January 21, 2024

Brightstar Resources Limited (ASX: BTR) (Brightstar or the Company) is pleased to announce that it has begun to receive assays from the recently completed ~5,000m RC drilling program at the Link Zone and Aspacia deposits at the Menzies Gold Project.

HIGHLIGHTS

- Partial results from the 42 hole, +2,800m reverse circulation drilling program at the Link Zone have been received, with best intercepts including:

- 1m @ 54.77g/t Au from 10m (MGPRC049)

- 7m @ 3.09g/t Au from 84m (MGPRC050)

- 2m @ 4.46g/t Au from 6m (MGPRC059)

- 3m @ 2.96g/t Au from 31m (MGPRC053)

- 3m @ 2.32g/t Au from 0m (MGPRC040)

- The Q4 2023 RC drilling program was designed to both infill and extend known boundaries of mineralisation with the intent of advancing it towards potential near-term mining opportunities similar to the Selkirk Mining JV

- The shallow gold results at the Link Zone continue to illustrate the potential for a modest scale mining operation to generate working capital to organically fund exploration and development activities ahead of the envisaged larger scale development of Brightstar’s Menzies and Laverton Gold Projects

- Assays for a further 15 holes completed at the Link Zone and 29 holes completed at the Aspacia deposit remain outstanding and will be reported once received and analysed

- Brightstar has commenced early-stage discussions with potential mining JV partners, and is independently advancing permitting and approvals to support production activities.

Brightstar’s Managing Director, Alex Rovira, commented: “It is pleasing to see the results from the December RC drilling campaign, with 21 out of 27 holes received to date returning significant intersections (> 0.5g/t Au), including shallow mineralisation up to 54g/t Au across the Merriyulah and Golden Dicks deposits.

This program was designed as extensional and infill drilling to both grow the existing resource at the Link Zone along strike and down dip, and also infill areas to increase geological understanding and certainty for assessing potential mining operations.

The Link Zone area continues to show potential for a shallow modest open pit mining operation that could be accelerated prior to the bigger-scale development of the Menzies and Laverton Gold Projects. Brightstar is continuing to rapidly advance our suite of projects in 2024, with the diamond drilling underway at Cork Tree Well in Laverton, pre-feasibility study activities continuing and exploration accelerating at Menzies.”

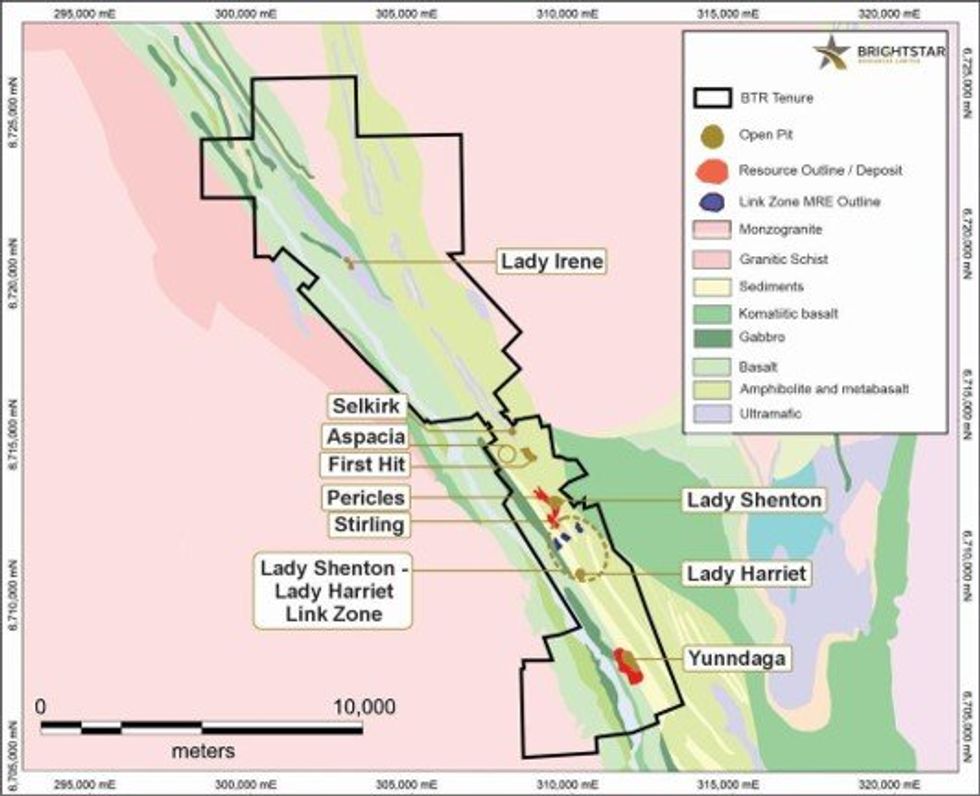

Brightstar has recently completed a 42 hole, +2,800m RC drilling program at the Link Zone in Menzies, which is located ~1km south of the 287koz Lady Shenton System and ~1km north of the 43koz Lady Harriet System (Figure 1).

In November 2023, the Company released a maiden MRE for the Link Zone1, which saw a combined 615,000t @ 1.07g/t Au for 21koz Au across the three deposits (Westralian Menzies, Merriyulah and Golden Dicks) as summarised in Table 1.

This drilling program utilised the resource wireframes from the November 2023 MRE and the successful drilling in July 20232 as a basis for the predominantly shallow extensional and infill drill holes to continue to grow the size of the MRE and improve the confidence classification of the deposits to advance them towards production (Figures 2 & 3). Significant intercepts above 0.5 g/t Au are presented in Table 2.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

01 February

Strategic $180M capital raising funds Goldfields development

Brightstar Resources (BTR:AU) has announced Strategic $180M capital raising funds Goldfields developmentDownload the PDF here. Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Brightstar Resources (BTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Updated Goldfields Feasibility Study

Brightstar Resources (BTR:AU) has announced Updated Goldfields Feasibility StudyDownload the PDF here. Keep Reading...

29 January

Updated Goldfields DFS Presentation

Brightstar Resources (BTR:AU) has announced Updated Goldfields DFS PresentationDownload the PDF here. Keep Reading...

28 January

Trading Halt

Brightstar Resources (BTR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

14h

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

15h

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

15h

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

20h

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

01 February

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00