- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

February 27, 2023

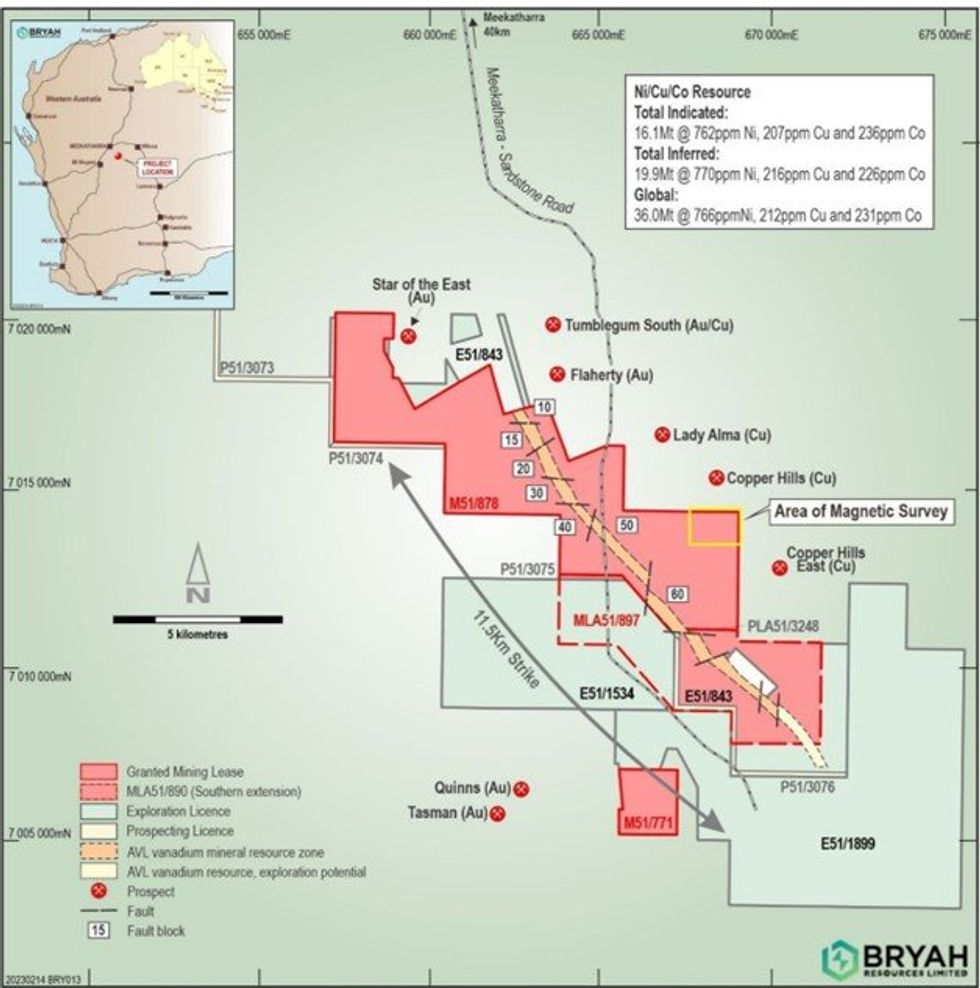

Ground magnetic survey and review of historical drilling highlights potential for new copper-nickel discovery within Gabanintha Project

Bryah Resources Limited (ASX: BYH, “Bryah” or “the Company”) is pleased to advise the results of a review of historical exploration and drilling results which were completed by Australian Vanadium Limited (ASX: AVL) in 2013 within the Company’s Gabanintha Project, approximately 50km south of the town of Meekatharra in central Western Australia.

- Close spaced 25m lines ground magnetics survey completed at target area.

- Copper mineralisation intersected at Copper Hills South Prospect in 5 historical drill holes. Best intersection reported in 20131 was:

- GRC1152 - 18 metres (7-25m) @ 0.42% Cu, including 2m (20-22m) @ 2.19% Cu

- Recent re-evaluation of 2013 drilling data has identified more copper anomalism than reported earlier. Additional intervals within hole GRC1152 include:

- 6 metres (34-40m) @ 0.27% Cu

- 7 metres (45-52m) @ 0.20% Cu

- 4 metres (149-153m) @ 0.22% Cu

- Copper mineralisation in GRC1152 is open in all directions

- 2013 drilling program was designed to test a strong geophysical anomaly associated with an ultramafic unit

- Historical reports in WAMEX show bottom of hole Copper assays up to 1.8% Cu

- Follow up Targeted RC drilling planned Q2 2023

The Copper Hills South Prospect (formerly Gabanintha East) is located 1.5 kilometres south of the Copper Hills Prospect on a granted mining lease M51/878 (see Figure 1).

The Copper Hills Prospect is currently being explored by Peak Minerals Limited (ASX: PUA).

Bryah holds a suite of mineral rights over tenements held by AVL covering 148km² (see Figure 1). Bryah’s mineral rights are for all minerals, excluding vanadium, titanium, cobalt, chromium, uranium, lithium, tantalum, iron ore and manganese. The vanadium-titanium-magnetite deposit is approximately 11.5km long within the Project with most of this lying on Mining Lease M51/878 which was granted in 2020.

Commenting on the results of the recent findings, CEO Ashley Jones said:

“We see very attractive fundamentals in the copper market, through the transition to electrification, hence Bryah’s geological team started re-assessing our Gabanintha tenements’ copper potential. A review of 2013 drill data showed great prospectivity south of Copper Hills. A ground magnetic survey was completed to better understand the 2013 geological interpretation which targeted a deep Induced Polarisation anomaly at Copper Hills South project. The highlight of the previous drilling was 2m at 2.1% Cu, and was part intersected mineralisation over multiple intersections above 0.2% Cu. The combined historical data, together with the newly acquired ground magnetics, has been used to define our new drill targets.”

Previous Exploration

In 2012, Australian Vanadium Limited (AVL) (formerly named Yellow Rock Resources Limited) completed a HELITEM helicopter-borne electromagnetic (EM) and magnetic survey over the Gabanintha Project. The aim of the geophysical survey was to gain a better understanding of the distribution of the structures and lithological units in the bedrock, define the location and extent of bedrock conductors, identify areas for potential mineralisation, and quantitative geological modelling of the layered gabbro within the project area.

Modelling of the HELITEM survey data led to the identification of an EM zone, interpreted to be an ultramafic unit, parallel to, and east of AVL’s Vanadium-Titanium-Magnetite deposit.2

A follow-up Induced Polarisation (IP) survey conducted in 2013 confirmed the strong EM anomaly in the area. The centre of the IP survey anomaly occurs at 100m to 300m below surface for a strike length exceeding 2 kilometres3 (see Figure 3). The anomaly appears to be open to the south east, beyond the edge of the IP survey area.

The potential that substantial sulphide mineralisation may occur and be associated with a left stepping structural “jog”, where co-incident strong to very strong modelled IP and strong magnetic anomalies occur, lead AVL to complete a program of 5 scout Reverse Circulation (RC) drill holes in 2013.

Click here for the full ASX Release

This article includes content from Bryah Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BYH:AU

The Conversation (0)

11 October 2022

Bryah Resources

Battery Metal Exploration and Development Opportunities in Western Australia

Battery Metal Exploration and Development Opportunities in Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00