February 12, 2024

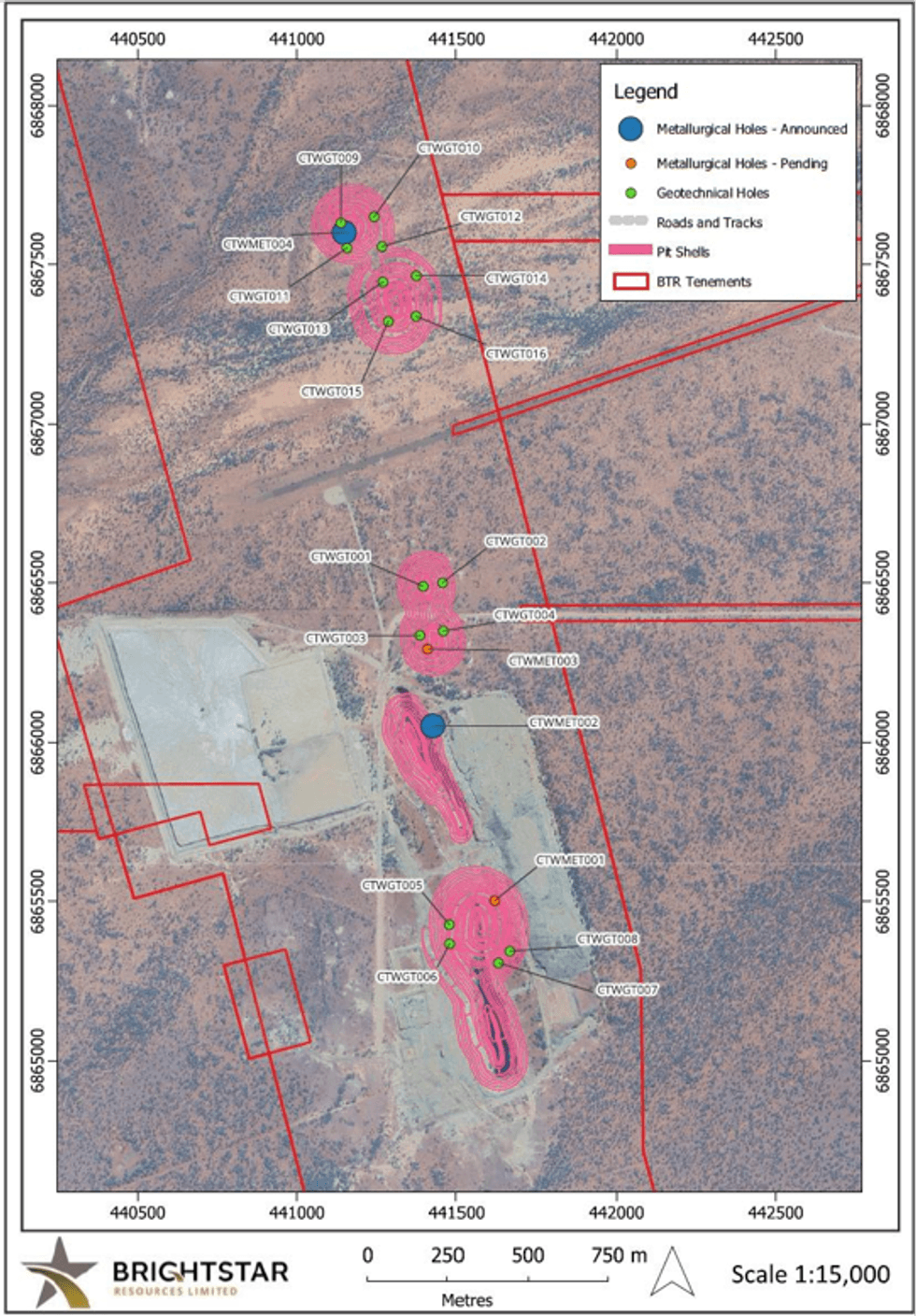

Brightstar Resources Limited (Brightstar or the Company) (ASX: BTR) is pleased to announce the initial assay results from the first two diamond drillholes at Cork Tree Well (CTW) within the Laverton Gold Project (LGP). These two holes, as part of a broader 20 hole program1, were completed in January 2024 with satisfying progress being made by Brightstar’s diamond drilling contractor and geology team.

HIGHLIGHTS

- Assays received from first two diamond holes completed at Cork Tree Well with numerous high grade gold assays up to 172.41g/t Au returned

- Multiple instances of visible gold observed in cut core supports high grade results

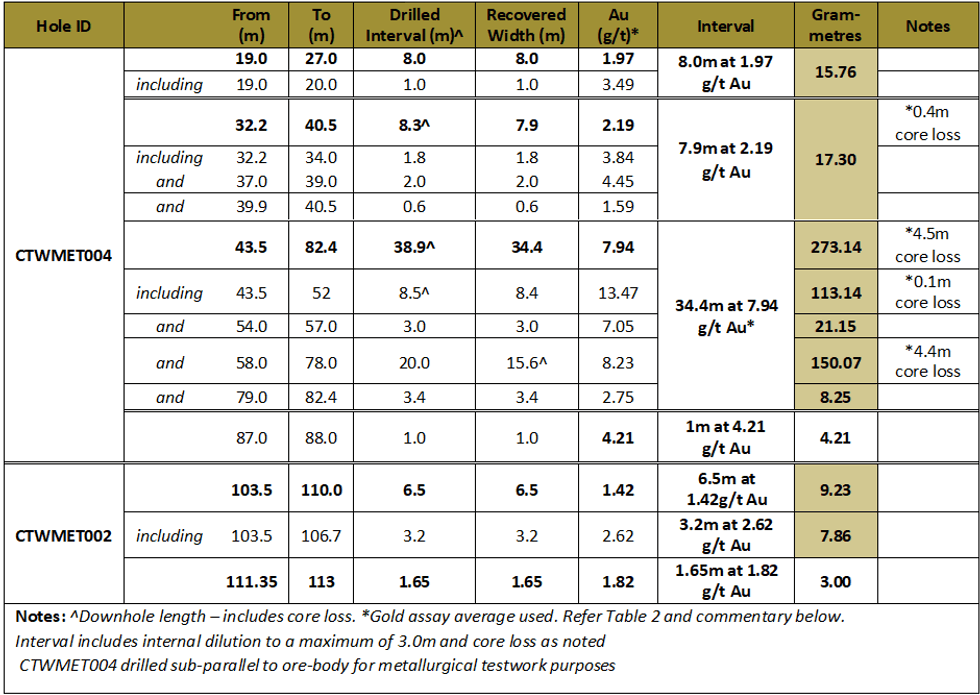

- Intercepts returned include 34.4m at 7.94g/t Au from 43.5m (CTWMET004), including

- 8.4m at 13.47g/t Au from 43.5m, and

- 3m at 7.05g/t Au from 54m, and

- 15.6m at 8.23g/t Au from 58m

- CTWMET004 was drilled in the virgin Delta deposit at Cork Tree Well North, with the gold mineralisation entirely contained with a mafic metadolerite and quartz breccia unit

- The Delta deposit remains completely open at depth, with the deepest hole previously drilled intercepting 31m @ 2.12g/t Au from 172m beneath the current open pit shell

- Assays received from CTWMET002 below the historical open pit at Cork Tree Well include:

- 6.5m at 1.42g/t Au (from 104m)

- 1.65m at 1.82g/t Au (from 112m)

- Two remaining holes (CTWMET003 and CTWMET001) prioritised for expedited turn- around, with another 16 holes pending drill completion & processing for PFS workstreams

Brightstar’s Managing Director, Alex Rovira, commented “These holes were the first diamond holes drilled at Cork Tree Well by Brightstar, with our understanding of the geological model and mineralisation styles defined by over 28km of previous Brightstar RC drilling being enhanced by the knowledge being gained from this +2,000m diamond core program currently in progress.

We have reinforced our view that the gold mineralisation at Cork Tree Well is structurally hosted, with a mafic metadolerite host rock observed in CTWMET004 at Delta, whilst gold mineralisation returned in CTWMET002 is positioned within a chert-breccia horizon in the sedimentary package underneath the shallow historically mined open pit.

Due to the high grades returned, several re-assays were completed to cross-check the veracity of the initial result in certain cases, with multiple high-grade re-assays and visible gold supporting a coarse-grained nuggety gold mineralisation model at Delta.

In order to provide sufficient rock mass for the metallurgical test work purposes across all oxidation states at the Delta (oxide, transitional and fresh), CTWMET004 was drilled sub-parallel to the ore body at Delta. Importantly, Delta is still open at depth with the deepest hole in the vicinity, SDR126001, returning 31m at 2.12g/t Au2 highlighting the immense potential for high grade depth extensions.

Given the inaugural diamond drilling results thus far, we remain of the view that we’ve barely scratched the surface at Cork Tree Well, with strong potential to build on the existing 303koz @ 1.4g/t Au Mineral Resource3 both at depth with high-grade plunging shoots and strike extensions targeting the structurally-controlled mineralised trends across geological units.

We look forward to updating our stakeholders with more information on our diamond program, including the expedited assays for CTWMET001 and CTWMET003. These four diamond holes will form the basis for metallurgical testwork within our Pre-Feasibility Study4 which envisages the broader Cork Tree Well project to form the baseload ore feed to our wholly owned processing plant and associated infrastructure located ~30km south of Laverton”.

Due to the nuggety and high-grade nature of the gold mineralisation observed in CTWMET004, multiple samples had repeat assays completed following from best QA/QC laboratory practice. The repeat fire-assays provided additional analytical insight into the nuggety nature of mineralisation in addition to the visible gold observed. Where multiple repeat assay runs occurred, an average of the results has been used in the reporting in Table 1 above and within this announcement. The full break-down of the re-assayed samples are outlined below in Table 2. Repeat assays were not conducted on all fire-assay samples and significant intercepts reported in this announcement will be re-evaluated following from planned additional analyses using a larger sample mass, towards a better representation of the mineralisation at Cork Tree Well and within the ‘Delta’ deposit.

Brightstar will be conducting continued analysis into the effects of the nuggety gold at Cork Tree Well, and specifically within the ‘Delta’ deposit, in future drilling programs. Metallurgical analyses in addition to re- assaying more samples using additional analytical methods (incorporating a greater sample mass) will assist with continued understanding of the nature of mineralisation. Additional analytical methods will commence with screen fire assaying to identify and better quantify the presence of coarse gold with photon analyses considered in conjunction with screen fire assaying processes.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

6h

Material early-stage aircore drilling success at Sandstone

Brightstar Resources (BTR:AU) has announced Material early-stage aircore drilling success at SandstoneDownload the PDF here. Keep Reading...

26 January

Sandstone Strategic Plan to Deliver Long-Life Production Hub

Brightstar Resources (BTR:AU) has announced Sandstone Strategic Plan to Deliver Long-Life Production HubDownload the PDF here. Keep Reading...

19 January

Fast Tracked Goldfields Development Update

Brightstar Resources (BTR:AU) has announced Fast Tracked Goldfields Development UpdateDownload the PDF here. Keep Reading...

13 January

Mining Approvals Received for Lady Shenton Mine in Menzies

Brightstar Resources (BTR:AU) has announced Mining Approvals Received for Lady Shenton Mine in MenziesDownload the PDF here. Keep Reading...

11 January

Lord Byron RC Drilling Results and Mineral Resource Upgrade

Brightstar Resources (BTR:AU) has announced Lord Byron RC Drilling Results and Mineral Resource UpgradeDownload the PDF here. Keep Reading...

5h

Further high-grade intercepts at BMT3 in Boundiali

Aurum Resources (AUE:AU) has announced Further high-grade intercepts at BMT3 in BoundialiDownload the PDF here. Keep Reading...

5h

Adrian Day: Gold "Nowhere Near" Top, Next Big Buyer Awakening

Adrian Day, president of Adrian Day Asset Management, shares his thoughts on gold's latest price activity, saying the metal is still "nowhere near a top." In his view, its long-term drivers remain in place, and two new ones have now emerged.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

6h

USD/JPY Rate Check Helps Boost Gold Above US$5,000

The US Federal Reserve's January 23 decision to help support Japan’s beleaguered yen is believed to be behind gold’s historic price rise past the US$5,000 per ounce level. The New York Federal Reserve reportedly conducted a “rate check” with currency dealers regarding the US dollar/Japanese yen... Keep Reading...

6h

What Was the Highest Price for Gold?

Gold has long been considered a store of wealth, and the price of gold often makes its biggest gains during turbulent times as investors look for cover in this safe-haven asset.The 21st century has so far been heavily marked by episodes of economic and sociopolitical upheaval. Uncertainty has... Keep Reading...

7h

A2GOLD COMMENCES 30,000-METRE DRILL PROGRAM AT EASTSIDE GOLD-SILVER PROJECT

DRILLING WILL TEST MULTIPLE HIGH PRIORITY TARGETS INCLUDING CONTINUITY OF MINERALIZATION BETWEEN THE MCINTOSH AND CASTLE DEPOSITS A2Gold Corp. ("A2Gold" or the "Company") (TSXV: AUAU) (OTCQX: AUXXF) (FRA: RR7) is pleased to announce the commencement of its fully funded 30,000-metre reverse... Keep Reading...

26 January

Drilling confirms grade continuity at depth and along strike

Asara Resources (AS1:AU) has announced Drilling confirms grade continuity at depth and along strikeDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00