July 06, 2023

Quimbaya Gold (CSE:QIM) is ideally positioned to become one of the most significant explorers in Colombia with over 40,000 hectares of mining assets across three projects. The company's Maitamac project is situated in an underexplored mineral district of Abejorral in the central cordillera. Known for its importance in Colonial times, the district and its surrounding regions host multiple world-class gold deposits and large-scale projects, including El Bagre, Gramalote, El Roble and Marmato. Prudent Minerals first began exploring Abejorral in 2020, with the establishment of its highly prospective Abe Gold Project.

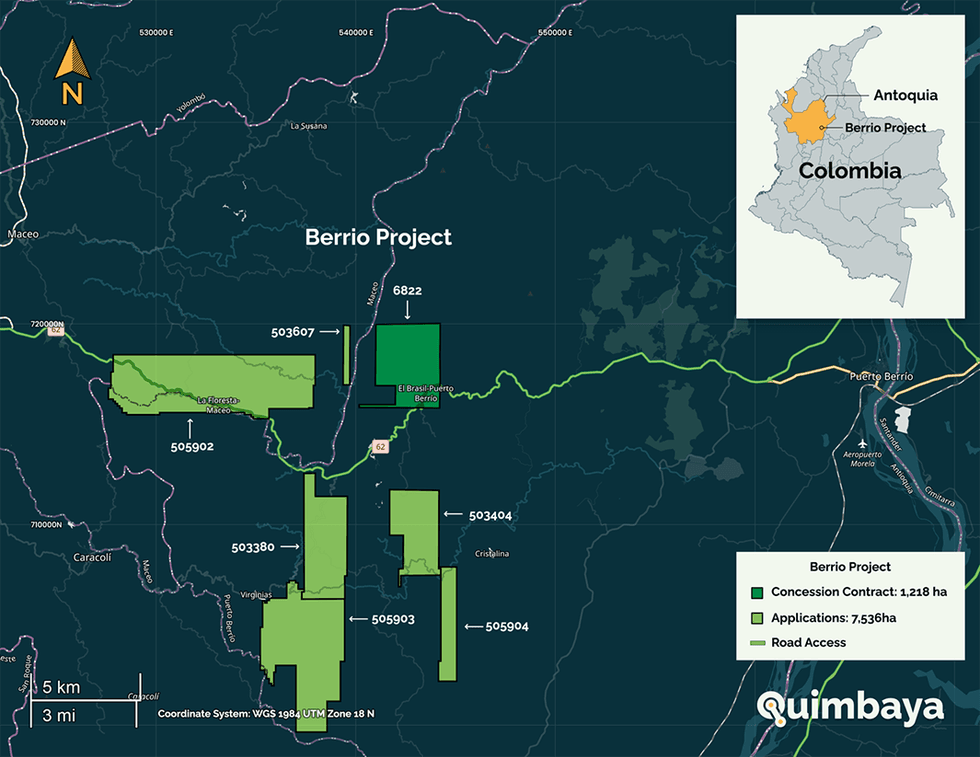

The Tahami and Berrio, are located in the Northeast Antioquia Region — the leading source of gold production in the country for centuries. The Segovia asset, held by GCM Mining (now known as Aris Mining), is arguably one of the most significant in the entire region. It's also a close neighbor of the Tahami Project and shares a geological corridor with Berrio.

Quimbaya's most valuable asset by far, however, is its people. The company has assembled a powerhouse team, combining extensive mining and corporate finance expertise with strong ties to communities throughout the country. Quimbaya's leadership includes Ernesto Cardenas, creator of the first interactive mining register in the country.

Company Highlights

- Quimbaya Gold is one of 10 junior mining companies and one of the most promising early-stage exploration companies in Colombia.

- Quimbaya has acquired over 40,000 hectares of mining assets with significant potential for high-grade gold, silver and copper along with the possibility of discovering Colombia's next world-class deposit.

- The company's three projects are all situated in Antioquia, considered the best mining district in Colombia. All three projects are surrounded by successful gold production operations, providing the company easy access to critical infrastructure.

- Quimbaya has a good capital structure and tight float, with 56 percent of shares held by the company's management and board of directors.

- Quimbaya employs a local team with strong community ties and an understanding of the region and its geology, including how to navigate Colombia's current political and environmental requirements.

- Quimbaya offers great value compared to competitors, with a current market cap of roughly C$7 million.

This Quimbaya Gold profile is part of a paid investor education campaign.*

Click here to connect with Quimbaya Gold (CSE:QIM) to receive an Investor Presentation

QIM:CC

Sign up to get your FREE

Quimbaya Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

29 July 2025

Quimbaya Gold

Unlocking high-grade gold potential in Antioquia, Colombia’s premier mining district

Unlocking high-grade gold potential in Antioquia, Colombia’s premier mining district Keep Reading...

29 May 2023

Quimbaya Gold Inc. Announces Investor Relations Agreement

/NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES / Quimbaya Gold Inc. (CSE: QIM) ("Quimbaya") is pleased to announce that it has entered into an Investor Relations Agreement (the "Agreement") with Pietro Solari (address: Torre de las Americas... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Sign up to get your FREE

Quimbaya Gold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Trading Halt

6h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00