- WORLD EDITIONAustraliaNorth AmericaWorld

April 28, 2024

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to advise that it has been successful in securing funding under the WA Government’s Exploration Incentive Scheme (EIS) for drilling at the Company’s 100%-owned district-scale Bangemall Projects in the Gascoyne region of Western Australia.

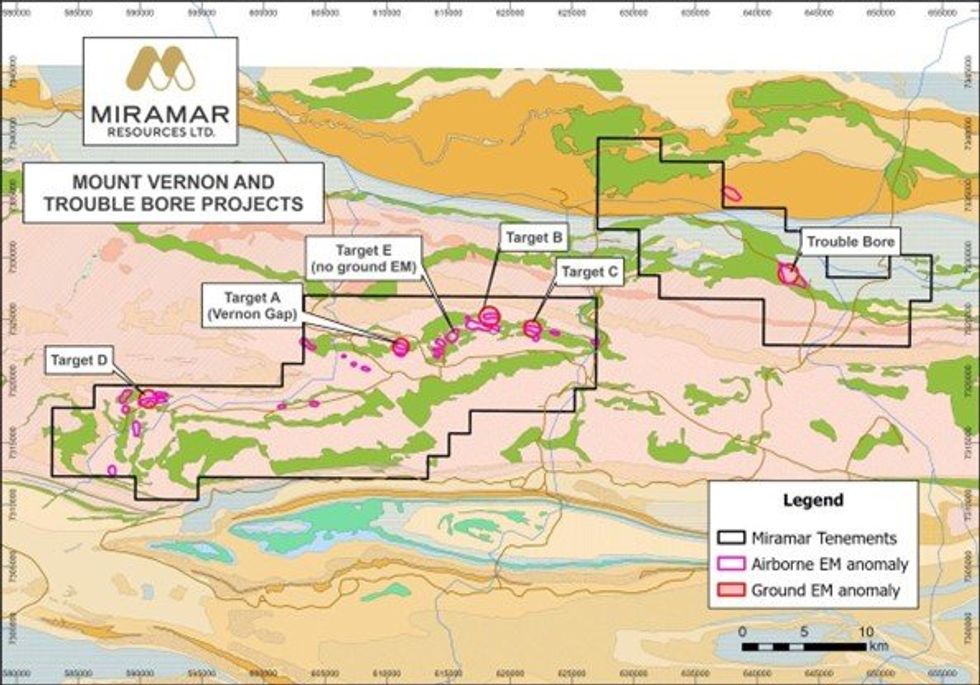

Miramar has been advised by the Department of Energy, Mines, Industry Regulation and Safety (DEMIRS) that it has been awarded up to $180,000 towards the drilling campaign, which will target Norilsk-style nickel, copper, cobalt and platinum group element (Ni-Cu-Co-PGE) mineralisation at the Mount Vernon and Trouble Bore Projects for the first time (Figure 1).

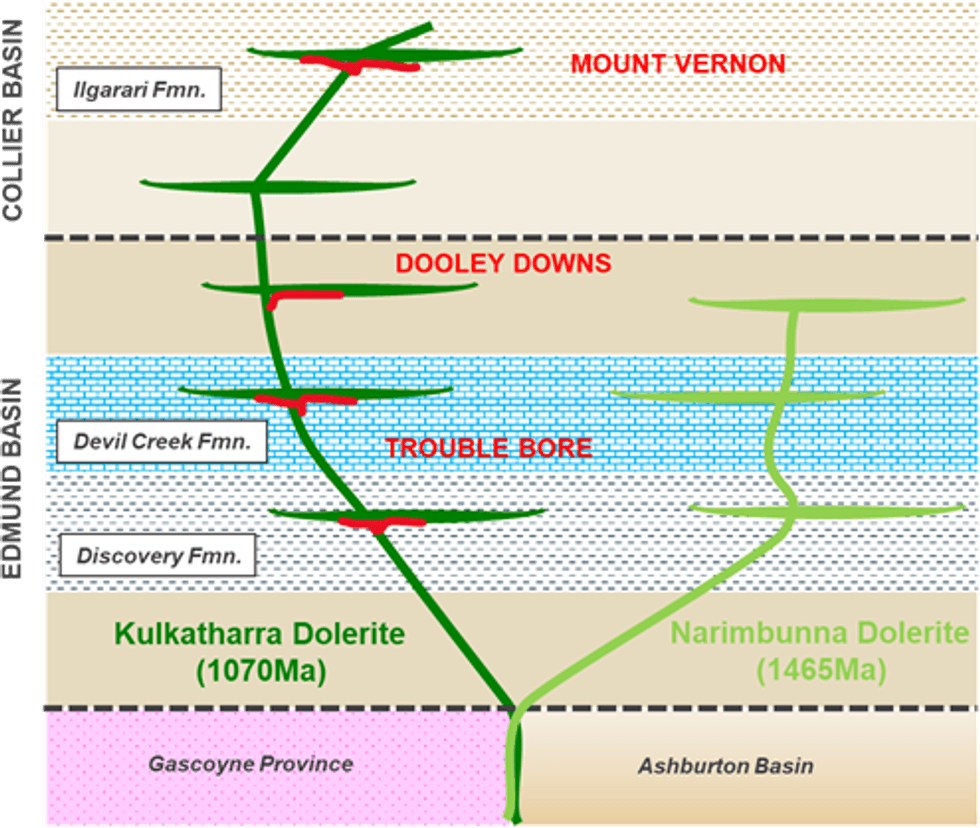

Miramar is exploring for mafic intrusion-hosted Ni-Cu-Co-PGE sulphide mineralisation related to 1070Ma aged Kulkatharra Dolerite sills, part of the Warakurna Large Igneous Province and the same age as the large Nebo-Babel deposits in the West Musgraves.

Miramar’s Executive Chairman, Mr Allan Kelly, said the funding validated the Company’s exploration model and the potential district-scale opportunity within the Bangemall Project, and looked forward to the maiden drilling campaign.

“Over the last 24 months, the Company has advanced the Bangemall Projects from an exploration concept to regional-scale area selection followed by collection of project-scale datasets and, more recently, to delineation of individual drill targets through ground EM surveys,” Mr Kelly said.

“We have the opportunity to make a discovery of a new style of mineralisation in an underexplored geological province where we are the dominant landholder,” he added.

Upcoming work programme

Miramar’s initial aim is to show “proof of concept” of the Norilsk-style deposit model by discovering Ni-Cu- Co-PGE sulphide mineralisation.

- Upcoming work includes:

- Completion of heritage surveys where required

- Systematic rock chip sampling

- RC drilling

- Working towards grant of various tenement applications

Miramar already has Programme of Work (POW) approval for drilling at Mount Vernon and is currently waiting on approval for Trouble Bore.

About the Ni-Cu-Co-PGE Bangemall Project

Miramar’s 100%-owned Bangemall Project comprises granted Exploration Licences and Applications covering approximately 2,190 km2 within the Gascoyne region of Western Australia.

The Proterozoic Edmund and Collier Basins have been intruded by numerous 1070Ma aged Kulkatharra Dolerite sills, part of the Warakurna Large Igneous Province, and the same age as the Giles Complex which hosts the large Nebo and Babel Ni-Cu deposits in the West Musgraves.

The region has been identified by both the Geological Survey of Western Australia and Geoscience Australia as having high prospectivity for Ni-Cu-PGE mineralisation associated with the Kulkatharra Dolerite sills, similar to the giant Norilsk-Talnakh Ni-Cu-PGE deposits in Russia.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

21h

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data showed that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00