- WORLD EDITIONAustraliaNorth AmericaWorld

February 04, 2024

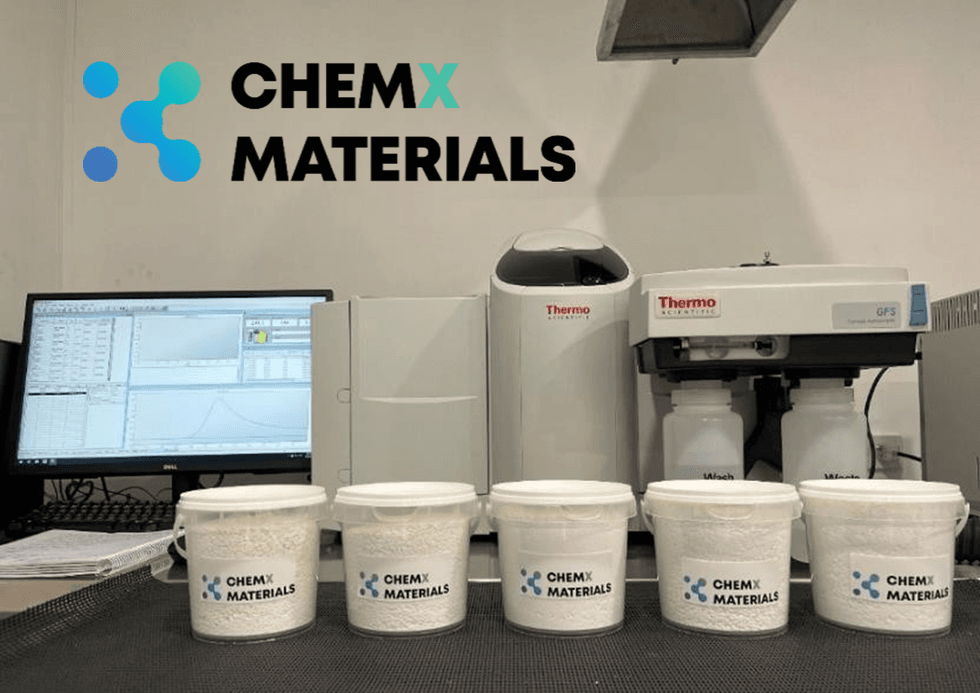

ChemX Materials (ASX:CMX) (ChemX or the Company), an Australian based high purity critical materials developer, has been granted an Australian Patent for its disruptive HPA Processing technology.

- HiPurA® High Purity Alumina (HPA) process granted patent in Australia.

- Following the Australian patent award further jurisdictions are expected to follow in subsequent months for ChemX’s 100%-owned HPA process.

- ChemX’s Australian patent protected HPA process provides for a simplified chemical flowsheet to produce HPA which is scalable, modular and able to be deployed in economically competitive jurisdictions.

- ChemX is advancing a globally disruptive HPA Process for the battery, LED, semiconductor and synthetic sapphire markets.

The granting of the Australian Patent (Patent no. 2022306695) represents a significant milestone for the HiPurA® HPA process. The granted patent protects ChemX’s novel HPA process that offers a significant step forward in the production of lower energy HPA1.

Commenting on the grant of the Australian Patent, ChemX CEO Peter Lee said:

“ChemX is extremely pleased with the award of the Australian patent on our innovative HPA flowsheet and now provides further formal recognition to the uniqueness of our 100%-owned game-changing technology.

With the increased focus in the development of energy efficient critical materials processes in Australia, this patent now places ChemX in a strongly competitive position with regard to ongoing development and the commercialisation of its high purity group of products including synthetic sapphire markets, LEDs, semi-conductor and optical lenses.”

The Australian patent provides ChemX with exclusive and legally enforceable commercial rights to the HiPurA® HPA process in Australia. The protection provided by the Australian patent system gives ChemX the right to stop others from manufacturing HPA using the disruptive HiPurA ® process.

As announced on 13 November 2023, ChemX’s 100%-owned HiPurA® chemical feedstock process has demonstrated its technical success, achieving an impressive result of 39ppm impurities (99.996% purity) across an impressive 66 element spectrum.

The patent grant will allow ChemX to have commercial discussions with interested parties with protection of its intellectual property as it seeks to commercialise the HPA process by exploiting its scalable and modular system in key global battery, LED and synthetic sapphire markets.

ChemX is currently accelerating construction of its 24tpa Pilot Plant which will deliver samples for qualification purposes with strategic customers and is on-track for early- stage commissioning in Q2 CY2024.

About the HiPurA® 100%-owned process

CMX’s HiPurA® process is a disruptive flowsheet which converts aluminous chemical feedstocks through selective refining to HPA. Ultimately, CMX has achieved the delivery of 4N (99.99%) high grade and is working towards 5N (99.999%) HPA products for the electric vehicle battery separator and synthetic sapphire markets, LEDs, semi-conductor and optical lenses.

The HiPurA® process is modular, scalable and independent of direct mine production, which enables ChemX to locate key future production facilities around the world close to customers in a just-in-time customised approach.

Click here for the full ASX Release

This article includes content from ChemX Materials, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CMX:AU

The Conversation (0)

01 July 2024

ChemX Materials

Critical materials company developing innovative, processing technology to produce high purity alumina for advanced technology and clean energy applications.

Critical materials company developing innovative, processing technology to produce high purity alumina for advanced technology and clean energy applications. Keep Reading...

28 November 2024

Agreement with Vytas Ltd for High Purity Assay Services

ChemX Materials (CMX:AU) has announced Agreement with Vytas Ltd for High Purity Assay ServicesDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00