May 10, 2023

SensOre (ASX: S3N or the Company) aims to become the top performing global minerals targeting company through deployment of big data, artificial intelligence/machine learning technologies and geoscience expertise.

SensOre Limited is pleased to announce it has secured binding commitments for a $1.0m placement to new and existing investors (Placement). Alongside the Placement, a Share Purchase Plan will be offered to existing eligible shareholders raising up to A$1.0 million.

Bell Potter Securities Ltd acted as Lead Manager for the Placement.

The issue price of A$0.25 per share for both the Placement and the Share Purchase Plan represents a:

- 16.7% discount to the closing price of SensOre shares of A$0.30 on 8 May 2023 being the last trading day prior to release of this announcement; and a

- 27.4% discount to the 10-day VWAP prior to the release of this announcement.

Under the Placement, a total of 4,000,000 new fully paid ordinary shares will be issued. Approximately 2.1 million shares (raising approximately $0.52 million) will be issued under ASX listing Rule 7.1 and a further 1.2 million shares (raising approximately $0.48 million) will be issued to Directors of the Company, subject to shareholder approval which will be sought at a General Meeting (GM), intended to be held in late June 2023. The Placement included a one (1) for two (2) free attaching option exercisable at $0.375 and expiring three (3) years from the issue date. It is anticipated that shares and options will be allotted under Listing Rule 7.1, with the shares expected to be issued on or around 18 May 2023. Further details of the Placement issue are set out in the Appendix 3B lodged by the Company today.

Funds raised under the Placement will primarily be used to fund growth of the Company’s technology and exploration services businesses, as well as for general working capital purposes.

Share Purchase Plan

SensOre Limited is also pleased to announce a Share Purchase Plan (SPP) offered to existing eligible shareholders, being those shareholders that are residents in Australia or New Zealand that held SensOre shares as at 7:00pm (AEDT) on Wednesday, 10 May 2023. Eligible shareholders will be invited to participate in the SPP at the same issue price as the Placement (A$0.25 per share and options with One (1) option for every two (2) shares at an exercise price of A$0.375 and with an expiry of three (3) years from the issue date) also announced today.

The SPP will provide eligible shareholders the opportunity to increase their holding by up to A$30,000 without incurring any brokerage or transaction costs. The SPP is targeted to raise a maximum A$1.0 million and is not underwritten. If the full amount is raised 4,000,000 shares and 2,000,000 options will be issued.

SensOre may increase or decrease the size of the SPP and/or scale back applications under the SPP at its discretion. Any scale-back will be applied to the extent and in the manner, SensOre sees fit, which may include taking into account a number of factors such as the size of an applicant's shareholding at the record date for the SPP, the extent to which the applicant has sold or purchased shares since the record date, whether the applicant may have multiple registered holdings, the date on which the application was made, and the total applications received from eligible shareholders.

Further information regarding the SPP (including terms and conditions of the SPP) will be provided to eligible shareholders in the SPP offer booklet, which will be made available to eligible shareholders shortly. Eligible shareholders wishing to participate in the SPP will need to apply in accordance with the instructions in the SPP offer booklet. Participation in the SPP is optional.

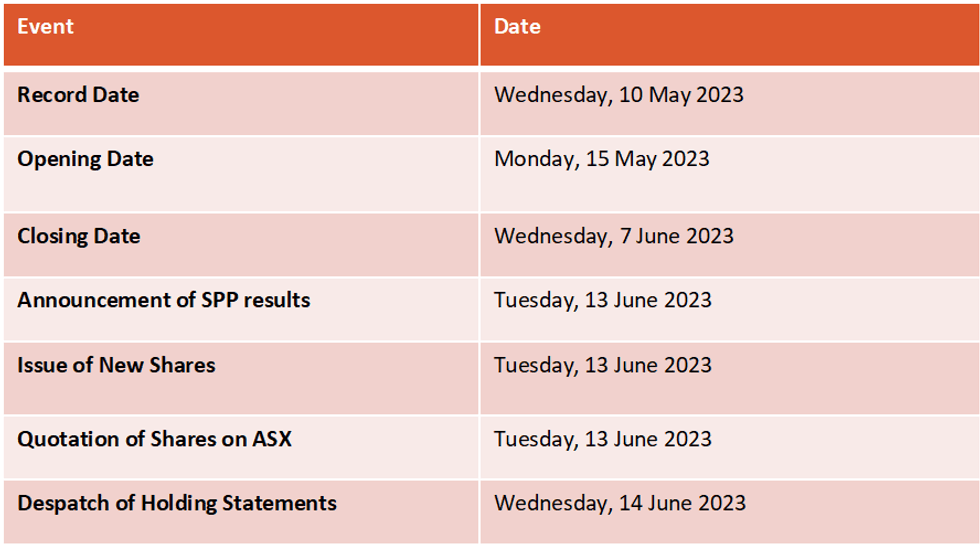

At the time of allotment under both the Placement and SPP, New Shares issued under the offers will rank pari- passu with existing shares. The Share Purchase Plan Timetable is as follows:

The above timetable is indicative only and is subject to change. All dates and times are AEST. Subject to the requirements of the Corporations Act, the ASX Listing Rules and any other applicable laws, SensOre reserves the right to amend this timetable at any time, including extending the closing date of the Share Purchase Plan period or accepting late applications, either generally or in particular cases, without notice. Any extension of the closing date will have a consequential effect on the issue date of the New Shares. The commencement of quotation of New Shares is subject to confirmation from ASX. The information in this announcement does not constitute financial product advice and does not take into account the financial objectives, personal situation or circumstances of any shareholder. If you are in any doubt as to how to proceed, please contact your financial, tax or other professional adviser.

Click here for the full ASX Release

This article includes content from SensOre Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

S3N:AU

The Conversation (0)

02 March

ASX AI Stocks: 5 Biggest Companies in 2026

Artificial intelligence (AI) continues to evolve and advance rapidly, becoming increasingly integrated in the automation of everyday life and a focal point of growth in the technology sector.Although the AI market is relatively small in Australia, it’s growing.According to a September 2023... Keep Reading...

04 February

AI Infrastructure Moving to the Edge to Transform User Experience

While the first phase of the AI gold rush was defined by massive investments in centralized data centers, 2026 is about proving those billions can translate into fast, reliable AI that people will use every day. One Canadian startup, PolarGrid, is betting that the answer lies at the edge rather... Keep Reading...

29 January

Quarterly Activities/Appendix 4C Cash Flow Report

Unith (UNT:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

20 January

The Performance Chasm: Is the AI Rally Over or Just Shifting Gears?

The investment landscape of 2025 will be remembered for its historic divide, where the widespread boom in artificial intelligence (AI) created a tale of two worlds in the stock market.On one side, the Magnificent 7 and specialized players like Palantir Technologies (NASDAQ:PLTR) drove massive... Keep Reading...

20 January

Nextech3D.ai Scales National Event Infrastructure to 35 Major U.S. Cities; Launches 58 New AI-Ready Experiences to Meet Enterprise Demand

Strategic Integration of Generative AI 'Semantic Memory' via OpenAI and Pinecone Vector Database Supports Rapid Expansion of Corporate Engagement Platforms TORONTO, ON / ACCESS Newswire / January 20, 2026 / Nextech3D.ai (OTCQB:NEXCF)(CSE:NTAR,OTC:NEXCF)(FSE:1SS), a leader in AI-powered event and... Keep Reading...

16 January

Tech Weekly: Chip Stocks Soar on Taiwan Semiconductor Earnings

Welcome to the Investing News Network's weekly brief on tech news and tech stocks driving the market. We also break down next week's catalysts to watch to help you prepare for the week ahead.Don't forget to follow us @INN_Technology for real-time news updates!Securities Disclosure: I, Meagen... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00