May 18, 2023

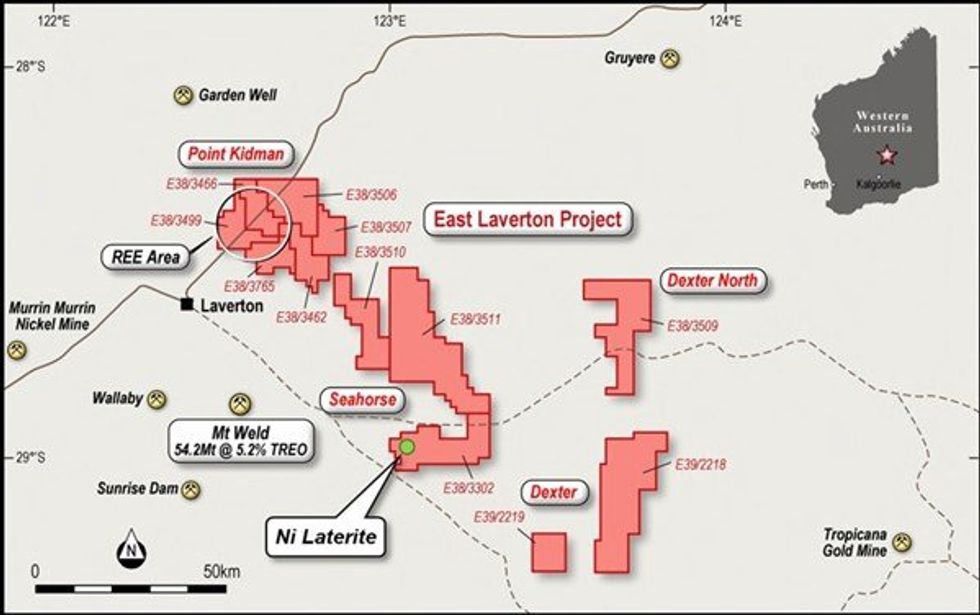

MTM Critical Metals Limited (ASX:MTM) (MTM or the Company) has received assay results from a recently completed program of aircore drilling that confirm nickel laterite mineralisation at the Seahorse prospect, part of the East Laverton Project in the north Eastern Goldfields of Western Australia (Figure 1).

Highlights:

- New laterite nickel mineralisation discovery made at the Seahorse prospect

- Aircore drilling confirms nickel-cobalt-chromite mineralisation over 1km strike length

- Higher grade drilling intersections include:

- 23ELAC175 - 17m @ 0.92% Ni

- 23ELAC176 - 28m @ 0.95% Ni, 10m @ 0.10% Co and 21m @ 0.97% Cr

- 23ELAC185 - 28m @ 0.97% Ni and 32m @ 1.08% Cr

- 23ELAC191 - 11m @ 0.88% Ni and 7m @ 1.28% Cr

- 23ELAC183 - 9m @ 0.72% Ni, 10m @ 0.91% Cr

- 23ELAC186 - 16m @ 0.65% Ni, 32m @ 0.13% Co and 44m @ 1.09% Cr

- Highest grade of 2.2% Ni over 1m and numerous samples >1% Ni

- Host ultramafic unit previously untested by drilling and is open along strike

- Magnetics and geochemistry indicate strike of prospective rocks extending in excess of 3km

- Rare earth element mineralisation up to 1,850ppm TREO also reported in the mineralised drilling intersections

- Additional priority target areas yet to be drilled

- Located approximately 100km from Glencore’s Murrin Murrin nickel mine

Results show significant nickel (Ni) mineralisation grades in the lateritic weathering zone over an ultramafic host rock, up to 2.2% Ni. The nickel zones are locally coincident with elevated cobalt (Co), chrome (Cr) and rare earth element (REE) mineralisation.

Regarding the latest drilling results from the Seahorse prospect, Managing Director Lachlan Reynolds commented:

“This discovery of lateritic nickel mineralisation is the successful result of MTM’s systematic exploration campaign at the Seahorse prospect over the past two years.

Prior to our work, there has been limited historical exploration in this area, which is mostly covered by transported sediments and marginal to the greenstone belts that are traditionally considered to be most prospective. However, our combined soil sampling program and interpretation of the regional geophysical surveys has identified numerous anomalies, which this drilling confirms can be associated with mineralisation developed in the laterite profile developed over prospective rocks.

The significant nickel grades and widths intersected at this stage are very encouraging. Furthermore, as only part of the interpreted strike length of the interpreted ultramafic unit have been tested with the drilling, there is considerable potential for a large resource to be delineated.

We are also keen to evaluate the potential for sulphide-hosted nickel mineralisation associated with the ultramafic units and are considering what ground geophysical survey types may be appropriate to undertake to define new drilling targets.”

Seahorse Prospect

The Seahorse area is located approximately 50km southeast of Laverton and is considered prospective for a range of commodities, including nickel, cobalt, rare earth elements (REE), gold and base metals based on limited historical exploration results.

Broad soil geochemical sampling completed by MTM over the western part of the Seahorse area (Exploration Licence 38/3302) in 2022 identified significant nickel anomalies that were interpreted to be associated with ultramafic lithologies in the basement, some of which have distinct basement magnetic anomalies (see MTM ASX announcement dated 27 April 2022).

Click here for the full ASX Release

This article includes content from MTM Critical Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

25 September 2023

MTM Critical Metals

Exploring Highly Prospective REE and Niobium Projects in Quebec and Western Australia

Exploring Highly Prospective REE and Niobium Projects in Quebec and Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00