July 18, 2023

Siren Gold Limited (ASX: SNG) (Siren or the Company) is pleased to provide an exploration update on the Auld Creek Prospect.

Highlights

- Siren’s fourth drillhole ACDDH007 at the Auld Creek prospect has intersected the Fraternal Shoot.

- ACDDH007 intersected 26.5m @ 2.7g/t Au, 0.07% Sb or 26.5m @ 2.9g/t AuEq from 124m, including zones of:

- 17.5m @ 3.7g/t Au, 0.1% Sb for 3.9g/t AuEq from 133m, and

- 8.5m @ 6.7g/t Au from 142m.

- Results expand mineralisation confirmed from existing drillholes that include:

- 35.0m @ 4.1g/t Au, 2.9% Sb or 35.0m @ 11.0g/t AuEq,

- 6.0m @ 4.1g/t Au, 4.1% Sb or 6.0m @ 13.8g/t AuEq,

- 34.0m @ 1.6g/t Au, 0.7% Sb or 34.0m @ 3.3g/t AuEq,

- 20.7m @ 5.9g/t Au, 2.6% Sb or 20.7m @ 12.0g/t AuEq, and

- 17.9m @ 2.3g/t Au, 0.1% Sb or 17.9m @ 2.6g/t AuEq.

- Assay results for drillholes ACDDH008 and ACDDH009 are still pending.

- An Exploration Target of 115,000 to 130,000 AuEq ounces at a grade of between 6.0 and 7.0g/t AuEq has been estimated for the Fraternal Shoot, based on existing surface trenches and drillhole results. This Exploration Target extends to approximately 185m down plunge.

- Maiden Resource will be estimated once all assays from the current drill program have been completed.

Executive Chairman Brian Rodan commented:

“As previously reported on 8 June, Siren was particularly excited about the type of mineralisation evident in the drillholes at Auld Creek and we are now very pleased to report that the latest assays confirm the presence of consistent high-grade gold across the entire Fraternal intercept. AXDDH009 also intersected a broad zone of mineralisation, with assays pending. Drilling is continuing, with updated results to be provided to the market over the coming weeks”.

Background

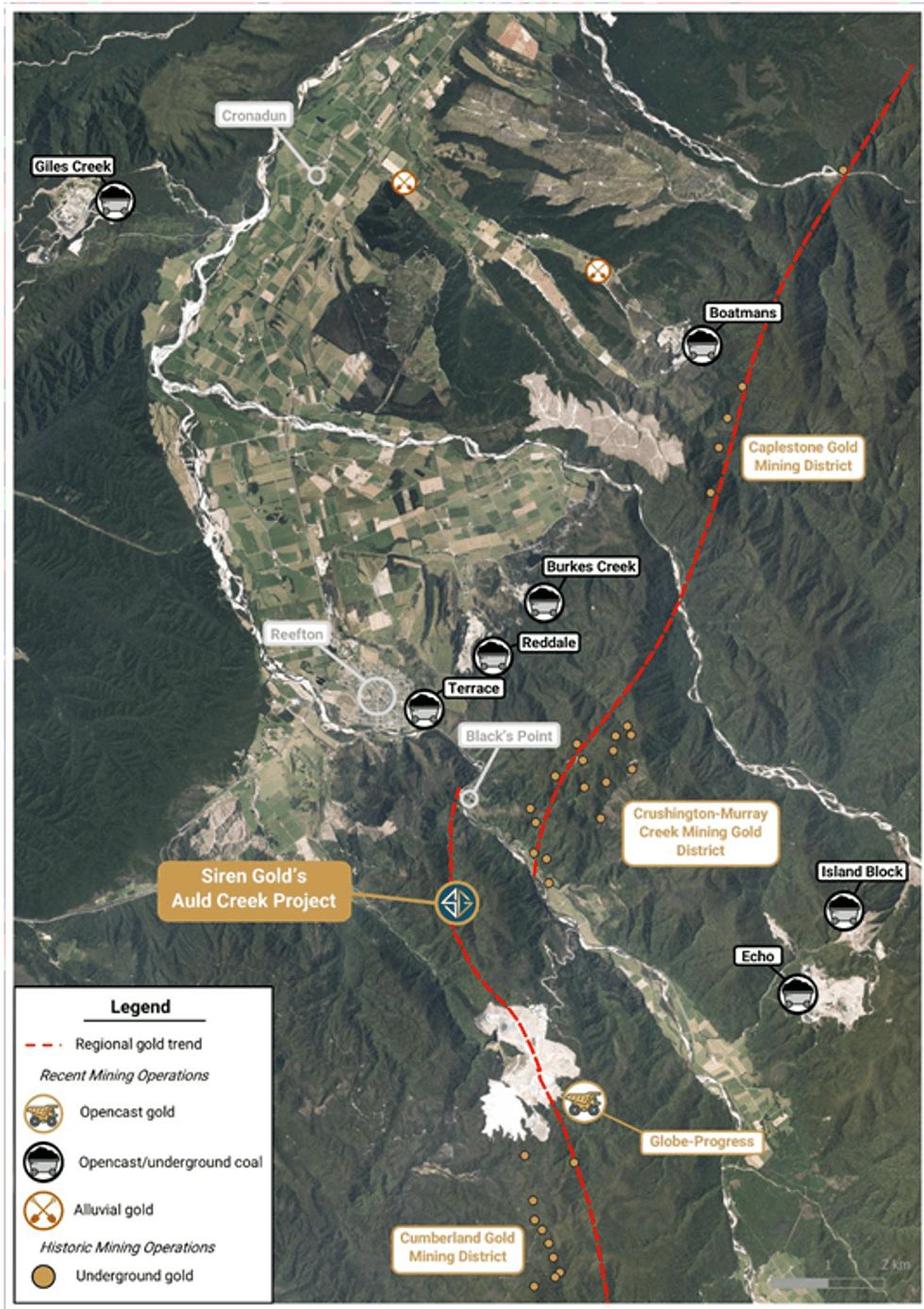

The Auld Creek Prospect is contained within Siren’s Golden Point exploration permit and is situated between the highly productive Globe Progress mine, which historically produced 418koz @ 12.2g/t Au, and the Crushington group of mines that produced 515koz @ 16.3g/t Au (Figure 1). More recently OceanaGold (OGL) mined an open pit and extracted an additional 600koz of gold from lower grade remnant mineralisation around the historic Globe Progress mine. Collectively these mines produced 1.6Moz at 10g/t Au.

Within 20kms of the Auld Creek Project at Reefton there are 18 mines, including seven coal mines and the Globe Progress gold mine. A coal handling facility and train loadout are located at the northern end of Reefton town.

The Auld Creek Prospect represents high-grade gold-antimony (Sb) mineralisation that was potentially offset to the west, along NE-SE trending faults between Globe Progress and Crushington.

The gold-antimony mineralisation extends from Auld Creek south through Globe Progress and the Cumberland prospects and on to Big River, a strike length of 12kms with 9kms in Siren’s permits and the remaining 3kms in the Globe Progress reserve area.

The Auld Creek arsenic soil anomaly now extends for over 700m along strike. Trenching along the soil anomaly has clearly defined the high-grade Au-Sb mineralisation in the Fraternal, Fraternal North, Bonanza and Bonanza West Shoots (Figure 2).

The Reefton Goldfield can be correlated with the Lachlan Fold that contains epizonal gold-antimony deposits like Fosterville and Costerfield. Siren’s Auld Creek epizonal deposit contains high grade gold and massive stibnite veins.

Siren has used the same gold equivalent formula (𝐴𝑢𝐸𝑞 = 𝐴𝑢 g/𝑡 + 2.36 × 𝑆𝑏 %) used by Mandalay Resources Ltd for the Costerfield mine (refer Mandalay Website: Mandalay have adopted CY2022 metal prices of US$1,750 / ounce gold and US$13,000 / tonne antinomy).

This article includes content from Siren Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SNG:AU

The Conversation (0)

18 March 2024

Siren Gold

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00