- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

March 25, 2024

Many Peaks Minerals Limited (ASX:MPK) (Many Peaks or the Company) is pleased to announce entering a binding Share Sale Agreement (Agreement) with Turaco Gold Limited (Turaco) to acquire its 89% interest in CDI Holdings (Guernsey) Ltd (CDI Holdings). CDI Holdings is an 89% subsidiary of Turaco, held with Predictive Discovery Limited (Predictive), holding an 11% free carry ownership in a joint venture with Turaco. The Agreement will trigger Turaco’s drag-along right in its joint venture with Predictive, whereby Many Peaks will also acquire Predictive’s remaining 11% interest and consolidate 100% ownership of the joint venture entity CDI Holdings.

HIGHLIGHTS

- Agreement to acquire 100% interest in Turaco Gold Ltd and Predictive Discovery Ltd joint venture holding the right to acquire an 85% interest in four mineral permits in Cote d’Ivoire

- Permits cover expansive 1,275km2 land package including recent gold discoveries with over US$4m previous exploration expenditure

- Acquisition includes the Ferke Gold Project, hosting the recent Ouarigue South discovery with open mineralisation ready for follow-up, and the Odienne Project immediately along strike from new gold discoveries

- Drilling to commence as soon as practicable in the coming quarter

Ferke Gold Project, 300km2

- 16km mineralised trend in soils with limited exploration follow-up.

- Previous diamond drilling confirms new discovery at the Ouarigue South prospect; results include:

- 35.95m @ 3.88 g/t gold within 77.6m @ 2.33 g/t gold from 45.9m and; 4.7m @ 6.14 g/t gold from 134m – FNDC001

- 91.1m @ 2.02 g/t gold from surface – FNDC008

- 47m @ 3.72 g/t gold from surface – FNDC012

- 15m @ 2.06 g/t gold from surface and 116.5m @ 0.98 g/t gold from 34.5m, including 30.09m @ 1.86 g/t gold – FNDC005

- 18m @ 3.38 g/t gold from 107m and; 13.65m @ 2.13 g/t gold from 194m – FNDC018

- 9.75m @ 7.46 g/t gold within 54.17m @ 1.88 g/t gold from 59.58m – FNDC019

Odienne Project, 758km2

- Project covers significant extent of high-strain corridor associated with the Archean domain

- margin and is comparable in stratigraphy to Guinea’s Siguiri basin

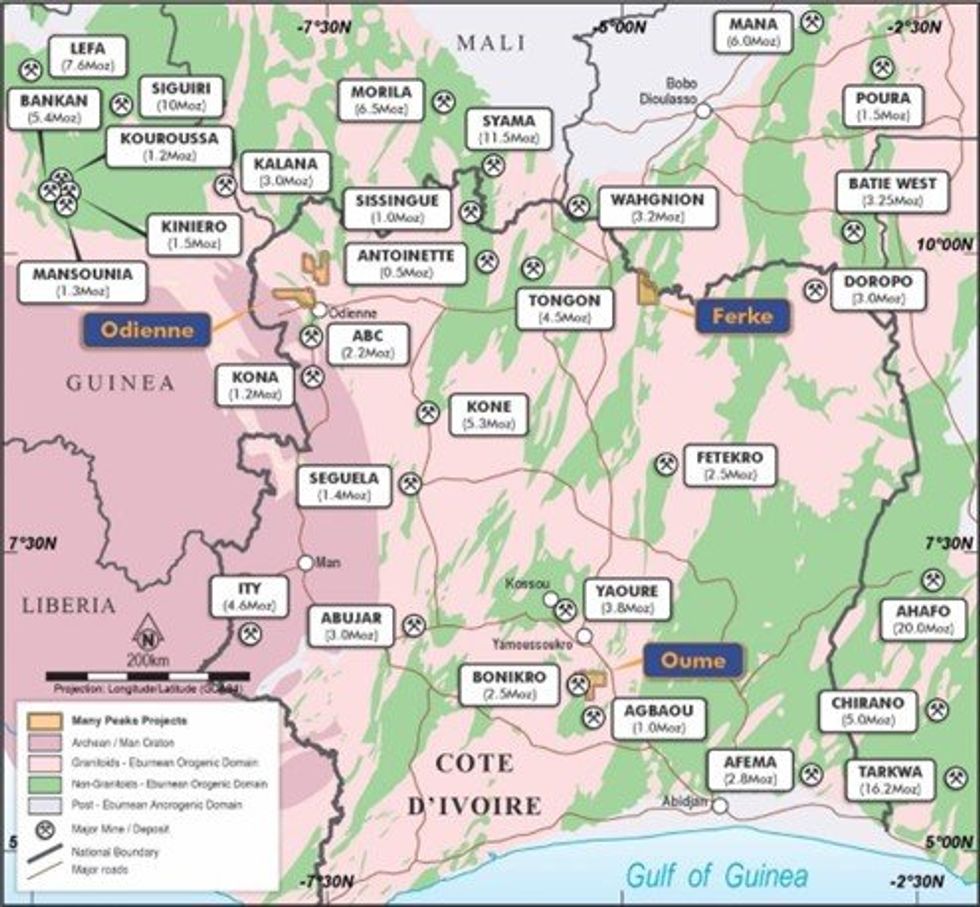

- On trend with Predictive’s 5.4Moz Au Bankan Project and Centamin’s 2.16Moz ABC project and contiguous to a new discovery by Awalé Resources/Newmont joint venture

- Recent first pass, wide-spaced air core drilling highlights a continuous zone of mineralisation returning >1g/t gold over 1,200m strike extent, with results including:

- 12m @ 1.18g/t gold from 4m

- 12m @ 1.06g/t gold from 16m

- 8m @ 1.30g/t gold from 28m

CDI Holdings is the holding company for two wholly-owned Ivorian entities, including the Ivorian subsidiary party to a joint venture with Gold Ivoire Minerals SARL (GIV Joint Venture) in Cote d’Ivoire in which it has earned a 65% interest and retains an exclusive right to earn-in to an 85% interest by sole funding any project within four mineral licences in Cote d’Ivoire to feasibility study.

The consideration for the purchase of 100% of CDI Holdings will be an aggregate 5,617,978 fully paid ordinary shares in Many Peaks subject to a 12 month escrow, to be issued under the Company’s capacity under ASX listing rule 7.1. Upon completion, Many Peaks will also assume a royalty deed for a 1% net smelter return royalty payable to Resolute (Treasury) Pty Ltd (Resolute)—further information on terms and conditions precedent outlined below.

Many Peaks’ Executive Chairman, Travis Schwertfeger, commented: “The Ferke and Odienne Projects in Cote d’Ivoire deliver Many Peaks a strong foundation of exploration success in Cote d’Ivoire with the potential to build significant high- grade ounces in the near term. Both projects are already covered with systematic geochemical coverage and high-resolution geophysics, which have led to demonstrated gold mineralisation confirmed in drilling. Leveraging over US$4m of previous expenditure in recent years has generated multiple targets ready for follow-up, including extension targets, providing Many Peaks with a transformational acquisition with near-term resource potential viable.

Our team has a depth of West African operating experience tied to multiple discovery and development projects over the past 15 years, and our technical team looks forward to operating in Cote d'Ivoire again. Over recent years, it has emerged as a premier jurisdiction within West Africa to operate in, with several recent exploration and development successes.

Ferke Gold Project

The Ferké Gold Project (Ferke) is located in northern Cote d’Ivoire, covering 300km2 in a granted exploration permit licence. Ferke is situated on the eastern margin of the Daloa greenstone belt at the intersection of major regional scale shear zones (refer to Figure 1). Initial exploration undertaken at the Ferke Gold Project by Predictive Discovery Ltd in 2016 and 2017 (previously referred to as Ferkessedougou North) comprised several phases of geochemical stream and soil sampling across the permit area, which has defined a more than 16km long gold-in-soils anomaly on the ‘Leraba Gold Trend’ (refer to Figure 2 and Predictive’s ASX announcement dated 2 February 2017).

Click here for the full ASX Release

This article includes content from Many Peaks Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MPK:AU

The Conversation (0)

10 September 2024

Many Peaks Minerals

Advancing gold discoveries in Côte d’Ivoire, West Africa

Advancing gold discoveries in Côte d’Ivoire, West Africa Keep Reading...

14 April 2025

Diamond Drilling Commences at Ferke Gold Project

Many Peaks Minerals (MPK:AU) has announced Diamond Drilling Commences at Ferke Gold ProjectDownload the PDF here. Keep Reading...

19 March 2025

Raises A$6.22m to Intensify Drilling at Ferke

Many Peaks Minerals (MPK:AU) has announced Raises A$6.22m to Intensify Drilling at FerkeDownload the PDF here. Keep Reading...

16 March 2025

New High Grade Gold Shoot at Ferke Project

Many Peaks Minerals (MPK:AU) has announced New High Grade Gold Shoot at Ferke ProjectDownload the PDF here. Keep Reading...

11 March 2025

AC Drilling Commences on Priority Targets at Ferke Project

Many Peaks Minerals (MPK:AU) has announced AC Drilling Commences on Priority Targets at Ferke ProjectDownload the PDF here. Keep Reading...

23 February 2025

Reconnaissance AC Drilling Yield Structural Targets

Many Peaks Minerals (MPK:AU) has announced Reconnaissance AC Drilling Yield Structural TargetsDownload the PDF here. Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00