When will mining stocks catch up to metals prices?

Kicking off the discussion, Rule, who is the proprietor at Rule Investment Media, asked the panelists if the discrepancy between metals prices and the performance of mining stocks will end — and if so, when and why.

Nick Hodge, publisher at Digest Publishing, was first to weigh in, saying, “Yes, it will."

As for when, Hodge anticipates more balance in mining shares once “the everything bubble ends.”

He explained that many assets, including tech stocks like the Magnificent 7, are overvalued, causing many of these assets to outperform the S&P/TSX Venture Composite Index (INDEXTSI:JX).

“I think once you get a — I don't want to say crash — once you get a sort of reckoning, a popping of the everything bubble, everything sort of resets," Hodge told the audience.

Lawrence Lepard, managing director Equity Management Associates, suggested the disjointment between metals prices and stock performances is the result of skepticism about current gold and silver projections.

“You look at Bloomberg, you look at the projections — everyone thinks gold is going back to US$2,000 (per ounce), they don't think this move is real,” he said. “We all know it's going to US$3,000 to US$5,000 and that has to change.”

Gold has sat firmly above the US$2,000 level since February, setting a record of US$2,788.54 in October.

For Lepard, the cynical view that gold will retreat is affecting sentiment. Additionally, concerns about rising all-in sustaining costs squeezing miners' margins is adding to the uncertainty.

In terms of a time frame, Lepard echoed Hodge’s position that a major reset is close.

“We're very close to this everything bubble bursting. I think they're going to probably try and pop the bubble to screw (Donald) Trump. I would expect that in the next six months, things are going to change dramatically in this area."

Gold Newsletter editor Brien Lundin thinks there is a different underlying factor contributing to the imbalance.

“There is a discrepancy, but it's more perception than reality,” said Lundin, who also hosts the New Orleans Investment Conference. “If you look at the ratios, the mining stocks, at least judged by the major indexes, have generally outperformed gold, just not as much as we would have expected given the movement in metals.”

He then pointed to the large gold purchases central banks have made in 2024.

“That move in the metals, though, was instigated by central banks buying hand over fist for the first couple of months of the move,” said Lundin. “And central banks don't buy mining stocks.”

According to data from the World Gold Council, by the end of Q3, global central banks had purchased 694 metric tons of gold since the start of the year. Leading the buying were India, Turkey and Poland.

Next in line to answer Rule’s query was Jennifer Shaigec, principal at Sandpiper Trading.

She reiterated Hodge’s “everything bubble bursting” as a catalyst for mining stocks to move.

“Given all the insider sales we've seen from people like (Jeff) Bezos, and Warren Buffet sitting on a big pile of cash, that tells me it's probably imminent,” she told the conference crowd.

“I think there's just a lot of disbelief right now that this move in gold is real … even the base metals (like) copper went up and went back down,” Shaigec added. “There's so much uncertainty on a geopolitical basis that it's going to take some of that to kind of settle in. And I think that could be a little while yet.”

For Shaigec, President-elect Trump’s inauguration is “going to answer a lot of questions for people,” and will likely serve as the tipping point for some of the aforementioned activity.

Lobo Tiggre, CEO of IndependentSpeculator.com,argued that gold stocks are already moving, but “with a caveat.” While there was an expectation that they would move at US$2,500 gold, that's not what happened.

“I think what it took was actually US$2,800 (gold), and that was so far above what anybody thought at the time,” he said, noting that the VanEck Gold Miners ETF (ARCA:GDX) is a poor performance indicator.

“The GDX, it's an ETF, it's defined by size, not quality,” said Tiggre. “(Because) it has some high performers, some low performers, the average number is not real. It's not going to tell you what's going on.”

He continued, “(At) US$2800, you started to see the higher-quality stuff, not just the big producers, but even the juniors — if there is such a thing as a high-quality junior — they really responded. We started seeing hockey sticks.”

Tiggre went on to highlight that for stock pickers, the momentum may already be underway, with the market experiencing a correction phase that’s part of a recurring cycle. The expectation is that these patterns of rise and correction will persist, signaling that while some of the movement has happened, further gains are likely ahead.

Bull market trajectory and top investment themes

Rule then turned to what trajectory a bull market in precious or industrial metals will take.

Overall, the panelists agreed that the traditional progression — where metals prices move first, followed by major producers and down the chain to juniors — will still play out, but perhaps with deviations.

Hodge noted that human nature hasn't changed, so the psychology of investors gravitating to the biggest names first may still hold true. However, he said the rise of "meme stocks" in mining could disrupt the normal trajectory.

Shaigec pointed out that the majors have been paying down debt and accumulating cash, which could lead to more acquisitions of promising development projects. This could light the junior sector on fire.

For their part, Lundin and Lepard both suggested that silver stocks may jump ahead of the typical order, outperforming as investors start to recognize that the white metal is in a true bull market.

Tiggre took a slightly contrarian view, arguing that the discrepancy between metals prices and mining equities has already been addressed for higher-quality companies.

Moderator Rule also asked the panelists for their favorite commodity to express in the equities market.

Tiggre underscored the “pre-production sweet spot” as his favourite investment thesis.

“It's developers,” he said. “But like real developers — you have a construction decision, you have the money, you have the permits. You're going to build a mine.”

Shaigec highlighted two themes, the first being the exciting opportunities that may emerge from drill plays, particularly as new discoveries have declined by 80 percent over the past 15 years.

This depletion of reserves is likely to drive major mining companies to seek fresh resources urgently, creating a significant push for exploration and reserve replacement efforts.

She then spoke about jurisdiction, pointing to the “incredible value to be found in Peru.”

“There's a lot of really exciting projects that have strong management teams in Peru. So that's kind of my favorite theme right now, I'm pretty heavily invested in that country,” said Shaigec.

Taking a more macro view, Lundin spoke about the growing relevance of optionality plays in mining.

“Basically, you buy cheap resources when they're out of favor in the ground and the metals prices aren't enough to justify their development. So you're gaining leverage on a rise in metals prices,” he said.

“(The hope is) that metals prices will rise enough that those ounces in the ground suddenly become economic and therefore very valuable — much more valuable than they were.”

Lepard’s favorite investment thesis is picking companies with strong corporate governance.

“My one thing would be good management,” said Lepard. “This industry is a very tough industry, and there are a million ways to lose money. I found them all. I really have.”

Lastly, Hodge drove home the importance of share structure. “Structure allows you to weather the storm. No matter what the theme is, no matter what the commodity is, the share structure really matters,” he said.

He also suggested that integration of technology could underpin a strong investment thesis.

Hodge explained that the mining industry is rapidly using advanced technology to adapt to new demands and regulations. Innovations like Ceibo’s “clean copper” technology, already adopted by Glencore (LSE:GLEN,OTC Pink:GLCNF), and advances from companies like Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) are reshaping the sector.

“You know, there's going to be battery passports required to be able to track all this stuff. I think that's really going to have to be one of the components of how you look at these mining companies,” said Hodge.

Stock picks from Hodge, Lepard, Lundin and Shaigec

To end the discussion, Rule asked the panelists for a favor.

“I'm a highly competitive person, and I really want this panel to be what everybody thinks is the most important product at the New Orleans Investment Conference,” he said. "In order for that to happen, we've got to give these folks a gift.”

Rule then asked the participants to provide some stock picks for the audience.

For Hodge, Mexico-focused silver company Kingsmen Resources (TSXV:KNG,OTCQB:KNGRF) has a share structure that he likes. He also mentioned Canadian lithium junior Q2 Metals (TSXV:QTWO), noting the company is on “a pretty robust lithium discovery" that may rival that of Patriot Battery Metals (TSX:PMET,OTCQX:PMETF).

Lepard kept it brief and started with Avino Silver & Gold Mines (TSX:ASM,NYSEAMERICAN:ASM), which he “loves.” He then referenced Banyan Gold’s (TSXV:BYN,OTCQB:BYAGF) “huge optionality” and “big deposit.”

Lundin praised the technical team at Relevant Gold (TSXV:RGC,OTCQB:RGCCF), noting that company has “high potential” due to its large percentage of an Abitibi-style district in Wyoming.

He also likes the drill results that Delta Resources (TSXV:DLTA,OTC Pink:DTARF) has been releasing.

Shaigec’s stock picks reflected her Peru-focused investment thesis.

“The first one is CopperEX (TSXV:CUEX),” she said. “One of the things I love about that story is it probably has the largest number of all stars on a team that I have seen assembled under one company name.”

Shaigec selected Coppernico Metals (TSX:COPR,OTCQB:CPPMF) as her second pick. Not only is she impressed by the company’s Sombrero project in Peru, but she also highlighted that several majors have invested in the company.

“(Coppernico) was just listed in August. And just prior to their listing, it was announced that Teck Resources (TSX:TECK.A,TSX:TECK.B,NYSE:TECK) is a strategic shareholder. They own 9.9 percent of the company, and Newmont (TSX:NGT,NYSE:NEM) owns over 6 percent," she said.

Keep an eye out for the rest of INN’s coverage from the New Orleans Investment Conference, including exclusive video interviews and full panel overviews.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

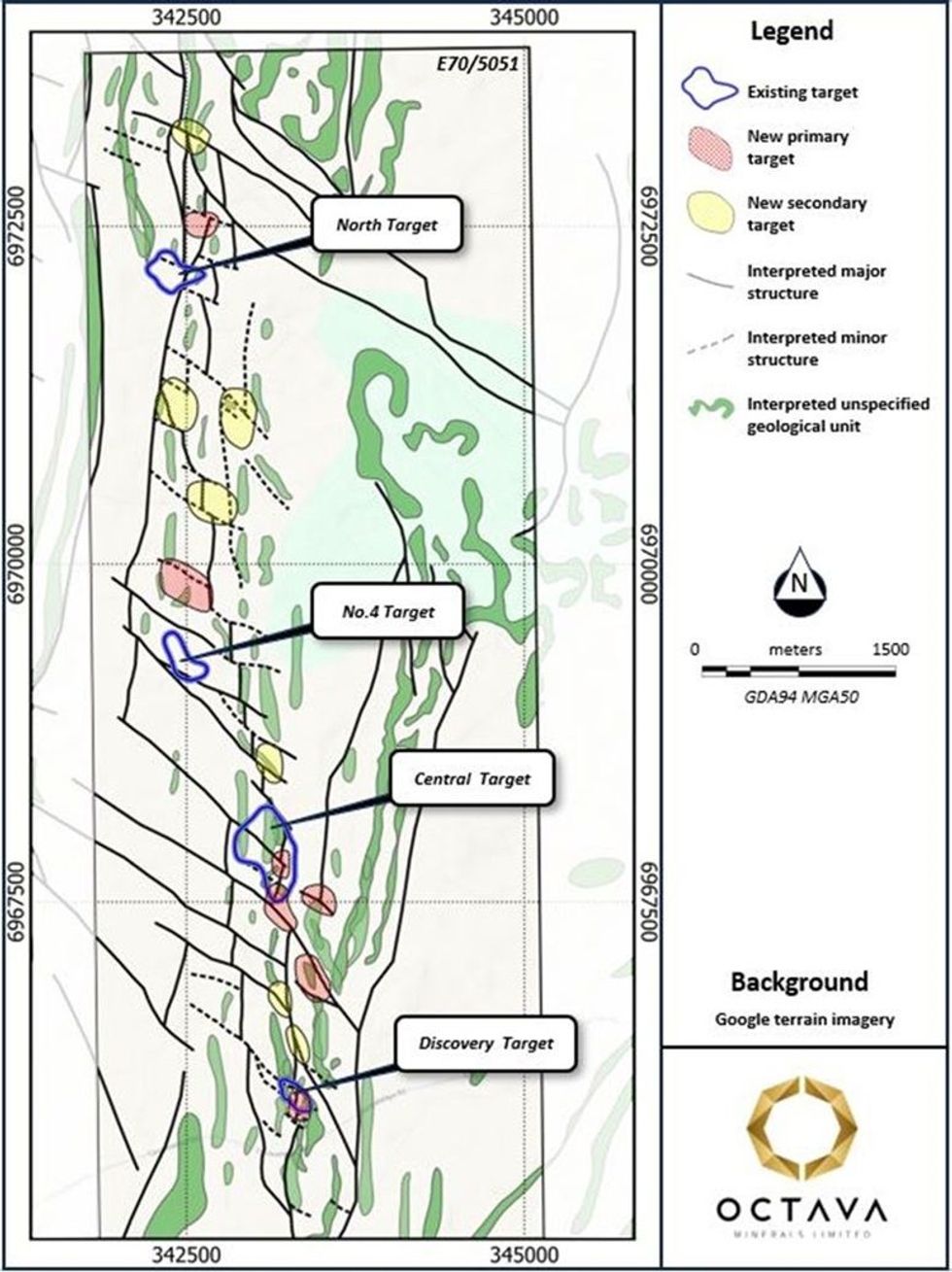

Figure 1. Summary structural interpretation and with existing and newly identified Sb targets at Yallalong.

Figure 1. Summary structural interpretation and with existing and newly identified Sb targets at Yallalong.

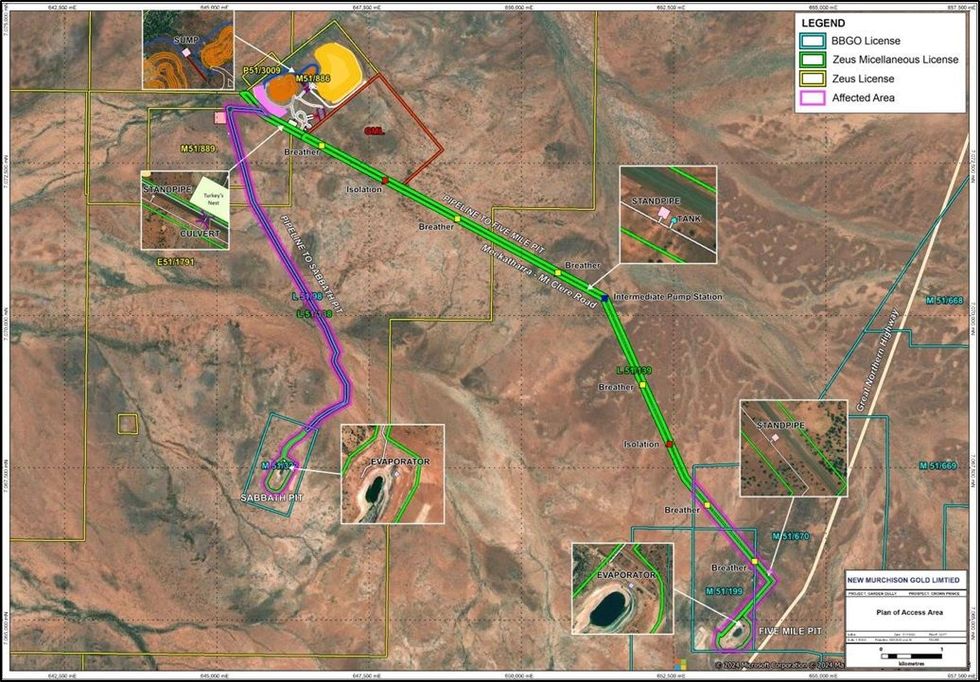

Plan of Access and Water Infrastructure - Crown Prince

Plan of Access and Water Infrastructure - Crown Prince