October 26, 2022

Sylla Gold Corp. (TSXV: SYG); (OTCQB: SYGCF) ("Sylla Gold" or the "Company") is pleased to announce on October 18, 2022 the Company entered into an arm's length letter of intent ("LOI") pursuant to which Sylla Gold would acquire an option to earn 100% of the Sananfara gold exploration permit located contiguously south of the Company's Niaouleni Gold Project.

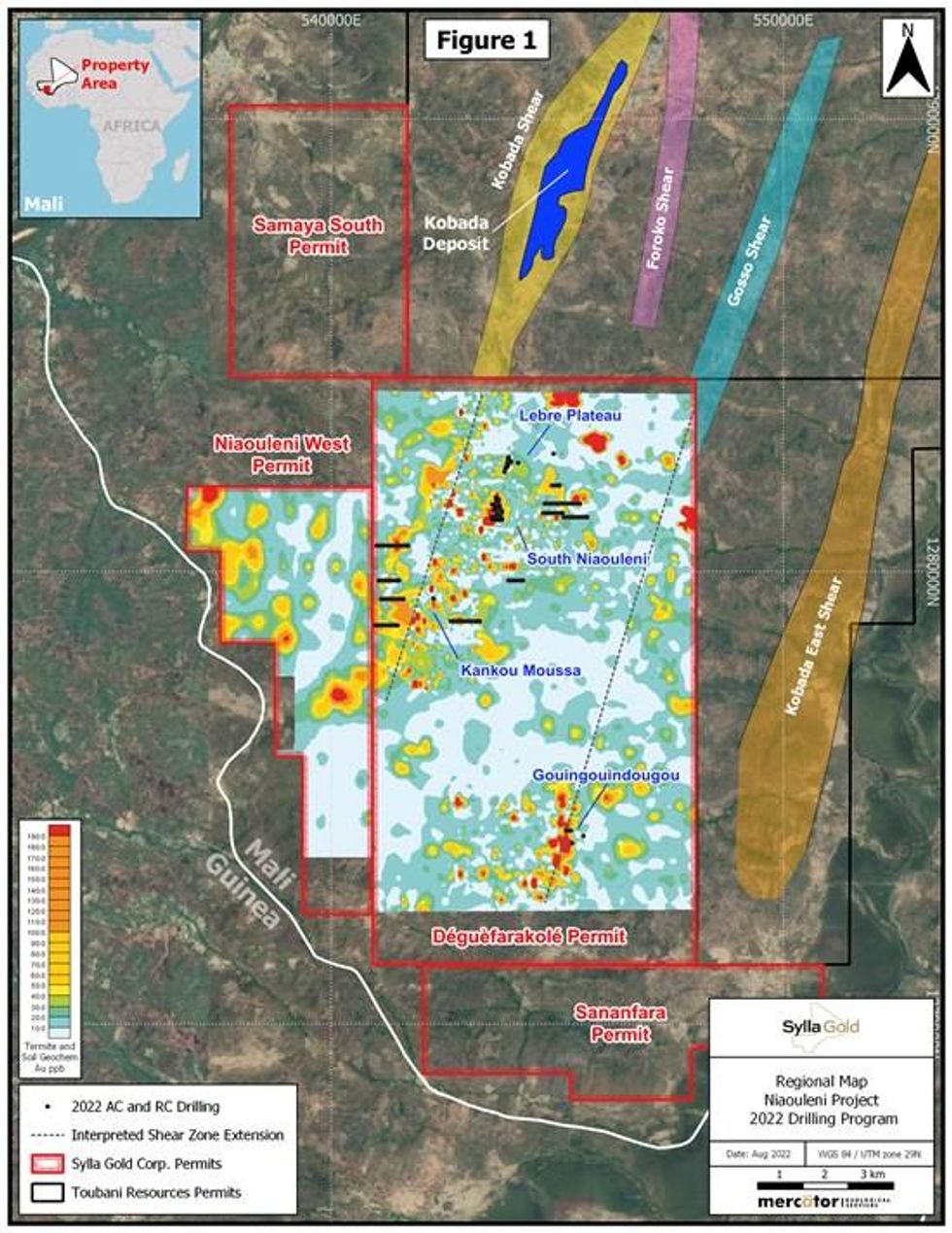

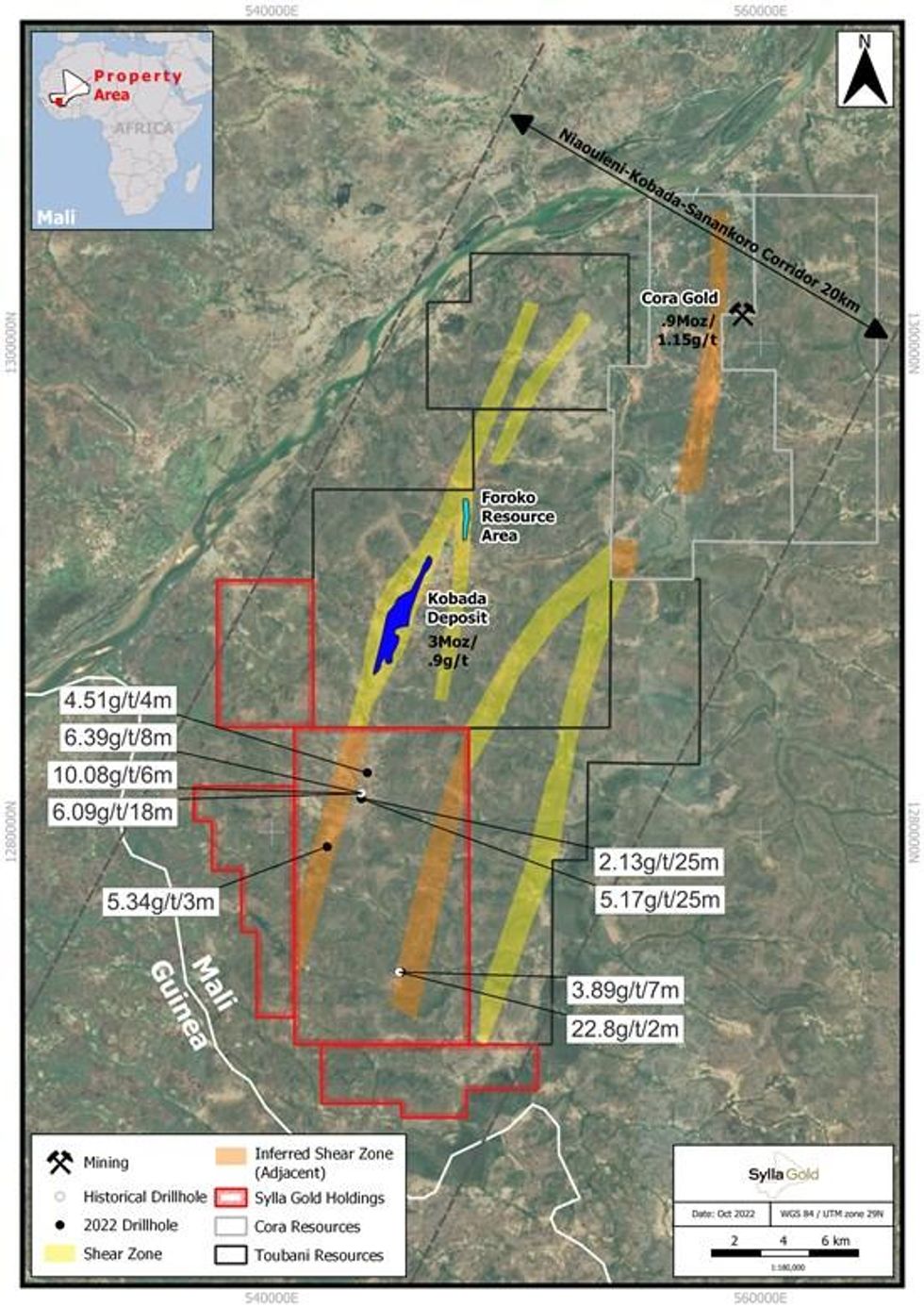

The Sananfara exploration permit is 2,100 hectares in size and once acquired would bring the total Niaouleni project area to 17,200 hectares in size (Figure 1). The Sananfara permit is host to numerous gold showings and artisanal workings in the area of the Gosso Shear extension.

Regan Isenor, President and CEO of Sylla Gold commented, "We prioritized picking up the Sananfara exploration permit as it represents the extension of the Gosso Shear and is a key piece of land in what is turning into a major gold bearing structural corridor. Acquiring the Sananfara permit is the result of the Company's ongoing land acquisition strategy within this developing corridor."

The completion of the transaction contemplated by the letter of intent remains subject to the Company entering into a definitive option agreement and all regulatory approvals.

Niaouleni Project

The Niaouleni Project (Figure 2) is accessible by paved highway and includes extensive artisanal mining activity within the interpreted extensions of gold bearing structures. Past exploration work at Niaouleni included extensive reverse circulation (RC) and diamond drilling, which identified several structural gold-bearing zones that appeared to extend from the adjacent Kobada gold deposit.

Sylla Gold's inaugural drilling program was completed between April and July 2022 and included 57 reverse circulation (RC) drill holes (7,305 m) and 212 air core (AC) drill holes (10,600 m) completed along several drill fences. These drill holes targeted the Niaouleni South, Lebre Plateau and Kankou Moussa prospects along the Kobada Shear, and the Gouingouindougou prospect located on the Gosso Shear. These prospects were all previously defined by termite mound and soil geochemistry results. Assay results from the RC and AC drilling programs were released by the Company in news releases dated August 29, 2022, September 13, 2022, and October 4, 2022.

OTCQB Listing

The Company is pleased to announce that it has received trading approval from the United States OTC Markets in order to increase accessibility to U.S. based retail and institutional investors. Sylla Gold is now actively trading on the OTCQB Venture Market under ticker symbol SYGCF and the company profile can be viewed at https://www.otcmarkets.com/stock/SYGCF/overview

Qualified Person Statement

All scientific and technical information contained in this news release was prepared and approved by Gregory Isenor, P.Geo., Director of Sylla Gold Corp. who is a Qualified Person as defined in NI 43-101.

For more information, please contact:

Regan Isenor

President and Chief Executive Officer

Tel: (902) 233-4381

Email: risenor@syllagold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information Statement

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information is characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, and includes those risks set out in the Company's management's discussion and analysis as filed under the Company's profile at www.sedar.com. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including that all necessary governmental and regulatory approvals will be received as and when expected. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, other than as required by applicable securities laws.

SYG:CA

The Conversation (0)

11 August 2023

Sylla Gold

Exploring West Africa’s Underexplored Highly Prospective Gold Greenstone Belt

Exploring West Africa’s Underexplored Highly Prospective Gold Greenstone Belt Keep Reading...

13h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

14h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

14h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

15h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

15h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

09 February

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00