December 11, 2023

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to announce further results from surface sampling at the Piedra Dura Prospect, within the Fortuna Project (the Project), Chile. Results confirm the extension of mineralisation for an additional 400m to the north and 150m east, with grades up to 9.78% Cu and 13.4g/t Au.

HIGHLIGHTS

- High grade copper and gold surface results returned from follow-up sampling at the Piedra Dura Prospect, within the Fortuna Project.

- Grades of up to 9.78% Cu and 13.4g/t Au from outcropping zones of mineralisation.

- Mineralisation extended 400m to the north and 150m to the east, strike now >1.5km and up to 250m wide.

- Mineralisation remains open to the north and south.

- Drilling is ongoing at the El Quillay North Prospect.

Culpeo Minerals’ Managing Director, Max Tuesley, commented:

“The 2023 exploration program continues to impress with high-grade, out-cropping copper and gold mineralisation now extending an additional 400m to the north and 150m to the east at Piedra Dura. Assay results returned for Piedra Dura reveal new wide, high-grade copper and gold zones that have the potential to add significant volumes of near-surface mineralisation.

The latest results are an excellent outcome as we continue to demonstrate the potential for a district scale copper and gold deposit within the Fortuna Project. We look forward to reporting further news from Fortuna, including drill hole results in the coming weeks.”

PIEDRA DURA PROSPECT

The Piedra Dura Prospect is located 1.8km west of El Quillay within the Fortuna Project (Figure 2). The structurally controlled outcropping copper mineralisation has been delineated over 1.5km of strike and up to 250m width.

The Company previously reported the discovery of significant high-grade outcropping copper and gold mineralisation at Piedra Dura with several parallel structures identified1. Recent exploration activities focused on exploring additional prospective structures in the area.

The field program at Fortuna continued during November, with the collection of a further 27 rock chip samples, focussed on extending the Piedra Dura mineralisation to both the north and east.

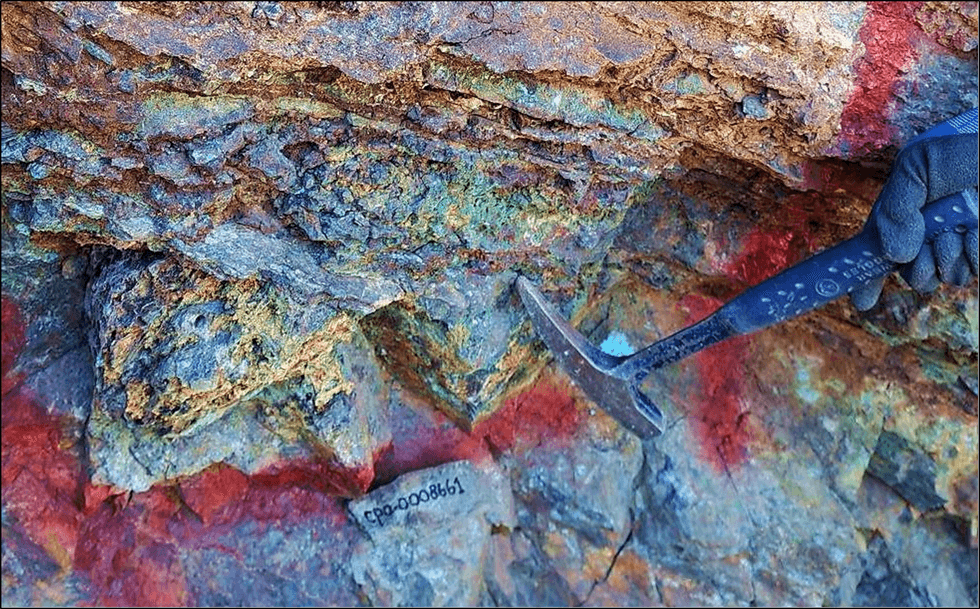

Of the 27 samples collected, 11 returned high-grade copper results >2% Cu (Table 1) including a sample of 9.78% Cu and 7.52g/t Au (CPO0008661) from within a gossanous shallow dipping structure, strongly mineralised with secondary copper including malachite, azurite and covellite (Figure 1).

High-grade gold results accompanied the significant copper mineralisation with sample number CPO0008659 returning 13.4g/t Au and 6.04% Cu (Figure 3).

It is clear from the assay results that the western tenure of Culpeo’s Fortuna Project, which includes Piedra Dura, is highly prospective for economic copper and gold mineralisation. The recent rock chip sampling extends mineralisation 400m to the north and 150m to the east with the target structure remaining open to the north and south.

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CPO:AU

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

10h

Rio Tinto and Glencore Walk Away from Mega-Merger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination have been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00