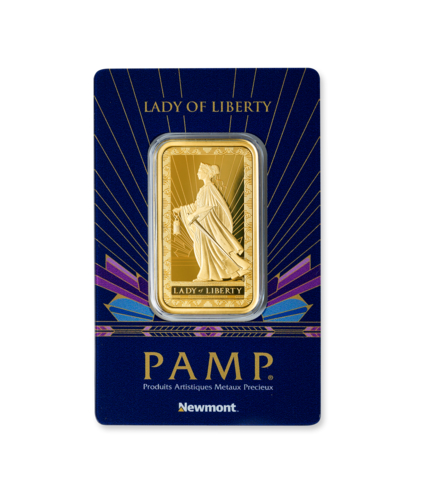

Newmont Corporation (NYSE: NEM, TSX: NGT, ASX: NEM, PNGX: NEM) and MKS PAMP partner to offer consumers a traceable gold bar exclusively made with Newmont-mined gold, refined and minted by MKS PAMP in Switzerland powered by Provenance ™. The mine-to-market traceable PAMP 1oz Lady of Liberty gold bar is available at the largest U.S. wholesaler, making owning gold an accessible option for wealth building.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241014009144/en/

Newmont and MKS PAMP partner to offer consumers a traceable gold bar. (Photo: Business Wire)

"The opportunity for Newmont gold to be accessible, direct to consumers, is a testament to our commitment to promoting gold as a prized commodity worth pursuing and owning. Our commitment to sustainable mining practices and sourcing transparency makes purchasing gold attainable for consumers – even while shopping for household goods," said Peter Toth, Chief Development Officer, Newmont.

The traceable 1oz Lady of Liberty gold bar leverages the established Provenance™ solution to give consumers greater assurance into the origin of their gold. The solution is pioneered by MKS PAMP and independently audited and certified, assuring complete segregation of the gold throughout the refining and minting process, guaranteeing transparency and full traceability of the gold.

"Our joint collaboration on this project is a crucial steppingstone towards a more unified gold industry where we collectively work together to further strengthen consumer trust and uphold the integrity that drives the demand for responsibly sourced gold," said Chris Carkner, Global Head of Minting, MKS PAMP.

In recognition of this longstanding partnership between the two companies, the Newmont and MKS PAMP teams worked collaboratively to bring this traceable gold bar to consumers. To craft this one-of-a-kind gold bar, highly skilled minting experts used the most advanced techniques to reimagine this iconic and recognizable figure adorning the gold bar. The PAMP 1oz Lady of Liberty gold bar is sealed within a secured CertiPAMP™ packaging, which acts as a certificate of authenticity and quality excellence.

The decade-long partnership between Newmont and MKS PAMP further marks the launch of their first co-branded traceable gold bar, underpinned by their common values and unwavering sustainability commitments. In addition, Newmont is the only gold producer listed in the S&P 500 Index and is widely recognized for its principled environmental, social, and governance practices.

About Newmont

Newmont is the world's leading gold company and producer of copper, zinc, lead, and silver. The company's world-class portfolio of assets, prospects and talent is anchored in favorable mining jurisdictions in Africa, Australia, Latin America & Caribbean, North America, and Papua New Guinea. Newmont is the only gold producer listed in the S&P 500 Index and is widely recognized for its principled environmental, social, and governance practices. Newmont is an industry leader in value creation, supported by robust safety standards, superior execution, and technical expertise. Founded in 1921, the company has been publicly traded since 1925.

At Newmont, our purpose is to create value and improve lives through sustainable and responsible mining. To learn more about Newmont's sustainability strategy and initiatives, go to www.newmont.com .

About MKS PAMP

MKS PAMP is a precious metal market leader providing financial and physical trading services operating a state-of-the-art precious metals refinery and mint. With a global footprint and over 60 years of experience in the precious metals industry, MKS PAMP – part of the MKS PAMP GROUP – is dedicated to creating a sustainable future with precious metals products and services. The company offers the world's most extensive range of durable, innovative, and responsibly sourced precious metal products and services.

Founded in 1977, PAMP (Produits Artistiques Métaux Précieux) is the product brand of the MKS PAMP company and is the world's leading bullion brand. PAMP was the first brand to ever decorate the reverse sides of its minted bars and was the first to produce original collectibles that forever changed the industry, making PAMP bars, most notably the world-renowned Lady Fortuna™, the most coveted bullion bar in the world. As part of its minted bars collection, PAMP offers an extraordinary range of shapes and designs from which to choose from, building on leading artisan savoir-faire and Swiss engineering to manufacture a wide range of products in all four precious metals and in various forms.

Still managed by the founding family, MKS PAMP is an advocate for long-term thinking, responsible sourcing, sustainability, and ethics, working closely with its stakeholders to set the highest codes of conduct in the industry. MKS PAMP developed Provenance™, a traceability solution that traces precious metals along the supply chain and guarantees responsible sourcing globally. MKS PAMP aims to create value by leveraging its technical expertise, innovations, and global infrastructure to be an indispensable global partner and the most sustainable organization in the precious metals industry.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241014009144/en/

Media Contacts:

Jennifer Pakradooni - Newmont

globalcommunications@newmont.com

Gloria Folidis - MKS PAMP

gloria.folidis@mkspamp.com

Investor Contact:

Neil Backhouse

investor.relations@newmont.com