0.89% Cu and 0.4g/t Ag

- 4.9m at 0.72% Cu and 0.6g/t Ag

Drillhole DS-21-02:

- 7m grading 1.67% Cu, 2.6g/t Ag and 0.08g/t Au

- 10m at 1.03% Cu and 2.1g/t Ag including 3m at 1.49% Cu and 2.3g/t Ag

- 2m at 2.34% Cu and 5g/t Ag

- 7m at 2.58% Cu and 2.7g/t Ag

- 11m at 1.08% Cu, 0.9g/t Ag and 0.08g/t Au including 4.0m at 2.32% Cu, 1.4g/t Ag and 0.17g/t Au and including 3.0m at 2.90% Cu, 1.7g/t Ag and 0.22g/t Au.

- Thirteen holes completed at Dalmacia have reached target depth and all holes have intersected significant visible copper mineralization.

- The Dalmacia drill program is designed to confirm mineralized zones identified by previous drilling programs and expand these mineralized zones north and south along strike and at also depth.

- Earlier results from historic exploration drilling programs include:

- DS-11-02: 17.9m at 1.34% Cu and 28.5m at 1.60% Cu

- DS-12-08: 9.7m at 1.39% Cu

- DS-12-12: 10.3m at 1.48% Cu

- DS-12-20: 7.5m at 1.76% Cu and 21m at 1.09% Cu

- DS-13-05: 9.0m at 1.62% Cu and 13.5m at 1.77% Cu

- DS-14-07: 27m at 1.62% Cu

- DS-14-12: 20m at 1.52% Cu

- DS-14-13: 26m at 1.23% Cu

- DS-14-14: 15m at 1.14% Cu

- DS-14-16: 24m at 1.10% Cu and 18m at 1.02% Cu

- DS-12-15: 25.8m at 1.79% Cu and 17.3m at 1.30% Cu

Battery CEO Martin Kostuik states; "Our recent acquisition of the former producing Punitaqui copper mine in Chile will give our investors an opportunity to participate in a potentially significant re-rating in BMR's valuation as we transition from development to operations and positive cash-flowing. The development of Punitaqui towards a restart is progressing well on all fronts such as drilling, engineering and permit modifications and we look forward to presenting the restart plan for the mine in Q1 2022. In addition, as the drilling program progresses across the various mineralized zones, we are excited to report the first of many results for Dalmacia. These new drilling results demonstrate that this program has the potential to provide the Company with an additional source of copper ore along with existing ore at the Cinabrio mine and the mineralization at the San Andres target. We look forward to providing further exciting updates for the drill program as we progress towards a potential near term resumption of operations and cashflow at Punitaqui."

Punitaqui Copper Mine

Punitaqui is a former producing copper mine located in the Coquimbo region of Chile with an eight-plus year operating history within which produced up to 25 million pounds of copper in concentrate annually. Punitaqui was recently acquired by BMR via a private placement equity financing announced on July 13, 2021. BMR began developing the project immediately by initiating a drilling program, operating and environmental permit modifications and engineering studies.

Dalmacia Drill Program

- Program comprises both confirmation and step-out diamond core drilling

- Currently, two diamond core drills are in operation at Dalmacia.

- Thirteen holes have been completed for 2,628 meters of diamond core drilling and the program continues

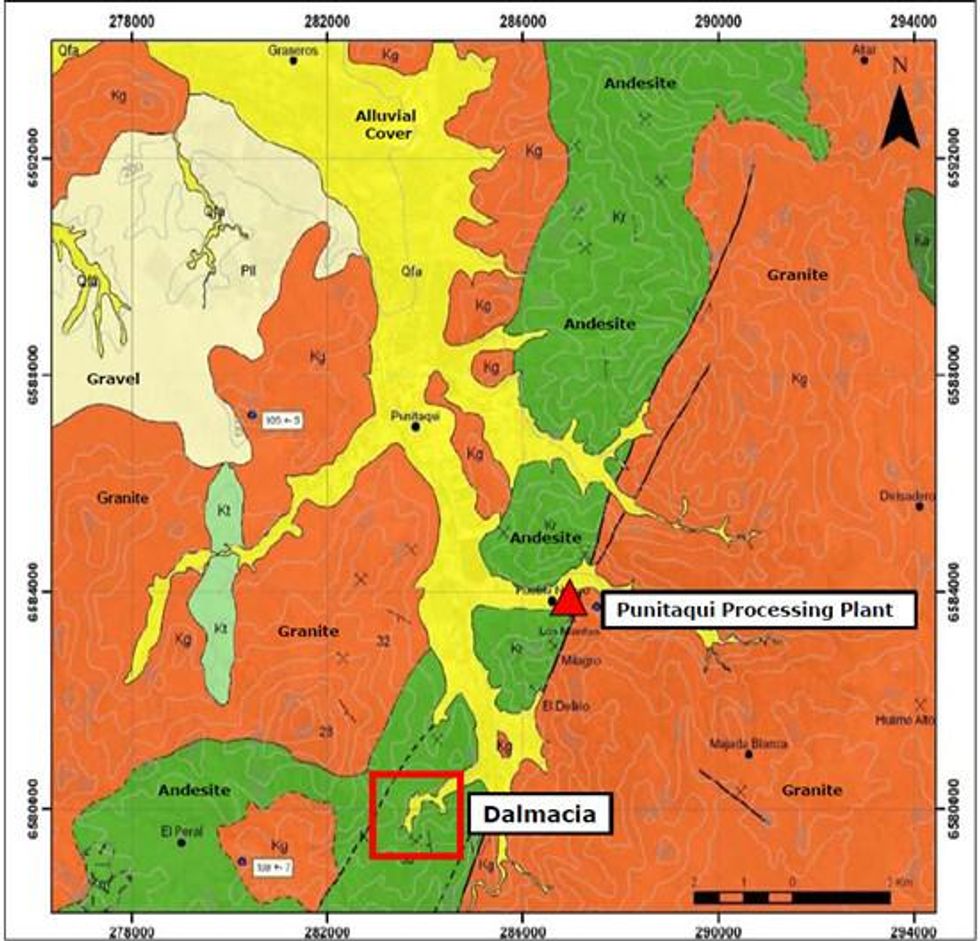

The Dalmacia target is located in the southern portion of the Punitaqui area about 6 kilometers south of the Punitaqui processing plant (see Figure 1 and Figure 2). The first drilling occurred in 1993-1994 when 49 reverse circulation ("RC") holes totaling 9,972m were completed. Exploration drilling at Dalmacia North has been completed at a grid spacing of 25m x 25m and 15m x 15m at Dalmacia South. In total, 229 drill holes (98 RC holes and 131 diamond core holes) have been drilled for a total of 53,294m.

The geological setting of the Dalmacia target is different from both the Cinabrio Mine and San Andres target which are located 20 kilometers to the north. Dalmacia is situated within a roof-pendant of volcanic rocks, with minor calcareous intercalations of Middle to Upper Jurassic age. This volcano-sedimentary complex is intruded by younger aged granites located in a reverse fault.

Copper-gold mineralization is related to regional structures and deformation zones, developed mainly in the contacts between granite and volcano-sedimentary rocks.

Sample assay results, reported herein, are from the first two drill holes from the Dalmacia target (see Table 1 and Figure 3).

Drillhole DS-21-01 was designed as an infill drill hole to test Dalmacia mineralization in the central portion of the target just west of the portal. It was drilled in a southeast direction, across the grain of previous drilling, and between drill holes SD-58 (24m at 1.96% Cu) and DS-11-02 (18.9 m at 1.30% Cu). DS-21-01 resulted in five intercepts; 12m grading 1.79% Cu and 2.5g/t Ag from 79m downhole including 8m at 2.44% Cu, 3.2g/t Ag and 0.04g/t Au from 80m, a second interval of 23m grading 1.16% Cu and 1.7g/t Ag from 105m downhole including 13m at 1.56% Cu and 2.1g/t Ag from 115.0m downhole including 7m at 2.32% Cu, 3.1g/t Ag and 0.04g/t Au from 115m, a third intercept of 2m at 1.06% Cu, 0.7g/t Ag and 0.03g/t Au from 137m downhole; a fourth interval of 4m at 0.89% Cu and 0.4g/t Ag from 180m downhole as well as a fifth hit of 4.9m at 0.72% Cu and 0.6g/t Ag from 220m downhole (See Figure 3).

Drillhole DS-21-02 was designed to test Dalmacia mineralization in the south-central portion of the mineralized zone. The hole was drilled 40 meters west of drill hole DS-14-07 which intersected 27 meters of 1.62% Cu from 110 meters. Drill hole DS-21-02 resulted in five intercepts; 7m grading 1.67% Cu, 2.6g/t Ag and 0.08g/t Au from 22m downhole, 10m at 1.03% Cu and 2.1g/t Ag from 64m downhole including 3m at 1.49% Cu and 2.3g/t Ag from 64m, 2m at 2.34% Cu and 5g/t Ag from 71m downhole, 7m at 2.58% Cu and 2.7g/t Ag from 99m downhole, 11m at 1.08% Cu, 0.9g/t Ag and 0.08g/t Au from 177m downhole including 4.0m at 2.32% Cu, 1.4g/t Ag and 0.17g/t Au from 177m and including 3.0m at 2.90% Cu, 1.7g/t Ag and 0.22g/t Au from 177m (See Figure 3).

Table 1: Dalmacia Drilling Latest Significant Assays Results - November 2021

| Drillhole Number | From (m) | To (m) | Sample Interval (m) | Copper Cu (%) | Silver Ag (g/t) | Gold Au (g/t) |

| DS-21-01 | 79.0 | 91.0 | 12.0 | 1.79 | 2.5 | - |

| including | 80.0 | 88.0 | 8.0 | 2.44 | 3.2 | 0.04 |

| and | 105.0 | 128.0 | 23.0 | 1.16 | 1.7 | - |

| including | 115.0 | 128.0 | 13.0 | 1.56 | 2.1 | 0.04 |

| including | 115.0 | 122.0 | 7.0 | 1.67 | 2.6 | 0.08 |

| and | 137.0 | 139.0 | 2.0 | 1.06 | 0.7 | 0.03 |

| and | 180.0 | 184.0 | 4.0 | 0.89 | 0.4 | - |

| and | 220.0 | 224.9 | 4.9 | 0.72 | 0.03 | - |

| DS-21-02 | 22.0 | 29.0 | 7.0 | 1.67 | 2.6 | 0.08 |

| and | 64.0 | 74.0 | 10.0 | 1.03 | 2.1 | - |

| including | 64.0 | 67.0 | 3.0 | 1.49 | 2.3 | - |

| and | 71.0 | 73.0 | 2.0 | 2.34 | 5.0 | - |

| and | 99.0 | 106.0 | 7.0 | 2.58 | 2.7 | - |

| and | 177.0 | 188.0 | 11.0 | 1.08 | 0.9 | 0.08 |

| including | 177.0 | 181.0 | 4.0 | 2.32 | 1.4 | 0.17 |

| Including | 177.0 | 180.0 | 3.0 | 2.90 | 1.7 | 0.22 |

Note: All Intercepts reported as downhole core intervals

Figure 1: Dalmacia Target Location Map

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/6076/105357_723cda9a54d658d5_002full.jpg

Figure 2: Dalmacia Target Geology

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/6076/105357_723cda9a54d658d5_003full.jpg

Figure 3: Dalmacia Target Drill Plan

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/6076/105357_723cda9a54d658d5_004full.jpg

Background - Dalmacia Target

The first modern drilling of the Dalmacia target occurred in 1993-1994 when 49 reverse circulation ("RC") holes totaling 9,972m were completed.

In 2007, Compañia Minera Punitaqui carried out ground magnetics and induced polarization surveys followed by RC drilling program (49 holes/11,473m). Between 2011 - 2018 a total of 131 diamond core drillholes were completed at Dalmacia for a total of 31,849m.

The Dalmacia exploration drilling has been completed at a grid spacing of 25m x 25m in the north and 15m x 15m in the south. In total, 229 drill holes (98 RC holes and 131 diamond core holes) have been drilled for a total of 53,294m with 35,201 samples analysed.

The Dalmacia target is located within a roof-pendant of volcanic rocks, with minor calcareous intercalations of Middle to Upper Jurassic age. This volcano-sedimentary complex is intruded by 105-130Ma granitoids located in a reverse fault.

The Dalmacia copper-gold mineralization is hosted in the Agua Salada Complex, consisting of andesites, ocoites (porphyritc andesites) with white phenocrysts and ocoites with black phenocrysts. The ocoites are conformable to stratigraphy ("sill-type") and in plan show an elliptical to sub-circular morphology.

The copper-gold mineralization occurs as veins, fracture infillings and disseminated oxides and sulphides. The known strike length of the mineralized zone is at least 1,500m and up to 300m wide with depths greater than 500m. Additionally, mineralization is related to regional structures and deformation zones, developed mainly in the contacts between granitoids and volcano-sedimentary rocks.

The mineralisation at Dalmacia is hosted in andesites, and andesitic porphyry dykes with both black and white phenocrysts. The copper-gold mineralization is structurally controlled and occurs as veins, fracture infillings and disseminated oxides and sulphides. The known strike length of the mineralised zone is at least 1,500m and up to 300m wide with depths greater than 500m.

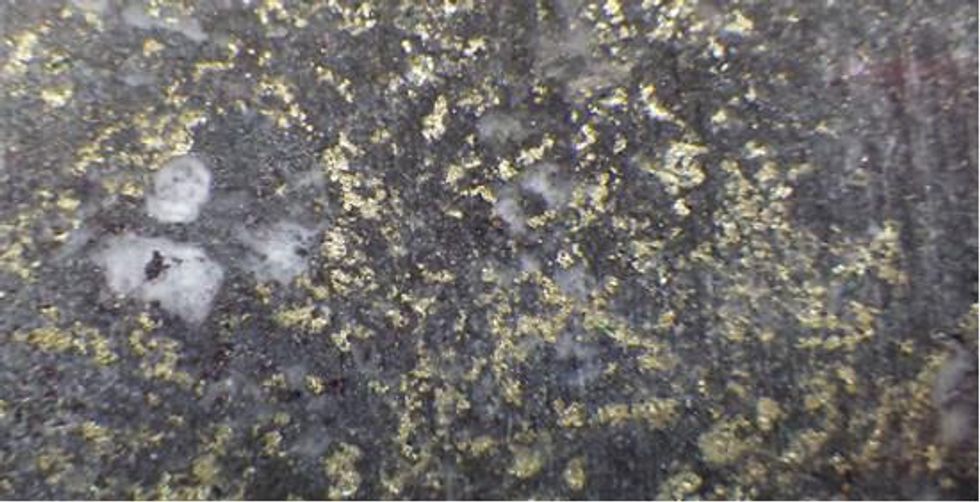

At Dalmacia, oxide mineralisation includes chrysocolla, atacamite, neotocite and cuprite. Primary mineralisation consists of chalcopyrite and bornite with pyrite. Secondary mineralisation includes chalcocite and bornite.

Locally, the copper mineralization at Dalmacia is hosted within a stratigraphic package that includes sedimentary rocks, andesites, and tuffs, intruded by ocoites and late intrusive diorite (dykes and stocks), which have generated hornfels. The alteration related with the mineralization varies from potassium feldspar, actinolite, secondary biotite, chlorite, green sericite to sericite-quartz/sericite.

The main copper mineralization occurs immediately after the ocoites undergo a late phase of chalcosodic alteration (quartz-albite-actinolite-epidote, "white" ocoites) with the destruction of magnetite and superimposed onto an earlier event of black albite, magnetite and silicates (black ocoites).

The upper portion of the Dalmacia target is accessed via a portal and a limited underground ramp and level development.

Dalmacia Drillcore - Typical Disseminated Chalcopyrite Mineralization

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/6076/105357_723cda9a54d658d5_005full.jpg

Quality Control

Sample preparation, analysis and security procedures applied on the BMR exploration projects is aligned with industry best practice. BMR has implemented protocols and procedures to ensure high quality collection and management of samples resulting in reliable exploration assay data. BMR has implemented formal analytical quality control monitoring for all field sampling and drilling programs by inserting blanks and certified reference materials into every sample sequence dispatched.

Sample preparation is performed ALS Global - Geochemistry Analytical Lab in La Serena, Chile and sample analyses by ALS in Lima, Peru. ALS analytical facilities are commercial laboratories and are independent from BMR. All BMR samples are collected and packaged by BMR staff and delivered upon receipt at the ALS Laboratory. Samples are logged in a sophisticated laboratory information management system for sample tracking, scheduling, quality control, and electronic reporting. Samples are dried then crushed to 70%

- ME-MS61: A high precision, multi-acid digest including Hydrofluoric, Nitric, Perchloric and Hydrochloric acids. Analysed by inductively coupled plasma ("ICP") mass spectrometry that produces results for 48 elements.

- ME-OG62: Aqua-Regia digest: Analysed by ICP-AES (Atomic Emission Spectrometry) or sometimes called optical emission spectrometry (ICP-OES) for high levels of Co, Cu, Ni and Ag.

Certified standards are inserted into sample batches by ALS. Blanks and duplicates are inserted within each analytical run. The blank is inserted at the beginning, certified standards are inserted at random intervals, and duplicates are analysed at the end of the batch.

Additional Information

Michael Schuler, Battery Mineral Resources Corp. Chile Exploration Manager, supervised the preparation of and approved the scientific and technical information in this press release pertaining to the Punitaqui Exploration Drill Program. Mr. Schuler is a qualified person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Battery Mineral Resources Corp.

A battery mineral company with high-quality assets providing shareholders exposure to the global mega-trend of electrification and focused on growth through cash-flow, exploration and acquisitions in the world's top mining jurisdictions. Battery is currently developing the Punitaqui Mining Complex and pursuing the potential near term resumption of operations for second half of 2022 at the prior producing Punitaqui copper-gold mine. The Punitaqui copper-gold mine most recently produced approximately 21,000 tonnes of copper concentrate in 2019 and is located in the Coquimbo region of Chile.

Battery is engaged in the discovery, acquisition, and development of battery metals (cobalt, lithium, graphite, nickel and copper), in North and South America and South Korea with the intention of becoming a premier and sustainable supplier of battery minerals to the electrification marketplace. Battery is the largest mineral claim holder in the historic Gowganda Cobalt-Silver Camp, Canada and continues to pursue a focused program to build on the recently announced, +1-million-pound high grade cobalt resource at McAra by testing over 50 high-grade primary cobalt silver-nickel-copper targets. In addition, Battery owns 100% of ESI Energy Services, Inc., also known as Ozzie's, a pipeline equipment rental and sales company with operations in Leduc, Alberta and Phoenix, Arizona.

For further information, please contact:

Battery Mineral Resources Corp.

Martin Kostuik

Phone: +1 (604) 229 3830

Email: info@bmrcorp.com

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

Forward-Looking Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections of the Company on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability of the Company to obtain sufficient financing to complete exploration and development activities, risks related to share price and market conditions, the inherent risks involved in the mining, exploration and development of mineral properties, government regulation and fluctuating metal prices. Accordingly, readers should not place undue reliance on forward-looking statements. Battery undertakes no obligation to update publicly or otherwise revise any forward-looking statements contained herein, whether as a result of new information or future events or otherwise, except as may be required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/105357