How Could Trump's US Election Win Affect the Gold Price?

Donald Trump has been re-elected as president of the US. Dive into how gold performed has performed during previous election cycles and what may happen this year.

With the 2024 US Presidential election in the rear view and Donald Trump emerging the victor, news of his upcoming presidency is already influencing global markets.

In 2020, Biden and Harris presented themselves as a team that would bring Republicans and Democrats together, challenging Trump’s divisive and populist rhetoric of making America great again. Although Trump lost that election, his popularity remained steadfast among his base, contributing to his success on November 5.

In the resource sector, investors are wondering how a Trump presidency may affect the gold price. While diverse factors drive the gold market, the US — and by extension its leader — impacts many of them, including the global geopolitical environment, interest rates and the performance of the US dollar.

During his last term in office, Donald Trump increased domestic oil production and tariffs on goods from overseas. Further increases to these have been central to his campaign this time around as well — he has promised to cut energy prices in half and increase tariffs to narrow trade deficits.

His policy has largely been focused on appeasing his base, promising sweeping immigration reform with a promise to deport 20 million people living in the US illegally. However, some suggest the plan would be wrought with logistical challenges and wreak havoc on the economy. He has also promised to take a tough-on-crime stance as president and push for expansion of the death penalty and provide the military with powers to police within US borders.

On foreign policy, Trump said he was also committed to ending the war and planned to push Ukrainian funding to European partners while attempting to bring Russian President Vladimir Putin and Ukrainian President Volodymyr Zelenskyy to the negotiating table. When it comes to the conflict in the Middle East, President-elect Trump has promised to back Israel but suggested he'd want the conflict wrapped up by the time he takes the oath of office.

With the presidency soon to be in Trump's hands, how he navigates all of these challenges will contribute to a broad geopolitical narrative that will touch many sectors of the global economy, including the price of gold. Looking back, we can see how past policy decisions have impacted gold and what could happen once Trump returns to the Oval Office.

The gold price has climbed significantly under both administrations. In the lead up to the 2024 election, it set a series of new price highs, including the current all-time high of US$2,788 per ounce on October 30 — more than double its price when Trump took office in 2017.

Some of the rise in gold prices is attributed to a 50-point cut to interest rates following the Federal Open Markets Committee meeting on September 17 and 18. At the next FOMC meeting on November 6 and 7, the committee elected to cut them a further 25 points. Fed Chair Jerome Powell stated that the election results did not influence the decision.

How does gold typically perform post-election, and how has it moved during Trump and Biden's presidencies? While the past doesn't necessarily dictate the future, reviewing gold price trends can help investors plan their strategy for navigating the gold market following Trump's win.

In this article

What happened to the gold price after Trump's election win?

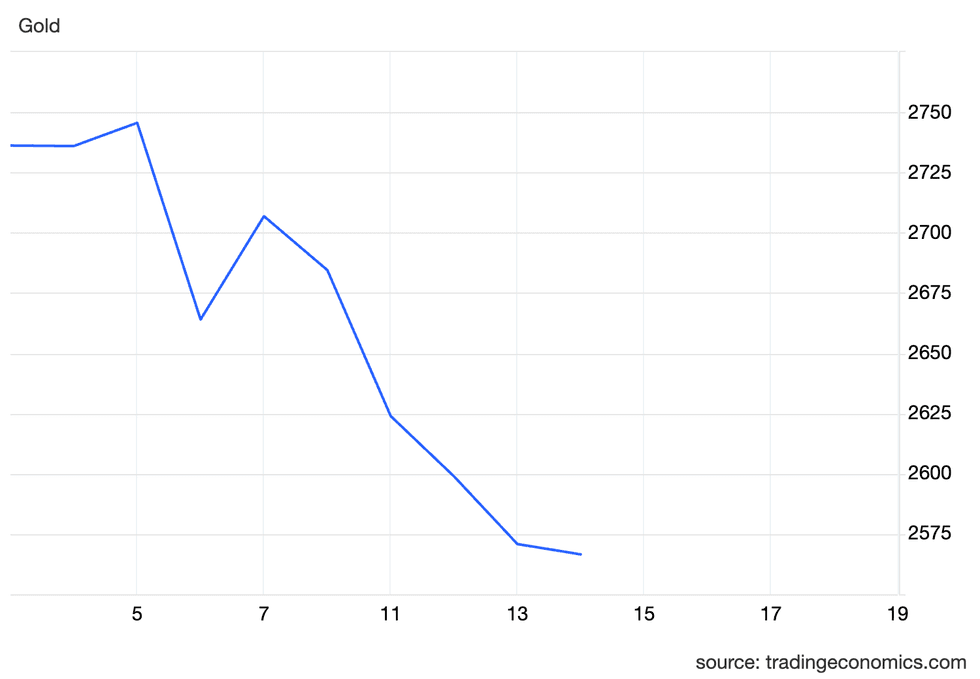

Gold price chart, November 1, 2024, to November 14, 2024.

Chart via Trading Economics.

In the time following the November 5 US election, which saw Trump re-elected, gold has fallen by 6.6 percent, from US$2,745 on November 5 to about US$2,565 on November 14. Overall, the decline in gold markets has been a headline for the resource sector, which has also seen broad declines across both precious and base metals.

Commodities have largely been influenced by the effect the Trump win is having on bonds and the dollar as market watchers prepare for policies that are expected to require increasing deficits and fuel a run in inflation.

How these financial markets move will have a strong influence on investor sentiment and, by extension, the price of gold as they look for a hedge to swings in market volatility that come with a shift in leadership in the world’s largest economy.

Gold's performance after the election has also been notable due to its strong performance in 2024. The week before the election, it set a new all time high of US$2,788. While its fall may seem dramatic, in fact gold's price movement is reminiscent of the past two elections, which also led to steep price declines in November.

With the election still fresh, what can be learned from past elections, and how might the price of gold move in the days, weeks and months ahead? Moreover, how can past policies set by presidents have an even deeper influence on the safe-haven metal than just the election cycle? Read on to learn more about what we could see going forward.

How do US elections affect the gold price?

Looking at past US elections can provide insight on how the gold price may move in the days and weeks following November 5. However, on a broad scale, changes post-election tend to normalize fairly quickly.

In an email to the Investing News Network, Lobo Tiggre, CEO of IndependentSpeculator.com, said he doesn’t see either candidate having a large effect on the price of gold post-election. “The outcome of the election will have ideological consequences, but it’ll make no difference to gold, silver, uranium or the commodities super-cycle,” he said.

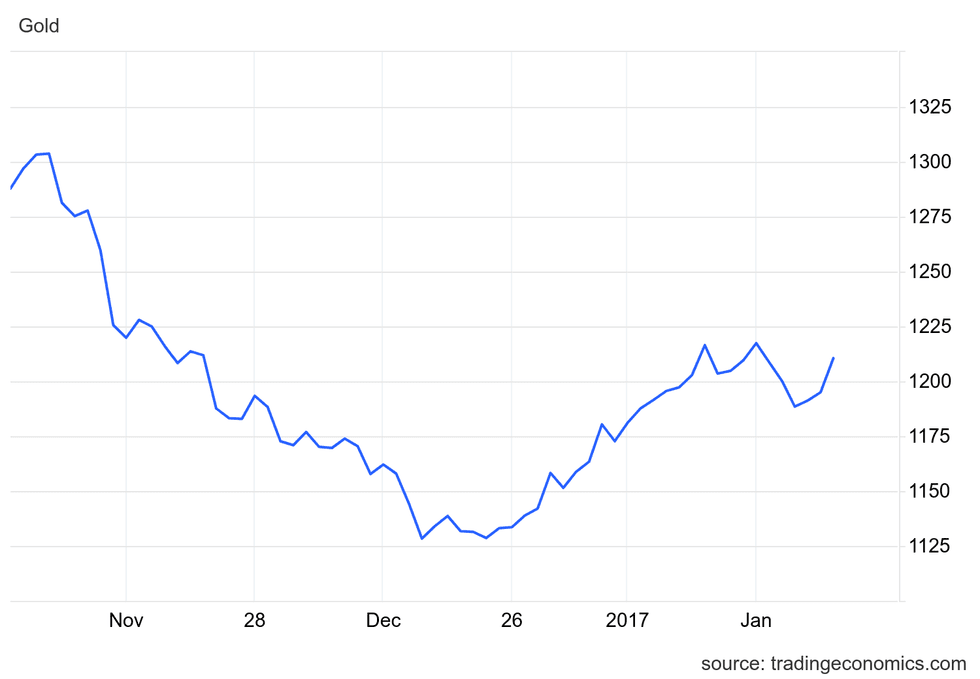

In 2016, when Trump ran against Hillary Clinton, the gold price climbed by about US$50 in the weeks leading up to the November 8 election, peaking at just above US$1,300 per ounce on November 4. Following Trump's win gold fell substantially, moving as low as US$1,128 in mid-December. Following that low point, the gold price began to rebound, and by the middle of January 2017 was once again above the US$1,200 level.

Gold price, November 1, 2016, to January 30, 2017.

Chart via Trading Economics.

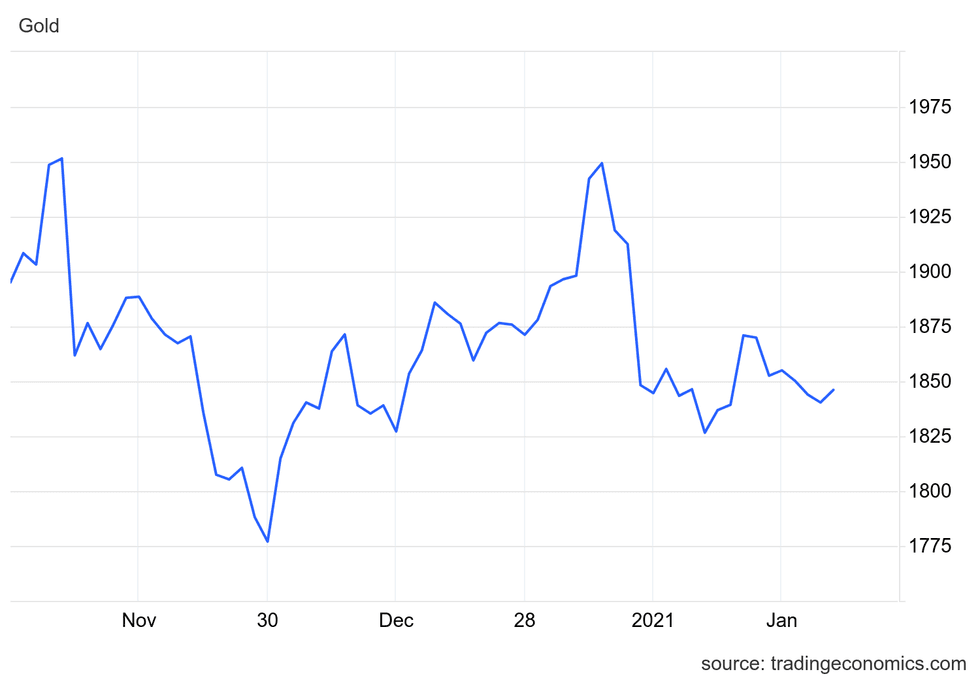

The 2020 election was on November 3, and in the week leading up to the vote gold was trading at around US$1,900, although it fell as low as US$1,867 on October 30. After the election, the gold price performed positively, spiking from US$1,908 on the day of the vote to US$1,951 on November 6.

However, gold fell back down over the following weeks, and dipped briefly below US$1,800 as vote recounts in Georgia and several districts and legal challenges by Trump’s team dragged on.

Gold price, November 1, 2020, to January 30, 2021.

Chart via Trading Economics.

Gold began to climb again in December ahead of January 6, 2021, when the electoral college met to formalize Biden’s victory. That day, the attack on the US Capitol building, which aimed to stop this process, caused the gold price to plunge from US$1,949 on January 5 to US$1,848 by January 8. The events of January 6 were the start of a decline in the gold price that continued until March 8, when gold bottomed out at US$1,674.80.

Gold's behavior at this time went against the usual trend whereby it performs well amid crisis and turmoil; the decline may been a reaction to the successful affirmation of Biden. Stock markets also reacted opposite to expectations, seeing strong gains on January 6 and 7 as investors and Wall Street believed an economic recovery was in sight.

How did the gold price perform when Trump was president?

The gold price rose substantially during Trump's presidency, increasing from US$1,209 when he assumed office on January 20, 2017, to US$1,839 on his final day, which was January 19, 2021.

While these gains can't be directly attributed to Trump, his actions helped shape the geopolitical landscape both in the US and abroad. During his tenure, trade wars with both allies and competitors were in focus.

China was a key target for Trump. While tariffs on Chinese goods were already in place, his administration applied new restrictions to more items, including steel, electric vehicle batteries and consumer goods. Also under Trump's watch, relations with India fractured and the country lost its preferential trade status with the US. He also withdrew from the Iran nuclear treaty and imposed punishments on anyone who traded with Iran.

These and other “America First” protectionist policies and sanctions implemented by the Trump administration tarnished the image of the US as a reliable trade partner, helping to push the BRICS nations — Brazil, Russia, India, China and South Africa — away from the US dollar as a global reserve currency.

The BRICS have since expanded to include Iran, Egypt, Ethiopia and other emerging nations, and have increasingly turned toward gold. China and India in particular have increased purchases of gold through their central banks, leading some to speculate that they are attempting to create a new currency that is at least partially backed by gold.

One other factor that drove the gold price during Trump’s term was the outbreak of the COVID-19 pandemic and government policies put in place to support citizens and the economy. For example, the former president oversaw multiple stimulus efforts, including packages announced in March 2020 and December 2020. These actions led many to turn to gold as a safe haven out of concern for a weakening US dollar.

A second Trump term would likely bring more of the same protectionist policies. Indeed, his 2024 campaign has similarities to his 2016 and 2020 campaigns. He has reused his “America First'' rhetoric and promised a fresh round of tariffs if elected. Singling out China, Trump has said he would look to implement a 60 percent tariff on all goods imported into the US, a move that would likely increase tensions and the likelihood of a widening division between the countries.

How has the gold price performed with Biden and Harris in office?

Gold has also seen sizable gains during Biden's presidency. The price of gold was US$1,871 when he took over from Trump on January 20, 2021. And while Biden's term as president is not over until January 2025, as of October 15, the gold price was trading at about US$2,665. It reached a new record on October 30 above US$2,770.

Again, it's hard to say how many of the Biden administration's policies directly influenced these gains. Geopolitical conflict and black swan events outside of his control all affected the gold market during this time.

For example, Biden and Harris entered office one year after the start of the COVID-19 pandemic. Inflation was ballooning, which typically leads to higher gold prices. The US Federal Reserve has worked to counteract inflation and strengthen the US dollar by raising interest rates beginning in 2022, a move that tempered the gold price for a time. The anticipation of rate cuts and the 50 point cut that came in September were factors in driving gold to its record highs in recent months.

Biden came into office on a promise of restoring the US' place in the global community, and while his administration did close rifts among important trading partners like Canada and the EU, tensions with China remain. This rift is a holdover from the Trump administration's more isolationist policies, but has also been representative of a more competitive global trade landscape as the BRICS nations seek to move away from the US dollar and America’s influence on world economics.

Biden has attempted to at least partially mend the US' relationship with China, including by meeting with President Xi Jinping in the summer of 2023. However, a key sticking point in negotiations between the two has been Biden’s continued stance that the US would support Taiwan if China were to invade it; at the same time, he has said that the US does not support Taiwan’s independence. Both of these stances are in line with the US’ longtime position on the matter, but escalating tensions between China and Taiwan have brought this to the forefront.

Harris has a similar stance when it comes to Taiwan. In a September 2022 meeting with South Korean President Yoon Suk Yeol, she said the US was committed to opposing unilateral actions by China and would maintain the status quo in the South China Sea. The White House added that peace and stability across the Taiwan Strait was essential to a free Indo-Pacific region.

Harris discussed trade routes in the region again when she attended the ASEAN summit in Jakarta, Indonesia, in September of 2023. She told CBS’s Margaret Brennan that it's not about pulling out of Southeast Asia, but about de-risking the region and ensuring that American interests were protected.

On an economic level, the Biden administration has distanced itself from China with policies such as the Inflation Reduction Act and Chips Act, which support the development of western supply chains for a variety of industries, including clean energy, electric vehicles and semiconductor chips, in part by introducing subsidies for companies that don’t rely on China for their supply chain.

Meanwhile, China has accelerated its de-dollarization efforts, dumping roughly US$50 billion worth of US Treasuries and agency bonds during the first quarter of this year.

Additionally, Biden’s role in implementing a strict set of sanctions against Russia following its invasion of Ukraine in February 2022 deepened a divide between the US and Russia, as well as the other BRICS nations.

Among other sanctions, the US limited Russia's access to SWIFT, a communications network that helps facilitate the global movement of funds. The US Department of the Treasury also implemented controls that effectively cut off Russia’s central bank and key funds and personnel from accessing the US financial system. Some analysts believe the move may work to undermine the US dollar as the global reserve currency in the long term, as it sent a signal to the rest of the world that the US is willing to effectively weaponize the US dollar.

Investor takeaway

Historically speaking, returns for gold under Democrat and Republican presidents have averaged 11.2 percent and 10.2 percent, respectively. But that might not be the data point investors should focus on.

Which party controls Congress, which is comprised of the House and Senate, has had a far stronger influence on the gold price. Under Democrat-controlled Congresses, gold has averaged a 20.9 percent gain, compared to just 3.9 percent when Congress is controlled by Republicans. In cases where neither controls Congress, gold has averaged 3.5 percent.

With that in mind, investors should consider the effects of policies enacted not only by the executive branch of the US government, but also by Congress and the Senate. Those hoping to use the immediate aftermath of the election outcome to their advantage should also proceed with caution — when it comes to gold, past elections haven't provided great investment opportunities, with losses and gains typically being short-lived.

This is an updated version of an article first published by the Investing News Network in 2020.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Affiliate Disclosure: The Investing News Network may earn commission from qualifying purchases or actions made through the links or advertisements on this page.

- US Indexes Hit Fresh All-time Highs as Trump Secures Election Win ›

- What Was the Highest Price for Gold? (Updated 2024) ›

- How Would a New BRICS Currency Affect the US Dollar? (Updated 2024) ›

- VIDEO - Judy Shelton: Trump, the Next Fed Chair and the Gold Standard ›

- Trump and the Gold Standard (Updated 2024) ›