Highlights from 7,800 metre diamond hole (35-151 metres) Resource Conversion Drill Program:

- Hole C23-265: 2.47 g/t gold equivalent over 85 metres from surface to end of hole.

- Hole C23-302: 1.75 g/t gold equivalent over 113 metres from 2 metres to end of hole.

- Hole C23-317: 1.86 g/t gold equivalent over 96 metres from surface to end of hole.

- Highest gold assay ever on the project in hole C23-253, 2 metres from 40 to 42 metres grading 580 g/t Au.

Lumina Gold Corp. (TSXV: LUM) (OTCQX: LMGDF) (the "Company" or "Lumina") is pleased to announce results from the 2023 Phase 1 mining resource conversion drilling campaign in support of the ongoing Feasibility Study ("FS") at its Cangrejos Project (the "Project") in Ecuador . Resource drilling comprised part of a larger drill campaign at the Cangrejos and Gran Bestia deposits which also included, metallurgical samples and geotechnical holes with subsequent hydrogeological testing in support of pit slope design. The 2023 drill program at the Project is summarized below in Table 1.

Marshall Koval , CEO and Director commented: "The completion of this drilling supports several key programs of the Feasibility Study. Work on the revised resource estimate, pit slope design metallurgical testing including High-Pressure Grinding Roll testing are now all underway. The assays from the resource infill program continue to demonstrate the exceptional continuity of grade at Cangrejos and are in line with expectations from previous drilling and studies."

Table 1: 2023 Drill Program Summary

| | Resource | Pit Slope | Metallurgical | Hydrogeological Pump Testing | Totals |

| Cangrejos | |||||

| Total # of holes | 91 | 10 | 9 | 6 | 116 |

| Total metreage | 7,786 | 3,729 | 1,668 | 215 | 13,399 |

| Shallowest hole (m) | 35 | 180 | 56 | 27 | |

| Deepest Hole (m) | 151 | 600 | 290 | 69 | |

| Gran Bestia | |||||

| Total # of holes | n/a | 10 | 7 | n/a | 17 |

| Total metreage | n/a | 4,142 | 1,397 | n/a | 5,539 |

| Shallowest hole (m) | n/a | 150 | 100 | n/a | |

| Deepest Hole (m) | n/a | 663 | 265 | n/a | |

| Overall | |||||

| Total # of holes | 91 | 20 | 16 | 6 | 133 |

| Total metreage | 7,786 | 7,871 | 3,065 | 215 | 18,938 |

Cangrejos Drill-Hole Results

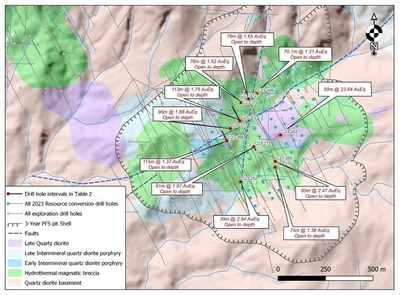

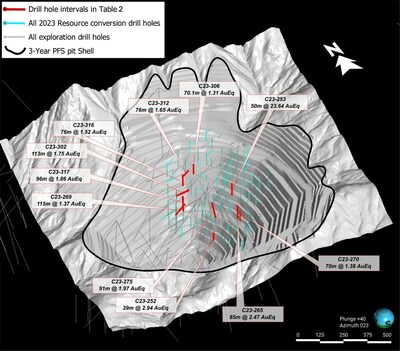

Highlights of the 2023 Project resource conversion program are provided in Table 2, and the corresponding intercepts are highlighted in Figures 1 and 2. A complete listing of results from the 2023 Project resource conversion program is provided in Annex 1.

Table 2: Highlighted Drill Results

| Hole Number | From (m) | To (m) | Interval (m) | Au Grade (g/t) | Cu Grade (%) | Au Eq. (g/t) | Total Depth (m) | Comments |

| C23-252 | 6.0 | 45.0 | 39.0 | 2.50 | 0.31 | 2.94 | 45 | Open to depth |

| C23-253 | 4.0 | 54.0 | 50.0 | 23.48 | 0.09 | 23.64 | 85 | Incl. 2m grading 580g/t Au - uncut |

| or | 4.0 | 54.0 | 50.0 | 3.08 | 0.09 | 3.24 | 85 | 2m grading 580g/t Au cut to 70g/t |

| C23-265 | 0.0 | 85.0 | 85.0 | 2.09 | 0.24 | 2.47 | 85 | Open to depth |

| C23-269 | 0.0 | 115.0 | 115.0 | 1.02 | 0.24 | 1.37 | 115 | Open to depth |

| C23-270 | 0.0 | 70.0 | 70.0 | 1.14 | 0.13 | 1.38 | 70 | Open to depth |

| C23-275 | 0.0 | 91.0 | 91.0 | 1.76 | 0.13 | 1.97 | 91 | Incl. 2m grading 16.4g/t Au - uncut |

| C23-302 | 2.0 | 115.0 | 113.0 | 1.50 | 0.16 | 1.75 | 115 | Open to depth |

| C23-306 | 0.0 | 70.1 | 70.1 | 1.12 | 0.12 | 1.31 | 70.1 | Open to depth |

| C23-312 | 0.0 | 76.0 | 76.0 | 1.40 | 0.17 | 1.65 | 76 | Open to depth |

| C23-316 | 0.0 | 76.0 | 76.0 | 1.24 | 0.19 | 1.52 | 76 | Open to depth |

| C23-317 | 0.0 | 96.0 | 96.0 | 1.48 | 0.27 | 1.86 | 96 | Open to depth |

| Note: Minor contributors to Au Eq. calculation, silver and molybdenum are not included in this table but are provided in Annex 1. Intervals in the reported holes are calculated using a cut-off of 0.2 g/t Au with maximum internal dilution of ten continuous metres. A 70g/t Au top cut was applied for the interval noted in the comments section. Sampling is done in consistent, continuous 2-metre intervals. Values assume 100% recovery of all quoted metals and the following prices were used to calculate Au Eq.: a gold price of US$1,500 per ounce, a copper price of US$3.00 per pound, a molybdenum price of US$7.00 per pound and a silver price of US$18.00 per ounce. |

| |

Lumina Gold received the highest drill assay ever returned from the project in hole C23-253, where a 2-metre intercept from 40 to 42 metres graded 580 g/t Au, see Figure 1.

Lumina is operating normally at the Project. The Company's activities have not been affected by the recent civil disturbances that have impacted other areas in Ecuador .

Quality Assurance

All Lumina sample assay results have been independently monitored through a quality control / quality assurance ("QA/QC") program that includes the insertion of blind standards, blanks and pulp and reject duplicate samples. Logging and sampling are completed at Lumina's secure facility located at the Project. Drill core is sawn in half on site and half drill-core samples are securely transported to ALS Labs' ("ALS") sample preparation facilities in Quito, Ecuador . Sample pulps are sent to ALS' chemical labs in Lima, Peru for analysis. Gold content is determined by fire assay of a 30-gram charge with total copper content determined by four-acid digestion with ICP finish. The lab is independent from Lumina.

Lumina is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein.

Qualified Person

Leo Hathaway , P.Geo., Senior Vice President of Lumina and the Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects for the Project has reviewed, verified, and approved the contents of this news release and has verified the data underlying the contents of this news release by review and supervision of, but not limited to, drilling procedures, chain of custody of core and samples, logging and sampling procedures and insertion of blind standards, blanks and pulp duplicates into the sample stream and running of check samples with an umpire laboratory; such that no limitations are known that would prohibit it being suitable for resource estimation.

About Lumina Gold

Lumina Gold Corp. (TSXV: LUM) is a Vancouver, Canada based precious and base metals exploration and development company focused on the Cangrejos Gold-Copper Project located in El Oro Province, southwest Ecuador . In 2023, the Company completed a Pre-Feasibility Study for Cangrejos, which is the largest primary gold deposit in Ecuador . Lumina has an experienced management team with a successful track record of advancing and monetizing exploration projects.

Follow us on: Twitter , Linkedin or Facebook .

Further details are available on the Company's website at https://luminagold.com/ . To receive future news releases please sign up at https://luminagold.com/contact .

Signed: "Marshall Koval"

Marshall Koval , President & CEO, Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Information

Certain statements and information herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Such forward-looking statements or information include but are not limited to statements or information with respect to potentially converting mineral resources to mineral reserves and future work programs and work on the FS. Often, but not always, forward-looking statements or information can be identified by the use of words such as "will" or "projected" or variations of those words or statements that certain actions, events or results "will", "could", "are proposed to", "are planned to", "are expected to" or "are anticipated to" be taken, occur or be achieved.

With respect to forward-looking statements and information contained herein, the Company has made numerous assumptions including among other things, assumptions about general business and economic conditions, the prices of gold and copper, and anticipated costs and expenditures. The foregoing list of assumptions is not exhaustive.

Although management of the Company believes that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that a forward-looking statement or information herein will prove to be accurate. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the Company's actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These factors include, but are not limited to: risks associated with the business of the Company; business and economic conditions in the mining industry generally; the supply and demand for labour and other project inputs; changes in commodity prices; changes in interest and currency exchange rates; risks relating to inaccurate geological and engineering assumptions (including with respect to the tonnage, grade and recoverability of reserves and resources); risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters); risks relating to adverse weather conditions; political risk and social unrest; changes in general economic conditions or conditions in the financial markets; and other risk factors as detailed from time to time in the Company's continuous disclosure documents filed with Canadian securities administrators. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Annex. 1: Drill result table – Complete 2023 Cangrejos Infill Resource Conversion Program Results. Intervals provided in Table 2. are shown in bold.

| Hole | From (m) | To (m) | Interval (m) | Au (g/t) | Cu (%) | Ag (g/t) | Mo (ppm) | Au (g/t) | Total (m) | Comments |

| C23-242 | 0.0 | 86.0 | 86.0 | 0.37 | 0.09 | 1.19 | 2 | 0.51 | 140.0 | 330 ° /-65 ° |

| and | 98.0 | 100.0 | 2.0 | 0.26 | 0.05 | 0.25 | 2 | 0.33 | | |

| and | 112.0 | 136.0 | 24.0 | 0.31 | 0.05 | 0.29 | 8 | 0.38 | | |

| C23-243 | 0.0 | 2.0 | 2.0 | 0.37 | 0.01 | 21.00 | 1 | 0.64 | 85.2 | |

| and | 10.0 | 14.0 | 4.0 | 0.31 | 0.03 | 9.75 | 1 | 0.46 | | |

| and | 52.0 | 70.0 | 18.0 | 0.25 | 0.09 | 0.72 | 1 | 0.38 | | |

| C23-244 | 0.0 | 88.0 | 88.0 | 0.54 | 0.07 | 1.53 | 6 | 0.66 | 130.9 | 150 ° /-65 ° |

| and | 118.0 | 128.0 | 10.0 | 0.26 | 0.02 | 0.46 | 15 | 0.30 | | |

| C23-245 | 4.0 | 18.0 | 14.0 | 0.33 | 0.06 | 12.59 | 2 | 0.55 | 45.1 | |

| and | 30.0 | 45.1 | 15.1 | 0.25 | 0.15 | 1.23 | 2 | 0.47 | | Open to depth |

| C23-246 | 0.0 | 2.0 | 2.0 | 0.33 | 0.03 | 22.50 | 3 | 0.64 | 85.3 | |

| and | 12.0 | 30.0 | 18.0 | 0.43 | 0.04 | 25.34 | 5 | 0.79 | | |

| and | 52.0 | 84.0 | 32.0 | 0.44 | 0.02 | 0.29 | 11 | 0.48 | | |

| C23-247 | 14.0 | 16.0 | 2.0 | 0.95 | 0.04 | 1.30 | 1 | 1.03 | 75.4 | |

| and | 26.0 | 58.0 | 32.0 | 0.27 | 0.12 | 1.97 | 5 | 0.46 | | |

| C23-248 | 2.0 | 30.0 | 28.0 | 0.31 | 0.09 | 5.88 | 5 | 0.51 | 50.0 | |

| and | 42.0 | 50.0 | 8.0 | 0.58 | 0.15 | 1.40 | 8 | 0.81 | | Open to depth |

| C23-249 | 0.0 | 35.1 | 35.1 | 0.47 | 0.17 | 3.10 | 9 | 0.75 | 35.1 | Open to depth |

| C23-250 | 16.0 | 18.0 | 2.0 | 0.74 | 0.04 | 2.90 | 1 | 0.83 | 100.4 | |

| and | 46.0 | 92.0 | 46.0 | 0.29 | 0.14 | 2.01 | 10 | 0.50 | | |

| C23-251 | 0.0 | 86.0 | 86.0 | 0.44 | 0.05 | 2.14 | 6 | 0.53 | 90.1 | |

| C23-252 | 6.0 | 45.1 | 39.1 | 2.50 | 0.31 | 3.83 | 11 | 2.94 | 45.1 | Open to depth |

| C23-253 | 4.0 | 54.0 | 50.0 | 3.08 | 0.09 | 2.46 | 4 | 3.24 | 85.2 | 2m sample grading |

| or | 4.0 | 54.0 | 50.0 | 23.48 | 0.09 | 2.46 | 3 | 23.64 | 85.2 | 2m sample grading |

| and | 70.0 | 76.0 | 6.0 | 0.75 | 0.05 | 1.30 | 4 | 0.96 | | |

| C23-254 | 0.0 | 100.1 | 100.1 | 0.68 | 0.05 | 1.90 | 18 | 0.78 | 100.1 | Open to depth |

| C23-255 | 0.0 | 45.2 | 45.2 | 1.46 | 0.37 | 1.75 | 1 | 1.98 | 45.2 | Open to depth |

| C23-256 | 16.0 | 48.0 | 32.0 | 0.42 | 0.09 | 8.49 | 8 | 0.64 | 76.0 | |

| and | 64.0 | 66.0 | 2.0 | 1.68 | 0.06 | 0.25 | 6 | 1.76 | | |

| C23-257 | 8.0 | 14.0 | 6.0 | 0.39 | 0.09 | 6.23 | 13 | 0.59 | 55.2 | |

| C23-258 | 0.0 | 48.0 | 48.0 | 1.09 | 0.06 | 4.81 | 8 | 1.22 | 85.4 | Open to depth |

| and | 62.0 | 85.4 | 23.4 | 0.69 | 0.04 | 0.33 | 37 | 0.77 | | |

| C23-259 | 16.0 | 54.0 | 38.0 | 0.22 | 0.15 | 1.19 | 3 | 0.44 | 65.0 | |

| C23-260 | 0.0 | 2.0 | 2.0 | 0.37 | 0.05 | 0.25 | 2 | 0.44 | 75.3 | |

| and | 8.0 | 10.0 | 2.0 | 0.33 | 0.01 | 0.50 | 1 | 0.35 | | |

| and | 52.0 | 62.0 | 10.0 | 0.23 | 0.05 | 0.30 | 24 | 0.32 | | |

| C23-261 | 0.0 | 65.1 | 65.1 | 1.13 | 0.12 | 1.55 | 30 | 1.40 | 65.1 | Open to depth |

| C23-262 | 8.0 | 10.0 | 2.0 | 0.57 | 0.07 | 1.20 | 2 | 0.67 | 75.3 | 330 ° /-85 ° Open to depth |

| and | 26.0 | 75.3 | 49.3 | 0.24 | 0.09 | 0.42 | 15 | 0.37 | | |

| C23-263 | 2.0 | 8.0 | 6.0 | 0.88 | 0.23 | 6.47 | 3 | 1.28 | 91.3 | Open to depth |

| and | 22.0 | 26.0 | 4.0 | 0.23 | 0.04 | 0.53 | 1 | 0.30 | | |

| and | 36.0 | 40.0 | 4.0 | 0.33 | 0.13 | 0.25 | 4 | 0.51 | | |

| and | 52.0 | 91.3 | 39.3 | 0.67 | 0.20 | 0.58 | 8 | 0.95 | | |

| C23-264 | 12.0 | 24.0 | 12.0 | 0.34 | 0.10 | 0.79 | 7 | 0.49 | 90.2 | |

| and | 82.0 | 84.0 | 2.0 | 0.26 | 0.12 | 0.70 | 70 | 0.45 | | |

| C23-265 | 0.0 | 85.3 | 85.3 | 2.09 | 0.24 | 1.44 | 78 | 2.47 | 85.3 | Open to depth |

| C23-266 | 0.0 | 115.1 | 115.1 | 0.83 | 0.18 | 0.57 | 10 | 1.09 | 115.1 | Open to depth |

| C23-267 | 0.0 | 65.7 | 65.7 | 1.09 | 0.14 | 2.09 | 24 | 1.31 | 65.7 | Open to depth |

| C23-268 | 2.0 | 22.0 | 20.0 | 0.25 | 0.14 | 0.86 | 1 | 0.46 | 55.1 | 150 ° /-50 ° |

| and | 46.0 | 54.0 | 8.0 | 0.24 | 0.08 | 0.61 | 3 | 0.35 | | |

| C23-269 | 0.0 | 115.0 | 115.0 | 1.02 | 0.24 | 0.67 | 46 | 1.37 | 115.0 | 330 ° /-60 ° Open to depth |

| C23-270 | 0.0 | 70.0 | 70.0 | 1.14 | 0.13 | 4.70 | 40 | 1.38 | 70.0 | Open to depth |

| C23-271 | 2.0 | 100.2 | 98.2 | 0.60 | 0.16 | 4.74 | 8 | 0.88 | 100.2 | Open to depth |

| C23-272 | 0.0 | 100.0 | 100.0 | 0.87 | 0.14 | 0.63 | 19 | 1.07 | 100.0 | 150 ° /-50 ° Open to depth |

| C23-273 | 0.0 | 75.2 | 75.2 | 0.88 | 0.19 | 2.10 | 3 | 1.17 | 75.2 | 330 ° /-60 ° Open to depth |

| C23-274 | 0.0 | 65.5 | 65.5 | 0.57 | 0.09 | 0.68 | 15 | 0.72 | 65.5 | 150 ° /-75 ° Open to depth |

| C23-275 | 0.0 | 90.8 | 90.8 | 1.76 | 0.13 | 2.15 | 23 | 1.97 | 90.8 | 150 ° /-75 ° 2m sample grading |

| C23-276 | 14.0 | 22.0 | 8.0 | 0.37 | 0.11 | 3.55 | 2 | 0.56 | 95.1 | |

| and | 52.0 | 54.0 | 2.0 | 0.34 | 0.13 | 2.50 | 6 | 0.55 | | |

| and | 64.0 | 66.0 | 2.0 | 0.25 | 0.11 | 0.60 | 2 | 0.41 | | |

| and | 88.0 | 90.0 | 2.0 | 0.25 | 0.02 | 0.25 | 7 | 0.27 | | |

| C23-277 | 0.0 | 2.0 | 2.0 | 0.32 | 0.04 | 0.25 | 2 | 0.37 | 105.9 | 330 ° /-70 ° Open to depth |

| and | 10.0 | 12.0 | 2.0 | 0.24 | 0.08 | 2.30 | 1 | 0.37 | | |

| and | 32.0 | 34.0 | 2.0 | 0.21 | 0.06 | 0.60 | 2 | 0.31 | | |

| and | 36.0 | 38.0 | 2.0 | 0.27 | 0.05 | 2.30 | 2 | 0.37 | | |

| and | 86.0 | 105.9 | 19.9 | 0.40 | 0.07 | 0.75 | 4 | 0.51 | | Open to depth |

| C23-278 | 0.0 | 80.0 | 80.0 | 0.58 | 0.15 | 0.55 | 10 | 0.79 | 80.0 | Open to depth |

| C23-279 | 0.0 | 71.4 | 71.4 | 0.53 | 0.14 | 0.40 | 10 | 0.73 | 71.4 | Open to depth |

| C23-280 | 0.0 | 65.4 | 65.4 | 0.51 | 0.12 | 2.98 | 17 | 0.72 | 65.4 | Open to depth |

| C23-281 | 10.0 | 28.0 | 18.0 | 0.88 | 0.16 | 1.63 | 1 | 1.11 | 110.1 | Open to depth |

| and | 44.0 | 46.0 | 2.0 | 0.23 | 0.07 | 0.25 | 2 | 0.33 | | |

| and | 48.0 | 50.0 | 2.0 | 0.21 | 0.09 | 0.25 | 1 | 0.34 | | |

| and | 60.0 | 64.0 | 4.0 | 0.42 | 0.09 | 1.20 | 4 | 0.56 | | |

| and | 80.0 | 110.1 | 30.1 | 0.43 | 0.13 | 0.53 | 24 | 0.63 | | |

| C23-282 | 4.0 | 6.0 | 2.0 | 0.22 | 0.08 | 0.60 | 3 | 0.34 | 81.2 | 330 ° /-65 ° |

| and | 16.0 | 18.0 | 2.0 | 0.27 | 0.04 | 0.25 | 8 | 0.33 | | |

| and | 26.0 | 72.0 | 46.0 | 0.71 | 0.04 | 0.31 | 7 | 0.77 | | |

| C23-283 | 24.0 | 36.0 | 12.0 | 0.31 | 0.10 | 1.03 | 4 | 0.46 | 79.2 | 150 ° /-70 ° |

| and | 52.0 | 74.0 | 22.0 | 0.57 | 0.08 | 0.74 | 6 | 0.69 | | |

| C23-284 | 4.0 | 84.0 | 80.0 | 0.63 | 0.11 | 0.67 | 40 | 0.80 | 100.2 | 330 ° /-70 ° Open to depth |

| and | 96.0 | 100.2 | 4.2 | 0.64 | 0.12 | 0.25 | 120 | 0.84 | | |

| C23-285 | 0.0 | 84.0 | 84.0 | 0.58 | 0.20 | 2.17 | 12 | 0.88 | 85.0 | |

| C23-286 | 0.0 | 90.8 | 90.8 | 0.39 | 0.12 | 1.23 | 7 | 0.58 | 90.8 | 330 ° /-50 ° Open to depth |

| C23-286A | 6.0 | 88.0 | 82.0 | 0.37 | 0.13 | 1.20 | 7 | 0.56 | 150.5 | 330 ° /-50 ° Open to depth |

| and | 106.0 | 122.0 | 16.0 | 0.26 | 0.08 | 0.76 | 4 | 0.39 | | |

| and | 142.0 | 150.5 | 8.5 | 0.60 | 0.10 | 0.91 | 2 | 0.74 | | |

| C23-287 | 0.0 | 46.0 | 46.0 | 0.54 | 0.08 | 0.35 | 9 | 0.65 | 50.3 | |

| C23-288 | 0.0 | 65.2 | 65.2 | 0.67 | 0.08 | 0.47 | 40 | 0.80 | 65.2 | 330 ° /-60 ° Open to depth |

| C23-289 | 0.0 | 46.0 | 46.0 | 1.35 | 0.32 | 2.58 | 5 | 1.82 | 100.1 | Open to depth |

| and | 64.0 | 100.2 | 36.2 | 1.29 | 0.45 | 2.45 | 13 | 1.95 | | |

| C23-290 | 0.0 | 62.0 | 62.0 | 0.92 | 0.05 | 1.01 | 6 | 1.00 | 65.5 | |

| C23-291 | 0.0 | 80.0 | 80.0 | 0.65 | 0.07 | 2.23 | 23 | 0.77 | 100.2 | |

| C23-292 | 0.0 | 65.4 | 65.4 | 0.88 | 0.12 | 0.34 | 108 | 1.09 | 65.4 | Open to depth |

| C23-293 | 0.0 | 62.0 | 62.0 | 0.36 | 0.12 | 1.18 | 4 | 0.54 | 75.1 | |

| C23-294 | 10.0 | 34.0 | 24.0 | 0.23 | 0.16 | 0.75 | 4 | 0.46 | 140.7 | |

| and | 42.0 | 44.0 | 2.0 | 0.21 | 0.06 | 0.25 | 2 | 0.30 | | |

| and | 58.0 | 72.0 | 14.0 | 0.55 | 0.04 | 0.25 | 10 | 0.60 | | |

| and | 86.0 | 116.0 | 30.0 | 0.23 | 0.04 | 0.38 | 2 | 0.29 | | |

| and | 132.0 | 136.0 | 4.0 | 0.27 | 0.05 | 0.85 | 2 | 0.35 | | |

| C23-295 | 0.0 | 60.9 | 60.9 | 0.84 | 0.12 | 2.49 | 23 | 1.03 | 60.9 | Open to depth |

| C23-296 | 2.0 | 50.0 | 48.0 | 0.31 | 0.14 | 1.67 | 3 | 0.53 | 55.2 | |

| C23-297 | 0.0 | 80.6 | 80.6 | 0.74 | 0.11 | 0.85 | 46 | 0.91 | 80.6 | Open to depth |

| C23-298 | 0.0 | 70.3 | 70.3 | 0.87 | 0.07 | 1.42 | 25 | 0.99 | 70.3 | Open to depth |

| C23-299 | 6.0 | 16.0 | 10.0 | 0.50 | 0.06 | 2.50 | 1 | 0.62 | 35.2 | |

| and | 28.0 | 30.0 | 2.0 | 0.46 | 0.03 | 0.25 | 6 | 0.50 | | |

| C23-300 | 6.0 | 95.3 | 89.3 | 0.42 | 0.08 | 0.44 | 24 | 0.54 | 95.3 | Open to depth |

| C23-301 | 16.0 | 20.0 | 4.0 | 0.56 | 0.18 | 1.75 | 10 | 0.83 | 105.3 | Open to depth |

| and | 36.0 | 38.0 | 2.0 | 0.35 | 0.07 | 0.70 | 1 | 0.46 | | |

| and | 50.0 | 52.0 | 2.0 | 0.59 | 0.06 | 0.70 | 1 | 0.68 | | |

| and | 70.0 | 72.0 | 2.0 | 0.31 | 0.03 | 0.90 | 2 | 0.35 | | |

| and | 84.0 | 105.3 | 21.3 | 0.91 | 0.08 | 0.51 | 2 | 1.03 | | |

| C23-302 | 2.0 | 115.1 | 113.1 | 1.50 | 0.16 | 1.48 | 44 | 1.75 | 115.1 | 330 ° /-45 ° Open to depth |

| C23-303 | 0.0 | 50.2 | 50.2 | 1.22 | 0.08 | 2.02 | 19 | 1.36 | 50.2 | Open to depth |

| C23-304 | 2.0 | 8.0 | 6.0 | 0.32 | 0.04 | 2.00 | 3 | 0.40 | 65.1 | 330 ° /-60 ° Open to depth |

| and | 28.0 | 30.0 | 2.0 | 0.25 | 0.10 | 0.60 | 7 | 0.39 | | |

| and | 64.0 | 65.1 | 1.1 | 0.43 | 0.02 | 0.25 | 1 | 0.47 | | |

| C23-305 | 24.0 | 66.0 | 42.0 | 0.26 | 0.05 | 0.52 | 7 | 0.33 | 105.2 | Open to depth |

| and | 92.0 | 105.2 | 13.2 | 0.32 | 0.06 | 0.42 | 12 | 0.40 | | |

| C23-306 | 0.0 | 70.1 | 70.1 | 1.12 | 0.12 | 0.55 | 48 | 1.31 | 70.1 | Open to depth |

| C23-307 | 4.0 | 100.4 | 96.4 | 0.32 | 0.10 | 0.32 | 8 | 0.47 | 100.4 | Open to depth |

| C23-308 | 0.0 | 78.0 | 78.0 | 0.82 | 0.08 | 2.44 | 6 | 0.96 | 80.5 | |

| C23-309 | 0.0 | 85.4 | 85.4 | 0.84 | 0.16 | 1.45 | 17 | 1.08 | 85.4 | Open to depth |

| C23-310 | 8.0 | 22.0 | 14.0 | 0.24 | 0.06 | 2.50 | 4 | 0.35 | 101.1 | Open to depth |

| and | 42.0 | 44.0 | 2.0 | 1.35 | 0.06 | 0.60 | 1 | 1.44 | | |

| and | 56.0 | 58.0 | 2.0 | 0.65 | 0.08 | 0.60 | 5 | 0.77 | | |

| and | 84.0 | 86.0 | 2.0 | 0.25 | 0.07 | 0.25 | 7 | 0.35 | | |

| and | 98.0 | 101.1 | 3.1 | 1.15 | 0.15 | 0.77 | 11 | 1.37 | | |

| C23-311 | 2.0 | 70.3 | 68.3 | 0.71 | 0.04 | 0.26 | 26 | 0.78 | 70.3 | Open to depth |

| C23-312 | 0.0 | 75.8 | 75.8 | 1.40 | 0.17 | 0.71 | 24 | 1.65 | 75.8 | 330 ° /-60 ° Open to depth |

| C23-313 | 0.0 | 92.0 | 92.0 | 0.41 | 0.10 | 0.38 | 12 | 0.55 | 115.6 | |

| and | 106.0 | 108.0 | 2.0 | 0.22 | 0.03 | 0.25 | 5 | 0.27 | | |

| C23-314 | 16.0 | 24.0 | 8.0 | 0.42 | 0.10 | 1.73 | 4 | 0.58 | 145.9 | 150 ° /-85 ° Open to depth |

| and | 38.0 | 52.0 | 14.0 | 0.40 | 0.06 | 0.49 | 5 | 0.48 | | |

| and | 88.0 | 145.9 | 57.9 | 0.40 | 0.13 | 0.53 | 9 | 0.59 | | |

| C23-315 | 0.0 | 115.5 | 115.5 | 0.32 | 0.12 | 0.48 | 4 | 0.49 | 115.5 | Open to depth |

| C23-316 | 0.0 | 75.7 | 75.7 | 1.24 | 0.19 | 0.82 | 31 | 1.52 | 75.7 | Open to depth |

| C23-317 | 0.0 | 95.7 | 95.7 | 1.48 | 0.27 | 0.50 | 56 | 1.86 | 95.7 | Open to depth |

| C23-318 | 0.0 | 46.0 | 46.0 | 0.64 | 0.14 | 1.75 | 4 | 0.85 | 115.4 | 330 ° /-55 ° |

| and | 60.0 | 114.0 | 54.0 | 0.37 | 0.10 | 0.63 | 5 | 0.52 | | |

| C23-319 | 0.0 | 122.0 | 122.0 | 0.50 | 0.15 | 0.54 | 13 | 0.72 | 125.9 | 330 ° /-60 ° |

| C23-320 | 0.0 | 78.0 | 78.0 | 0.54 | 0.20 | 0.43 | 23 | 0.82 | 86.2 | 330 ° /-45 ° |

| C23-321 | 0.0 | 36.0 | 36.0 | 0.53 | 0.17 | 1.06 | 2 | 0.78 | 105.0 | Open to depth |

| and | 48.0 | 105.0 | 57.0 | 0.97 | 0.34 | 0.99 | 13 | 1.44 | | |

| C23-322 | 0.0 | 100.4 | 100.4 | 0.67 | 0.20 | 0.58 | 15 | 0.95 | 100.4 | Open to depth |

| C23-323 | 2.0 | 95.7 | 93.7 | 0.27 | 0.11 | 1.70 | 16 | 0.45 | 95.7 | Open to depth |

| C23-324 | 4.0 | 95.7 | 91.7 | 0.54 | 0.16 | 0.39 | 13 | 0.78 | 95.7 | 330 ° /-55 ° Open to depth |

| C23-325 | 0.0 | 98.0 | 98.0 | 0.35 | 0.08 | 0.78 | 15 | 0.48 | 141.2 | 330 ° /-70 ° Open to depth |

| and | 112.0 | 141.2 | 29.2 | 1.36 | 0.15 | 3.84 | 9 | 1.61 | | |

| C23-326 | 0.0 | 75.1 | 75.1 | 0.90 | 0.31 | 0.70 | 19 | 1.34 | 75.1 | Open to depth |

| C23-327 | 26.0 | 30.0 | 4.0 | 2.65 | 0.03 | 1.00 | 2 | 2.71 | 106.0 | 225 ° /-65 ° |

| and | 40.0 | 84.0 | 44.0 | 0.33 | 0.14 | 0.91 | 8 | 0.53 | | |

| and | 98.0 | 106.0 | 8.0 | 0.57 | 0.09 | 1.44 | 13 | 0.72 | | |

| C23-328 | 0.0 | 8.00 | 8.0 | 0.27 | 0.05 | 2.28 | 3 | 0.37 | 60.6 | |

| and | 52.0 | 60.0 | 8.0 | 0.36 | 0.04 | 0.25 | 5 | 0.41 | | |

| C23-329 | 2.0 | 75.2 | 73.2 | 0.35 | 0.11 | 0.32 | 11 | 0.51 | 75.2 | Open to depth |

| C23-330 | 6.0 | 71.3 | 65.3 | 0.81 | 0.32 | 1.49 | 6 | 1.27 | 71.3 | 330 ° /-55 ° Open to depth |

| C23-331 | 0.0 | 55.2 | 55.2 | 0.29 | 0.13 | 0.38 | 5 | 0.48 | 55.2 | Open to depth |

| Note: All holes drilled at 0 ° azimuth and -90 ° dip unless otherwise stated in the comments. Intervals in the reported holes are calculated using a cut-off of 0.2 g/t Au with maximum internal dilution of ten continuous metres. A top-cut of 70 g/t Au was applied to one sample as noted in comments. Sampling is done in consistent, continuous 2-metre intervals. Values assume 100% recovery of all quoted metals and the following prices were used: a gold price of US$1,500 per ounce, a copper price of US$3.00 per pound, a molybdenum price of US$7.00 per pound and a silver price of US$18.00 per ounce. |

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/lumina-gold-announces-results-from-19-000-metre-drill-program-at-cangrejos-including-85-metres-grading-2-42-gt-gold-equivalent-from-surface-and-open-to-depth-302037958.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/lumina-gold-announces-results-from-19-000-metre-drill-program-at-cangrejos-including-85-metres-grading-2-42-gt-gold-equivalent-from-surface-and-open-to-depth-302037958.html

SOURCE Lumina Gold Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2024/18/c4798.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2024/18/c4798.html